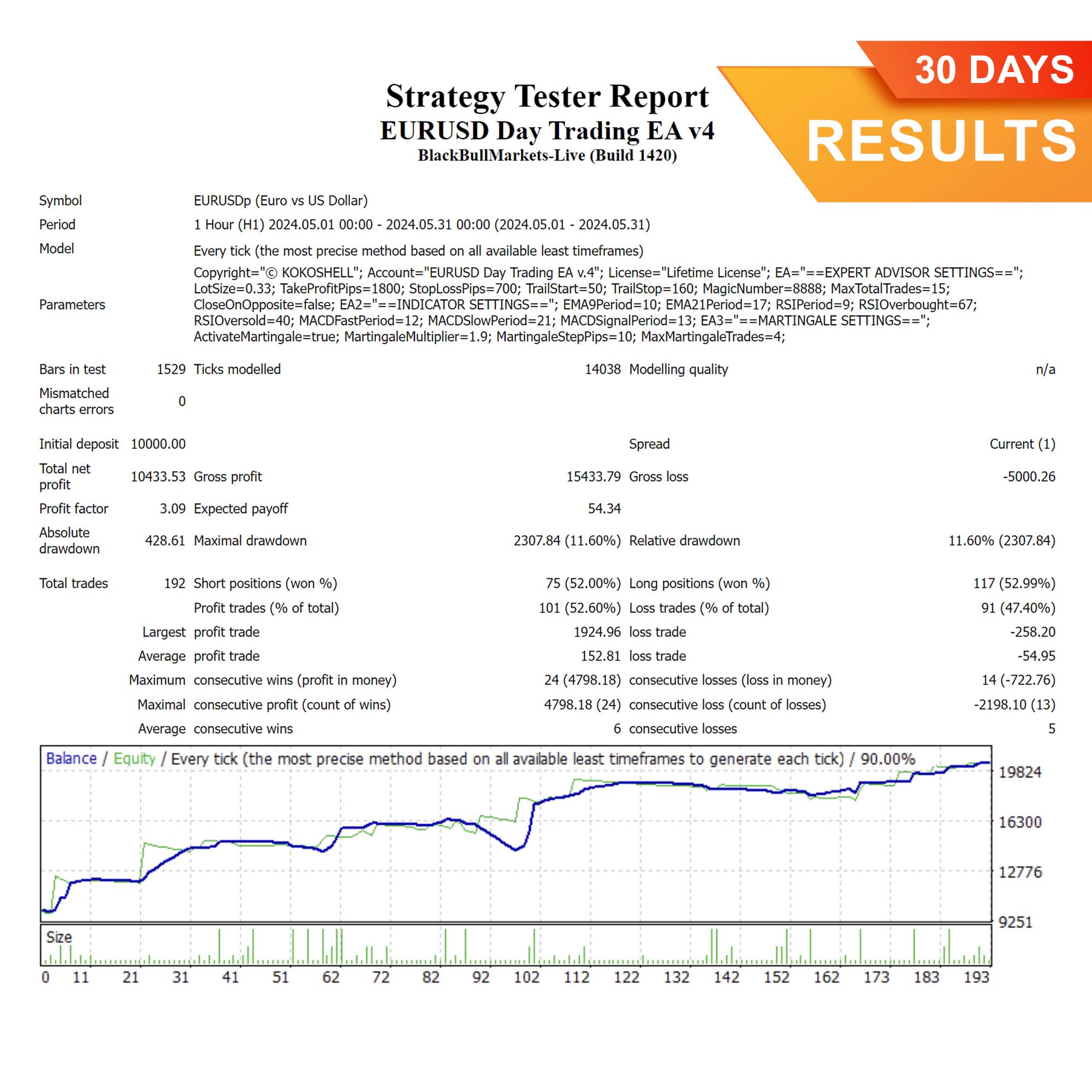

Elevate Your Trading with EURUSD Day Trading EA

Experience the precision and efficiency of automated trading with the EURUSD Day Trading EA (Expert Advisor) for MT4 (Metatrader 4). This Expert Advisor (EA) enhances your day trading strategies by leveraging advanced technical indicators. Whether you are a seasoned trader or a beginner, the EURUSD Day Trading MT4 Expert Advisor offers an effective, automated solution to help you achieve consistent success in the forex market.

