Are you ready to dive into the thrilling world of forex trading in Switzerland, CH? Indeed, this ultimate FX trading guide in Switzerland, CH will equip you with everything you need to navigate the dynamic forex market in Switzerland, CH with confidence. From understanding the basics to mastering advanced strategies and leveraging powerful forex signals in Switzerland, CH, this guide is your comprehensive roadmap to success in the forex trading arena.

Introduction to Forex Trading

Understanding the Basics of Forex (FX) in Switzerland, CH: Your Gateway to Global Markets

Imagine a world where you can trade currencies seamlessly from anywhere, at any time. Welcome to the foreign exchange market, commonly known as forex. As the largest financial market in the world, forex operates 24 hours a day, five days a week, offering unparalleled flexibility. This means that whether you’re in Switzerland, New York, or Tokyo, you can buy, sell, and speculate on currency pairs whenever the opportunity arises. For instance, while sipping your morning coffee in Switzerland, you could be executing trades with partners in Australia. This global connectivity and continuous operation make forex an exciting arena for both novice and experienced traders.

- Example: If you anticipate that the Euro will strengthen against the US Dollar, you can buy the EUR/USD pair. If your prediction is correct, you will profit as the value of the pair increases.

- Tip: Always stay updated with global economic news to make informed trading decisions, as events such as elections or policy changes can significantly impact currency values.

Why Forex Trading? Unlocking the Potential of the Forex Market in Switzerland, CH

Forex trading in Switzerland, CH is a journey filled with opportunities and rewards. The high liquidity in the forex market in Switzerland ensures that you can enter and exit trades swiftly without significant price changes. Imagine being able to control a large position with just a small amount of capital; this is made possible by the leverage available in FX trading in Switzerland, CH. Moreover, the low transaction costs make it an attractive option for anyone looking to maximize their investment. For example, with a modest initial investment, you can potentially control a much larger market position, thereby amplifying your potential gains. The thrill of the forex market in Switzerland, CH lies in its ability to transform small investments into significant profits, offering a promising pathway to financial freedom.

- Example: A trader in Switzerland, CH with $1,000 can use leverage to control a $50,000 position in the market. This leverage can potentially increase profits from favorable movements.

- Tip: Use leverage wisely, as it can amplify both gains and losses. Therefore, never risk more than you can afford to lose.

Unleash the Power of Simple Algorithmic Forex Trading Systems in Switzerland, CH

Getting Started with Forex Trading: Your First Steps to Success

Choosing a Reliable Forex Broker: Building a Strong Foundation

Your forex trading journey in Switzerland, CH begins with choosing the right broker. This decision is pivotal to your success. Look for brokers regulated by reputable authorities like the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US. A reliable FX trading broker in Switzerland, CH provides a solid foundation for your trading activities. Furthermore, consider their trading platform, customer service, and transaction fees. For instance, brokers offering MetaTrader 4 or 5 platforms provide robust, user-friendly experiences that can enhance your trading effectiveness. A good broker is not just a service provider but a partner in your trading journey. Refer to a comprehensive forex guide in Switzerland when making your choice.

- Example: A regulated broker like OANDA or IG provides security for your funds and offers advanced trading tools to enhance your trading experience.

- Tip: Firstly, read reviews and compare brokers to find the one that best fits your trading style and needs. Additionally, a good broker should offer low spreads, high leverage, and excellent customer support.

Opening and Funding Your Trading Account in Switzerland, CH: Your Gateway to the Forex Market

Opening and funding your trading account is your gateway to the forex market in Switzerland, CH. The process typically involves filling out an online application and submitting identification documents. Once approved, you can fund your account through various methods like bank transfers, credit cards, or e-wallets. For instance, some brokers offer instant funding options, allowing you to start trading immediately. Imagine the excitement of watching your first trade unfold, knowing that you’ve taken the first step towards financial independence. Refer to this forex guide in Switzerland, CH to understand the best practices for account funding.

- Example: After you select a broker, proceed by filling out the application form. Next, verify your identity and deposit funds using your preferred payment method. Additionally, many brokers provide a welcome bonus for new traders.

