BTC Day Trading EAUnleash the Power of Automated Trading

The BTC Day Trading EA is an innovative Expert Advisor for MT4 (Metatrader 4) designed by KOKOSHELL to maximize your trading efficiency. Tailored specifically for Bitcoin day trading, this EA leverages cutting-edge algorithms to execute trades with precision and accuracy. Furthermore, whether you’re a novice or an experienced trader, the BTC (Bitcoin) Day Trading EA can significantly enhance your trading performance by automating your strategy and managing risks effectively.

How It Works: Precision and Efficiency in Every Trade

- Step-by-Step Trading Process:

- Indicator Analysis: The EA continuously monitors market conditions using advanced indicators like MACD, RSI, and ATR. Additionally, it adapts to changes in market dynamics.

- Signal Generation: When conditions are favorable, the EA generates buy or sell signals based on the MACD crossover and RSI levels. Therefore, ensuring timely and accurate signals.

- Order Execution: Upon receiving a signal, the EA executes trades with predefined lot sizes, take profit, and stop loss levels. This approach maintains discipline in trading.

- Risk Management: The BTC Day Trading EA employs trailing stops to lock in profits and an optional martingale strategy for trade recovery. Consequently, it safeguards your capital.

- Trade Monitoring: The EA constantly monitors open trades, ensuring optimal exit points and managing trades based on market dynamics. Thus, it ensures consistent performance.

Key Features: Advanced Tools for Superior Trading

The BTC Day Trading EA offers advanced tools for superior trading performance:

