Transform Your Trading with MACD EA

The MACD EA (Expert Advisor) for MT4 (Metatrader 4) revolutionizes your trading experience. It integrates the powerful MACD indicator into your strategy. This expert advisor provides an automated solution to identify and capitalize on market trends and momentum. Consequently, you make the most of every trading opportunity.

Whether you’re just starting in forex trading or are a seasoned professional, MACD EA equips you with the necessary tools for achieving consistent profitability.

How It Works: Automated Trading Using MACD Signals

MACD EA leverages the MACD indicator, a robust tool for identifying trends and momentum. The EA monitors the crossover of the MACD line and the signal line to generate trading signals. When the MACD line crosses above the signal line, the MT4 EA opens a buy order. Conversely, when the MACD line crosses below the signal line, it opens a sell order.

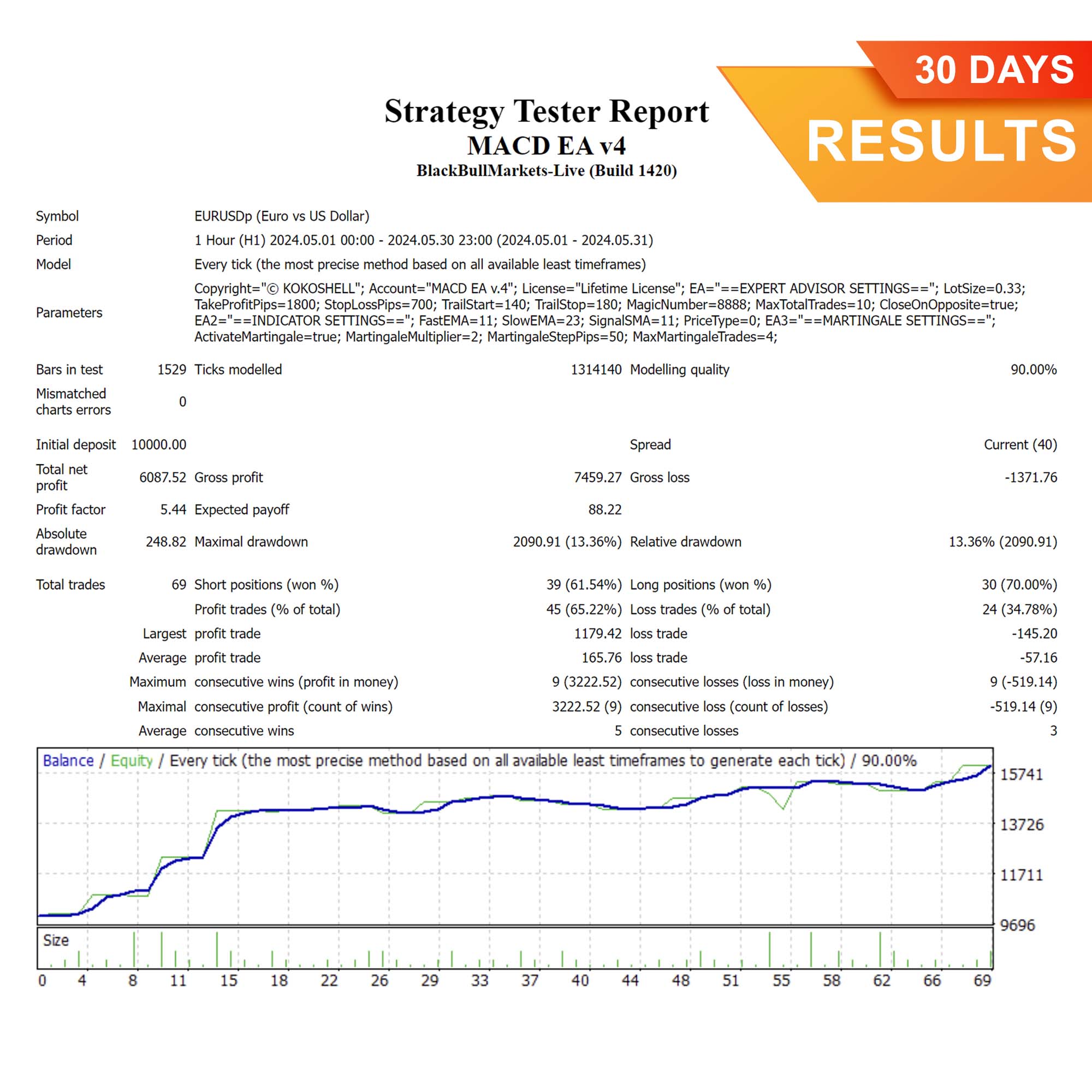

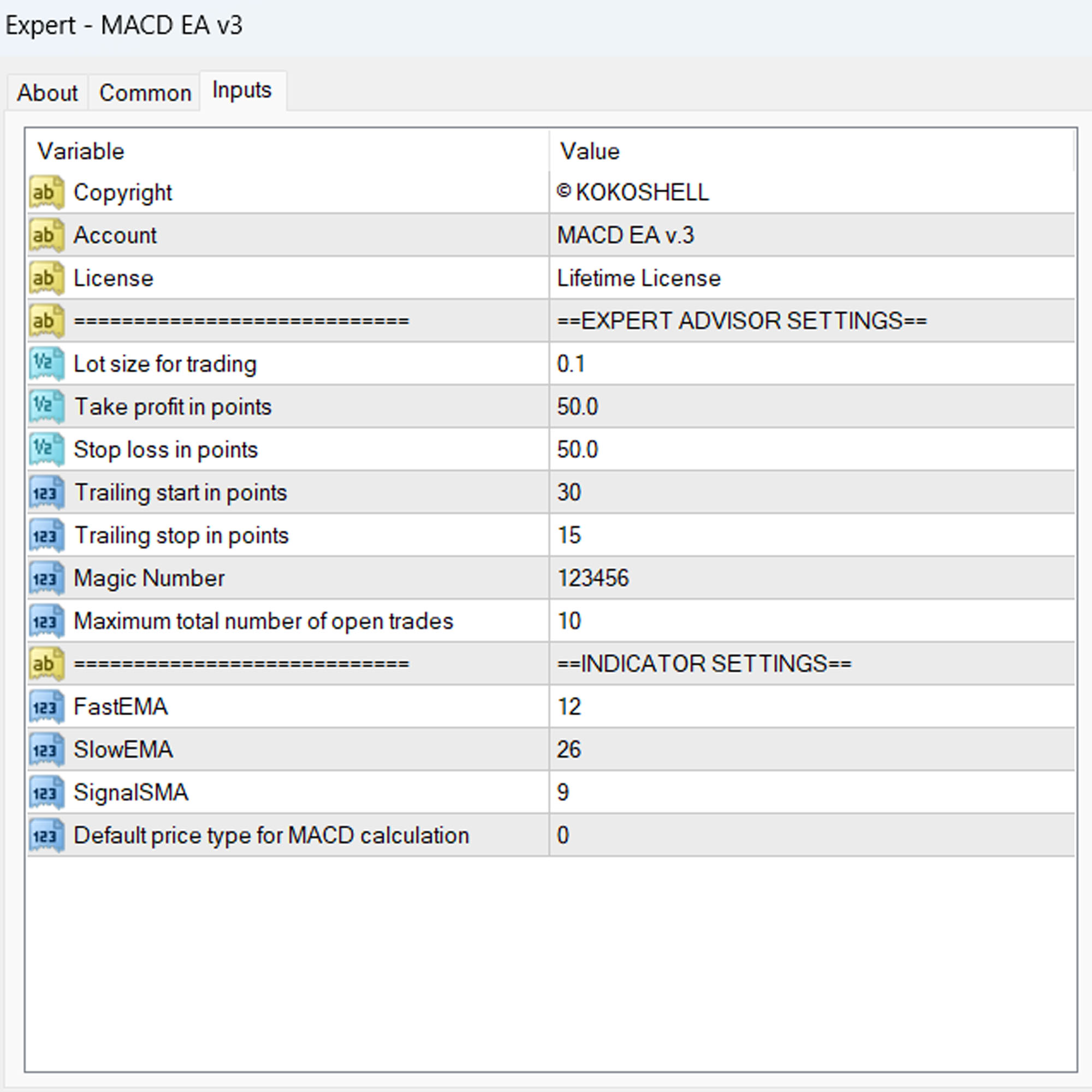

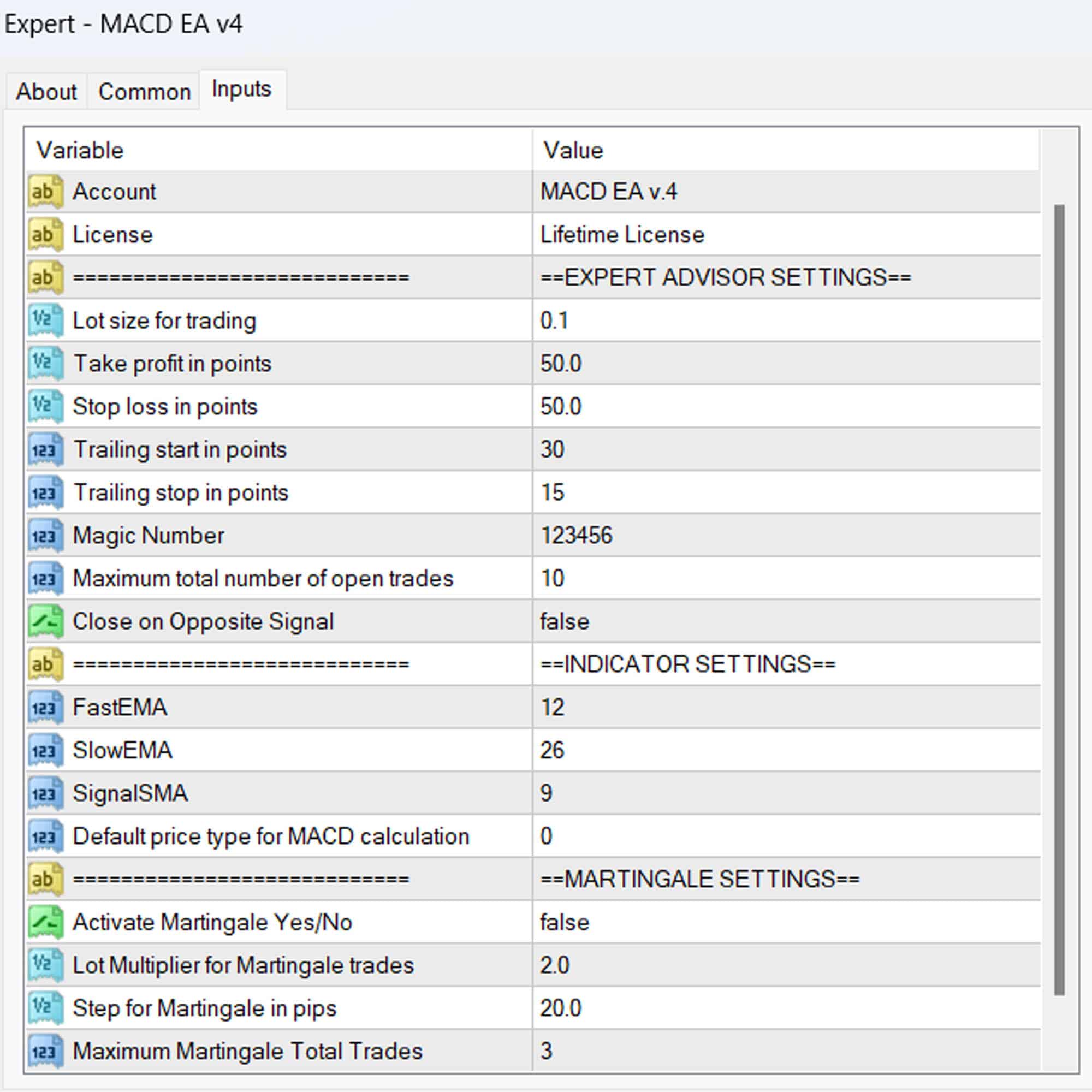

Additionally, the EA comes with customizable settings, allowing you to tailor its operation to your trading style. You can adjust the lot size, take profit, stop loss, and trailing stop values to match your risk tolerance and goals. Furthermore, for those looking to implement a more aggressive strategy, the optional Martingale feature can be activated. It increases lot sizes after losses to enhance recovery and profitability.