- Tip: Initially, start with a small deposit to get comfortable with the trading platform and process. Gradually increase your investment as you gain more experience and confidence.

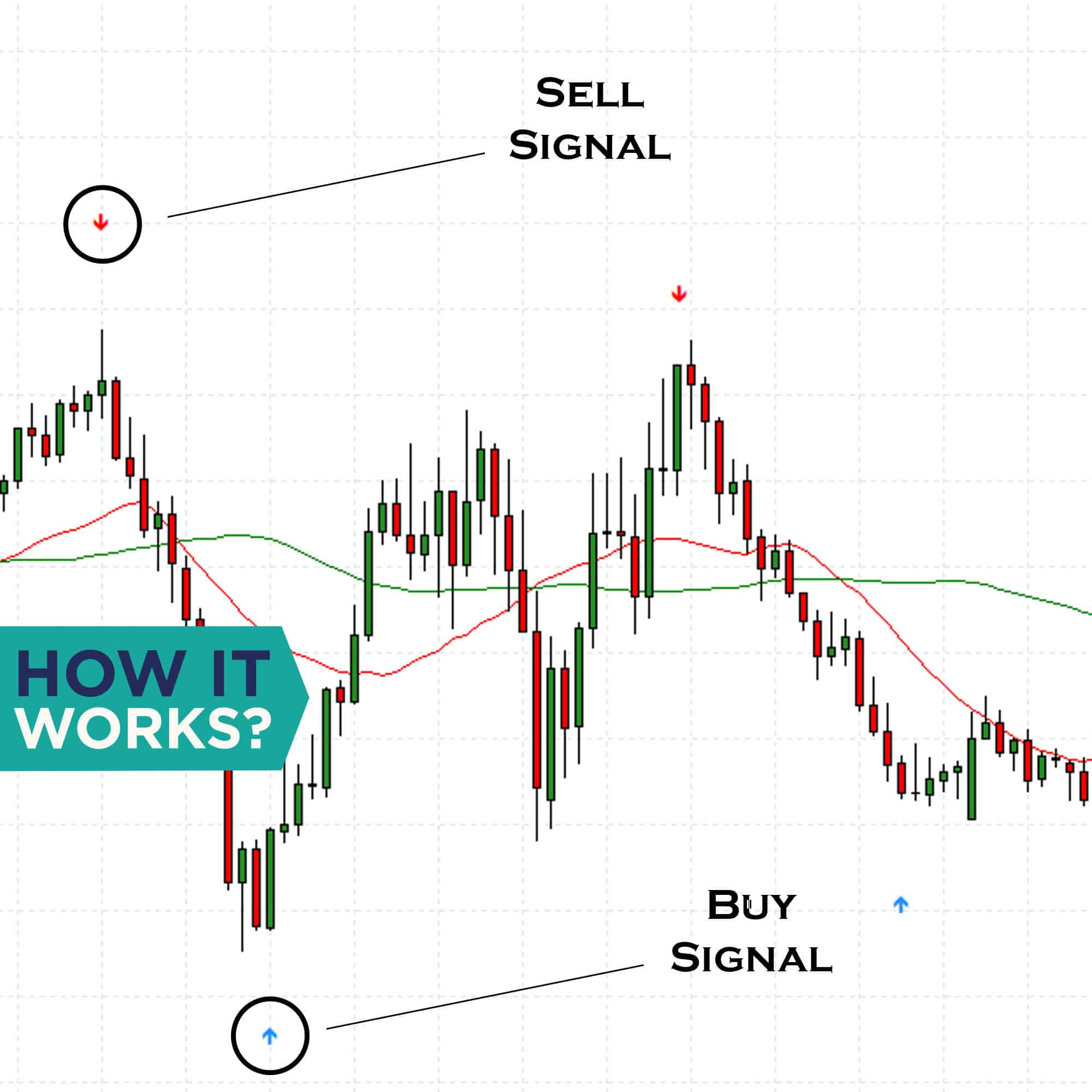

Forex Trading Platforms and Tools: Boost Your Trading Efficiency

A robust trading platform is essential for successful forex trading. Popular platforms like MetaTrader 4 and 5 offer advanced charting tools, technical indicators, and automated trading capabilities. Additionally, using forex signals in Switzerland, CH can significantly enhance your trading strategy. Forex signals provide buy and sell recommendations based on in-depth market analysis, guiding you towards profitable trades. For example, a signal might suggest buying the EUR/USD pair if specific technical indicators align, turning potential market movements into tangible profits. This forex guide will help you choose the best tools for your trading needs.

