Optimize Your Bitcoin Trading with BTC Trend Trading EA

Welcome to the future of automated Bitcoin trading: The BTC Trend Trading EA is a state-of-the-art Expert Advisor for MT4 (Metatrader 4) designed to maximize your trading efficiency and profitability. Developed by KOKOSHELL, this EA is your ultimate solution for leveraging market trends and executing trades with precision and confidence. Additionally, it offers a seamless trading experience for all users.

How It Works: Advanced Trading Logic

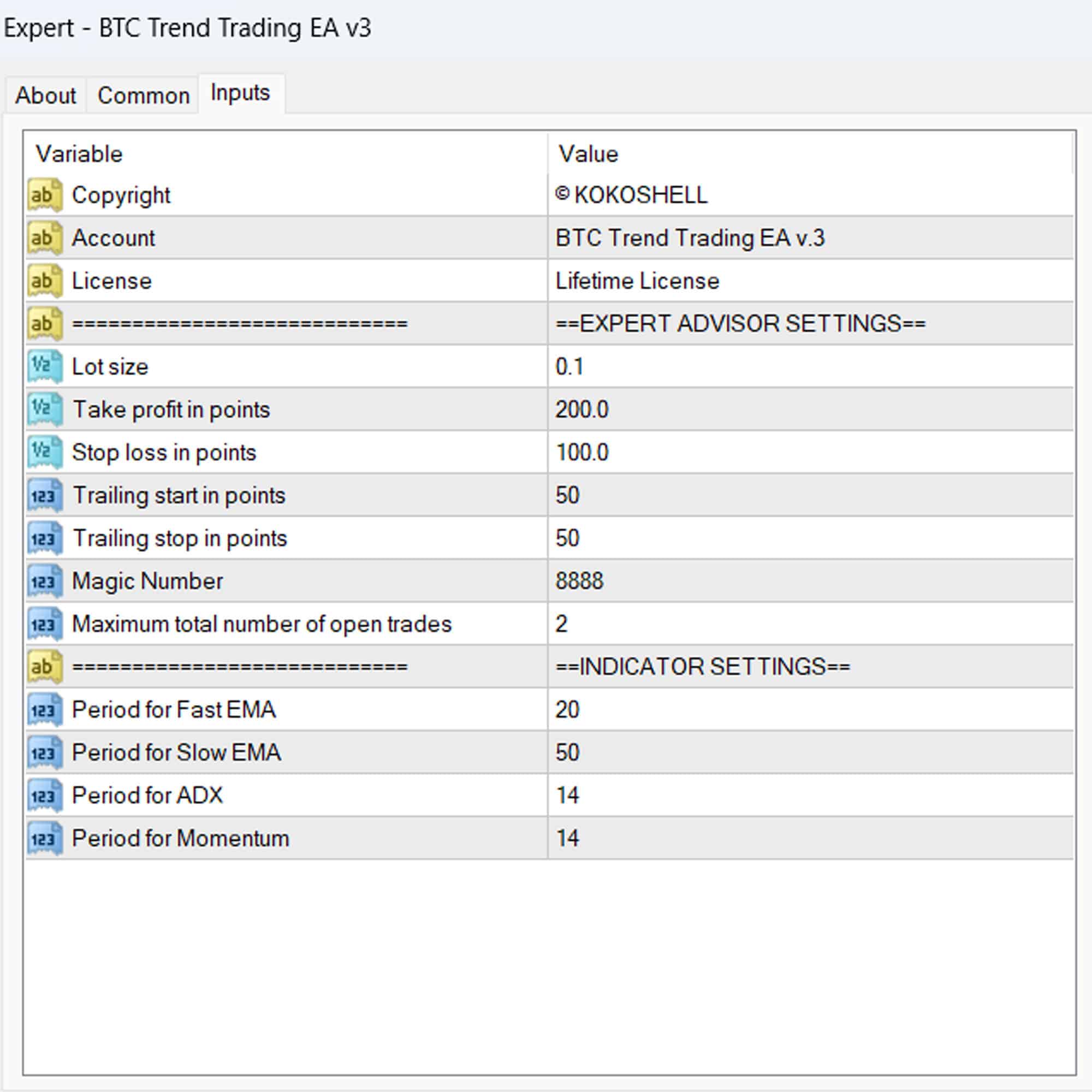

The BTC Trend Trading EA utilizes a combination of Exponential Moving Averages (EMA), Average Directional Index (ADX), and Momentum indicators to identify and act on market trends. Therefore, here’s a step-by-step breakdown of its operation:

- Indicator Analysis: The EA continuously monitors the fast and slow EMA, ADX, and Momentum indicators.

- Signal Generation: Buy and sell signals are generated based on the crossover of EMAs, ADX values above 25, and momentum conditions.

- Trade Execution: Upon signal confirmation, the EA executes trades with predefined lot sizes, take profit, and stop loss levels.