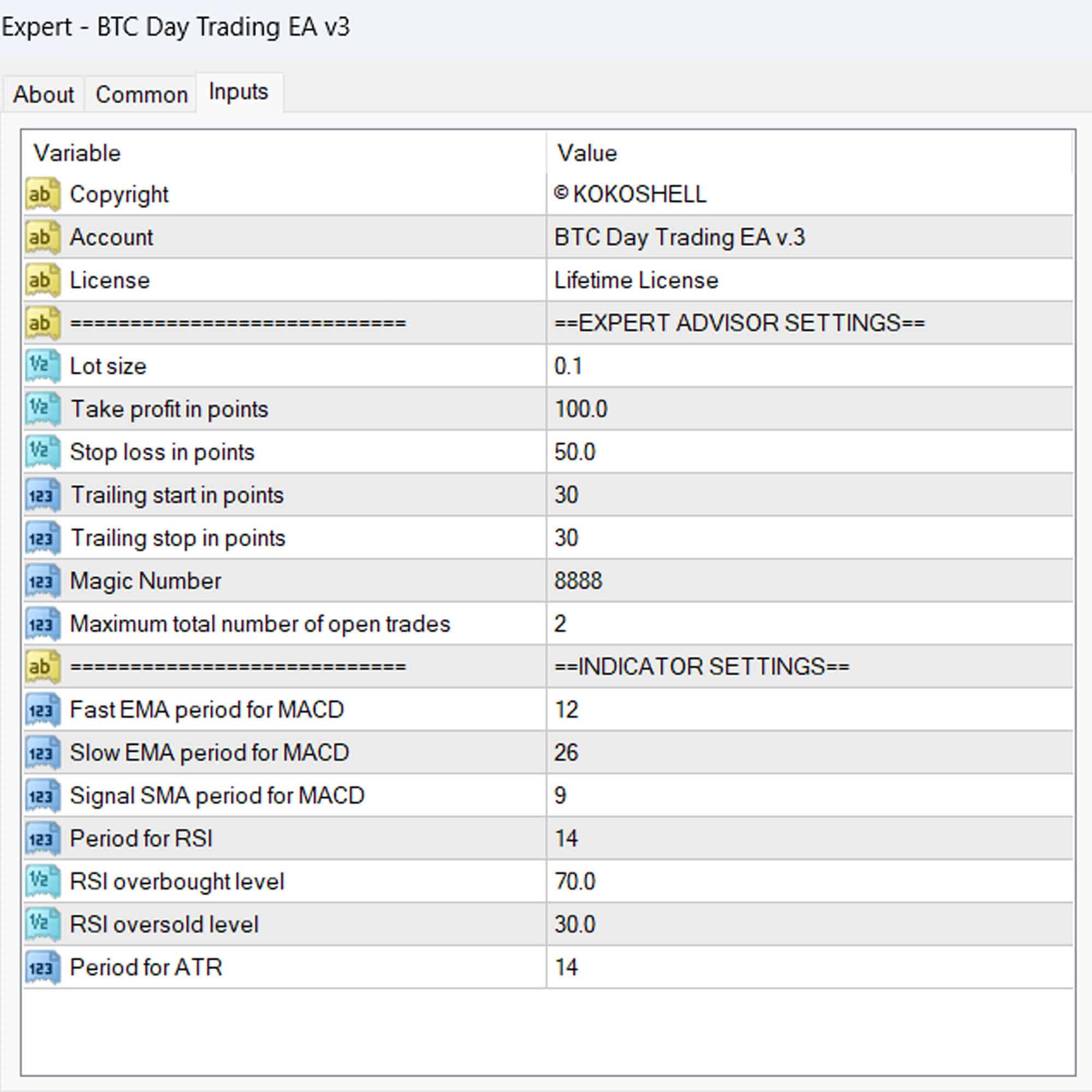

- Comprehensive Indicator Settings:

- MACD: Utilizes Fast EMA, Slow EMA, and Signal SMA to identify trend changes. Additionally, it confirms market momentum.

- RSI: Analyzes overbought and oversold conditions to predict market reversals. Therefore, it provides reliable signals.

- ATR: Measures market volatility to adjust trading strategies dynamically. Consequently, it enhances trade accuracy.

- Customizable Trading Parameters:

- Lot Size: Adjustable to suit different trading preferences and account sizes. This flexibility caters to various traders.

- Take Profit & Stop Loss: Predefined levels to ensure disciplined trading. Additionally, they help manage risks effectively.

- Trailing Stops: Secure profits by adjusting stop loss levels as trades become profitable. Consequently, they maximize gains.