- Example: For instance, MetaTrader 4 provides tools like Fibonacci retracement, moving averages, and various oscillators to help you analyze the market and make informed decisions.

- Tip: Furthermore, take advantage of demo accounts to practice using the trading platform. This allows you to test your strategies without risking real money.

Master Your Trades with Algorithmic FX Trading Systems in Switzerland, CH

Mastering Forex Trading Strategies in Switzerland, CH: Enhance Your Trading Skills

Technical Analysis in Forex Trading: Predicting Market Movements

Technical analysis is the art of predicting future price movements by studying price charts and using technical indicators. Commonly used indicators include moving averages, the relative strength index (RSI), and Bollinger Bands. For example, a trader might use moving averages to identify trends and RSI to determine overbought or oversold conditions. Mastering technical analysis can transform your trading approach, enabling you to make informed decisions and capture market opportunities. A forex guide in Switzerland, CH can provide you with detailed explanations and applications of these indicators.

- Example: If the 50-day moving average crosses above the 200-day moving average, it signals a potential upward trend. This crossover prompts a buy decision.

- Tip: Additionally, combine multiple indicators to confirm signals and increase the accuracy of your predictions. Always backtest your strategies using historical data.

Fundamental Analysis in Forex Trading: Understanding Economic Indicators

Fundamental analysis delves into economic indicators, geopolitical events, and other factors that impact currency values. Key indicators include interest rates, inflation rates, and employment figures. For instance, if the US Federal Reserve raises interest rates, the US dollar may strengthen against other currencies. By staying informed about economic news and events, you can make more accurate predictions and better trading decisions, turning knowledge into profit. A forex guide can help you stay on top of these critical factors.

- Example: If the European Central Bank announces a cut in interest rates, the Euro might weaken against other currencies, presenting a selling opportunity.

- Tip: Moreover, regularly follow economic calendars and news releases to stay ahead of market-moving events. Consider using economic analysis tools available on most trading platforms.

Risk Management Techniques in Switzerland, CH: Protect Your Capital

Effective risk management is the cornerstone of long-term trading success. Techniques include setting stop-loss and take-profit orders, diversifying your trading portfolio, and using proper position sizing. For example, setting a stop-loss order at 2% of your trading capital can help limit losses on a single trade. Additionally, never risk more than 1-2% of your capital on a single trade to avoid significant losses. By managing your risks wisely, you can protect your capital and ensure steady growth over time. A forex guide in Switzerland, CH can provide you with detailed risk management strategies.

- Example: If you have a $10,000 account, risk no more than $200 per trade to ensure sustainable trading.

- Tip: Use a risk-reward ratio of at least 1:2 to ensure that potential profits outweigh potential losses.

Harnessing the Power of Automated Trading: Let Technology Work for You

What Are Automated Trading and Expert Advisors?

Automated trading involves using software to execute trades based on pre-set criteria. Expert Advisors (EAs) are automated trading systems that analyze market conditions and execute trades on your behalf. These tools can operate 24/7, ensuring you never miss an opportunity. Imagine waking up to see that your trading account has grown overnight, thanks to your EA making profitable trades while you slept. Automated trading takes the emotion out of trading, ensuring disciplined and consistent performance. A forex guide in Switzerland, CH can help you understand the intricacies of automated trading.

- Example: An EA programmed to trade the EUR/USD pair based on moving average crossovers can automatically buy or sell when the criteria are met, regardless of the time.

