Discover the Power of EURUSD Day Trading EA

Discover how to make money with EURUSD Day Trading EA, be profitable, and optimize your trading approach using this powerful tool. This expert advisor leverages trend-following strategies in the EURUSD market, utilizing sophisticated algorithms to identify and capitalize on market trends. EURUSD, representing the euro against the US dollar, offers excellent liquidity and volatility, making it perfect for day trading. By automating your trading with EURUSD Day Trading EA, you can focus on strategic analysis while the EA efficiently executes trades, reducing the stress of manual trading.

Moreover, this EA features a comprehensive suite of tools designed for traders aiming to maximize their returns. It includes customizable settings for lot sizes, stop losses, take profits, and trailing stops, enabling adaptation to various market conditions and trading styles. The EA’s advanced use of technical indicators such as EMA (Exponential Moving Averages), RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) ensures you capitalize on market movements. Furthermore, risk management tools like Martingale strategies and daily profit/loss limits help safeguard your investments.

To unlock the full potential of EURUSD Day Trading EA, understanding and utilizing its capabilities is essential. This guide will explore the significance of backtesting, fine-tuning input parameters, implementing risk management strategies, and selecting optimal trading hours to help you be profitable with this versatile EA.

How Important is Backtesting Your Strategy with EURUSD Day Trading EA?

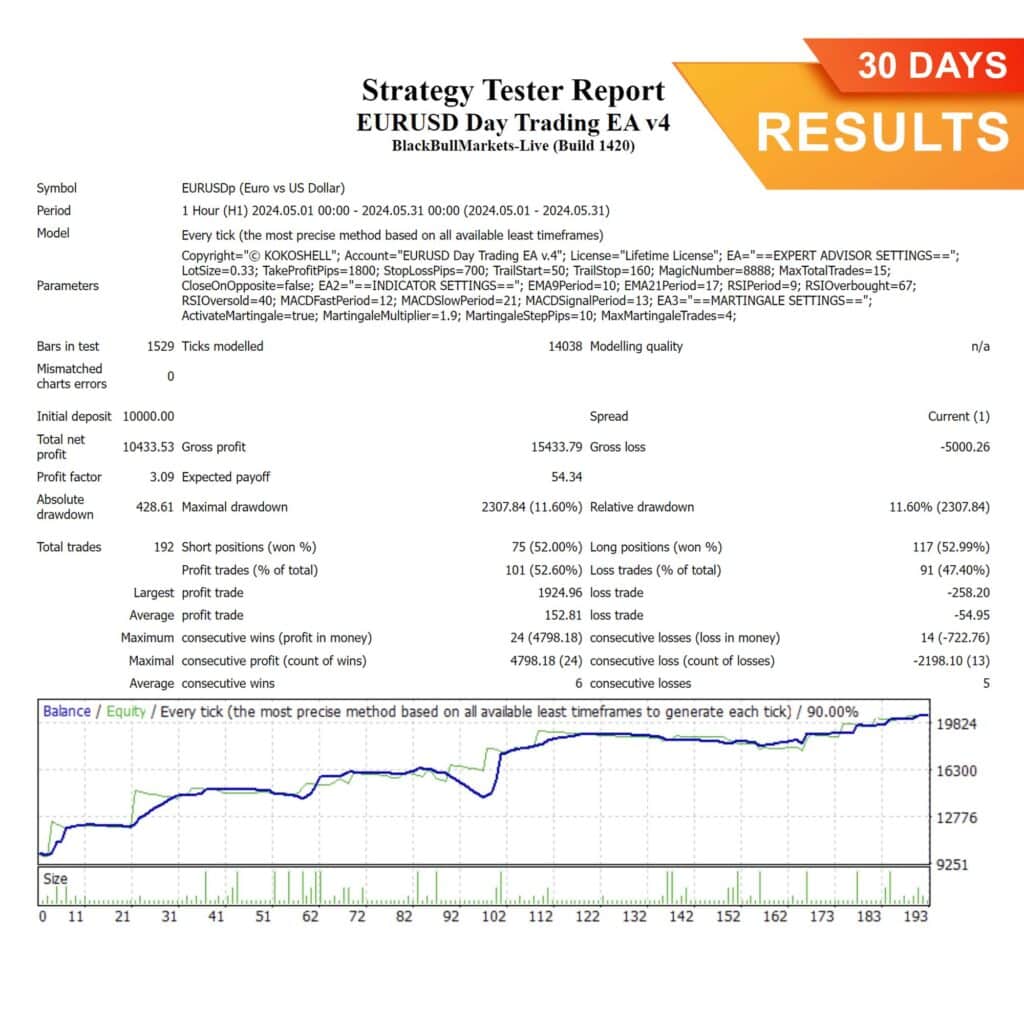

Backtesting is crucial to know how to make money with EURUSD Day Trading EA and be profitable. This process simulates trading with historical data, offering insights into how the EA would perform under various market conditions. Identifying the most effective input parameters tailored to your trading style and risk tolerance is a major benefit of backtesting.