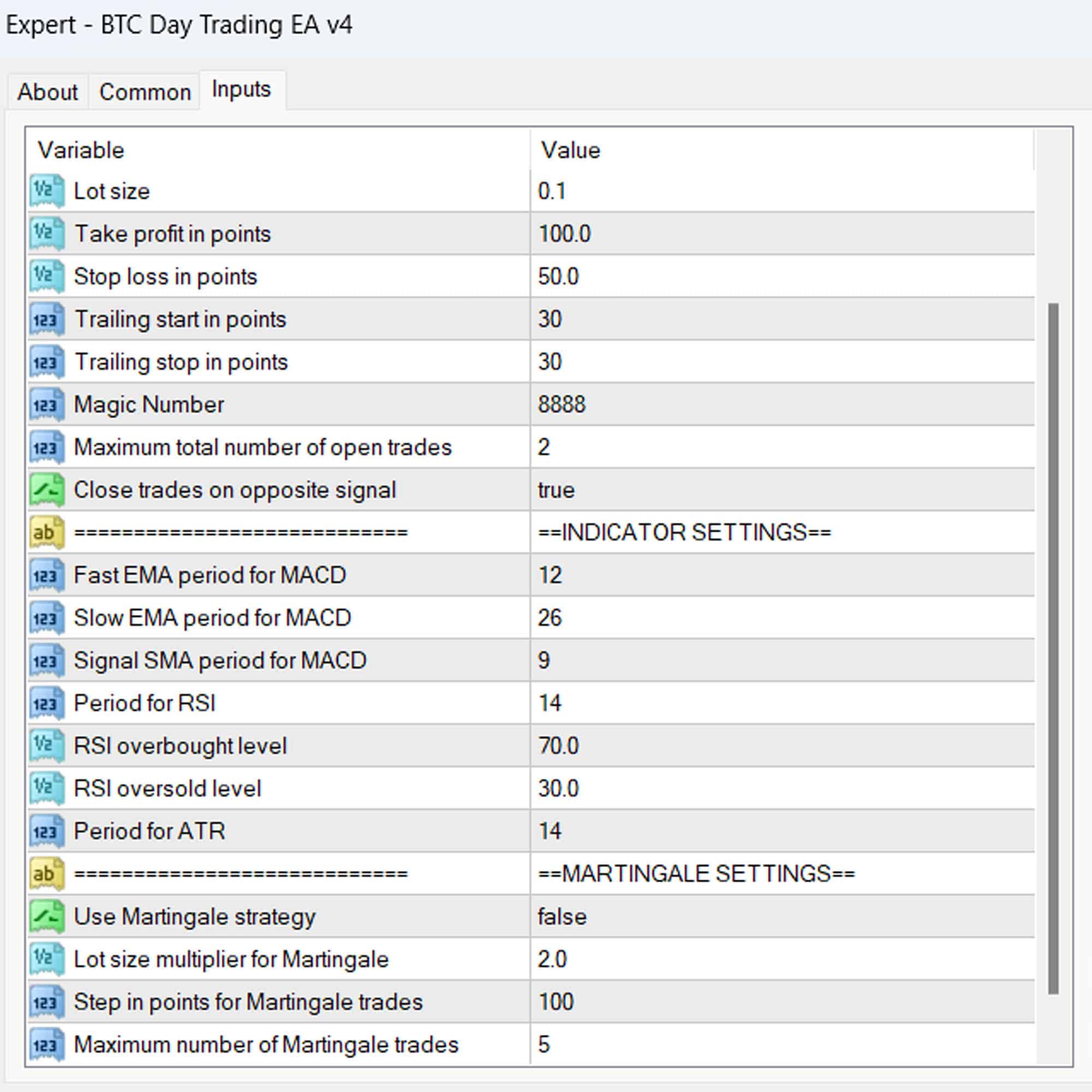

- Martingale Strategy:

- Martingale Multiplier: Automatically increases lot sizes after a loss to recover previous losses. This strategy enhances potential recovery.

- Step Pips & Max Trades: Customizable settings to control the martingale strategy effectively. Additionally, they manage risks.