- Tip: Regularly monitor the performance of your EA and adjust its settings as needed to adapt to changing market conditions.

Benefits of Using Automated Trading Systems

Automated trading systems offer numerous benefits. They can execute trades faster and more efficiently than a human trader, taking advantage of every market opportunity. Additionally, EAs follow pre-defined strategies, eliminating emotional decision-making and maintaining consistency. For example, an EA might use a scalping strategy to make multiple small trades throughout the day, capturing minor price movements for profit. By leveraging automated trading, you can enhance your trading performance and achieve better results. This forex guide will show you how to effectively use these systems.

- Example: A scalping EA can perform dozens of trades in a single day, capturing small profits that accumulate over time.

- Tip: Diversify your use of EAs by running multiple strategies simultaneously to spread risk and increase profitability.

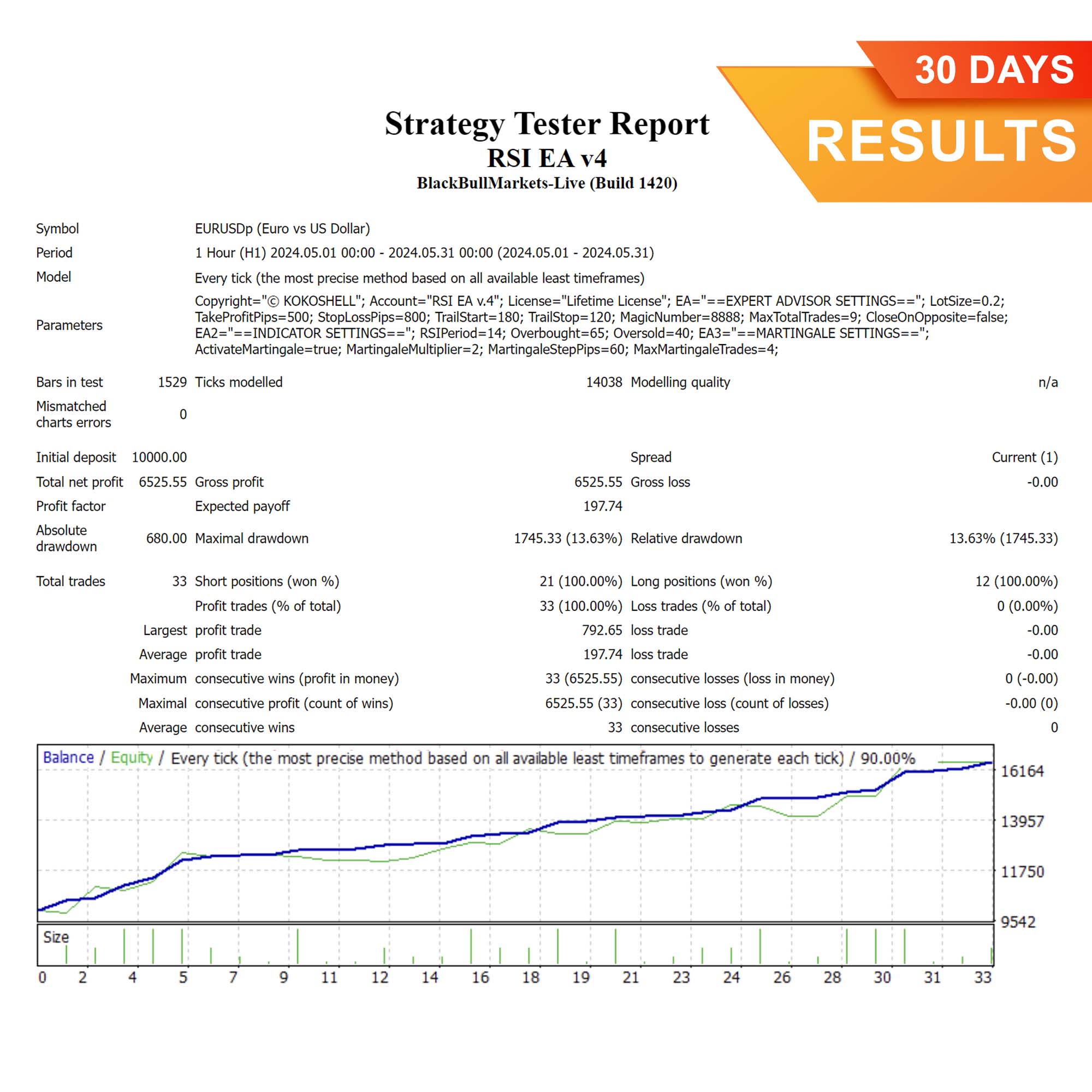

How to Choose the Right Expert Advisor in Switzerland, CH

Selecting the right Expert Advisor is crucial for your trading success. Look for EAs with a proven track record, transparent performance reports, and positive user reviews. Consider using a demo account to test the EA before committing to real money. For instance, many brokers offer demo accounts that allow you to evaluate an EA’s performance without risking your capital. By choosing the right EA, you can automate your trading strategy and enjoy consistent, profitable results. A forex guide in Switzerland, CH can help you evaluate different EAs.

- Example: Research and select an EA that suits your trading style, whether it’s trend following, scalping, or swing trading.

- Tip: Join forex trading communities and forums to get recommendations and insights on the best-performing EAs from other traders.

Recommended Expert Advisors for Successful Automated Trading

For those looking to integrate powerful automated trading systems into their strategy, we highly recommend exploring the expert advisors available at KOKOSHELL. These trading bots are designed to analyze market conditions and execute trades efficiently, ensuring you never miss an opportunity. Consequently, by using these expert advisors, you can significantly enhance your trading performance and achieve consistent results.

- Example: Specifically, KOKOSHELL offers EAs that can perform high-frequency trades based on sophisticated algorithms, ensuring optimal performance.

- Tip: Thus, visit KOKOSHELL to explore their range of expert advisors and choose the one that best fits your trading needs.