Key Features

- MACD Strategy: Leveraging the MACD indicator, it provides accurate market analysis and identifies potential market trends.

- Customizable Parameters: Moreover, with adjustable settings for lot size, take profit, stop loss, and trailing stops, you can optimize your trading strategy.

- Martingale System: Additionally, the optional Martingale strategy, designed to recover losses quickly, increases lot sizes after losses to achieve profits faster.

- Comprehensive Risk Management: Furthermore, to manage risk effectively, it includes settings for maximum total trades, trailing stops, and close-on-opposite-signal functionality.

- Automated Trading: Consequently, by executing trades automatically based on predefined settings, it minimizes manual intervention and reduces emotional trading decisions.

Why Choose MACD MT4 Expert Advisor?

MACD EA offers a unique combination of reliability, flexibility, and performance. Designed to cater to various trading styles, this EA helps traders maximize their potential by providing accurate and timely trading signals. Additionally, the user-friendly interface makes it easy to set up and customize.

The advanced features ensure you have the tools needed to succeed in the forex market. By choosing MACD Expert Advisor, you gain a significant advantage. Therefore, you can effectively capitalize on market trends and achieve consistent trading success.

Optimize Your Trading with MACD EA

The MACD EA for Metatrader 4 by KOKOSHELL is an indispensable tool for traders looking to enhance their trading strategy. By integrating the MACD indicator and offering a range of customizable features, this expert advisor enables you to make informed and profitable trades. Therefore, with MACD Expert Advisor for Metatrader 4, you can optimize your trading approach, manage risks effectively, and achieve consistent success in the forex market.

Oliver Scott –

Great results! Very reliable EA.

Emma Davis –

Helpful tool. Improved my trading strategy a lot.

Liam Parker –

This EA has been a game-changer for my trading. It’s accurate and easy to use.

Mia Thompson –

It’s a decent product.

Noah Brown –

Excellent tool! My trading efficiency has significantly improved. Easy to set up and reliable.

Sophia Green –

Good performance overall. It helps me stay on top of trends, though it feels a bit rigid sometimes.

Benjamin White –

Fantastic EA! Easy setup and delivers consistent results. My trading has never been better.

Chloe Martin –

Solid tool for trading. It’s helped me maintain consistency and make better decisions.

Daniel Lopez –

This trading advisor has taken my trading to the next level. The setup was a breeze, and the strategic insights are spot on. My profits have soared, and the risk management features are top-notch. I couldn’t be happier with the results. Highly recommend this to anyone serious about trading!