How It Works: Utilizing Advanced Indicators for Day Trading Success

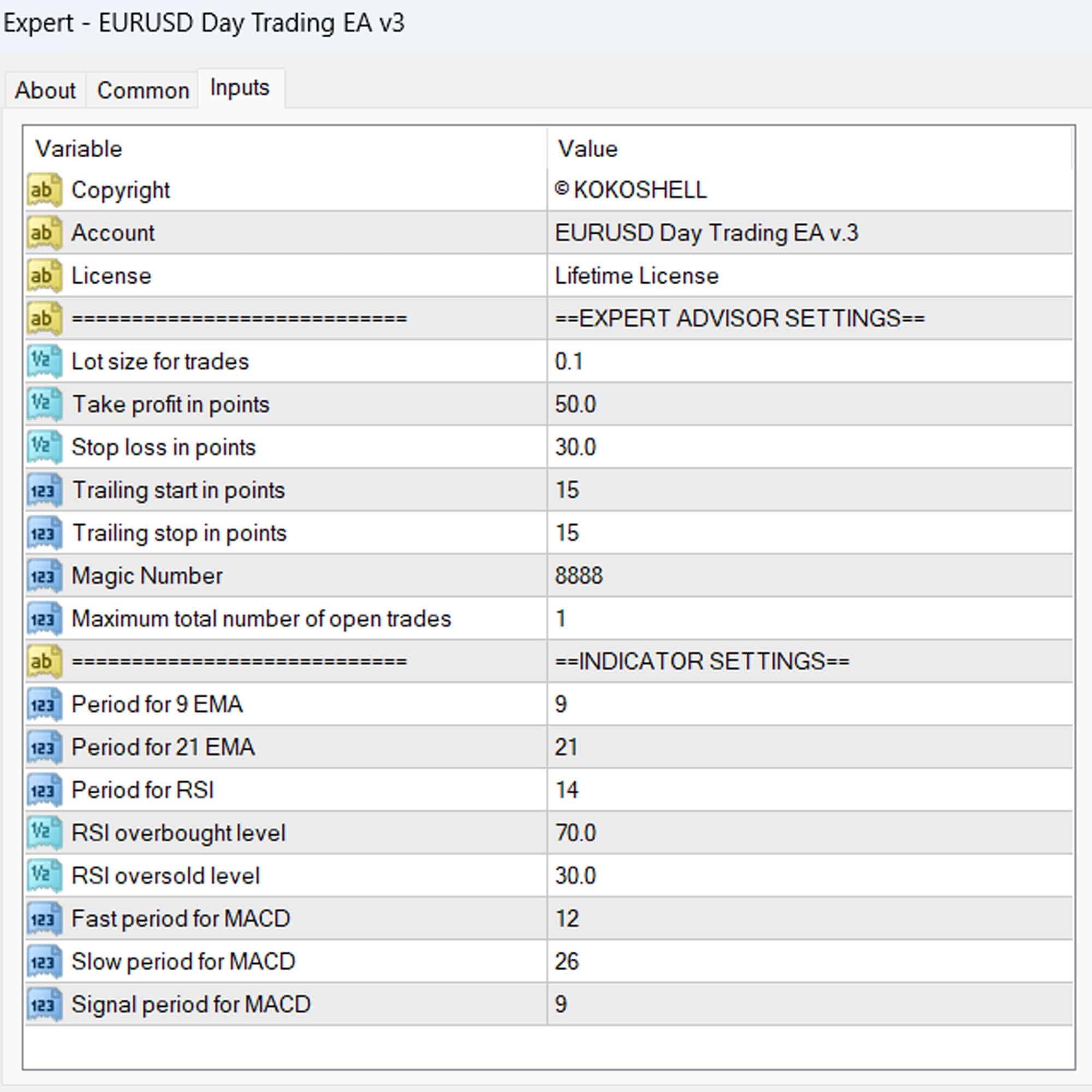

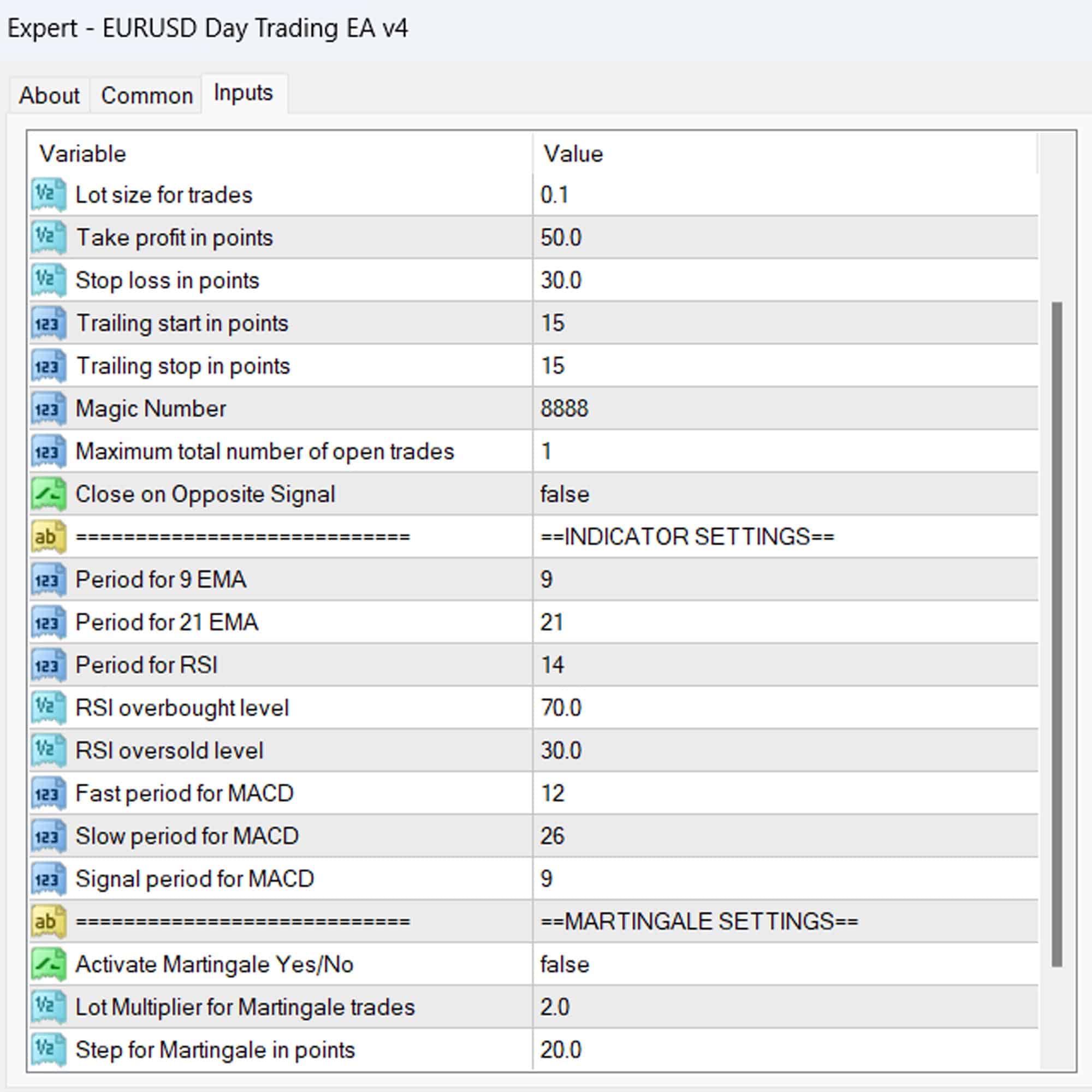

The EURUSD Day Trading EA analyzes market conditions through a combination of Exponential Moving Averages (EMAs), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) indicators. For instance, when the short-term EMA crosses above the long-term EMA, the EA identifies a potential buy signal, provided the RSI is in a favorable range and the MACD line is above the signal line.

Conversely, a sell signal is generated when the short-term EMA crosses below the long-term EMA, the RSI indicates overbought conditions, and the MACD line is below the signal line. This comprehensive approach ensures accurate and timely trade executions.

Key Features: Cutting-Edge Tools for Enhanced Trading

Discover the robust features of the EURUSD Day Trading EA, designed to elevate your trading strategy:

- Precision Signal Generation: Utilizes EMA crossovers, RSI, and MACD to generate accurate buy and sell signals. Moreover, it ensures timely trade executions.

- Dynamic Trailing Stops: Adjusts stop-loss levels as trades move in your favor, locking in profits effectively. Consequently, it maximizes gains.

- Martingale Strategy: Optional feature to multiply lot sizes on losing trades, aiming for quicker recovery. Furthermore, this strategy enhances potential profitability.

- Customizable Settings: Tailor parameters like lot size, take profit, stop loss, and more to suit your trading style. Additionally, you can adjust settings as market conditions change.

- Risk Management: Limits the maximum number of open trades and manages risk with intelligent stop-loss strategies. Therefore, it minimizes potential losses.

Why Choose EURUSD Day Trading EA: Superior Performance and Flexibility

Choosing the EURUSD Day Trading EA for Metatrader 4 means opting for a robust and reliable trading solution. By leveraging powerful technical indicators, this EA identifies high-probability trading opportunities, ensuring you don’t miss out on profitable trades.

