Maximize Your Profits with EURUSD Reversal EA

Unlock the potential of forex trading with the EURUSD Reversal EA (Expert Advisor) for MT4 (Metatrader 4) by KOKOSHELL. This advanced Expert Advisor captures reversal trends in the EURUSD pair, providing high-probability trading opportunities. Whether you are a seasoned trader or a novice, EURUSD Reversal EA offers a robust, automated solution to enhance your trading strategy and maximize profitability.

How It Works: Precision Reversal Detection

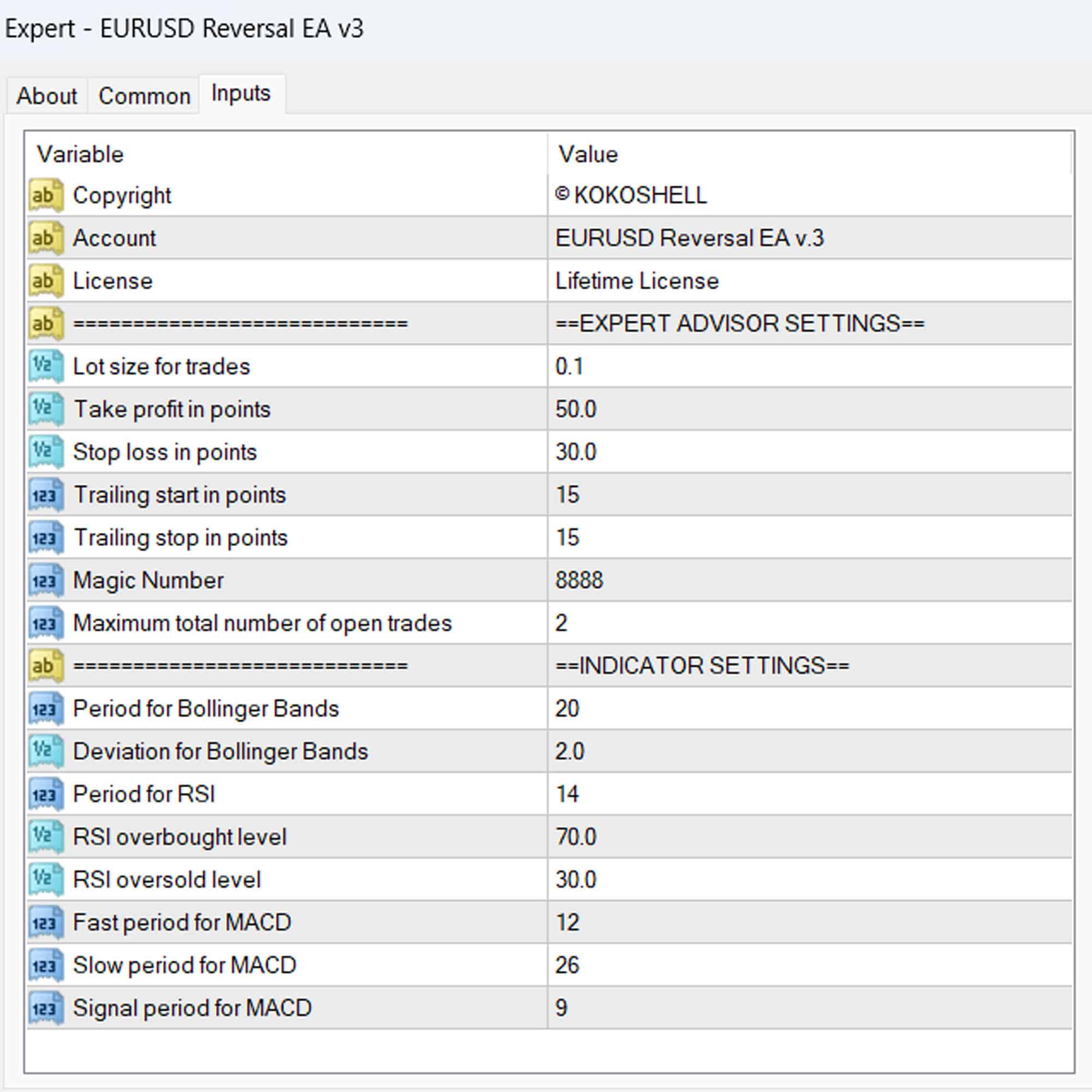

EURUSD Reversal EA utilizes a sophisticated combination of technical indicators to identify potential reversal points in the market. By analyzing Bollinger Bands, RSI, and MACD, the EA generates accurate buy and sell signals. For instance, when the RSI indicates an oversold condition and prices touch the lower Bollinger Band while MACD confirms a bullish crossover, a buy order is triggered.

Conversely, a sell order is executed when the RSI signals overbought, prices hit the upper Bollinger Band, and MACD confirms a bearish crossover. Consequently, this multi-indicator approach ensures high accuracy and timely trade executions.

Key Features: Advanced Tools for Optimal Trading

Discover the EURUSD Reversal EA within the robust features designed to elevate your trading strategy:

- Precision Signal Generation: Combines Bollinger Bands, RSI, and MACD for accurate reversal signals. Moreover, it ensures timely trade executions.

