Revolutionize Your Trading with Bollinger Bands EA

Discover the power of automated trading with the Bollinger Bands EA (Expert Advisor) for MT4 (Metatrader 4) by KOKOSHELL.

Consequently, this advanced expert advisor is designed to optimize your trading strategy. By leveraging the renowned Bollinger Bands indicator, it makes precise, profitable trades. Whether you are a novice or an experienced trader, Bollinger Bands Expert Advisor for Metatrader 4 offers the tools you need to enhance your trading efficiency and achieve consistent results.

How It Works: Automated Trading Simplified

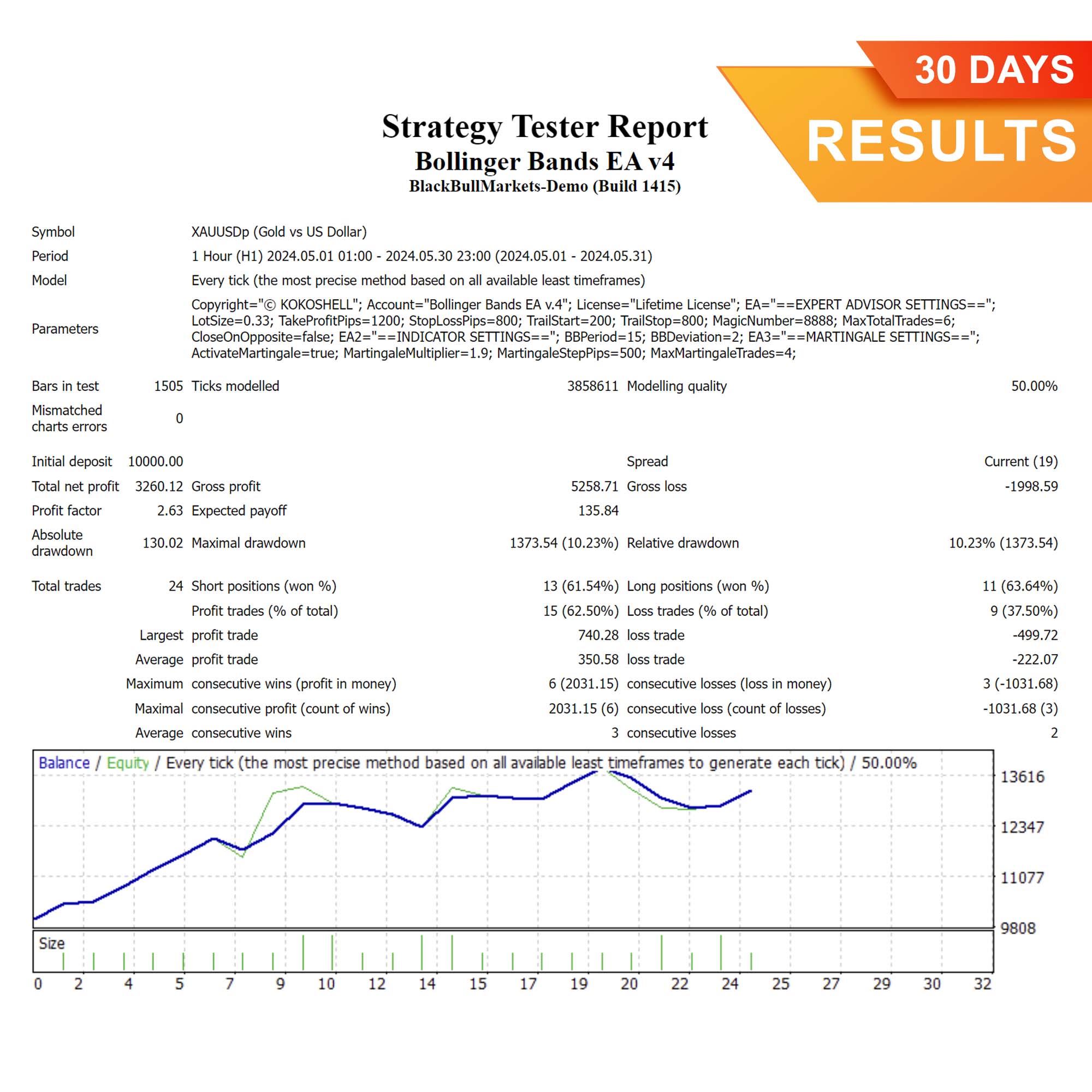

Bollinger Bands EA operates by analyzing market conditions using Bollinger Bands, a popular technical indicator that measures market volatility and identifies potential entry and exit points. Consequently, the EA automatically opens buy or sell orders when the price crosses above or below the Bollinger Bands.