Boost your Profits with Elite Automated FX Systems in Switzerland, CH

Advanced Forex Trading Techniques: Take Your Trading to the Next Level

Leveraging (FX) Forex Trading Bots and Algorithms in Switzerland, CH

Forex trading bots and algorithms can revolutionize your trading strategy. These tools analyze market data, identify trading opportunities, and execute trades based on pre-set criteria. For example, a trading bot might use a trend-following strategy to capitalize on market movements, ensuring you stay ahead of the curve. By leveraging trading bots, you can maximize your trading efficiency and capture more opportunities. Refer to this forex guide to understand how to implement trading bots effectively.

- Example: A trend-following bot might enter a long position when a currency pair breaks above a resistance level and exit when it shows signs of reversal.

- Tip: Regularly update your trading bot to incorporate the latest market data and improve its performance.

Hedging Strategies in Forex Trading

Hedging involves opening multiple positions to offset potential losses. This technique can protect your capital during volatile market conditions. For instance, if you hold a long position on the EUR/USD pair, you might open a short position on the USD/JPY pair to hedge against unfavorable price movements. By balancing your positions, you can minimize risk and protect your investment, ensuring steady growth even in uncertain times. This forex guide provides detailed hedging strategies to help you manage risk effectively.

- Example: If you’re long on EUR/USD and anticipate market turbulence, shorting USD/CHF can help mitigate risks associated with adverse currency movements.

- Tip: Use hedging sparingly and only when necessary to avoid overcomplicating your trading strategy.

Carry Trade Strategy: Profiting from Interest Rate Differentials

The carry trade strategy involves borrowing funds in a currency with a low-interest rate and investing them in a currency with a higher interest rate. This strategy allows you to profit from the interest rate differential. For example, if the interest rate in Japan is 0.1% and in Australia is 2%, you could borrow in Japanese yen and invest in Australian dollars to earn the interest rate difference. However, be aware of exchange rate risks that can impact your profits. By mastering the carry trade strategy, you can take advantage of global interest rate disparities for consistent returns. A forex guide can help you understand and implement the carry trade strategy effectively.

- Example: Borrowing JPY at a low-interest rate and buying AUD to benefit from the higher Australian interest rates.

