Elevate Your Trading with XAUUSD Scalping EA

Introducing XAUUSD Scalping EA (Expert Advisor) for MT4 (Metatrader 4), the latest innovation from KOKOSHELL designed to revolutionize your forex trading experience. This Expert Advisor (EA) harnesses advanced technical indicators and robust algorithms to deliver unparalleled trading performance. Therefore, whether you’re a novice trader or an experienced professional, XAUUSD Scalping Expert Advisor provides a seamless, automated solution to help you achieve consistent profits.

How It Works: Intelligent Automation for Optimal Results

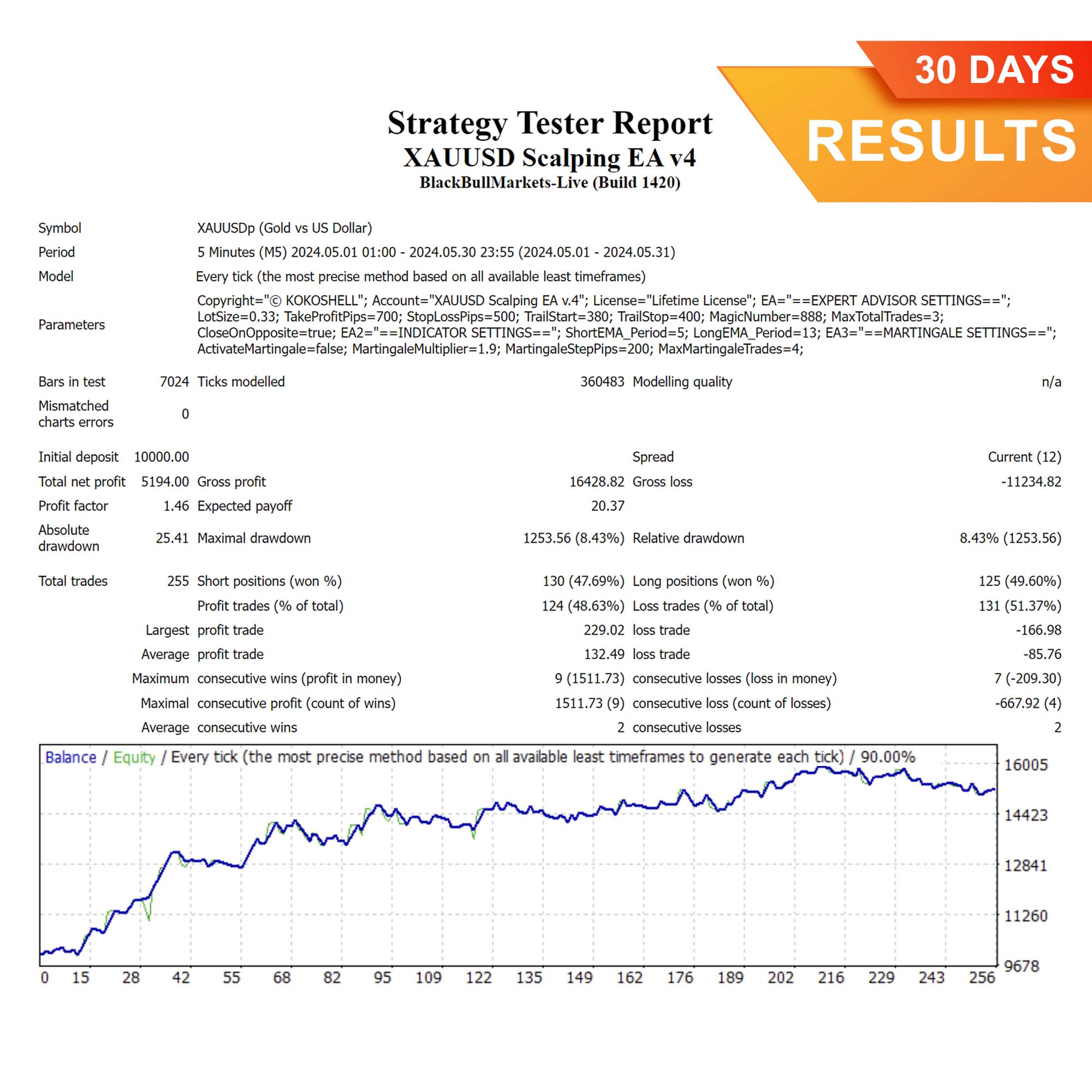

XAUUSD Scalping EA operates by analyzing market conditions using Exponential Moving Averages (EMA). When the short EMA crosses the long EMA, the EA generates precise entry points for buy or sell orders. Additionally, XAUUSD Scalping MT4 Expert Advisor incorporates a trailing stop mechanism to secure profits and an optional Martingale strategy to manage and recover from losses. Furthermore, with its robust algorithms, this EA ensures optimal performance and profitability.

