Elevate Your Trading with US30 Day Trading EA

Discover the transformative power of the US30 Day Trading EA (Expert Advisor) for MT4 (Metatrader 4), meticulously crafted by KOKOSHELL. This robust Expert Advisor is specifically designed for the US30 index. It offers automated day trading capabilities to enhance your trading strategy and profitability. Whether you’re an experienced trader or new to the market, the US30 Day Trading Expert Advisor provides a powerful tool for achieving consistent trading success.

How It Works: Advanced Algorithm for Day Trading

The US30 Day Trading EA utilizes Heiken Ashi candlesticks, Exponential Moving Averages (EMAs), and the Stochastic Oscillator to generate precise buy and sell signals. By analyzing these indicators, the EA executes trades with optimal entry and exit points. This ensures you capitalize effectively on market trends and fluctuations.

Key Features: Cutting-Edge Tools for Maximum Profitability

- Precision Signal Generation: The EA uses a combination of Heiken Ashi, EMAs, and the Stochastic Oscillator to generate accurate buy and sell signals. Moreover, it ensures timely execution of trades based on market analysis.

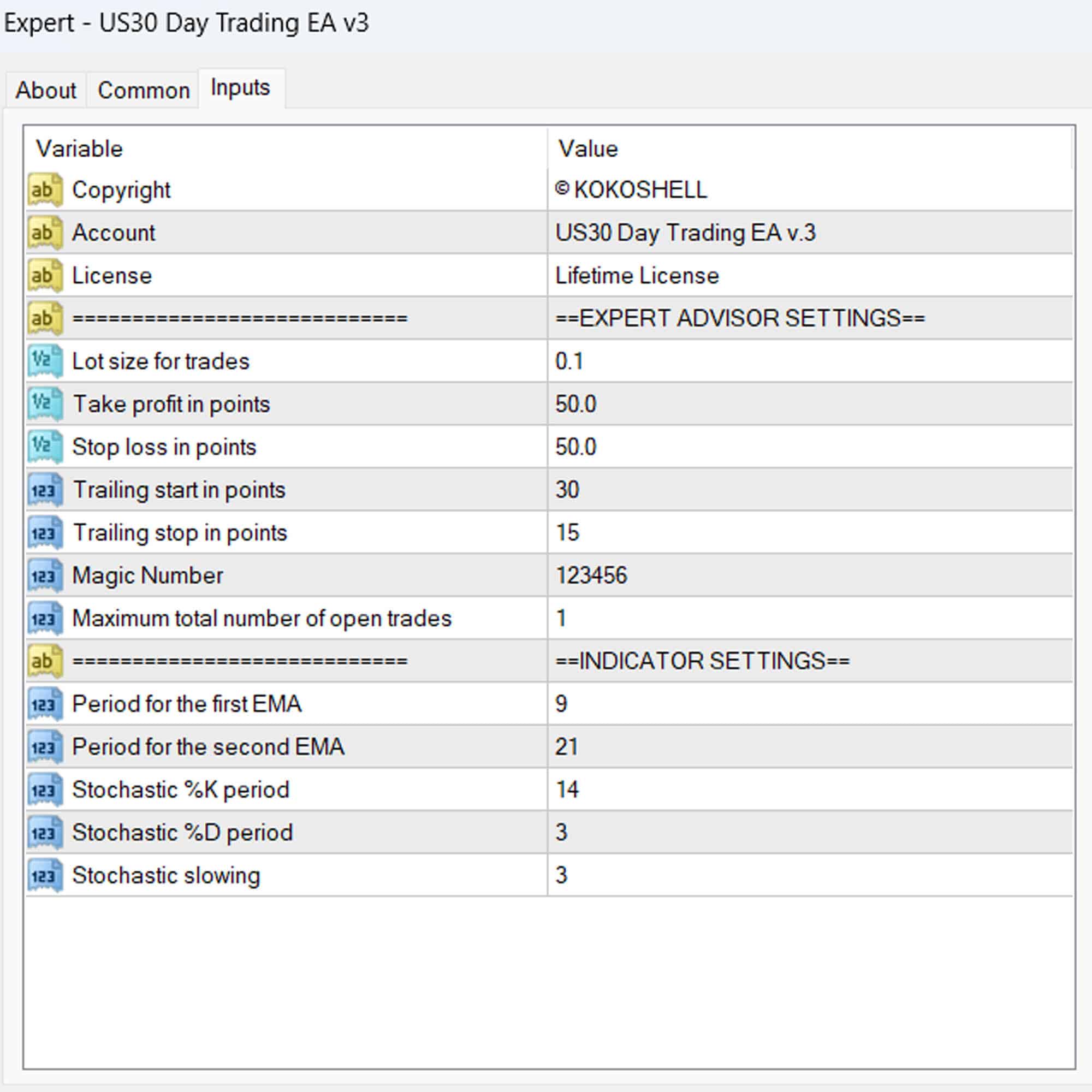

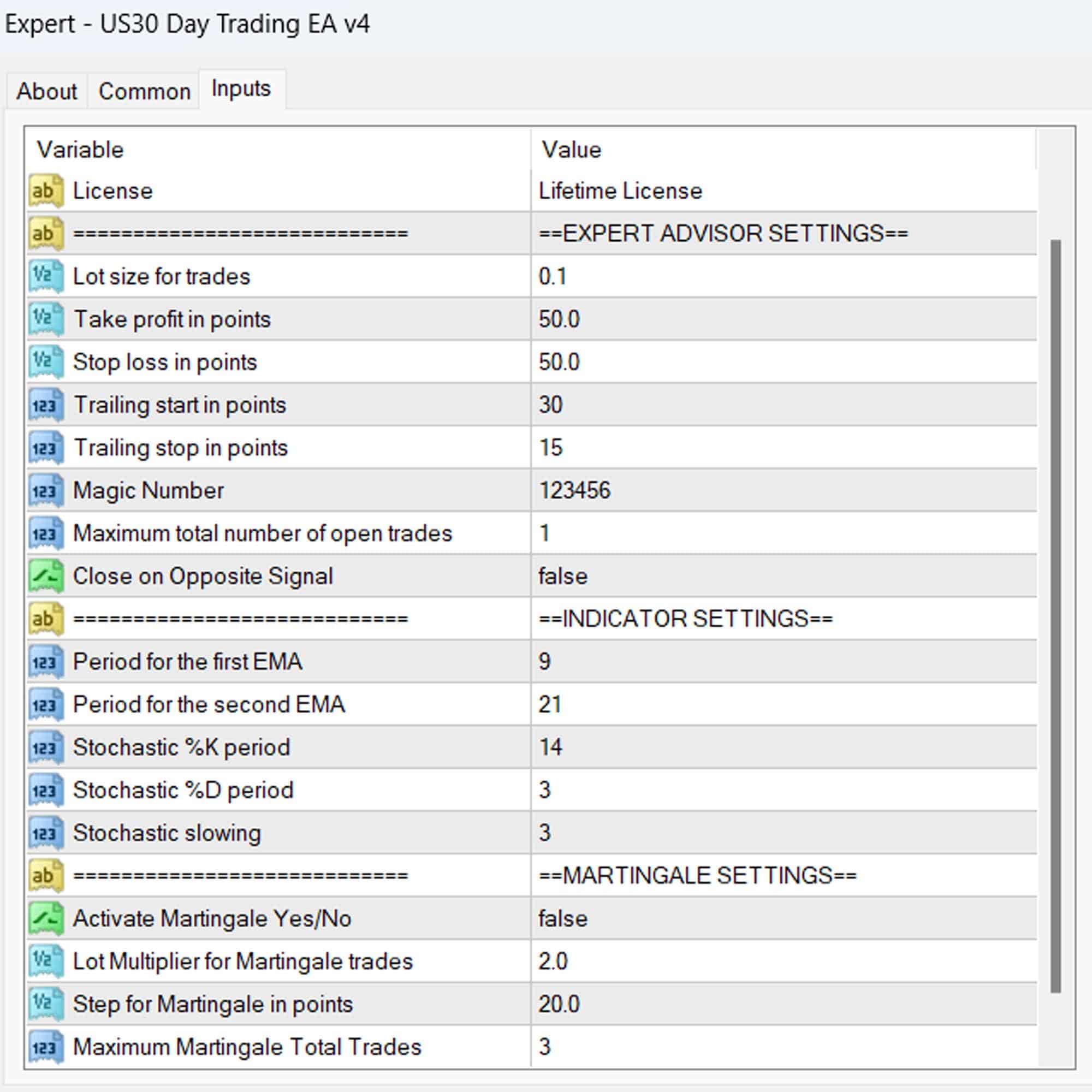

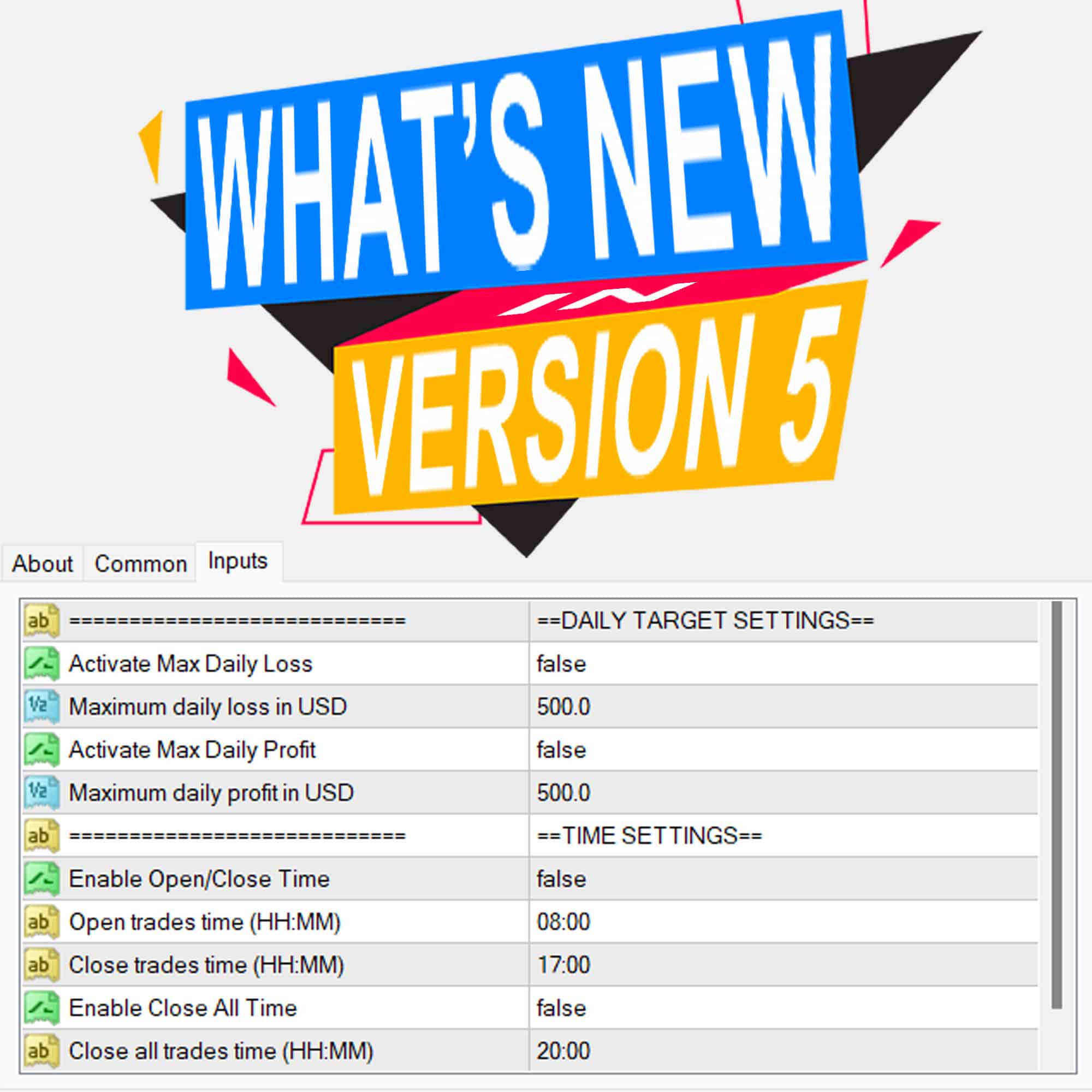

- Dynamic Risk Management: Customize parameters such as lot size, take profit, stop loss, and trailing stops to tailor the EA to fit your risk management strategy. Additionally, adjust settings in real-time to adapt to changing market conditions.

- Martingale Strategy: Optionally activate the Martingale strategy to enhance profit potential by increasing trade sizes after losses. Furthermore, automate the scaling up of trades to maximize returns.

- Automatic Trade Closure: The EA can automatically close opposite trades when a new signal is generated. This ensures your trades align seamlessly with the latest market conditions. Additionally, it offers flexibility in managing multiple trades simultaneously.

- User-Friendly Settings: Easily configure the EA with intuitive input parameters, allowing for seamless integration into your trading platform. Besides, streamline your trading operations with user-friendly interfaces.

Why Choose US30 Day Trading EA?

- Tailored for US30 Index: Specifically optimized for day trading the US30 index, providing you with an edge in one of the most popular markets. Furthermore, leverage its specialized features for targeted trading strategies.

- Advanced Technical Analysis: Leverages a powerful combination of technical indicators to identify and act on trading opportunities. In addition, utilize comprehensive data analysis tools for informed decision-making.

- Customizable Settings: Offers extensive customization options to fit your unique trading style and risk tolerance. Besides, fine-tune parameters to align with your individual trading goals.