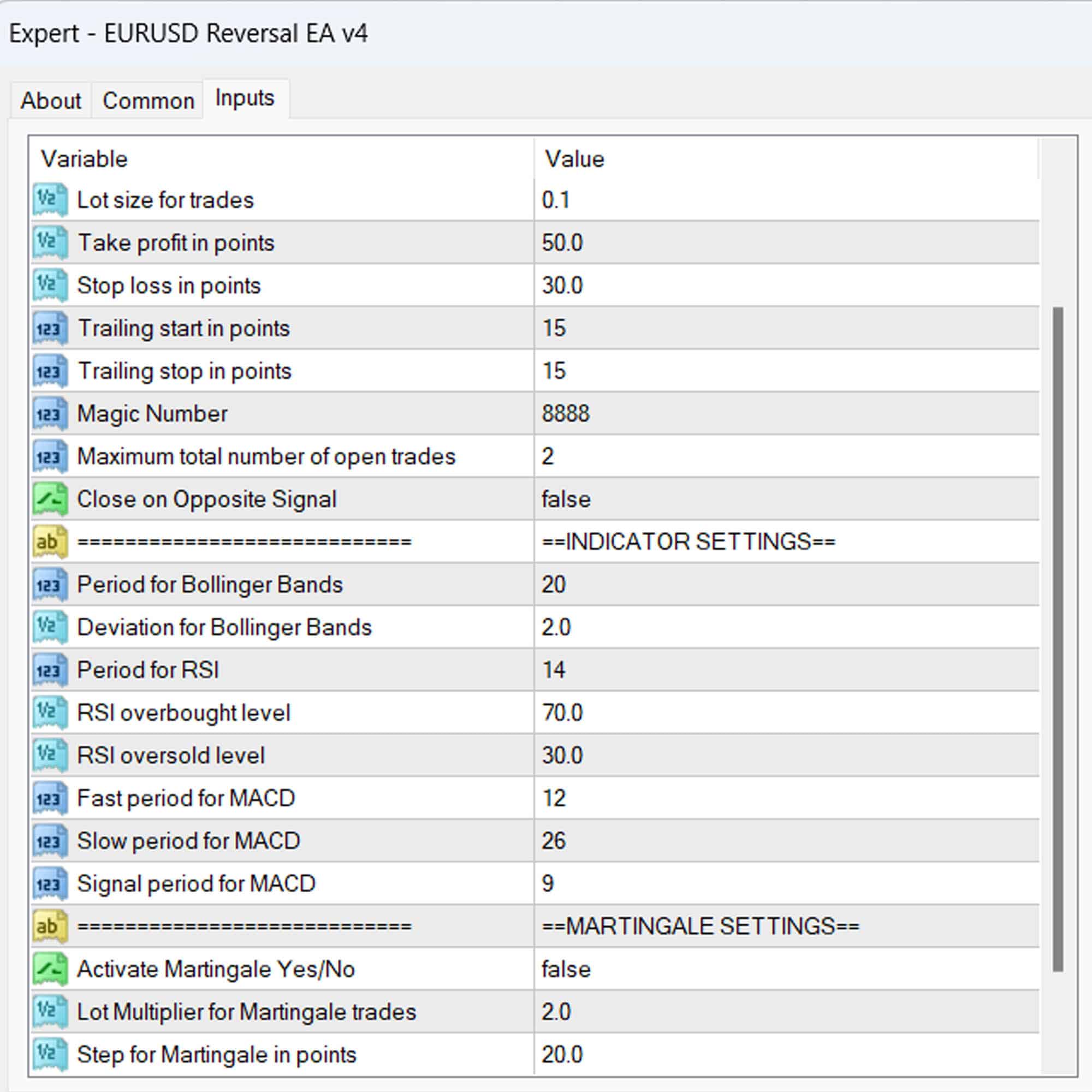

- Customizable Settings: Tailor lot size, take profit, stop loss, and trailing stops to fit your trading style. Additionally, you can adjust settings as market conditions change.

