Master Bitcoin Trading with BTC Reversal EA

BTC Reversal EA for MT4 (Metatrader 4) is a state-of-the-art Expert Advisor engineered to optimize Bitcoin trading by detecting precise reversal signals. Developed by KOKOSHELL, this EA integrates advanced technical indicators to provide timely entry and exit points. Consequently, traders can capitalize on market reversals effectively.

How It Works: Leveraging Advanced Indicators

BTC Reversal EA for MT4 harnesses the power of multiple technical indicators to identify potential reversal points in Bitcoin trading. Specifically, here’s a breakdown of the key components:

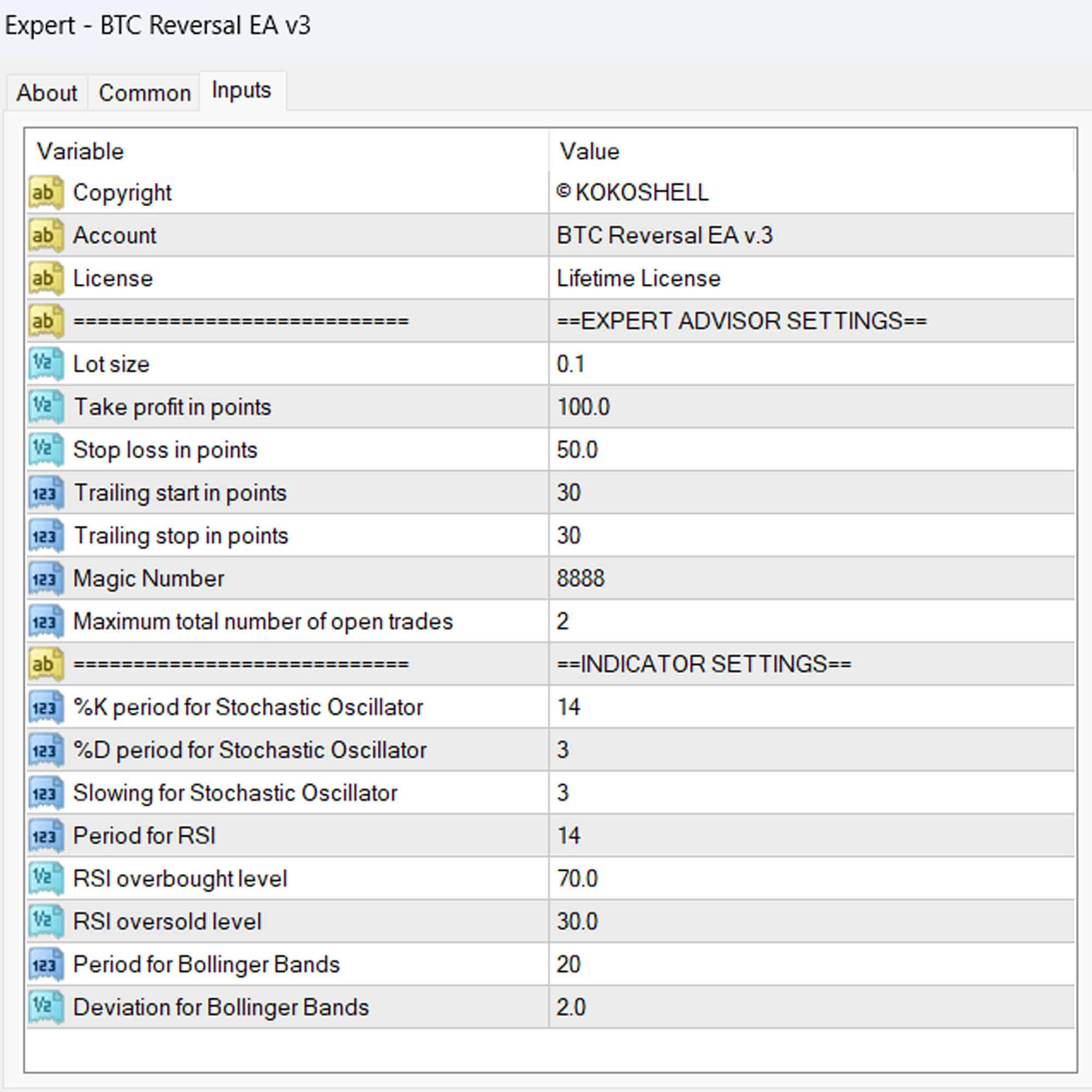

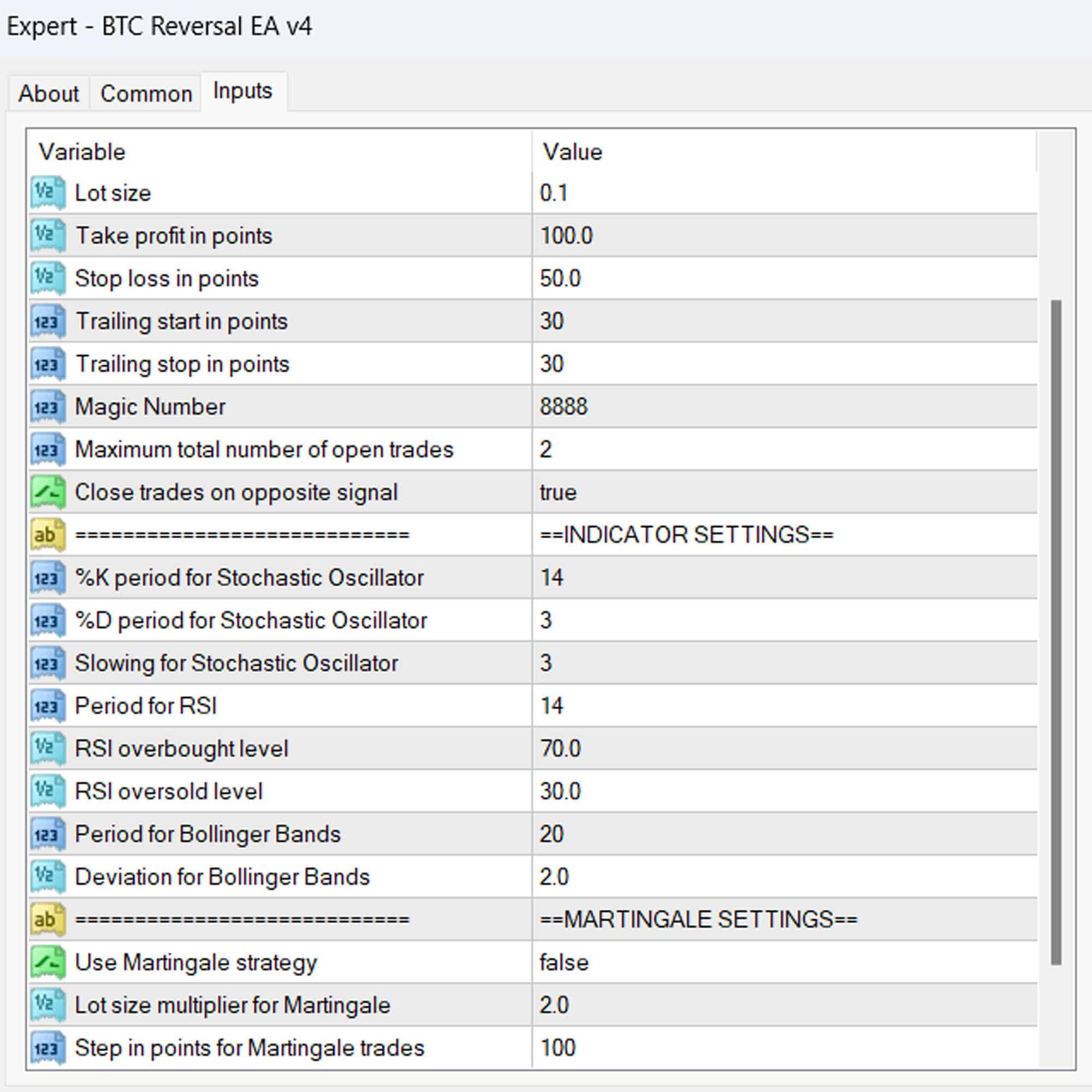

- Stochastic Oscillator: Assesses overbought and oversold conditions by comparing a specific closing price to a range of its prices over time. Thus, signaling potential reversals.

- RSI (Relative Strength Index): Measures the speed and change of price movements, indicating overbought or oversold conditions that may precede a reversal.

- Bollinger Bands: Provides a volatility range within which the price typically moves, indicating potential reversals.

Key Features: Unmatched Trading Precision

- Accurate Reversal Signals: BTC Reversal EA combines the strengths of the Stochastic Oscillator, RSI, and Bollinger Bands to deliver precise buy and sell signals. Therefore, you can make informed trading decisions.

- Customizable Settings: Tailor your trading experience with adjustable parameters, including lot size, take profit, stop loss, and trailing stop. Additionally, this flexibility allows you to match your risk tolerance and trading style.

- Martingale Strategy Option: Implement the Martingale strategy to recover losses by increasing the trade size after each loss. Consequently, maximizing your potential for profit recovery.

- Automated Trade Management: BTC Reversal Expert Advisor for Metatrader 4 automatically manages trades, from adjusting trailing stops to closing trades based on opposite signals. Moreover, this feature allows you to trade without constant monitoring.

- Robust Risk Management: Incorporate effective risk management with customizable stop loss and take profit settings. Consequently, safeguarding your capital while trading.