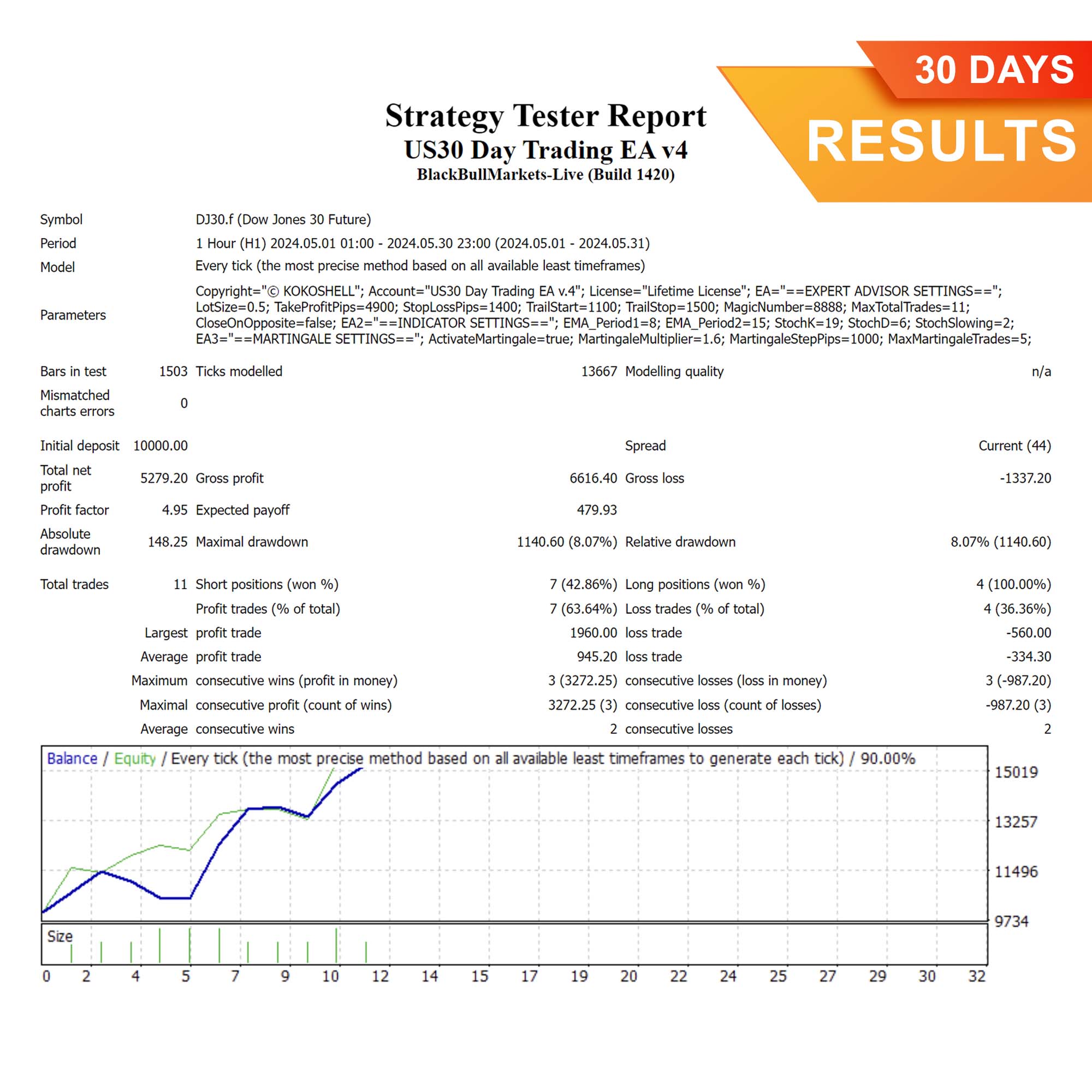

- Proven Performance: Developed by KOKOSHELL, a trusted name in trading software, ensuring reliability and consistent performance. Also, benefit from its track record of delivering reliable trading solutions.

- Lifetime License: Enjoy unlimited use of the EA with a one-time purchase, with no recurring fees. Additionally, secure long-term access to cutting-edge trading technology.

Achieve Consistent Success with US30 Day Trading EA

The US30 Day Trading EA for Metatrader 4 opens the door to more efficient and profitable trading in the US30 market. By leveraging advanced technical analysis and robust risk management features, this EA empowers you to make better trading decisions. It helps you achieve consistent results.

Whether you aim to enhance your trading strategy or automate day trading operations, the US30 Day Trading Expert Advisor provides the tools you need. Optimize your trading and capitalize on market opportunities with the US30 Day Trading Expert Advisor for MT4 (Metatrader 4) today.

Ethan Smith –

Transformed my trading results. Consistent profits and reliable signals.

Mia –

Excellent tool! Highly profitable.

Lucas Anderson –

Great for day trading. Easy to use, accurate signals.

Sofia Martinez –

Outstanding tool! My profits have increased significantly. Highly recommend for serious traders.

John –

Decent performance. Good price. Backtesting required.

Ava Brown –

Profits up! Easy to integrate into my strategy.

David Johnson –

Reliable signals, effective for day trading. Needs more customization.

Noah Thompson –

My trading has never been better. Consistent and profitable signals.

Emily –

Amazing results! Trading has become much more profitable.

Carlos Garcia –

Needs better parameters. Backtesting required.

Kevin Perez –

This trading advisor is amazing. The setup was quick and hassle-free, and the profits started coming in almost immediately. The strategy is highly effective, and the risk management ensures my investments are safe. This tool has made trading stress-free and highly rewarding. Highly recommended!