Key Features: Advanced Tools for Superior Trading

Discover the robust features of the XAUUSD Scalping EA designed to elevate your trading strategy:

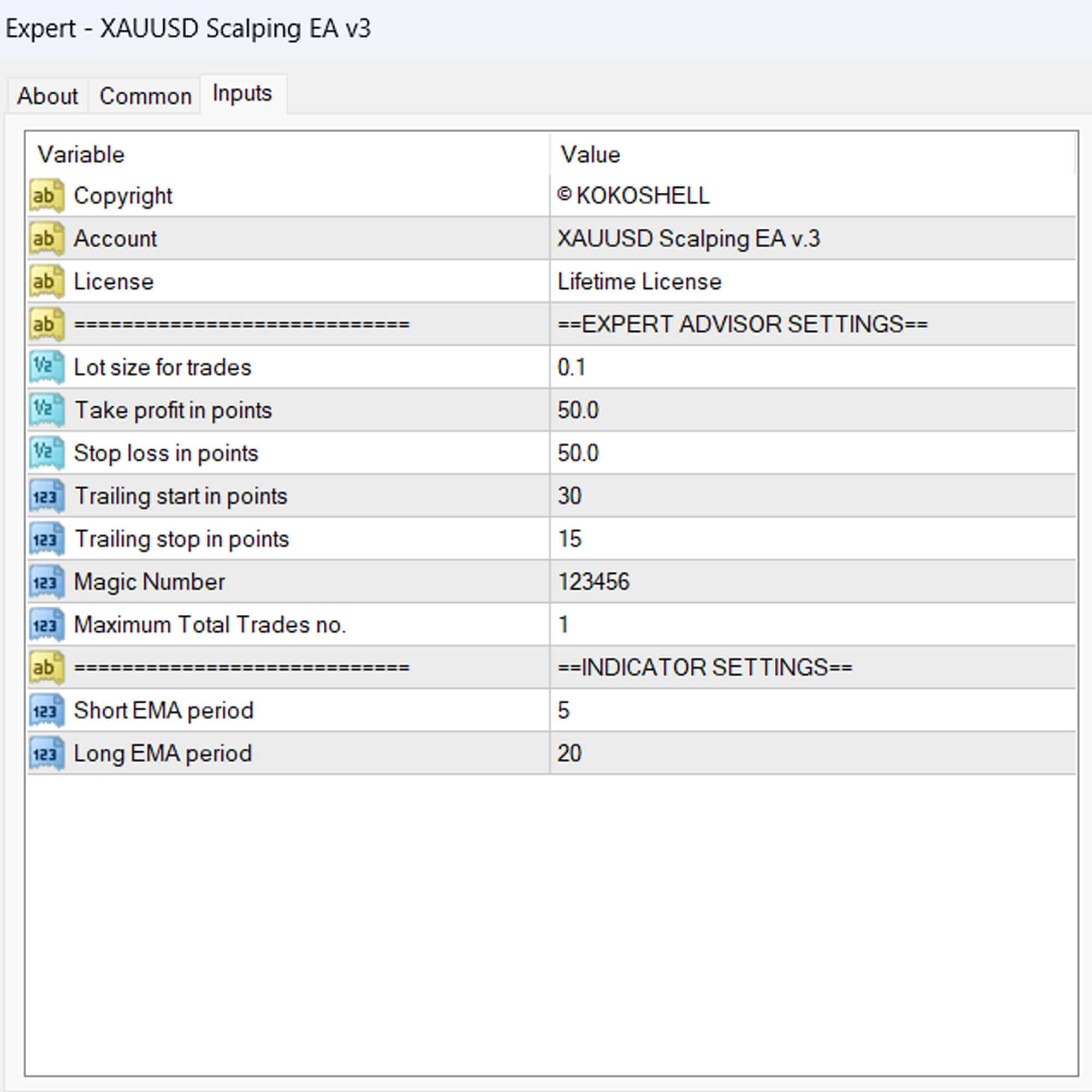

- Precision Entry Signals: Utilizes short and long EMAs for accurate buy and sell signals. Moreover, it ensures timely trade executions.

- Dynamic Trailing Stops: Adjusts stop-loss levels as the trade moves in your favor, securing profits effectively. Consequently, it helps you maximize gains.