Why Choose BTC (Bitcoin) Day Trading EA: Your Path to Consistent Profits

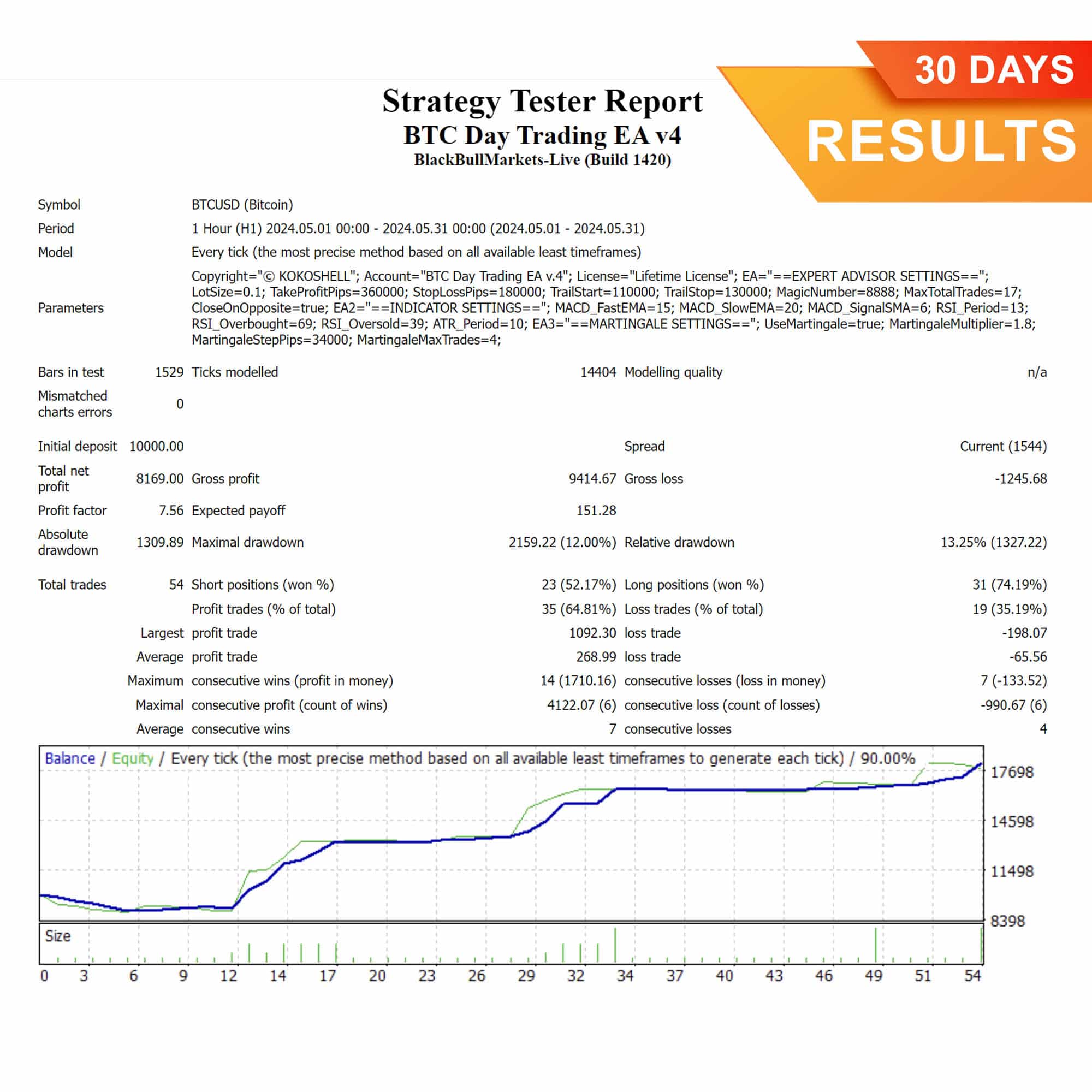

- Proven Performance:

- High Accuracy: The EA’s sophisticated algorithms ensure high-accuracy trade execution. Therefore, it delivers reliable results.

- Efficiency: Automates complex trading tasks, allowing you to focus on strategy development. Additionally, it saves time.

- Versatility: Suitable for traders of all experience levels, from beginners to experts. Consequently, it caters to a wide audience.

- Superior Risk Management:

- Automated Risk Controls: The BTC Day Trading EA’s built-in risk management features help protect your investments. Additionally, they ensure safety.

- Dynamic Adjustments: Adapts to changing market conditions to maintain optimal trading performance. Therefore, it enhances reliability.

- Ease of Use:

- User-Friendly Interface: Simple setup and configuration for hassle-free trading. Consequently, it ensures easy adoption.

- 24/7 Trading: Operates round the clock, taking advantage of all market opportunities. Additionally, it maximizes potential profits.

Transform Your Trading with BTC (Bitcoin) Day Trading EA

The BTC Day Trading EA for Metatrader 4 is your ultimate solution for automated Bitcoin trading. By integrating advanced indicators, customizable parameters, and robust risk management, this EA offers unparalleled trading efficiency and accuracy. Experience the future of trading with BTC (Bitcoin) Day Trading EA and achieve consistent, profitable results effortlessly. Invest in your trading success today with BTC Day Trading Expert Advisor for MT4 (Metatrader 4).

Jesse Brown –

Incredible profits! This tool is a game-changer.

Eduard –

My best trading results ever.

Patrick Scott –

Great tool, but backtesting needed.

Sophia Wilson –

Consistent gains, easy to use, highly recommend.

Tyler –

Needs better input parameters. Decent price.

Juan Anderson –

Outstanding tool! My trading has improved dramatically.

Christopher Moore –

Absolutely fantastic! Setting up was easy, and the profits have been consistent. The strategy is incredibly effective, and the risk management features are excellent. This advisor has made trading not only profitable but also enjoyable. Highly recommend it for any trader looking to succeed.