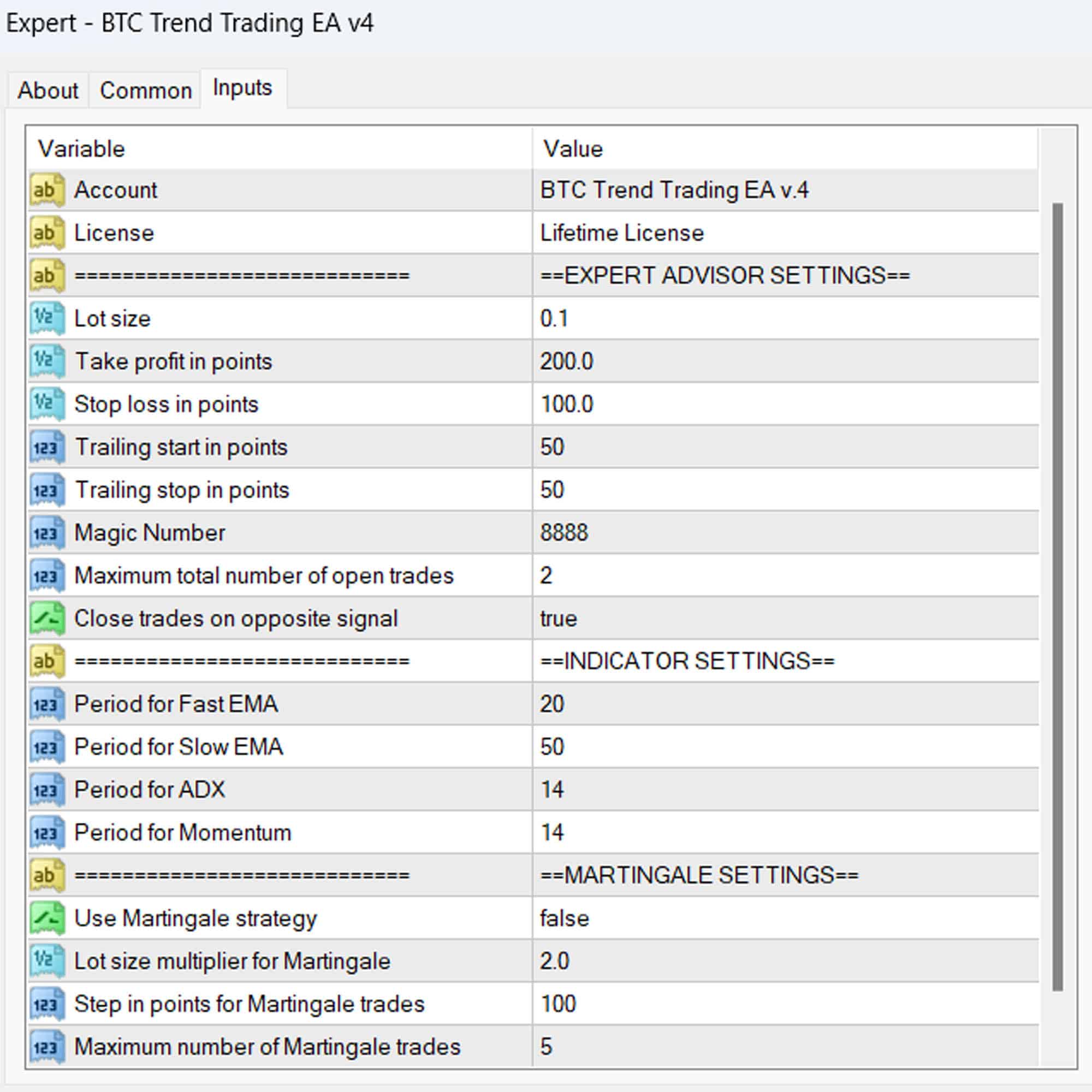

- Trade Management: The EA includes trailing stop functionality and an optional Martingale strategy to optimize profit and manage risk.

Key Features: Unmatched Trading Tools

Essential Features of BTC Trend Trading Expert Advisor for MT4 (Metatrader 4):

- Automated Trading: Fully automated trading based on sophisticated algorithms, thus reducing manual effort.

- EMA Crossover Strategy: Uses fast and slow EMA crossovers for trend identification. Furthermore, it ensures timely trades.

- ADX Indicator: Confirms trend strength with ADX values. Therefore, providing reliable signals.

- Momentum Confirmation: Adds an extra layer of confirmation to ensure high-probability trades. Consequently, it increases trade accuracy.

- Trailing Stop: Protects profits by adjusting stop loss levels as the trade moves in your favor. Additionally, it locks in gains.

- Martingale Option: For traders who prefer an aggressive risk management approach. Moreover, it can recover from losses quickly.

- Flexible Settings: Customize lot size, take profit, stop loss, and more to suit your trading style. Hence, it offers great flexibility.

Why Choose Bitcoin Trend Trading EA?

