Boost Your Trading Success

Candlestick Patterns

Candlestick Patterns

A Comprehensive Guide to Boost Your Trading Success

What is a candlestick?

A candlestick is a way of displaying information about an asset’s price movement. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars.

Candlestick Patterns

Candlestick Patterns

Candlestick Patterns

Single candlestick patterns

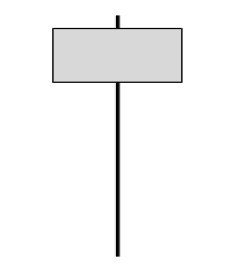

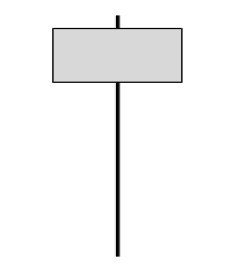

Hammer

bullish reversal

1. Small real body

2. Real body is at the top end of the session’s range

3. Very small or no upper shadow

4. The lower shadow should be at least twice the

height of the real body

5. The color of the real body is not important

6. Market must be in a downtrend

Hanging man

bearish reversal

1. Small real body

2. Real body is at the top end of the session’s range

3. Very small or no upper shadow

4. The lower shadow should be at least twice the

height of the real body

5. The color of the real body is not important

6. Market must be in an uptrend

Shooting Star

bearish reversal

1. Small real body

2. Real body is at the bottom end of the session’s range

3. Very small or no lower shadow

4. The upper shadow should be at least twice the

height of the real body

5. The color of the real body is not important

6. Market must be in an uptrend

Inverted Hammer

bullish reversal

1. Small real body

2. Real body is at the bottom end of the session’s range

3. Very small or no lower shadow

4. The upper shadow should be at least twice the

height of the real body

5. The color of the real body is not important

6. Market must be in a downtrend

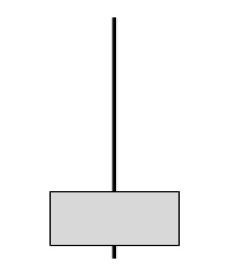

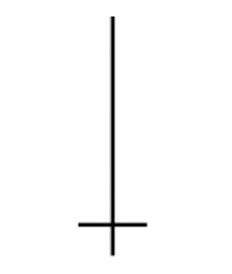

Dragonfly Doji

bullish reversal

1. No (or very small) real body

2. Open and close are at (or very close to) the top of

the candle

3. No (or very small) upper shadow

4. Long lower shadow

5. Market must be in a downtrend

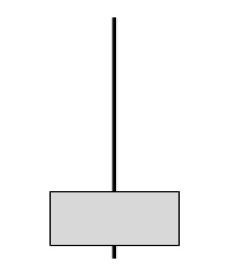

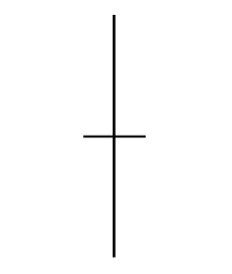

Gravestone Doji

bearish reversal

1. No (or very small) real body

2. Open and close are at (or very close to) the bottom

of the candle

3. No (or very small) lower shadow

4. Long upper shadow

5. Market must be in an uptrend

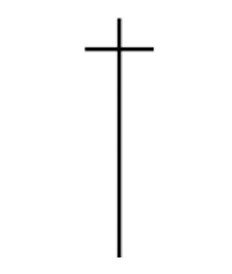

Long-legged Doji

bullish reversal or bearish reversal

1. No (or very small) real body

2. Open and close are at (or very close to) the middle

of the candle

3. Long shadows, equal in length

4. Market can be either in an uptrend or a downtrend

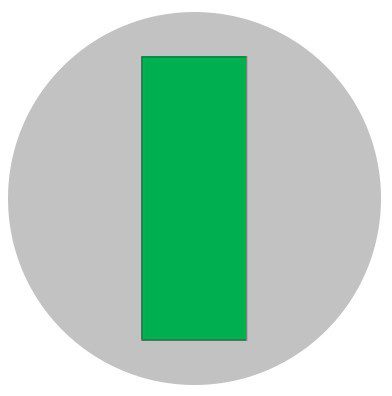

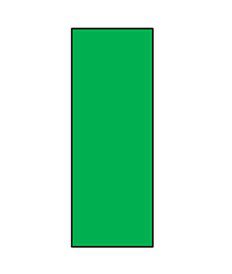

Bullish Marubozu

Bullish continuation (or reversal)

1. Long real body and no shadows

2. The candle must be green

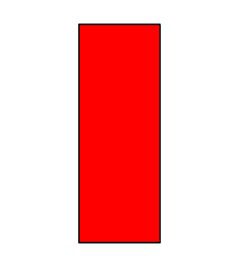

Bearish Marubozu

Bearish continuation (or reversal)

