Unlock Profitable Trading with S&P500 Day Trading EA

Discover the power of the S&P500 Day Trading EA (Expert Advisor) for MT4 (Metatrader 4), an expertly crafted algorithmic trading tool by KOKOSHELL. Specifically designed for the S&P500 index, this EA leverages advanced technical indicators to capitalize on market trends, enabling traders to achieve consistent profits. Whether you’re a novice or an experienced trader, the S&P500 Day Trading Expert Advisor is your key to unlocking successful trades with minimal effort.

How It Works: Intelligent Analysis for Optimal Trading Decisions

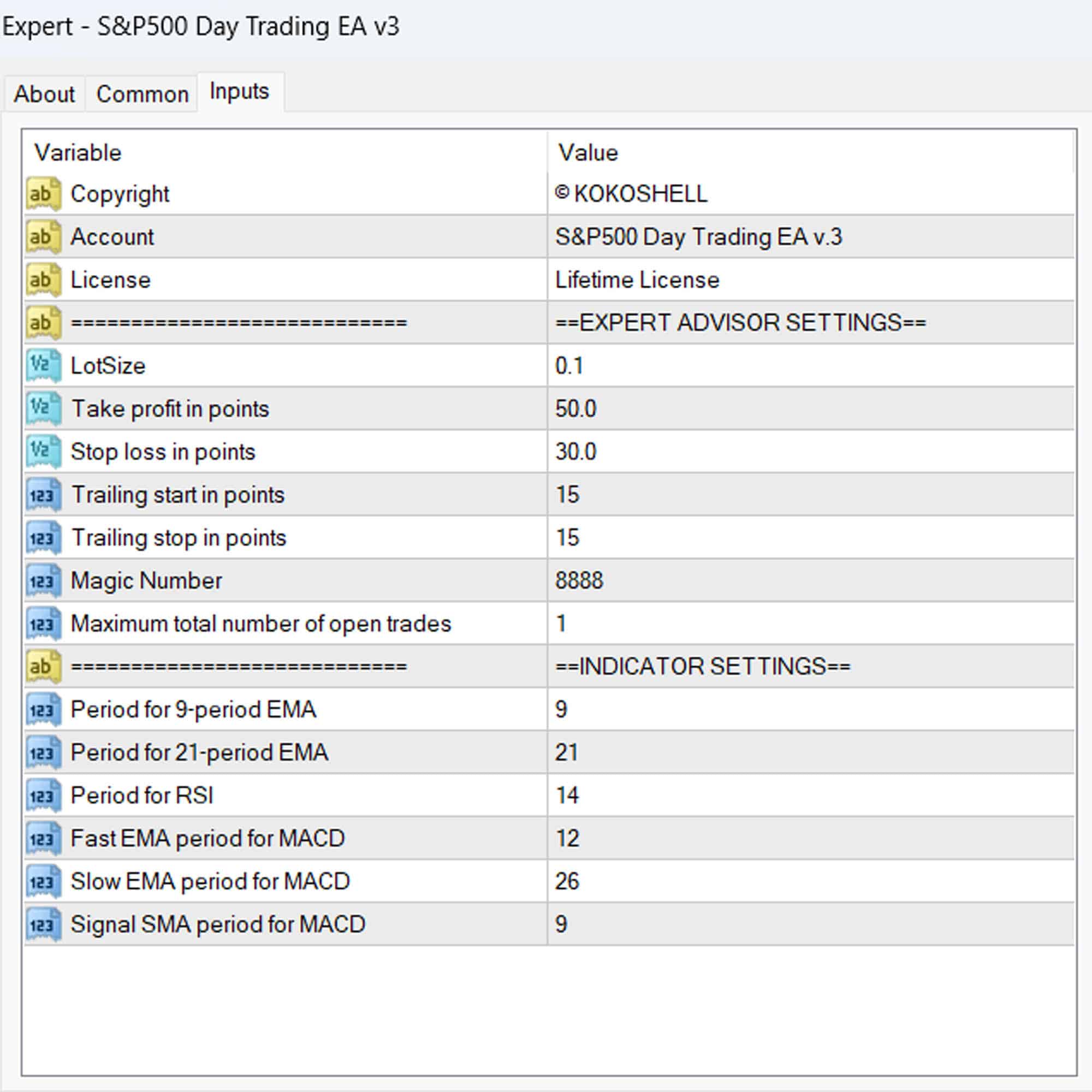

The S&P500 Day Trading EA meticulously analyzes market conditions using key technical indicators such as the Exponential Moving Averages (EMA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). Here’s how it generates high-probability trade signals:

- Buy Signal: The EA initiates a buy order when the 9-period EMA is above the 21-period EMA, RSI ranges between 50 and 70, and the MACD line crosses above the signal line.

- Sell Signal: Conversely, a sell order triggers when the 9-period EMA is below the 21-period EMA, RSI ranges between 30 and 50, and the MACD line crosses below the signal line.

