Comprehensive Backtesting Guide for Traders

Backtesting Forex Strategies

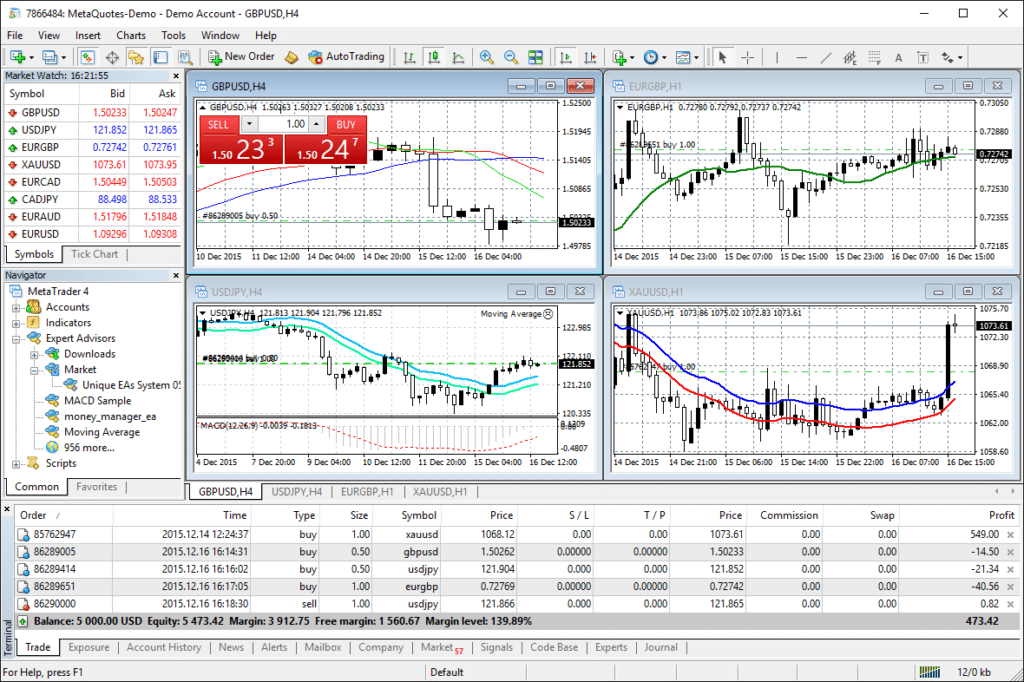

Backtesting in MT4 for Expert Advisors

Essential Prerequisites for Backtesting in MT4

- MetaTrader 4 platform installed on your computer: Make sure you have the MT4 software installed and updated to the latest version. This is necessary because the platform needs to be fully functional for accurate expert advisor backtesting.

- Historical data for the currency pairs or instruments you plan to test: Ensure you have comprehensive historical data to simulate past market conditions accurately. Consequently, without accurate data, your backtest results may not be reliable.

- Expert Advisor that you want to backtest: Have your EA ready, which is a piece of automated trading software designed to execute trades according to predefined criteria. Additionally, ensure the EA is compatible with MT4.

Step-by-Step Backtesting Guide for EA (Expert Advisor) in MT4 (MetaTrader 4)

1. Open MetaTrader 4 for Backtesting

Ensure your MT4 platform is installed and open.

Secondly, launch the MetaTrader 4 application from your desktop or start menu. Moreover, ensure it is connected to your broker’s server.

2. Access the Strategy Tester in MT4

Navigate to the View menu and select Strategy Tester, or press Ctrl + R. This will open the Strategy Tester panel at the bottom of your MT4 terminal.

The Strategy Tester is the tool within MT4 that allows you to run backtests and optimizations on EAs. Additionally, this tool helps you analyze the performance of your strategies in a simulated environment.

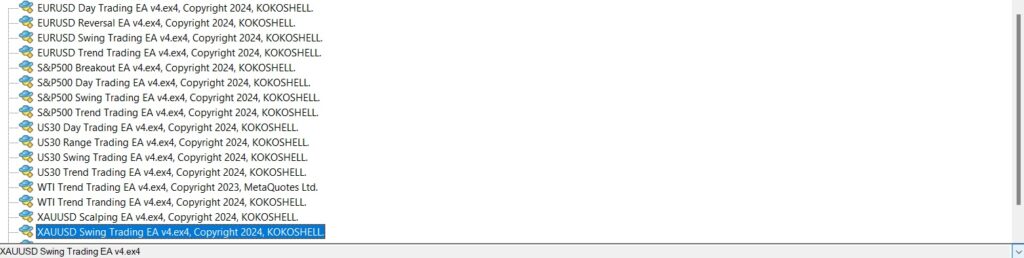

3. Select Expert Advisor for Backtesting

In the Strategy Tester panel, select the Expert Advisor (EA) you want to test from the Expert Advisor dropdown menu.

