Enhance Your Trading with WTI Reversal EA

The WTI Reversal EA for MT4 (Metatrader 4) is a state-of-the-art expert advisor designed for automated trading on the WTI (West Texas Intermediate) market. Developed by KOKOSHELL, this EA leverages advanced technical indicators to identify market reversals and execute trades with precision. Whether you’re a novice or an experienced trader, the WTI Reversal Expert Advisor simplifies trading decisions. Thus, it allows you to maximize your profits with minimal effort.

How It Works: Automated Precision with Advanced Indicators

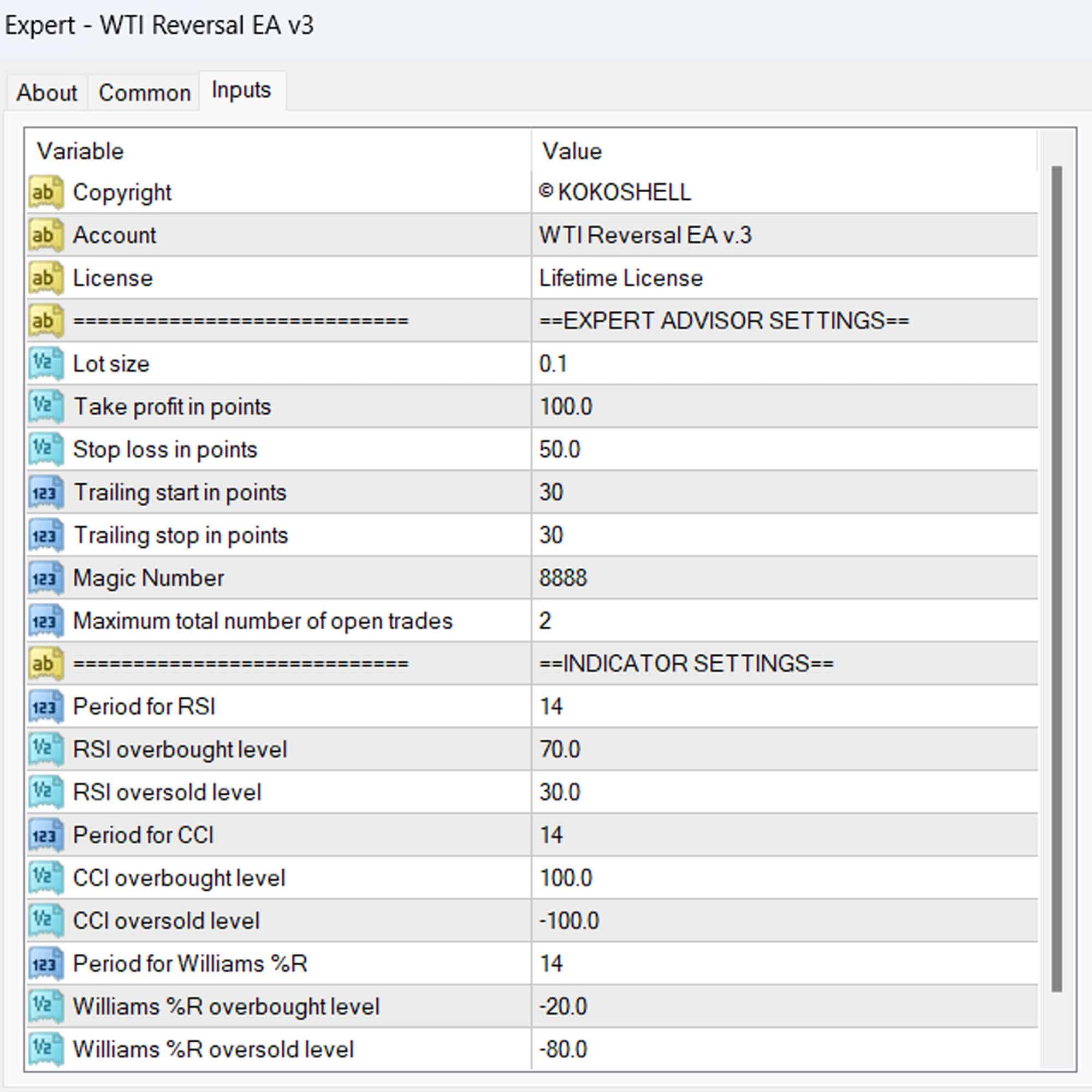

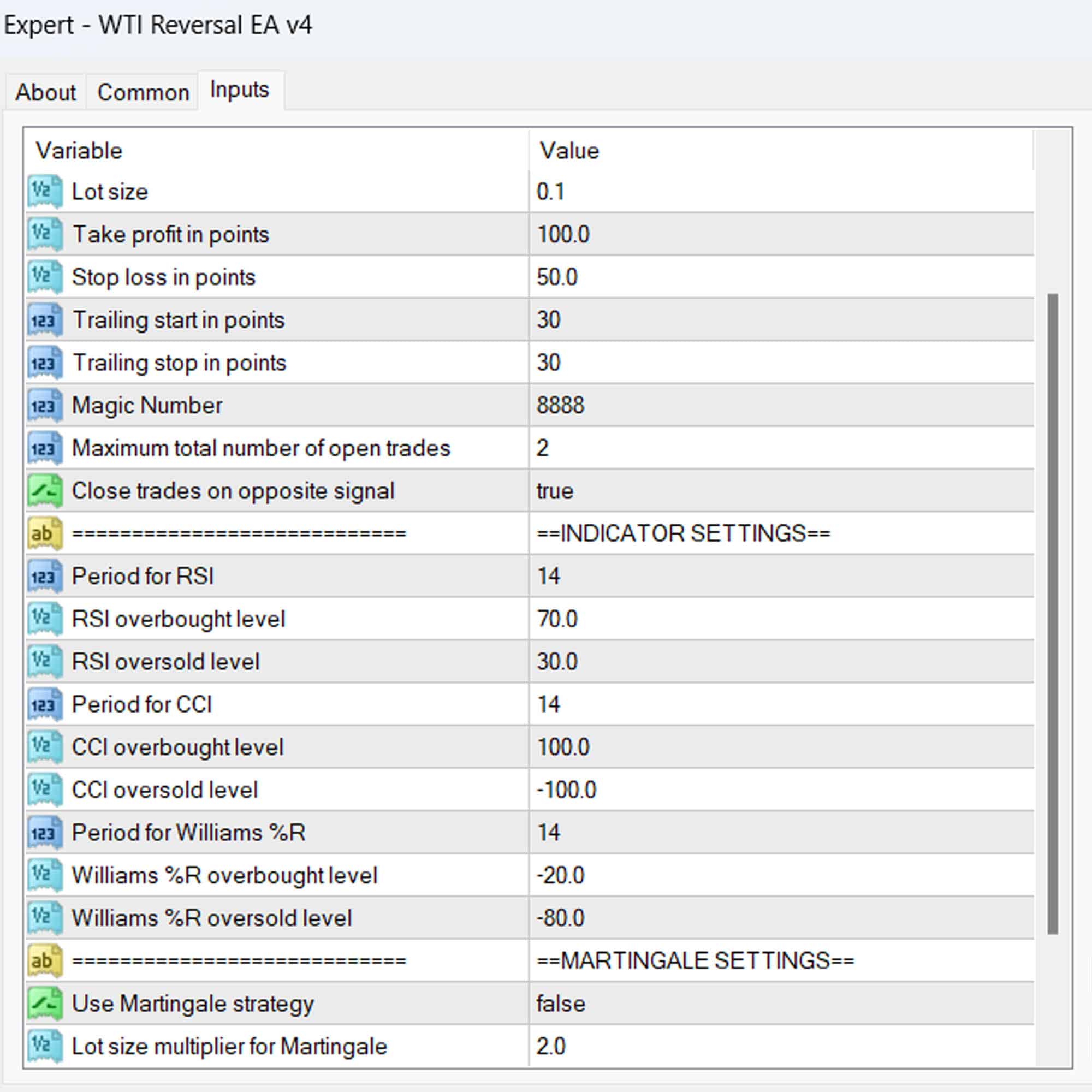

WTI Reversal EA operates by analyzing key technical indicators to detect potential market reversals. Additionally, the EA uses:

- RSI (Relative Strength Index): Identifies overbought and oversold conditions, thereby helping to determine market entry points.

- CCI (Commodity Channel Index): Spots trading opportunities in extreme market conditions. Consequently, it provides accurate signals.

- Williams %R: Confirms the strength of market trends. Therefore, it aids in making informed trading decisions.

