Enhance Your Trading with S&P500 Trend Trading EA

Discover the S&P500 Trend Trading EA (Expert Advisor) for MT4 (Metatrader 4), a state-of-the-art trading tool designed specifically for the S&P500 index. This expert advisor harnesses advanced technical indicators to identify and capitalize on trending market conditions. Whether you are a novice or a seasoned trader, the S&P500 Trend Trading Expert Advisor simplifies your trading experience, allowing you to trade with confidence and precision.

How It Works: Intelligent Algorithms for Optimal Performance

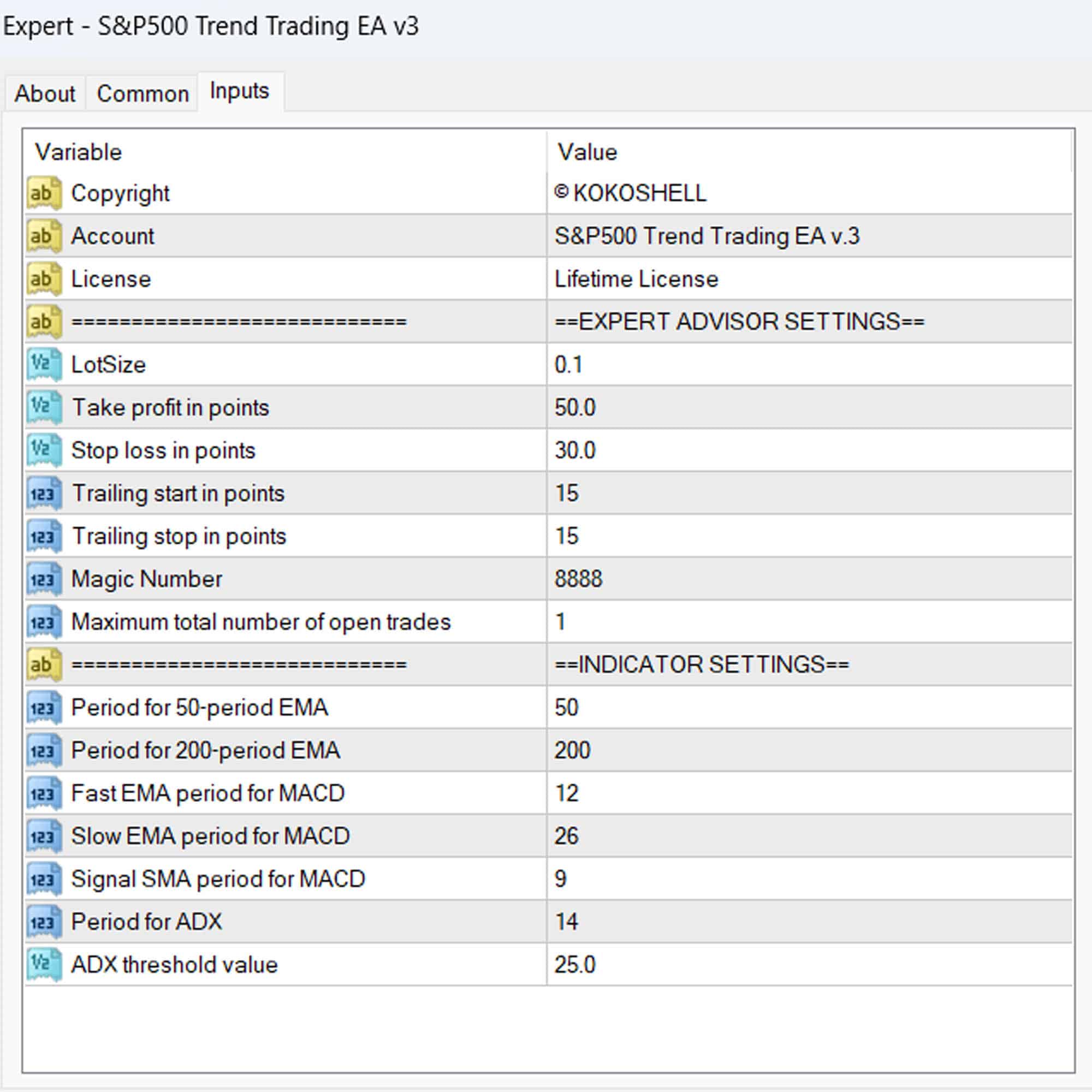

The S&P500 Trend Trading EA operates by meticulously analyzing market trends. Firstly, it uses a combination of Exponential Moving Averages (EMA), MACD, and ADX indicators. Here’s how it generates high-probability trade signals:

