Enhance Your Trading Strategy with WTI Swing Trading EA

The WTI Swing Trading EA is a cutting-edge Expert Advisor designed for automated trading on MT4 (MetaTrader 4). This EA optimizes your trading strategy by leveraging advanced technical indicators and robust algorithms, ensuring precise trade entries and exits. Whether you’re a seasoned trader or a beginner, the WTI Swing Trading Expert Advisor helps you maximize your profits and minimize risks.

How It Works: Leveraging Advanced Indicators for Optimal Trades

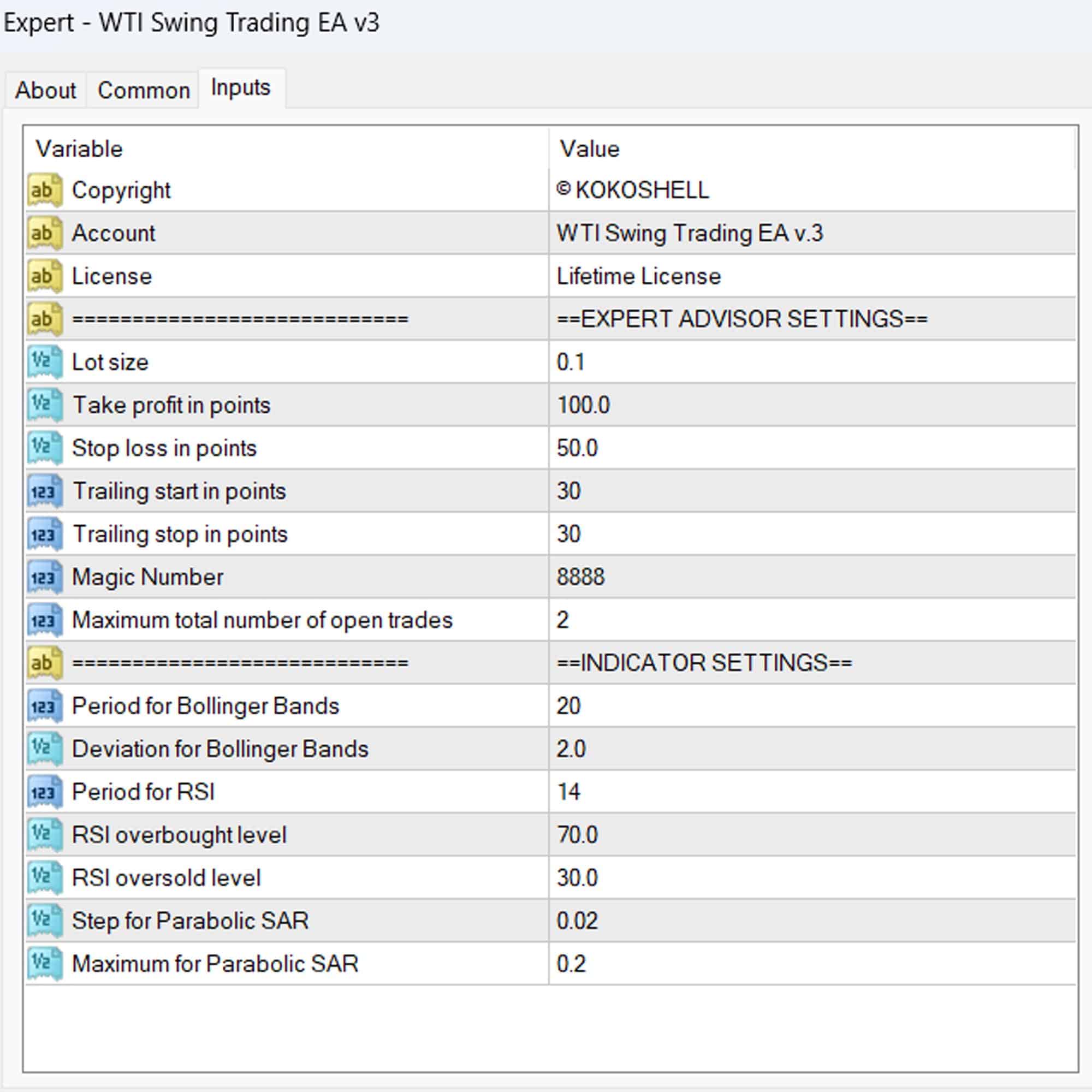

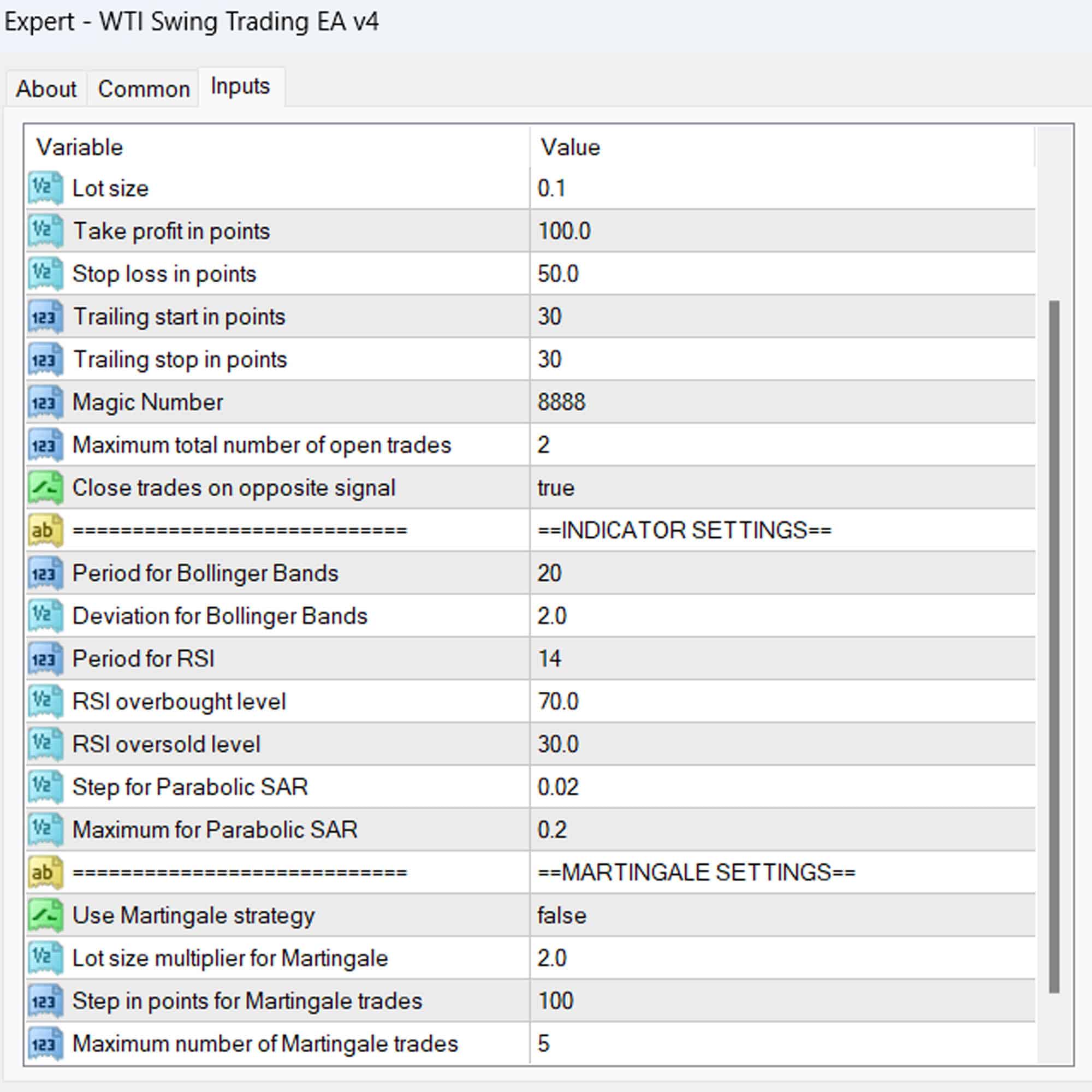

The WTI Swing Trading EA for Metatrader 4 analyzes key technical indicators such as Bollinger Bands, RSI, and Parabolic SAR. It identifies high-probability trading opportunities by evaluating market conditions and executing trades based on predefined criteria:

- Bollinger Bands: They detect volatility and potential trend reversals. Therefore, you can make informed decisions.

- RSI (Relative Strength Index): This indicator helps identify overbought and oversold conditions. Thus, you can avoid poor trades.

- Parabolic SAR: It assists in determining the direction of the trend and potential reversal points. Consequently, it aids in timing your trades.

When specific conditions are met, the WTI Swing Trading EA places buy or sell orders, manages trailing stops, and ensures optimal trade exits to secure profits.

Key Features: Powerful Tools for Successful Trading

- Automated Trading: Executes trades automatically based on predefined criteria. Additionally, it reduces emotional decision-making.

- Advanced Indicators: Utilizes Bollinger Bands, RSI, and Parabolic SAR for accurate market analysis. Hence, you get precise signals.

- Martingale Strategy: Offers the option to use Martingale for recovering losses and maximizing gains. Moreover, it enhances your trading strategy.

- Trailing Stop: Dynamically adjusts stop-loss levels to protect profits. As a result, it locks in your gains.

- Close on Opposite Signal: Ensures trades are closed when an opposite signal is detected, minimizing losses. Furthermore, it maintains your account’s health.

- Customizable Settings: Allows traders to adjust lot size, take profit, stop loss, and other parameters. Thus, it suits various trading styles.

Why Choose WTI Swing Trading EA?