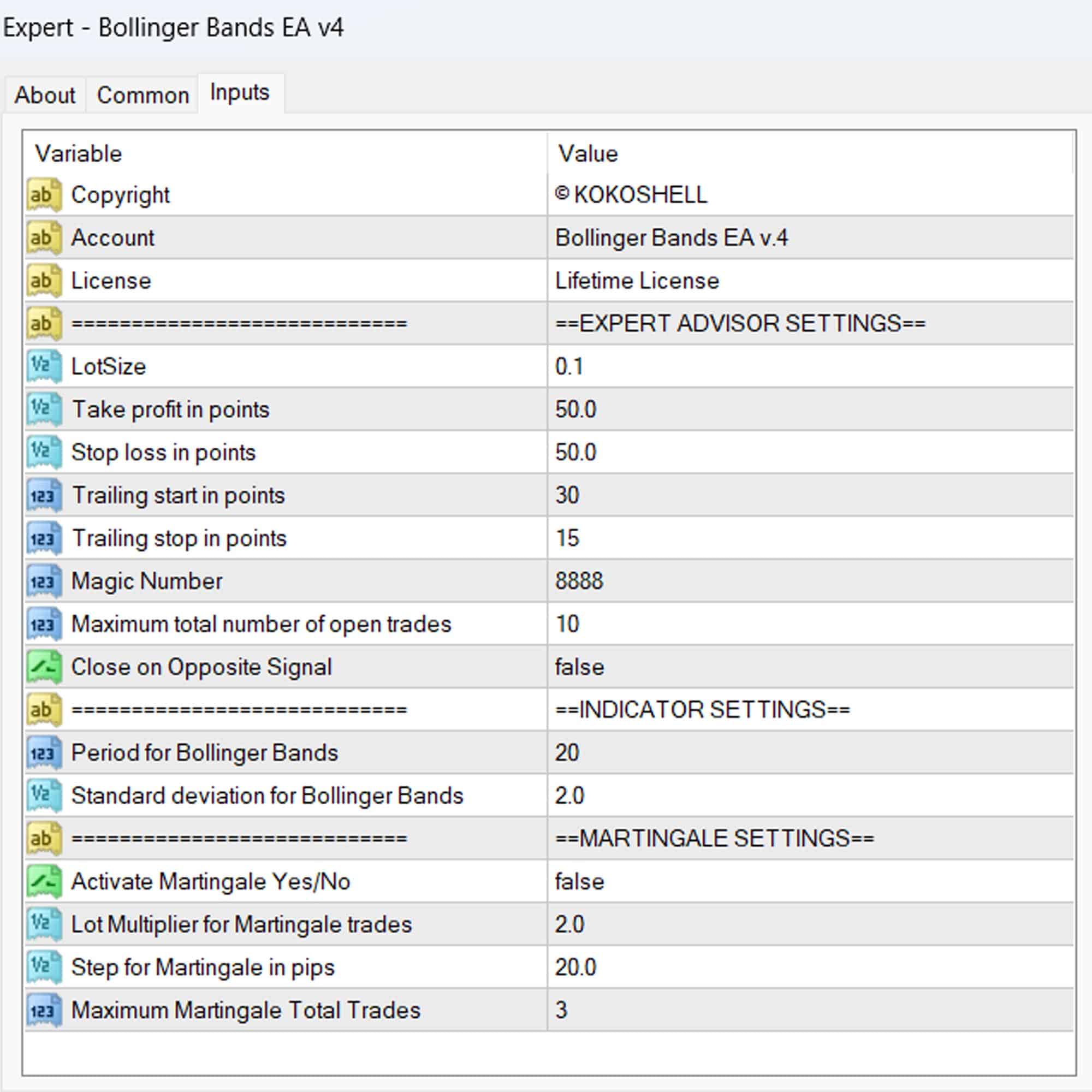

Moreover, it features adjustable parameters for lot size, take profit, stop loss, and trailing stops, allowing you to customize the EA to fit your trading style. Additionally, an optional Martingale strategy can be activated to increase lot sizes after losses, aiming to recover previous losses and secure profits. Furthermore, this comprehensive approach ensures your trades align with market movements.