- Buy Signal: The EA initiates a buy order when the 50-period EMA crosses above the 200-period EMA. Additionally, it considers when the MACD line crosses above the signal line and ADX is above the threshold, indicating a strong uptrend.

- Sell Signal: Conversely, a sell order is triggered when the 50-period EMA crosses below the 200-period EMA. This occurs alongside the MACD line crossing below the signal line. Moreover, ADX remains above the threshold, indicating a strong downtrend.

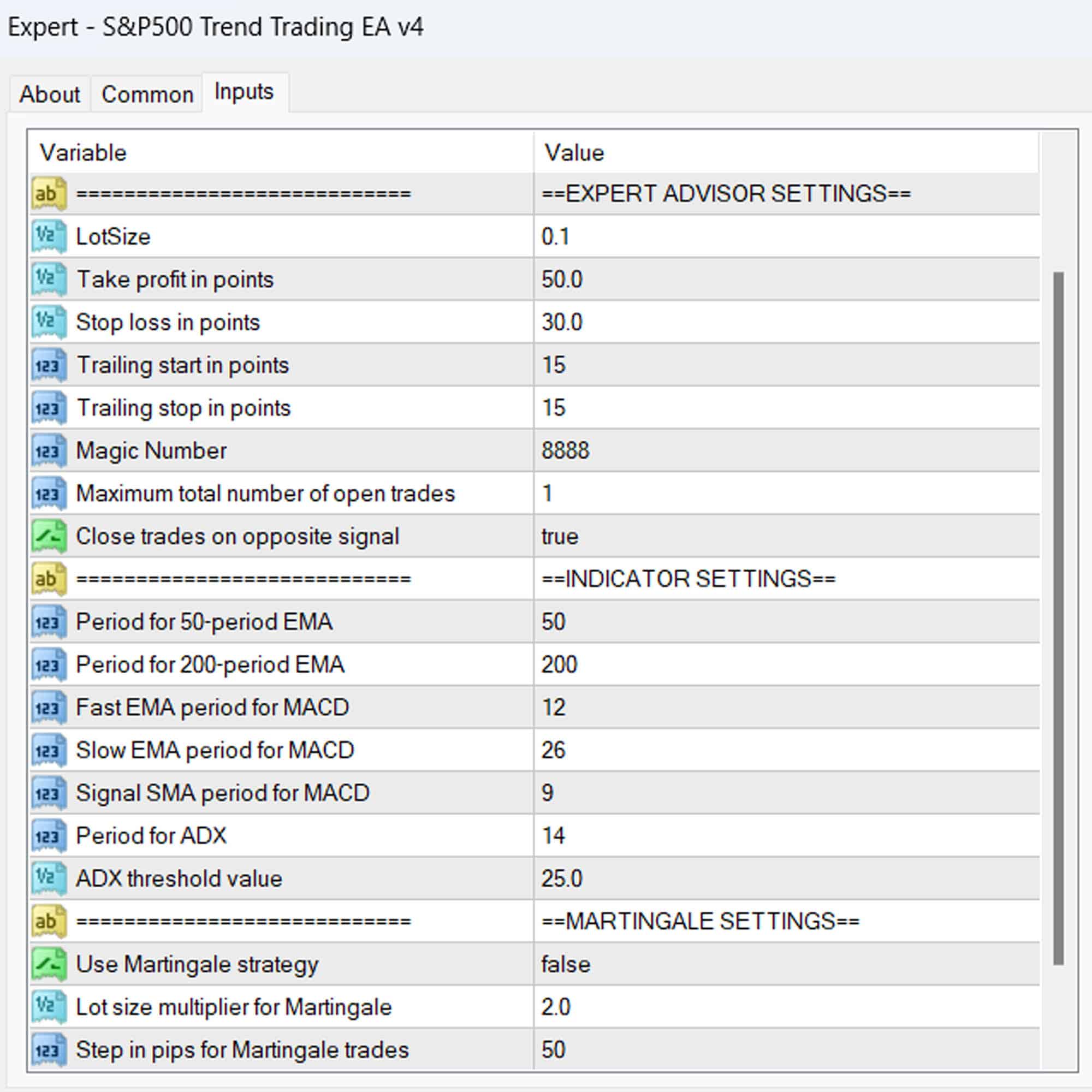

Additionally, the S&P500 Trend Trading EA features a trailing stop mechanism to secure profits as trades move in your favor. Furthermore, it includes an optional Martingale strategy to recover from losses effectively.

Key Features: Cutting-Edge Tools for Superior Trading

- Precision Entry Signals: It utilizes EMA crossovers, MACD, and ADX to generate accurate buy and sell signals. Furthermore, these signals are critical for timely decision-making.

- Dynamic Trailing Stops: These automatically adjust stop-loss levels as trades move in your favor, thereby securing profits effectively. Additionally, they ensure optimal risk management.

- Martingale Strategy: An optional feature allows multiplication of lot sizes on losing trades, enhancing recovery potential. Moreover, it provides a strategic advantage in volatile markets.

- Customizable Settings: You can tailor parameters such as lot size, take profit, stop loss, and trailing stop to match your trading style. Additionally, this customization ensures flexibility and adaptability.

- Automatic Trade Closure: The EA closes trades based on opposite signals for optimal performance. Consequently, it minimizes potential losses during market reversals.

Why Choose S&P500 Trend Trading EA?

Opting for the S&P500 Trend Trading EA means equipping yourself with a powerful and reliable tool designed to maximize your trading potential. Here’s why it stands out:

- Specialized for S&P500: It is specifically tailored for the S&P500 index, ensuring precise performance. Furthermore, this specialization guarantees accuracy in trading signals.

- Robust Indicator Combination: The EA combines the strengths of multiple indicators for reliable signal generation. Additionally, this synergy enhances signal confirmation.

- Comprehensive Risk Management: It offers extensive settings for effective risk control and profitability enhancement. Moreover, these risk management features mitigate potential trading risks.

- Lifetime License: This is a one-time purchase with lifetime access and updates, offering exceptional value. Hence, it provides long-term cost savings and continuous support.