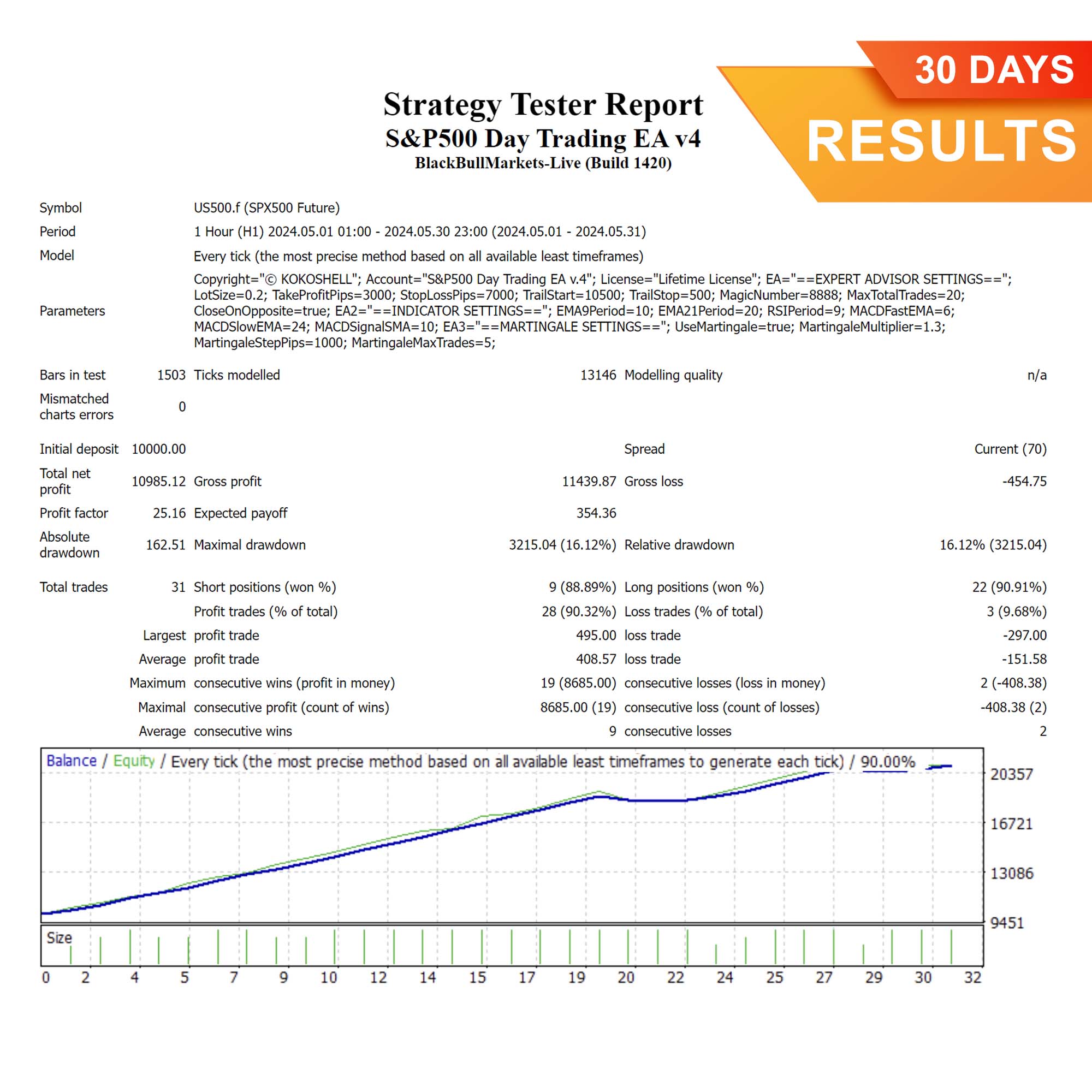

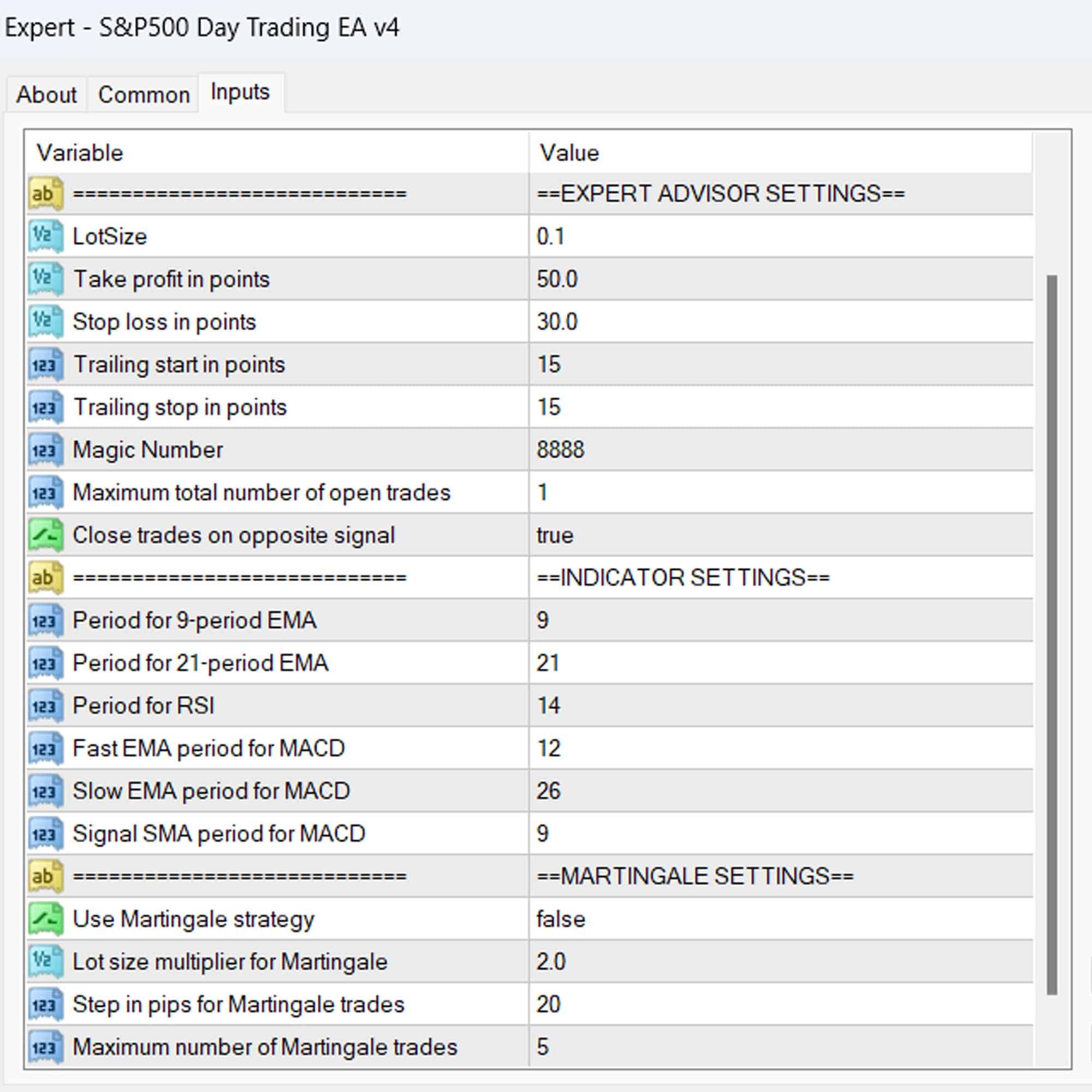

The S&P500 Day Trading EA integrates a trailing stop mechanism to secure profits as trades move favorably. Moreover, it includes an optional Martingale strategy to enhance recovery from losses.

Key Features: Advanced Tools for Superior Trading Performance

- Precision Entry Signals: Utilizes EMA, RSI, and MACD for accurate buy and sell signals. Additionally, these indicators ensure timely trade executions.

- Dynamic Trailing Stops: Adjusts stop-loss levels as trades move in your favor, effectively securing profits. Furthermore, it optimizes risk management.

- Martingale Strategy: Optional feature to multiply lot sizes on losing trades, thereby enhancing recovery potential. This strategy provides strategic advantages in volatile market conditions.

- Automatic Trade Closure: The EA closes trades based on opposite signals, optimizing overall performance. This feature minimizes potential losses during market reversals.

- Customizable Settings: Tailor parameters such as lot size, take profit, stop loss, and trailing stop to align with your trading style. This customization ensures flexibility and adaptability.

Why Choose S&P500 Day Trading EA?