Its customizable settings allow you to adapt the EA to your specific trading preferences, whether you aim for aggressive growth or steady gains. The optional Martingale strategy adds an extra layer of potential profitability, making it a versatile tool in any trader’s arsenal.

Achieve Consistent Success with EURUSD Day Trading EA

Incorporate the EURUSD Day Trading EA into your trading strategy and experience the benefits of automated, precise, and profitable trading. Moreover, with its advanced features and robust risk management, this Expert Advisor is designed to help you achieve consistent success in the forex market. Therefore, don’t miss the opportunity to elevate your trading game—try the EURUSD Day Trading Expert Advisor for Metatrader 4 by KOKOSHELL today.

James L. –

Remarkable gains! Highly suggest.

Matthew –

Strong strategy delivering consistent profits.

David Garcia –

This trading tool revolutionized my approach. The strategy is exceptionally effective, and the risk management is excellent. My profits have surged.

Gabriel R. –

Reliable strategy, but the limited customization options are a drawback. The price makes it worth a try, but it requires more backtesting.

Jeffrey M. –

Excellent performance, though more customization would be beneficial. Overall, very pleased with the results.

Anthony –

Fantastic results, very user-friendly.

Charles W. –

Strategy is precise, and risk management is solid. My trading has improved significantly. Couldn’t ask for more.

Juan –

Boosted my daily earnings!

James Davis –

This trading advisor is fantastic! The setup was straightforward, and the profits have been substantial. The strategic insights are precise, and the risk management is exceptional. It’s clear that a lot of thought went into designing this tool. Highly recommend it for anyone looking to boost their trading success.