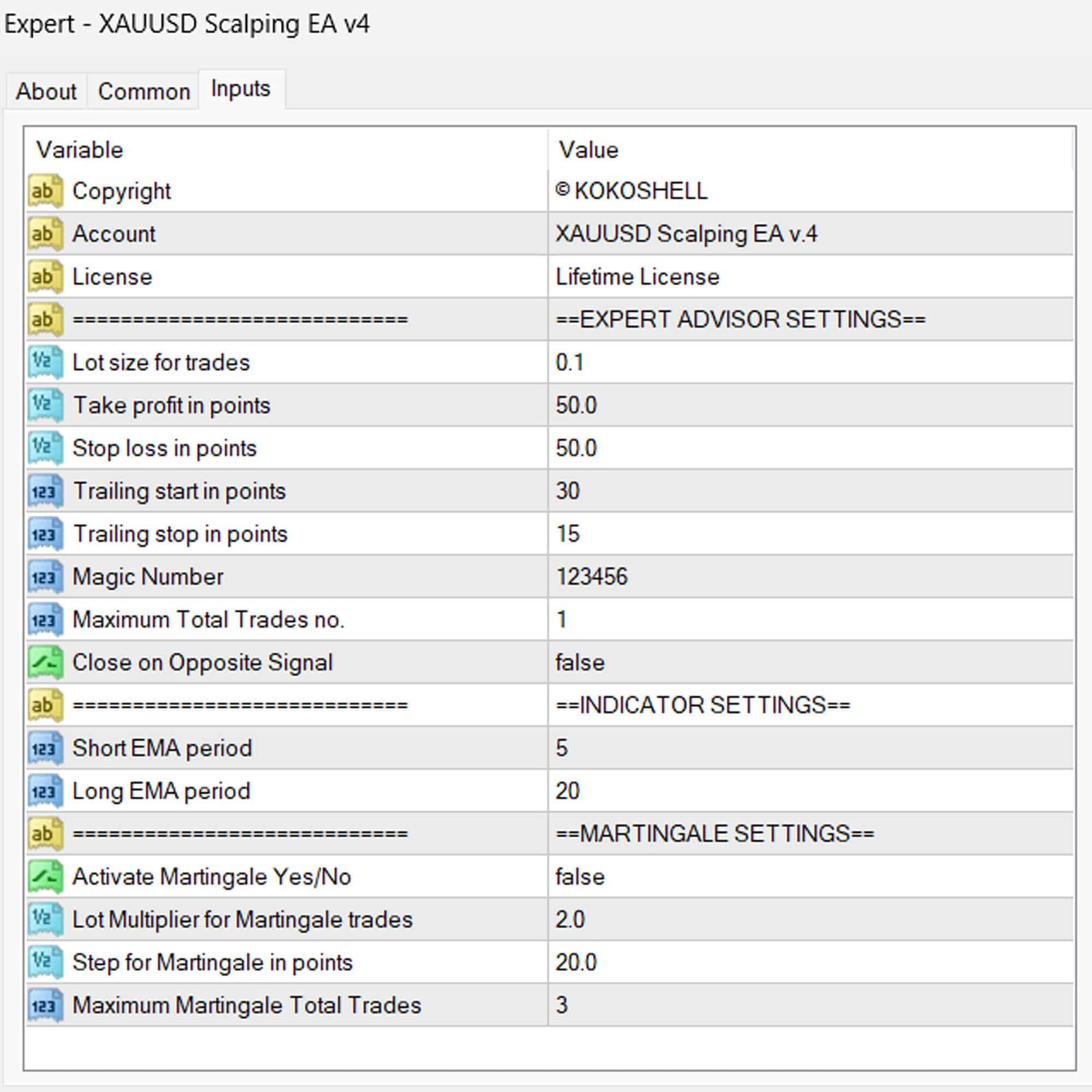

- Martingale Strategy: Optional feature to multiply lot sizes on losing trades, aiming to recover losses quickly. Furthermore, it provides an additional layer of profitability.

- Customizable Settings: Tailor parameters like lot size, take profit, stop loss, and more to fit your trading style. Additionally, you can adjust settings as market conditions change.

- Risk Management: Limits the maximum number of open trades and manages risk with intelligent stop-loss strategies. Therefore, it minimizes potential losses.

- Lifetime License: One-time purchase with lifetime access and updates. This feature provides long-term value.

Why Choose XAUUSD Scalping EA: Enhance Your Trading Strategy

XAUUSD Scalping EA for Metatrader 4 stands out due to its robust and reliable performance. By leveraging the power of EMAs, it identifies trading opportunities that might be missed by other strategies. Moreover, its customizable settings allow you to tailor the EA to your specific needs, whether you’re looking for aggressive growth or steady, conservative gains.

The optional Martingale strategy adds an extra layer of potential profitability, making it a versatile tool in any trader’s arsenal.

Elevate Your Trading with XAUUSD Scalping Expert Advisor

Incorporate XAUUSD Scalping EA into your trading strategy and experience the benefits of automated, precise, and profitable trading. Furthermore, with its advanced features and robust risk management, this expert advisor is designed to help you achieve consistent trading success. Don’t miss out on the opportunity to elevate your trading game—try XAUUSD Scalping Expert Advisor for Metatrader 4 by KOKOSHELL today.

Andrew –

Impressive profits, highly recommended!

Jessica Carter –

Consistent gains with minimal risk. Perfect for scalping and swing trading also!

Carlos Rodriguez –

Outstanding EA! The strategy and risk management are excellent.

Steven Miller –

Decent results but lacks input parameters. Worth the price though.

Ethan Davis –

Excellent performance! Consistent profits on higher timeframes.

Lucas Wilson –

Amazing strategy, reliable and profitable.

Isabella –

Great EA, but could use more input parameters.

Sophia –

Profitable and easy to use. My trading has never been better.

Patrick Lee –

Incredible results! This EA is a must-have.

Robert Anderson –

Phenomenal tool! Setting up was a breeze, and I’ve seen incredible profits right from the start. The strategy this advisor uses is brilliant, and the risk management is impeccable. It’s transformed my trading experience into something highly profitable and enjoyable. This is a must-have for any serious trader.