Opting for the S&P500 Day Trading EA means equipping yourself with a powerful tool designed to maximize your trading potential. Here’s why it stands out:

- Specialized for S&P500: Specifically tailored for the S&P500 index, ensuring precise performance. Additionally, this specialization guarantees accuracy in trading signals.

- Robust Indicator Combination: Combines the strengths of multiple indicators for reliable signal generation. Furthermore, this synergy enhances signal confirmation.

- Comprehensive Risk Management: Offers extensive settings for effective risk control and profitability enhancement. These risk management features mitigate potential trading risks.

- Lifetime License: A one-time purchase with lifetime access and updates, offering exceptional long-term value. Therefore, it provides continuous support and cost savings.

Elevate Your Trading with S&P500 Day Trading EA

The S&P500 Day Trading Expert Advisor for MT4 (Metatrader 4) by KOKOSHELL is your gateway to achieving consistent trading success. By harnessing advanced technical indicators and robust risk management strategies, this EA offers a reliable solution for traders looking to optimize their performance in the S&P500 market.

Invest in your trading future with the S&P500 Day Trading EA for Metatrader 4 and take control of your trading journey today. Secure your lifetime license and start trading smarter.

Ethan Rodriguez –

This tool has transformed my day trading. Consistent profits and reliable signals.

Mia Sanchez –

Great performance overall. Easy to use and accurate signals. Highly recommended.

Olivia Brown –

Lacks input options but the price is good. Needs backtesting for optimal results.

Lucas Miller –

Fantastic tool! My trading success has increased significantly. Worth every penny.

Isabella Clark –

Outstanding performance. It has made my trading more profitable and less stressful.

Noah Martinez –

Effective and reliable. The signals are timely, but more customization would be nice.

Emily Davis –

Excellent results. Easy to integrate into my strategy. Consistent profits since I started using it.

Angela Brown –

Incredible! This trading advisor has revolutionized my trading. The setup was a breeze, and within days, my profits soared. The strategy this advisor uses is brilliant, and the risk management is impeccable. It’s transformed my trading experience into something highly profitable and enjoyable. This is a must-have for any trader.