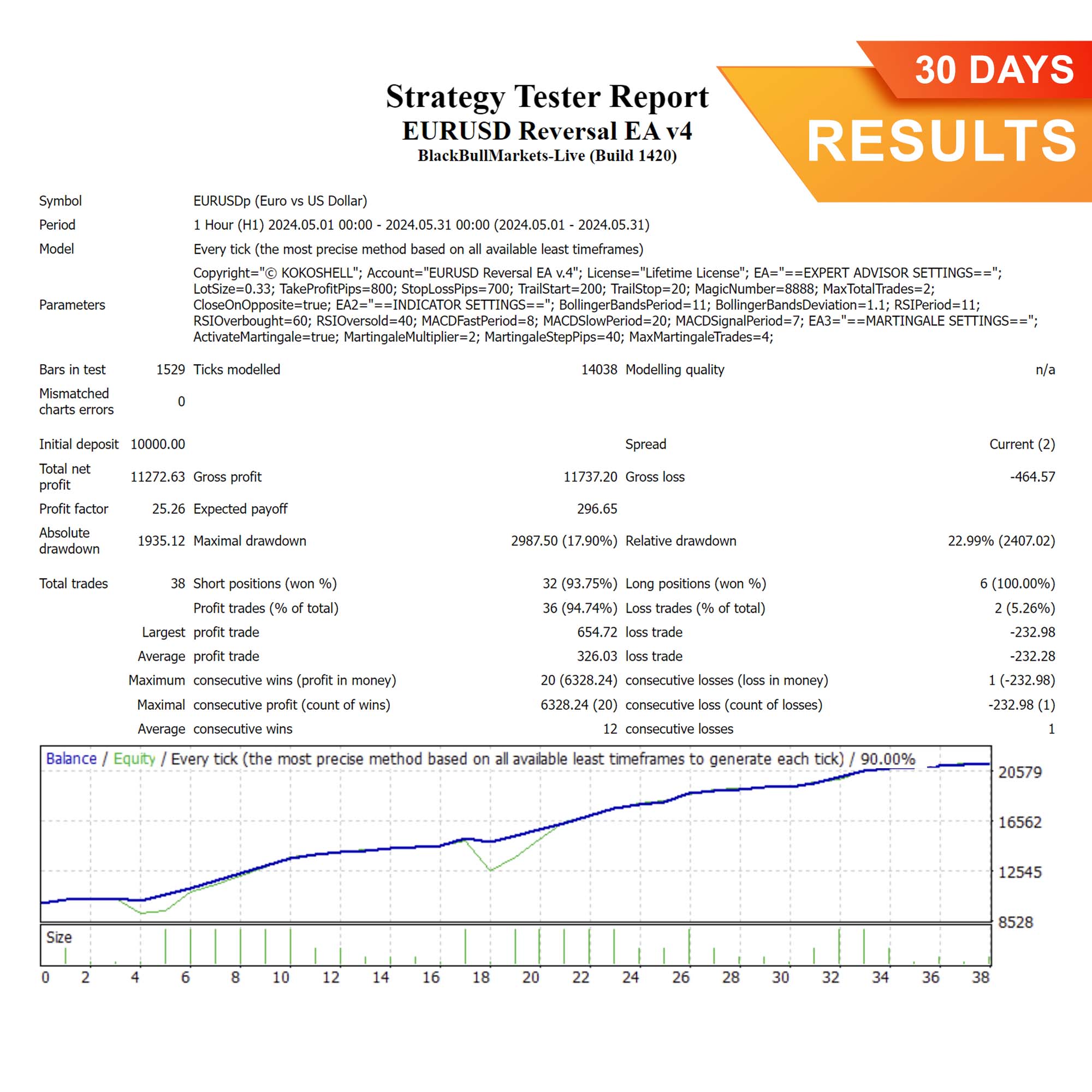

- Martingale Strategy: Optional feature to double lot sizes after losses, aiding in quicker recovery. Furthermore, this strategy enhances potential profitability.

- Risk Management: Comprehensive risk controls to protect your investment and manage trades effectively. Consequently, it minimizes potential losses.

- Automated Trading: Fully automated operations allow you to trade without constant monitoring. Therefore, it saves you time and effort.

- Lifetime License: One-time purchase with lifetime access and updates. This feature provides long-term value.

Why Choose EURUSD Reversal EA: Achieve Consistent Success

The EURUSD Reversal EA for Metatrader 4 excels at identifying and capitalizing on reversal trends with high precision. Multiple integrated indicators ensure reliable signals, minimizing false entries and maximizing profit potential. Additionally, traders can customize settings to suit their specific needs, whether they prefer aggressive or conservative strategies. The optional Martingale feature adds an extra layer of profitability, making it a versatile tool for any trader.

Elevate Your Trading Game with EURUSD Reversal Expert Advisor

Incorporate the EURUSD Reversal EA into your trading toolkit and experience the power of automated, precise, and profitable trading. Moreover, with its advanced features and robust risk management, this Expert Advisor is designed to help you achieve consistent trading success. Therefore, don’t miss out on the opportunity to enhance your trading strategy—try the EURUSD Reversal Expert Advisor for MT4 (Metatrader 4) by KOKOSHELL today.

Alexander M. –

Amazing returns! Highly efficient.

Amanda –

The strategy works well, but the limited input parameters are a downside. However, the price is excellent for what you get. Needs more backtesting to see full potential.

Matthew J. –

Good performance, but lacks customization options for more control over the strategy.

Liam –

Boosted my trading returns tremendously!

Steven M. –

Reliable and profitable, but I wish there were more input parameters to adjust. Still, very pleased with the results.

Julia –

Consistent profits, highly recommend!

Anthony B. –

The trading strategy is brilliant. I’ve seen steady profits with minimal risk. Perfect for anyone serious about trading.

Daniel T. –

Consistent gains and excellent risk management. Customization options are limited, but the overall performance is outstanding for the price.

Laura –

Fantastic results, great tool!

Samuel P. –

Superb risk management and impressive profits. The strategy adapts well to market changes, making it a must-have for any trader.

Laura Martinez –

Incredible tool! The setup was seamless, and the profits started rolling in quickly. The strategy it uses is very effective, and the risk management features are excellent. Trading has never been this profitable and stress-free. This advisor is a must-have for any serious trader.