Why Backtesting is Essential

- Discover Ideal Settings: Testing different parameter combinations through backtesting helps find the most profitable settings for the EA. Additionally, adjusting take profit and stop loss levels can significantly impact performance.

- Analyze Performance Metrics: Through backtesting, you can review key metrics such as win rate, average profit/loss per trade, and maximum drawdown. These metrics provide a clearer picture of the EA’s potential profitability and risk.

- Boost Confidence: Ultimately, seeing how the EA has performed historically increases your confidence in its ability to handle live trading scenarios. Knowing that your strategy has been successful in the past provides reassurance.

- Adapt to Market Changes: As markets evolve, past performance might not guarantee future success. Consequently, regular backtesting ensures your strategy remains relevant to current market conditions.

Example of a Backtesting Process

Consider testing the EURUSD Day Trading EA over two years of historical data. Begin with the default parameters and observe the results. If the average drawdown exceeds your risk tolerance, tighten the stop loss to reduce drawdown, even if it affects the win rate. For instance, you might start with a stop loss of 30 pips and adjust it to 25 pips to find the optimal balance. Through continuous tweaking, find a balance where the profit factor is acceptable, and the drawdown is manageable. This iterative process of backtesting and refining helps optimize your strategy.

For more insights into backtesting, check out the Ultimate Guide for Backtesting – Step by Step at kokoshell.com/backtesting. This step is crucial to understand how to make money with EURUSD Day Trading EA.

How to Fine-Tune Your Input Parameters for EURUSD Day Trading EA

Although EURUSD Day Trading EA comes with default settings, fine-tuning these parameters can significantly enhance profitability. Experimenting with different lot sizes, stop losses, take profit levels, trailing stops, and indicator settings is essential to be profitable. Rigorous backtesting helps customize these settings to find what works best for you. Knowing how to make money with EURUSD Day Trading EA involves constant optimization.

Key Parameters to Adjust

- Lot Size: Adjusting the lot size determines the trade volume and potential profit or loss. Therefore, conservative traders might start with smaller lot sizes to mitigate risk.

- Take Profit: Setting an optimal take profit level ensures that profits are secured when the market moves in your favor.

- Stop Loss: A well-placed stop loss protects your capital from significant market reversals.

- Trailing Stop: Moreover, this feature locks in profits by moving the stop loss level as the trade gains profitability.

- Indicator Parameters: Fine-tuning settings for technical indicators like EMA, RSI, and MACD is crucial for generating accurate trading signals.

Example of Parameter Fine-Tuning

Suppose you start with a lot size of 0.1, a take profit of 50 pips, and a stop loss of 30 pips. During backtesting, you notice better results with a take profit of 40 pips and a stop loss of 25 pips. Setting the trailing stop to activate at 15 pips with a trailing step of 15 pips maximizes profits. Additionally, adjusting the EMA periods to 9 and 21, the RSI period to 14 with overbought and oversold levels at 70 and 30 respectively, and fine-tuning the MACD settings (12, 26, 9) enhances signal accuracy. This fine-tuning process involves testing various combinations to find the most effective settings to optimize EURUSD Day Trading EA.

Benefits of Customization

- Maximized Profits: Therefore, finding the optimal take profit and stop loss levels maximizes each trade’s profitability.

- Reduced Drawdowns: Adjusting the stop loss minimizes losses during unfavorable market conditions.

- Enhanced Risk Management: Customizing lot sizes, trailing stops, and indicator parameters aligns the EA’s risk profile with your personal risk tolerance.

How to Embrace Risk Management for Long-Term Success with EURUSD Day Trading EA

Risk management is vital to be profitable with EURUSD Day Trading EA. Implementing strategies such as setting daily profit and loss limits, and using the Martingale method cautiously, protects your investments. Ultimately, maximizing gains while minimizing potential losses is the goal. Knowing how to optimize and make money with EURUSD Day Trading EA requires effective risk management.

Risk Management Techniques

- Daily Profit and Loss Limits: Setting these limits ensures that you secure profits and cap losses daily. This prevents overtrading and protects your capital.

- Martingale Strategy: While this strategy can help recover losses quickly, it exponentially increases risk. Use it sparingly and with strict limits.

- Position Sizing: Adjusting your lot size based on account equity helps maintain a consistent risk level.

Practical Example of Risk Management

Imagine setting a daily profit target of $500 and a maximum daily loss of $300. On a particular trading day, the EA hits the profit target by midday, stopping further trading and securing the profits. Conversely, if the EA reaches the maximum daily loss, it halts trading to prevent further losses. This disciplined approach ensures long-term profitability without taking excessive risks.

How Trading Hours Impact Your Strategy with EURUSD Day Trading EA

Trading during optimal hours can significantly enhance the performance of EURUSD Day Trading EA. Being profitable with EURUSD Day Trading EA involves recognizing periods of high market liquidity and volatility. Adjust your EA’s settings to operate within these times to capture the most lucrative trading opportunities. Understanding how to make money with EURUSD Day Trading EA includes optimizing your trading hours.