- Tip: Monitor global interest rate trends and economic policies to make informed carry trade decisions.

Navigating the Forex Market in Switzerland, CH with Confidence: Stay Informed and Prepared

Staying Informed with Forex News and Analysis in Switzerland, CH

Staying updated with the latest forex news and analysis is crucial for making informed trading decisions. Follow reputable news sources, subscribe to economic calendars, and participate in forex forums and communities. For instance, economic calendars provide schedules of major economic events and data releases, helping you anticipate market movements. By staying informed, you can turn market news into profitable trading opportunities. This forex guide in Switzerland, CH can direct you to the best news sources and analysis tools.

- Example: Using an economic calendar to anticipate non-farm payroll (NFP) releases in the US and adjusting your trades accordingly.

- Tip: Set alerts for major economic events to ensure you’re always aware of potential market-moving news.

Developing a Forex (FX) Trading Plan in Switzerland, CH: Your Roadmap to Success

A well-defined trading plan outlines your trading goals, risk tolerance, and strategies. It helps you stay disciplined and focused, reducing emotional decision-making. Your plan should include entry and exit criteria, risk management rules, and performance evaluation metrics. For example, set specific goals such as achieving a 10% return on investment within six months and outline the steps to achieve them. By following a structured trading plan, you can stay on track and achieve your financial goals. A forex guide can assist you in crafting a comprehensive trading plan.

- Example: A trading plan might specify entering trades based on RSI and MACD signals, with a stop-loss set at 2% below the entry point.

- Tip: Regularly review and adjust your trading plan to reflect changes in market conditions and personal goals. Moreover, this will help you stay on track and achieve your financial objectives.

Continuous Learning and Improvement in Switzerland, CH: Stay Ahead of the Curve

Forex trading is a dynamic field that requires continuous learning and improvement. Stay updated with new strategies, tools, and market developments. Participate in webinars, read trading books, and practice your skills using demo accounts. For instance, many brokers offer demo accounts that allow you to practice trading with virtual funds, helping you hone your skills without risking real money. By committing to continuous learning, you can stay ahead of the competition and achieve long-term trading success. Use this forex guide to find the best learning resources and stay current in the industry.

- Example: Enroll in online courses or attend forex seminars to expand your knowledge and stay updated with the latest strategies.

- Tip: Furthermore, keep a trading journal to document your trades, analyze your performance, and identify areas for improvement. This practice can lead to more informed decisions and better trading outcomes.

Maximize your Profits with PRO Autotrading Systems in Switzerland, CH

Mastering Forex (FX) Trading in Switzerland, CH: Your Path to Financial Freedom

Mastering forex trading requires dedication, continuous learning, and effective strategies. Firstly, by understanding the basics, utilizing forex signals in Switzerland, CH, and automated trading systems, and implementing advanced techniques, you can navigate the forex market in Switzerland, CH with confidence. Additionally, always remember to stay informed, manage your risks, and continually refine your trading approach. With persistence, the right knowledge, and the power of automated trading, you can achieve success in the dynamic world of forex trading. Therefore, embrace the journey, stay motivated, and let the forex market in Switzerland, CH pave your way to financial freedom. Ultimately, this forex (FX) trading guide in Switzerland, CH is your key to unlocking the potential of the forex market in Switzerland, CH.

Incorporating Forex Signals in Switzerland, CH for Enhanced Trading

Forex signals play a crucial role in enhancing your trading strategy. These signals are derived from technical and fundamental analysis, providing timely buy and sell recommendations. By integrating forex signals in Switzerland, CH into your trading approach, you can make informed decisions and capitalize on market opportunities more effectively. Consequently, this forex guide emphasizes the importance of forex signals in achieving trading success.

- Example: A forex signal might indicate a strong buy signal for the GBP/USD pair based on recent economic data and technical indicators.

- Tip: Therefore, subscribe to reliable forex signal providers in Switzerland, CH to receive accurate and timely signals that can enhance your trading performance.