Choosing Bitcoin Trend Trading EA means:

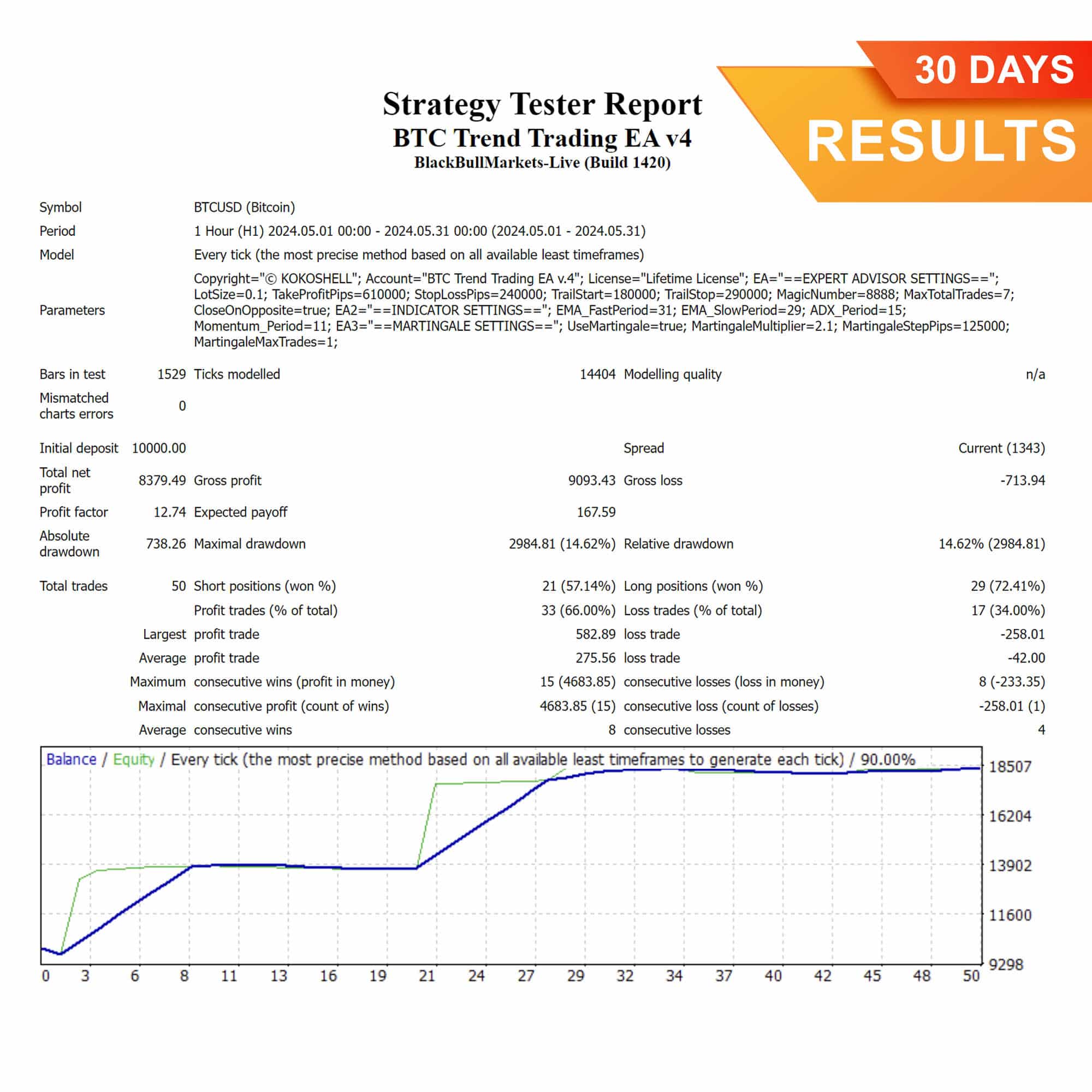

- Proven Performance: Backtested and optimized for consistent results. Additionally, it has a strong track record.

- User-Friendly: Easy to set up and use, even for beginners. Therefore, it is accessible to all.

- Risk Management: Built-in features to protect your capital and maximize returns. Furthermore, it ensures safer trading.

- Continuous Updates: Regular updates ensure the EA adapts to changing market conditions. Consequently, it remains effective.

- Support and Community: Access to a supportive community and dedicated customer support. Moreover, it provides extensive help.

Transform Your Trading

Unlock Your Trading Potential with Bitcoin Trend Trading EA! BTC Trend Trading EA for Metatrader 4 is designed to take your Bitcoin trading to the next level. By leveraging advanced technical indicators and automated trading strategies, you can achieve better trading outcomes with less effort. Consequently, don’t miss out on the opportunity to revolutionize your trading experience.

James King –

This tool has doubled my profits! Highly reliable and easy to use.

Mia –

Fantastic results! So consistent.

Ethan White –

Good for trend trading, but could use more features.

Sofia Moore –

My trades have never been better. A must-have for serious traders.

Lucas –

Needs more input parameters. Decent price. Thorough backtesting required.

Ava Scott –

Outstanding! My trading profits increased dramatically.

David Lee –

Reliable signals.

Noah Harris –

Incredible tool! My trading has become more profitable and stress-free.

Emily Gonzalez –

Excellent! Easy to integrate and highly effective.

Amanda Harris –

I’m beyond impressed with this trading advisor. The setup was straightforward, and the profits have been consistent. The strategic insights it provides are invaluable, and the risk management features give me confidence in every trade. Highly recommend this to anyone looking to boost their trading performance.