Optimal Trading Times

- London Session: Characterized by high liquidity and significant price movements.

- New York Session: Often overlaps with the London session, offering excellent trading opportunities.

- Asian Session: Generally quieter but can present steady trends.

Benefits of Trading at Optimal Times

- Increased Liquidity: Higher liquidity means more buyers and sellers, resulting in tighter spreads and better trade execution.

- Higher Volatility: Greater price movements provide more opportunities for profitable trades.

- Reduced Slippage: Therefore, high liquidity periods reduce the risk of slippage, ensuring your trades are executed at desired prices.

If you don’t know the trading hours, visit forex.timezoneconverter.com. Select your time zone to instantly view market open and close times.

Example of Adjusting Trading Hours

Suppose backtesting shows the EA performs best during the London and New York sessions. Set the EA to start trading at 8:00 AM GMT and stop at 5:00 PM GMT. This adjustment ensures the EA operates during peak market hours, thus increasing the likelihood of capturing profitable trades. This step is crucial to optimize EURUSD Day Trading EA for better performance.

Conclusion: Your Path to Profitable Trading with EURUSD Day Trading EA

To be profitable and know how to make money with EURUSD Day Trading EA, adopting a well-thought-out strategy, conducting rigorous backtesting, and implementing robust risk management practices is essential. This powerful tool can transform your trading experience by automating processes and maximizing efficiency. However, the true potential of the EA is unlocked when you take the time to customize and optimize its settings to align with your unique trading style and goals.

Backtesting is your ally in this journey. It allows you to fine-tune your parameters and understand the EA’s performance under various market conditions. Continuously refining your strategy helps you adapt to ever-changing market dynamics and stay ahead of the curve.

Risk management should always be a priority. Implementing strict daily profit and loss limits, and using strategies like Martingale cautiously, will protect your capital and ensure long-term success. Additionally, adjusting your trading hours to coincide with periods of high liquidity and volatility will enhance your trading outcomes.

By embracing these principles and diligently working on your trading approach, you can indeed be profitable and make money with EURUSD Day Trading EA. The journey to trading success is paved with continuous learning, adaptation, and disciplined execution. With the EURUSD Day Trading EA by your side, you’re well-equipped to navigate the complexities of the forex market and achieve your financial goals. Always remember to optimize EURUSD Day Trading EA to stay profitable.

Top FAQs about How to Make Money with EURUSD Day Trading EA

How does EURUSD Day Trading EA utilize technical indicators for trading?

EURUSD Day Trading EA uses a combination of advanced technical indicators to identify profitable trading opportunities. It primarily leverages EMA (Exponential Moving Averages) and RSI (Relative Strength Index) to analyze market trends and price movements. The EMA helps determine trend directions, while the RSI helps identify overbought and oversold conditions, signaling potential entry and exit points. By integrating these indicators, the EA can make informed decisions to optimize trading performance and maximize profits.

How can I ensure the security of my trading account while using EURUSD Day Trading EA?

Ensuring the security of your trading account while using EURUSD Day Trading EA involves several crucial steps. First, always use strong, unique passwords for your trading platform and account. Additionally, enable two-factor authentication (2FA) to add an extra layer of security. Regularly update your software and EA to protect against vulnerabilities. Moreover, avoid using public Wi-Fi networks when accessing your trading account. By following these measures, you can significantly enhance the security of your trading activities and protect your investments.

How does EURUSD Day Trading EA handle market volatility?

EURUSD Day Trading EA is designed to manage market volatility effectively. It uses EMA and RSI to measure market trends and adjust trading strategies accordingly. During periods of high volatility, the EA may tighten stop losses and take profits to lock in gains and minimize risks. Conversely, during low volatility periods, it might widen these levels to capture more significant market movements. Additionally, the EA’s trailing stop feature helps secure profits as trades become profitable, ensuring you benefit from favorable market conditions while limiting potential losses.

What are the benefits of backtesting EURUSD Day Trading EA before live trading?

Backtesting EURUSD Day Trading EA before live trading offers several key benefits. Firstly, it allows you to evaluate the EA’s performance using historical data, providing insights into its effectiveness under various market conditions. Secondly, backtesting helps identify the most optimal input parameters for your trading style and risk tolerance. Moreover, it boosts confidence in the EA’s ability to handle live trading scenarios, knowing that the strategy has been successful in the past. Finally, regular backtesting ensures your strategy remains relevant and adapts to changing market dynamics, ultimately enhancing your profitability.

How can I optimize EURUSD Day Trading EA for better performance?

Optimizing EURUSD Day Trading EA for better performance involves adjusting several parameters and settings. Start by fine-tuning the lot size to match your risk tolerance and trading goals. Next, calibrate the take profit and stop loss levels to ensure they align with current market conditions. Adjust the EMA and RSI settings to enhance trend accuracy. Additionally, regularly backtest the EA to evaluate its performance and make necessary adjustments. By continually refining these parameters, you can optimize EURUSD Day Trading EA and maximize your trading profits.