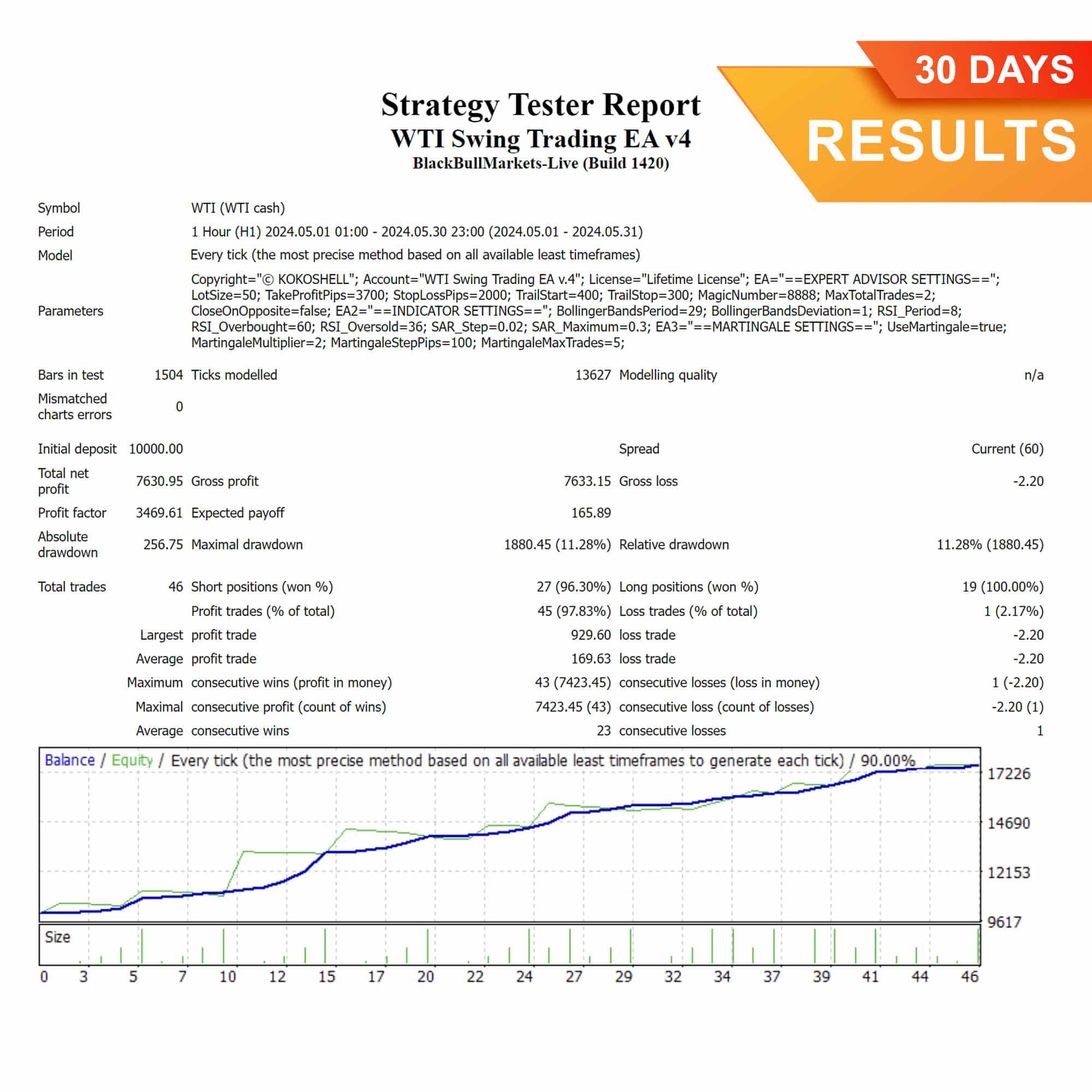

- Proven Performance: Backtested and optimized for consistent profitability. Consequently, it provides reliable results.

- User-Friendly: Easy to install and configure, even for novice traders. Therefore, it is accessible to all.

- Time-Saving: Automates the trading process, allowing you to focus on other activities. Moreover, it enhances your efficiency.

- Risk Management: Includes advanced features for managing risk and protecting your investment. Thus, it safeguards your capital.

- Lifetime License: One-time purchase with no recurring fees. Additionally, it offers long-term value.

Take Your Trading to the Next Level

The WTI Swing Trading EA by KOKOSHELL is the ultimate tool for traders looking to enhance their trading strategy with automated, precision-based trading. With its advanced features and user-friendly interface, this EA is designed to help you achieve consistent profits and grow your trading account. Invest in the WTI Swing Trading Expert Advisor for MT4 (Metatrader 4) today and experience the future of automated trading.

Nathan Smith –

This tool has revolutionized my trading strategy. Consistent profits and easy to use.

Mia –

Profits soared! Very reliable.

Ethan Johnson –

Effective for swing trading. Could use more customization options.

Sofia Brown –

My trading has improved significantly. Highly recommended for anyone serious about trading.

Lucas Davis –

Decent tool, but lacks input parameters. Good price. Needs thorough backtesting.

Ava –

Outstanding tool! My profits have increased dramatically.

David Martinez –

Reliable and effective. Signals are accurate, but more input options would be beneficial.

Noah Thompson –

Incredible results. My trading is now more profitable and less stressful.

Richard Lee –

This trading advisor is fantastic! The setup was seamless, and the profits started rolling in quickly. The strategy is brilliant, and the risk management features are exceptional. Trading has become stress-free and highly profitable. I highly recommend this tool to anyone serious about trading.