Elevate Your Trading with S&P500 Trend Trading Expert Advisor

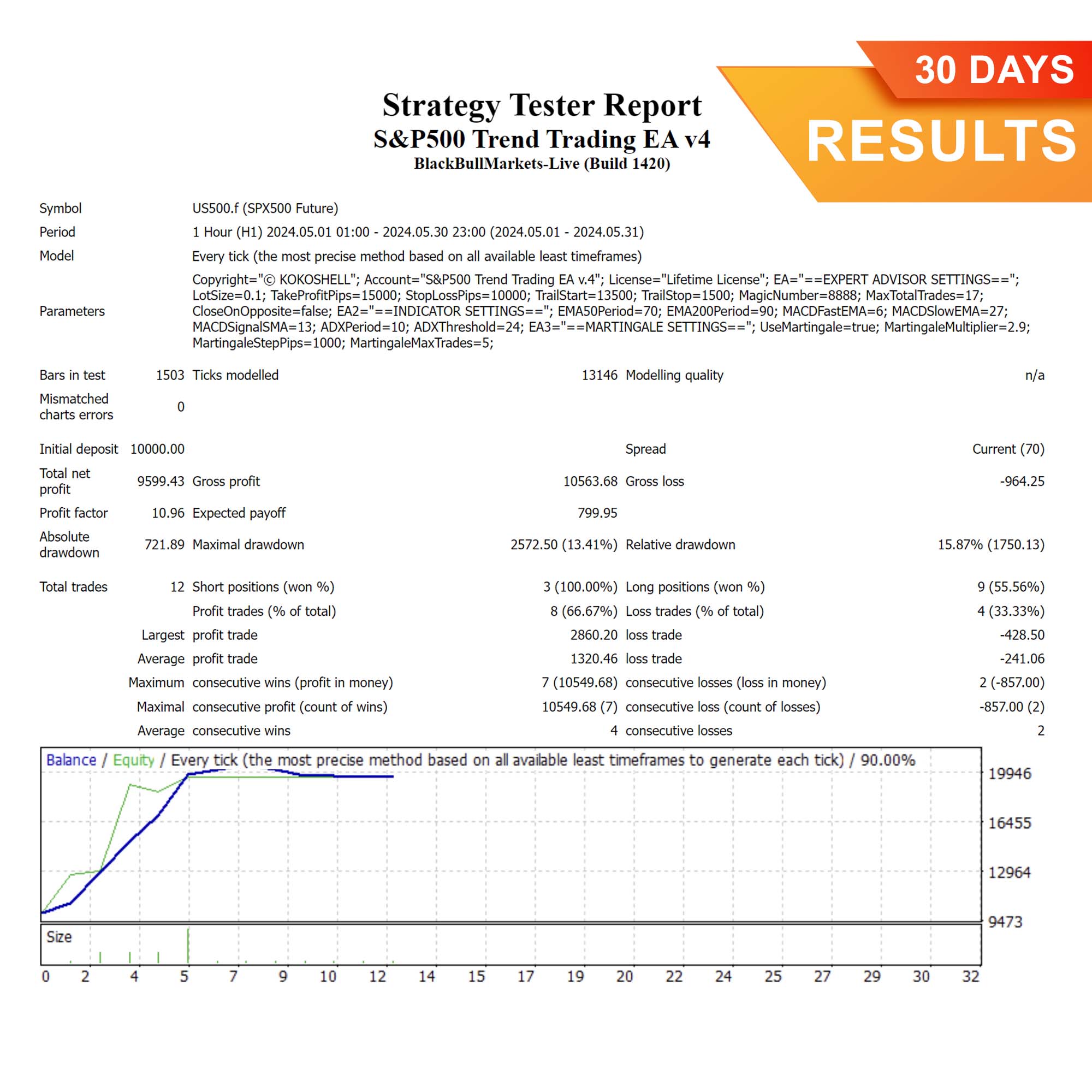

The S&P500 Trend Trading EA for Metatrader 4 by KOKOSHELL is your gateway to achieving consistent trading success. By harnessing advanced technical indicators and robust risk management strategies, this EA offers a reliable solution for traders looking to optimize their performance in the S&P500 market.

Invest in your trading future with the S&P500 Trend Trading Expert Advisor for MT4 (Metatrader 4) and take control of your trading journey today. Secure your lifetime license and start trading smarter.

Isabella Martinez –

This tool has boosted my trading performance significantly. Highly accurate signals.

David Johnson –

Great tool for trading the SP500. Reliable and easy to use.

Mia Hernandez –

Lacks input parameters. Needs backtesting. Good price, though.

Ethan Garcia –

Outstanding performance! My profits have increased steadily since I started using it.

Olivia Wilson –

Effective tool. Accurate signals and solid risk management.

Liam Brown –

My trading accuracy has improved greatly. Highly recommended!

Liam Brown –

Highly recommended!

Sophia Lopez –

Excellent results. The tool is easy to integrate into my trading strategy.

Carlos Rodriguez –

Good product, but needs more input options. Affordable and useful overall.

Patricia Gonzalez –

Using this trading advisor has been a game-changer. The setup was hassle-free, and the profits started coming in almost immediately. The strategic approach it takes is impressive, and the risk management is top-tier. Trading has become stress-free and profitable. I couldn’t be happier with the results.