Using Forex Signals to Manage Risk

In addition to identifying trading opportunities, forex signals can help you manage risk. By following these signals, you can set appropriate stop-loss and take-profit levels, ensuring that your trades align with market conditions and risk tolerance. This forex guide highlights the value of using forex signals for effective risk management.

- Example: A forex signal might suggest placing a stop-loss order 50 pips below the current price to limit potential losses.

- Tip: Always consider the risk-reward ratio when following forex signals to ensure that potential gains outweigh potential losses.

Choosing the Best Forex Signal Providers

Selecting the right forex signal provider is essential for your trading success. Look for providers with a proven track record, transparent performance data, and positive user reviews. Additionally, this forex guide in Switzerland, CH offers tips on evaluating and choosing the best forex signal providers to ensure that you receive high-quality, reliable signals.

- Example: Compare different forex signal providers based on their historical performance, signal frequency, and customer support.

- Tip: Use a trial period to test the accuracy and reliability of a forex signal provider before committing to a subscription.

Integrating Forex Signals in Switzerland, CH with Automated Trading Systems

Combining forex signals with automated trading systems can significantly enhance your trading efficiency. By using Expert Advisors (EAs) that follow forex signals, you can automate your trades and ensure that they are executed promptly based on the latest market analysis. This forex guide in Switzerland, CH provides insights into integrating forex signals in Switzerland, CH with automated trading systems for optimal results.

- Example: An EA that follows forex signals can automatically enter and exit trades based on the recommendations provided by the signal provider.

- Tip: Regularly review and adjust your automated trading system to ensure that it continues to align with current market conditions and signal accuracy. Additionally, this will help you maintain optimal performance and adapt to market changes.

FAQs: Understanding Forex in Switzerland, CH and Automated Trading

What is forex (FX) trading in Switzerland, CH and how does it work?

Forex trading involves buying and selling currencies in the foreign exchange market with the aim of making a profit. Traders speculate on currency price movements by buying one currency while simultaneously selling another. The forex market operates 24 hours a day, five days a week, allowing for continuous trading opportunities. Transactions are conducted over-the-counter (OTC) through a network of banks, brokers, and financial institutions.

How can I get started with automated forex (FX) trading in Switzerland, CH?

To start with automated FX trading in Switzerland, CH, you need to choose a reliable trading platform that supports Expert Advisors. Open and fund your trading account, then select an EA that aligns with your trading strategy. Platforms like MetaTrader 4 and 5 are popular choices for automated trading. Additionally, consider exploring expert advisors from KOKOSHELL for advanced trading solutions.

What are the benefits of using forex signals in Switzerland, CH?

Forex signals offer several benefits, including providing timely and accurate buy and sell recommendations based on market analysis. Furthermore, these signals help traders make informed decisions, manage risks, and maximize profits. By subscribing to reliable forex signal providers, traders can save time on market analysis and instead focus on executing profitable trades. Additionally, forex signals in Switzerland, CH can be particularly beneficial for beginners and those with limited time for in-depth market analysis.

How do I choose the right Expert Advisor for my trading needs?

When choosing an Expert Advisor, consider factors such as its track record, transparency, and user reviews. Look for EAs with a proven history of consistent performance and positive feedback from other traders. Use a demo account to test the EA’s functionality and performance before committing real money. Reputable sources like KOKOSHELL offer a range of expert advisors tailored to different trading strategies.

What risks are associated with automated forex (FX) trading in Switzerland, CH?

Automated FX trading in Switzerland, CH carries risks, including potential software glitches, over-optimization, and market volatility. Moreover, while EAs can execute trades based on pre-set criteria, they cannot predict unexpected market events. Therefore, it’s essential to regularly monitor your automated trading system, adjust settings as needed, and implement robust risk management practices. Additionally, diversifying your strategies and staying informed about market conditions can help mitigate these risks.

By following this comprehensive forex guide in Switzerland, CH, and leveraging the power of forex signals and automated trading systems, you can enhance your trading performance. This approach will help you achieve your financial goals in the dynamic world of FX trading in Switzerland, CH.