Then, you’ll see a list of all installed EAs. Finally, choose the one you wish to test.

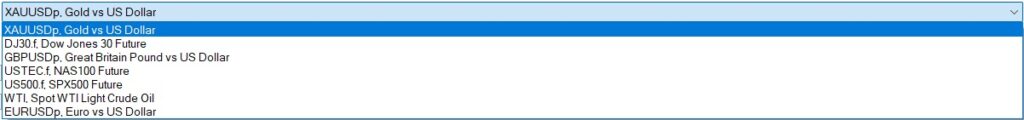

4. Choose the Symbol and Period for Backtesting

Symbol: Select the currency pair or instrument you want to test your EA on from the Symbol dropdown.

This defines which market data will be used for the backtest. Therefore, selecting the correct symbol is critical.

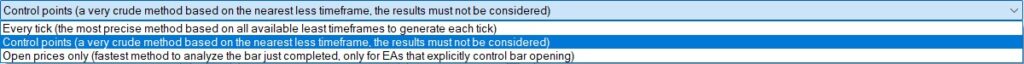

5. Configure the Backtesting Model in MT4

Choose the expert advisor backtesting model that suits your needs:

- Every tick: The most precise method, simulates every price change.

Best for accuracy but can be slow. It uses the smallest available price changes. As a result, this model is highly detailed. - Control points: A rough approximation, less precise.

Faster but less accurate. Suitable for quick, preliminary testing. Although this model is quicker, it may miss some details. - Open prices only: Fast method, useful for EAs that only operate on bar open prices.

Quickest and useful if your EA makes decisions based on the opening price of bars. Consequently, it saves time.

6. Set the Date Range for Backtesting MT4 EA

Specify the date range for the backtest by checking the Use date box and selecting the start and end dates.

This allows you to focus on specific periods, such as market crashes or particular trends, to see how your EA performs under those conditions. As a result, you can analyze performance under different scenarios.

7. Adjust Expert Properties for Optimal Backtesting

Click on the Expert properties button to configure the EA’s parameters. You can set:

- Input parameters: Specific to your EA.

These are customizable settings for your EA, such as risk levels, trade sizes, and other strategy-specific variables. Thus, adjusting these settings tailors the backtest to your strategy. - Testing tab: Initial deposit, currency, and leverage.

These settings reflect your simulated trading account’s starting conditions and can affect your EA’s performance metrics. Consequently, they help in assessing the EA under realistic conditions.

8. Download Historical Data for Accurate Backtesting

Ensure you have sufficient historical data. Go to Tools > History Center, select the instrument, and click Download.

High-quality historical data is crucial for accurate expert advisor backtesting. Therefore, the more data you have, the better you can assess your EA’s performance over different market conditions.

9. Start the Backtest in MT4

Click the Start button in the Strategy Tester panel. MT4 will begin the backtest, displaying progress in the bottom of the terminal.

The backtest will simulate the EA’s trading based on the historical data and settings you provided. Consequently, this gives you insights into how the EA would have performed in the past.

10. Analyze Backtesting Results

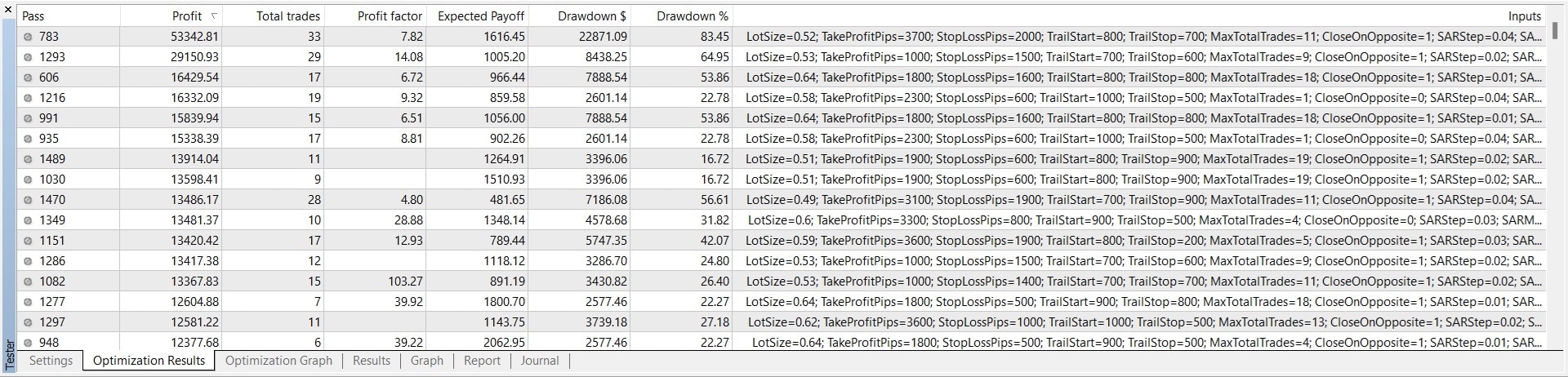

Once the test completes, navigate through the tabs in the Strategy Tester panel:

- Results: Displays trade-by-trade performance.