1. Long real body and no shadows

2. The candle must be red

Candlestick Patterns

Two candlestick patterns

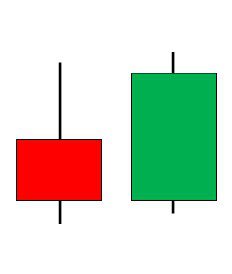

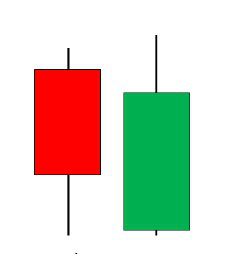

Bullish Engulfing

Bullish reversal

1. Two candle pattern

2. Market must be in a downtrend

3. The first candle must be red

4. The second candle must be green

5. The real body of the second candle surrounds the

real body of the first

6. The position of the shadows, on either candles,

doesn’t matter

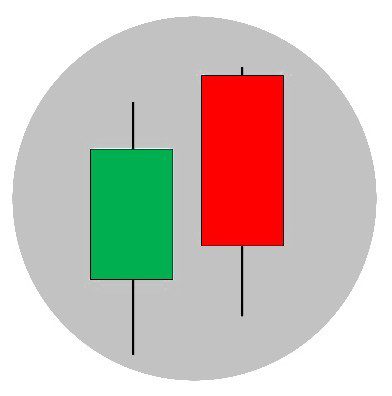

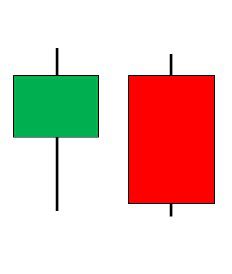

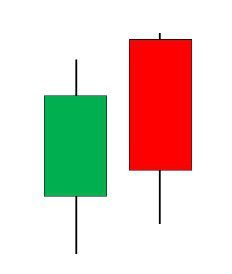

Bearish Engulfing

Bearish reversal

1. Two candle pattern

2. Market must be in an uptrend

3. The first candle must be green

4. The second candle must be red

5. The real body of the second candle surrounds the

real body of the first

6. The position of the shadows, on either candles,

doesn’t matter

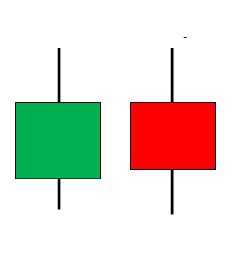

Tweezers Top

Bearish reversal

1. Two candle pattern

2. Market must be in an uptrend

3. The first and the second candle have the same high

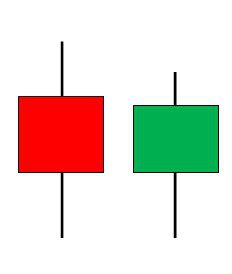

Tweezers Bottom

Bullish reversal

1. Two candle pattern

2. Market must be in a downtrend

3. The first and the second candle have the same low

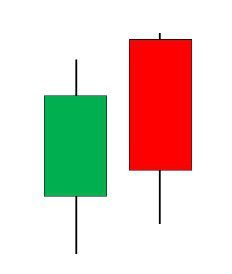

Dark Cloud Cover

Bearish reversal

1. Two candle pattern

2. Market must be in an uptrend

3. The first candle must be green

4. The second candle must be red

5. The market gaps higher on the open of the second

candle

6. The real body of the second candle must close into

the body of the first candle

Piercing Pattern

Bullish reversal

1. Two candle pattern

2. Market must be in a downtrend. The first candle must be red

4. The second candle must be green

5. The market gaps lower on the open of the second

candle

6. The real body of the second candle must close into

the body of the first candle

Bullish Harami

bullish reversal

1. Two candle pattern

2. Market must be in a downtrend

3. The first candle must be red

4. There’s a gap high between the two candles

5. The second candle has a very small real body,

the color is not important

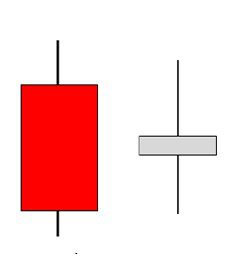

Bearish Harami

Bearish reversal

1. Two candle pattern

2. Market must be in an uptrend

3. The first candle must be green

4. There’s a gap low between the two candles

5. The second candle has a very small real body,

the color is not important

Candlestick Patterns

Three candlestick patterns

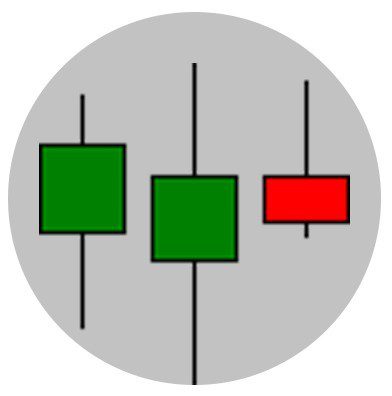

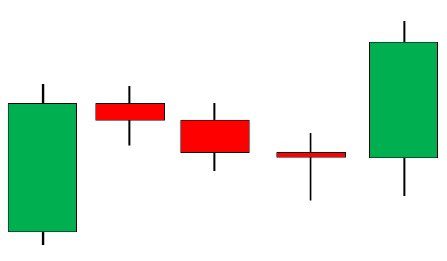

Rising three method

Bullish continuation

1. Composed of 5 candles

2. The market must be in an uptrend

3. The 1st and the 5th candle must be long green candles

4. The three candles in the middle must be small

candles, ideally dojis or small red candles.

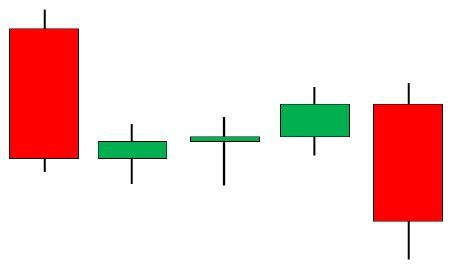

Falling three method

Bearish continuation

1. Composed of 5 candles

2. The market must be in a downtrend

3. The 1st and the 5th candle must be long red candles

4. The three candles in the middle must be small

candles, ideally dojis or small green candles.

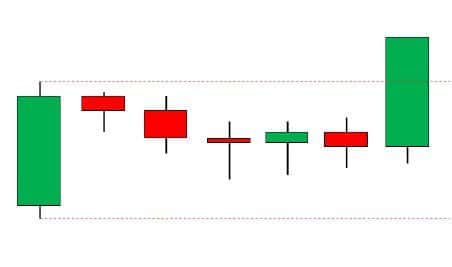

Master Candle

Bullish or Bearish continuation

1. Composed of 5 or more candles (max 11)

2. It is like a falling or rising three method with more

candles in the second phase