Key Features: Advanced Features for Maximum Trading Efficiency

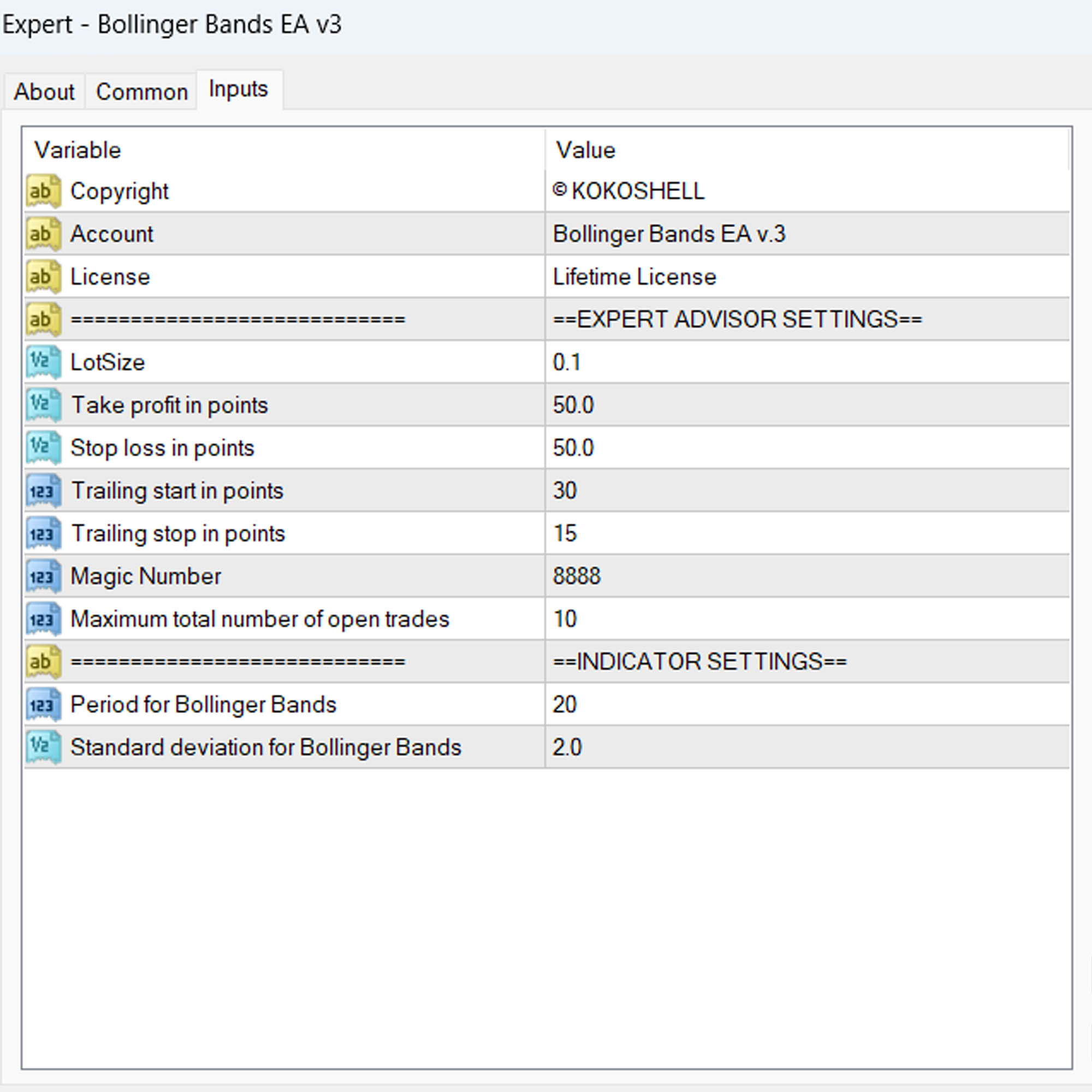

- Bollinger Bands Strategy: Utilizes Bollinger Bands to provide accurate market analysis and generate reliable trading signals.

- Customizable Parameters: Adjust lot sizes, take profit, stop loss, and trailing stops to align with your trading preferences.

- Martingale System: An optional feature that increases lot sizes after losses, designed to recover losses and achieve profits.

- Risk Management: Includes settings for maximum total trades, trailing stops, and a close-on-opposite-signal feature to effectively manage risk.

- Automated Trading: Executes trades automatically based on your predefined settings, saving time and reducing emotional decision-making.

Why Choose Bollinger Bands EA: Superior Trading Performance and Flexibility

Bollinger Bands EA for Metatrader 4 stands out for its reliability, flexibility, and robust performance. Consequently, it is designed to cater to both conservative and aggressive trading styles. Therefore, it provides comprehensive control over your trading strategy.

Furthermore, with its user-friendly interface and advanced features, Bollinger Bands Expert Advisor enables traders to maximize their trading potential and achieve consistent results. Consequently, choose Bollinger Bands Expert Advisor for an enhanced trading experience and a competitive edge in the forex market.

Enhance Your Trading with Advanced Automation

Experience the future of forex trading with Bollinger Bands MT4 EA by KOKOSHELL. By integrating advanced technical indicators and customizable strategies, this expert advisor empowers you to make informed and profitable trades. Therefore, optimize your trading strategy, manage risk effectively, and achieve consistent success with Bollinger Bands MT4 Expert Advisor. Consequently, visit KOKOSHELL to learn more and start your journey towards automated trading excellence today.

William Brown –

Decent, but had some issues with setup.

Chloe Davis –

This EA is perfect for my trading!

Daniel Garcia –

Good performance, but could use better documentation.

Lucas Johnson –

Excellent results, highly accurate.

Sofia Lewis –

Useful, but could be more intuitive.

Ethan Martinez –

Fantastic tool for both new and experienced traders.

Isabella Clark –

Good EA, but takes some getting used to.

Liam Smith –

Great performance, easy to set up.

Emily Walker –

Helped improve my trading consistency.

Noah Brown –

Excellent tool, very reliable.

Robert Williams –

This trading advisor has exceeded all my expectations. The setup was seamless, and it immediately started delivering impressive returns. The strategy it uses is highly effective, and the risk management ensures my investments are safe. My trading experience has never been more profitable and stress-free. I can’t recommend it enough!