Shows each trade the EA made, including entry and exit points, profits, and losses. Thus, you can evaluate individual trade performance. - Graph: Visual representation of the balance/equity curve.

Provides a visual overview of how the account balance or equity changed over time. Consequently, this helps in understanding the overall performance. - Report: Detailed statistics, including total net profit, drawdown, and more.

Comprehensive summary of the EA’s performance metrics. Therefore, this report is essential for evaluating the EA. - Journal: Log of events during the backtest.

Useful for debugging and understanding any errors or specific events that occurred during the backtest. As a result, it helps in identifying issues.

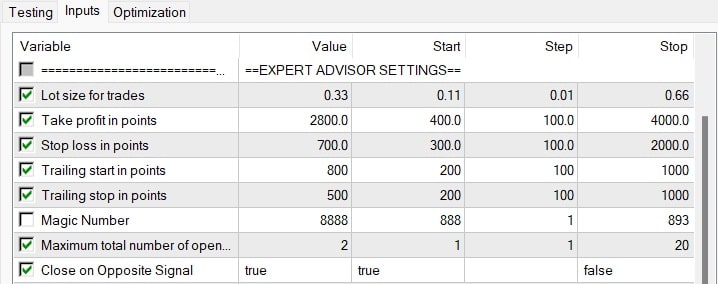

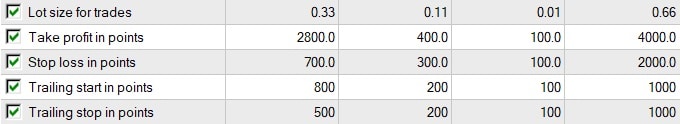

Explanation of Start, Step, and Stop in Backtesting Optimization

When optimizing an EA in MT4, you will encounter three important parameters: Start, Step, and Stop. These settings define the range and granularity of the values to be tested during optimization.

- Start: The initial value for a given parameter.

Example: If you’re optimizing the lot size, you might start at 0.01. Thus, this is the base value. - Step: The increment between values during optimization.

Example: With a step of 0.01, the optimization will test 0.01, 0.02, 0.03, etc. Consequently, this defines the precision. - Stop: The final value for the parameter.

Example: If the stop is 0.10, the optimizer will test values up to 0.10. Therefore, this sets the upper limit.

These values are crucial because they determine how thoroughly and efficiently the optimization process explores the parameter space. Choosing appropriate Start, Step, and Stop values ensures a good balance between optimization time and the thoroughness of the search. Too small a step size can make the process very slow, while too large a step size might skip over potentially optimal settings.

Essential Tips for Effective Backtesting MT4 EA

- Use High-Quality Data: Higher-quality historical data provides more reliable backtest results.

Avoid data with gaps or inconsistencies to ensure your backtest reflects real market conditions. Consequently, this improves reliability. - Longer Test Periods: Test your EA over different market conditions to ensure robustness.

This helps you understand how your EA performs during different market phases, such as trends, ranges, and high volatility. Therefore, longer periods provide more comprehensive insights. - Optimization: Use the

Optimizationfeature in the Strategy Tester to find the best parameters for your EA.

This process helps you identify the most profitable settings for your EA by testing various parameter combinations. As a result, this enhances performance. - Walk-Forward Analysis: Divide your data into in-sample (for testing) and out-of-sample (for validation) to prevent overfitting.

Ensures that your EA is not just performing well on historical data but is also likely to perform well in future, unseen data. Consequently, this validates the EA. - Monitor Slippage and Spread: Real market conditions include variable spreads and slippage, which should be accounted for in expert advisor backtesting.

Adjust settings to include realistic spread values and potential slippage to mimic actual trading conditions. Therefore, this provides a realistic assessment.

Mastering Backtesting in MT4 for Expert Advisors

Backtesting in MetaTrader 4 is a critical step in developing and validating your trading strategies. By following this Backtesting Guide for EA (Expert Advisor) in MT4 (MetaTrader 4), you can ensure your Expert Advisors are thoroughly tested and optimized before deploying them in a live trading environment. Additionally, implementing effective backtesting strategies helps you identify potential flaws and improve your trading approach.

By adhering to the steps outlined in this backtesting guide, you gain valuable insights into how your EA would perform under various market conditions. This comprehensive backtesting process ultimately leads to more robust and reliable trading strategies. Happy trading!

Feel free to reach out for any further clarifications or advanced tips on backtesting expert advisor in MetaTrader 4.