Why Choose BTC Reversal EA: Superior Trading Advantage

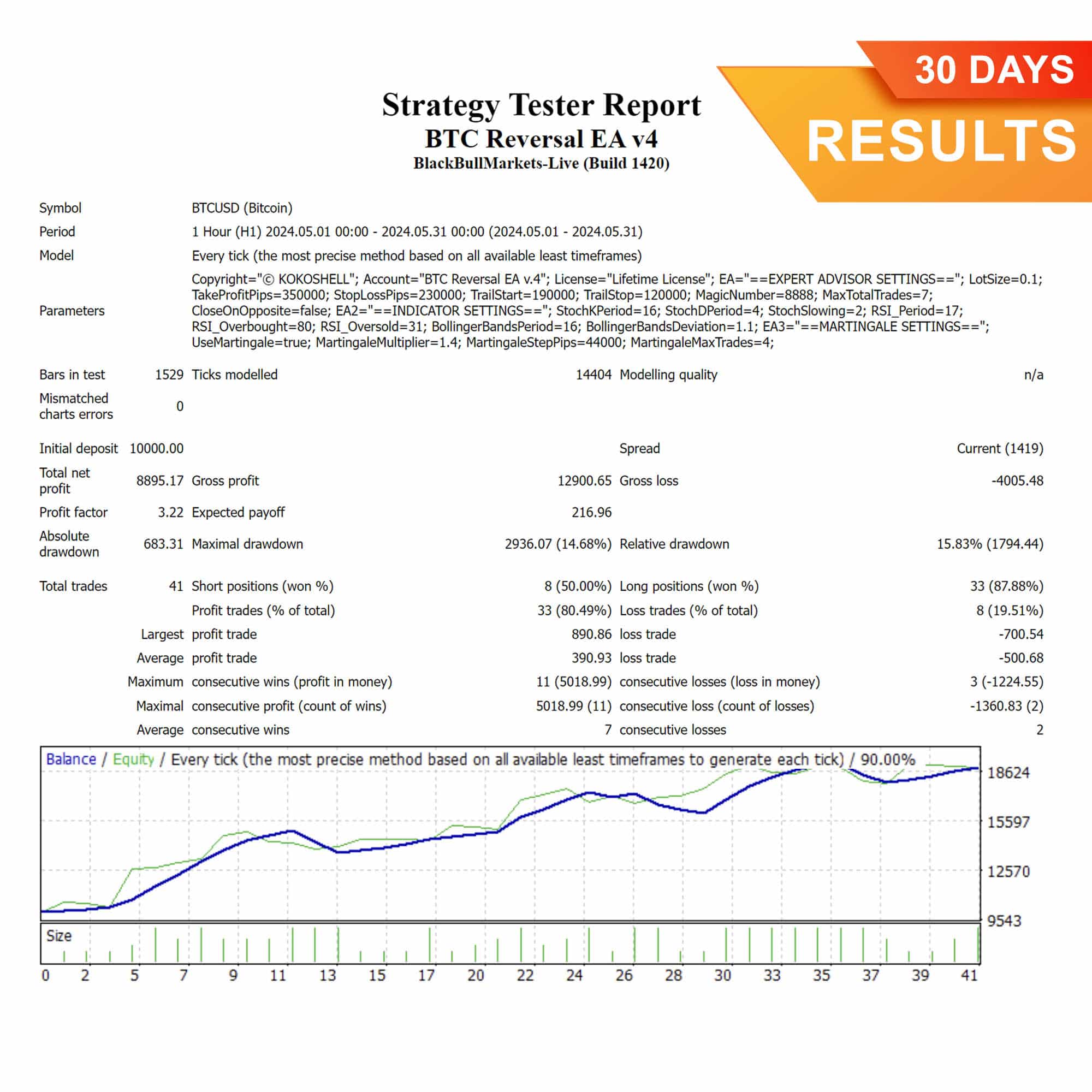

- Proven Performance: Bitcoin Reversal EA has undergone extensive testing to ensure consistent and reliable performance in the volatile cryptocurrency market. Moreover, its adaptive algorithms respond effectively to market changes.

- User-Friendly Interface: Designed for both novice and experienced traders, Bitcoin Reversal EA features an intuitive interface for easy installation, configuration, and performance monitoring.

- Comprehensive Support: Benefit from KOKOSHELL’s dedicated support team, ready to assist with installation, setup, and any queries. Consequently, you get the most out of your trading experience.

Transform Your Bitcoin Trading Strategy

BTC Reversal EA for MT4 (Metatrader 4) is the ultimate tool for traders looking to capitalize on Bitcoin market reversals. Its advanced features, customizable settings, and proven performance make it an indispensable asset for achieving trading success. Moreover, elevate your Bitcoin trading strategy with Bitcoin Reversal Expert Advisor for MT4 (Metatrader 4) and start trading with confidence today.

Caleb Johnson –

My trading profits have skyrocketed.

Tia –

Fantastic for reversals. Highly effective.

Nathan Lee –

Great tool but needs more input options.

Sofia Davis –

My trades are consistently profitable now. Highly recommend.

Lucas –

Decent tool, lacks some input parameters. Needs backtesting.

Ava Rodriguez –

This tool changed my strategy completely. Consistent gains.

Emily Moore –

Outstanding performance! My profits have increased significantly.

Ryan –

Easy to use and very profitable.

Jessica Thompson –

This trading advisor is simply amazing. The setup was quick and hassle-free, and the profits started coming in almost immediately. The strategic approach is impressive, and the risk management ensures my investments are safe. This tool has made trading stress-free and highly rewarding. I highly recommend it!