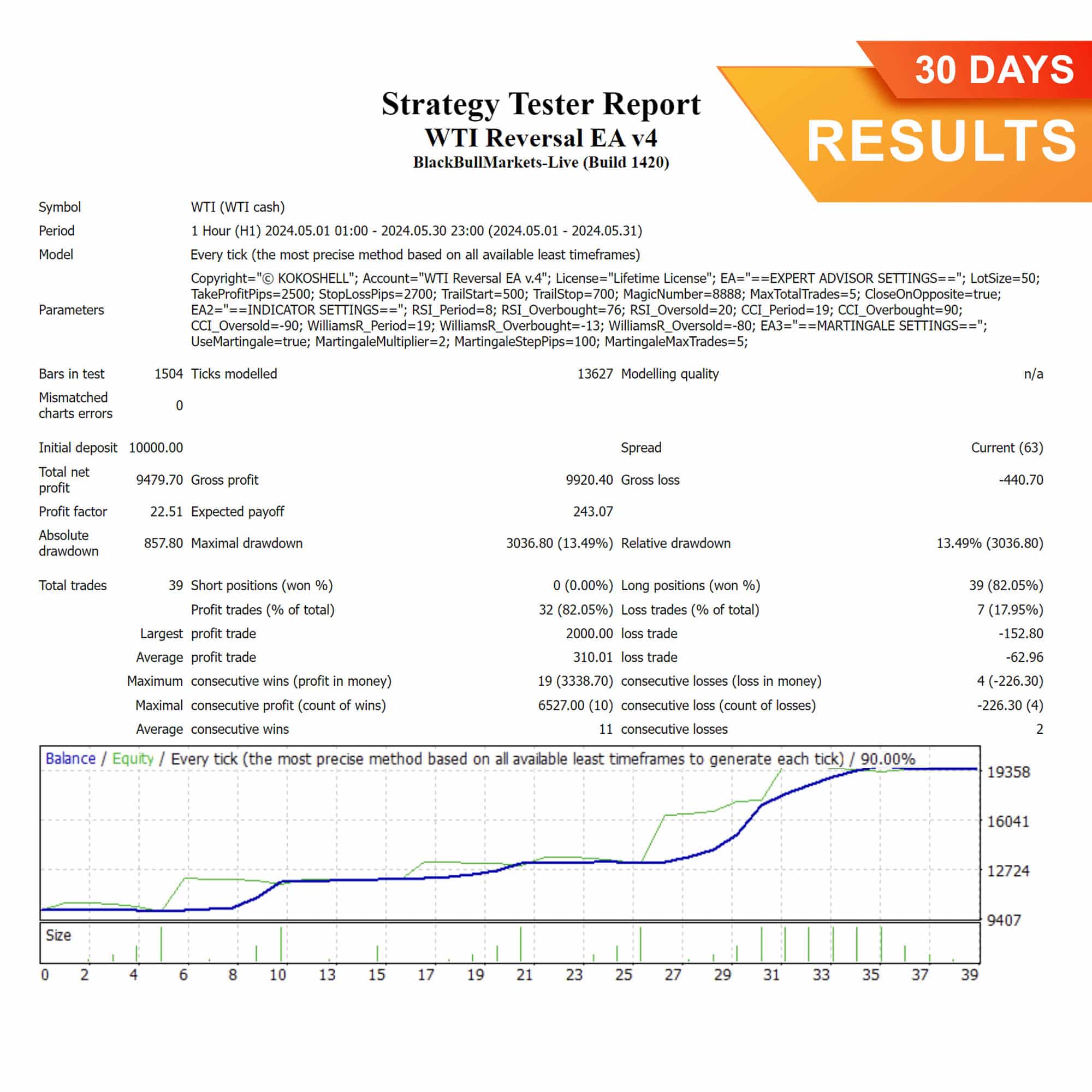

When these indicators align, the WTI Reversal EA automatically opens buy or sell orders, ensuring you capitalize on market movements. Furthermore, the EA includes a trailing stop mechanism to lock in profits and a martingale strategy for those looking to maximize returns through risk management.

Key Features: Cutting-Edge Technology for Optimal Trading

- Automated Trading: The EA autonomously executes trades based on predefined conditions. Thus, it reduces the need for constant market monitoring.

- Advanced Indicators: Utilizes RSI, CCI, and Williams %R for accurate market analysis and decision-making. Consequently, it ensures precise trading.

- Trailing Stop: Protects your profits by automatically adjusting the stop-loss level as the market moves in your favor. Moreover, it helps to secure gains.

- Martingale Strategy: Offers an optional martingale strategy to recover losses and amplify profits. Therefore, it enhances your trading strategy.

- Customizable Settings: Allows you to adjust lot size, take profit, stop loss, and indicator parameters to fit your trading style. Additionally, it provides flexibility in trading.

Why Choose WTI Reversal EA? Proven Performance and Reliability

WTI Reversal EA stands out due to its:

- Accuracy: High precision in detecting market reversals, ensuring profitable trades. Consequently, it delivers reliable results.

- Ease of Use: User-friendly interface and easy setup process, suitable for traders of all experience levels. Thus, it is accessible to everyone.

- Flexibility: Customizable settings allow you to tailor the EA to your specific trading preferences. Moreover, it adapts to various trading strategies.

- Safety: Built-in risk management features, including a trailing stop and the option to use a martingale strategy. Therefore, it protects your investment.

Elevate Your Trading Game with WTI Reversal EA

Transform your trading experience with the WTI Reversal EA for Metatrader 4. Its advanced technology and user-centric design make it an indispensable tool for anyone looking to achieve consistent trading success. By leveraging cutting-edge indicators and automated strategies, the WTI Reversal Expert Advisor for MT4 (Metatrader 4) helps you stay ahead of the market.

Therefore, ensuring you capitalize on every trading opportunity. Invest in the WTI Reversal Expert Advisor today and start your journey towards greater trading profits.

Joshua Smith –

This tool is fantastic! My trading results have improved dramatically.

Dylan –

Great for reversals. Easy to use. Reliable signals.

Alexander Perez –

Needs better input parameters. Good price though. Backtesting is necessary.

Anthony Lopez –

Outstanding performance! My profits have increased significantly. Highly recommend for serious traders.

Juan –

Profits soared! Very reliable.

Logan Wright –

Effective tool for reversal trading. Signals are accurate, but more input options would be nice.

Ashley Lewis –

Just wow! This trading advisor has completely changed my trading approach. The setup was simple, and the results were immediate. The strategic insights are sharp, and the risk management is top-tier. It’s like having an expert by my side. Don’t miss out on this one!