Transform Your Trading with OsMA MT4 EA

Introducing the OsMA EA (Expert Advisor) for MT4 (Metatrader 4), an advanced trading robot designed to maximize your trading potential. This Expert Advisor (EA) leverages the Oscillator of Moving Average (OsMA) indicator to generate precise and timely trading signals.

Whether you are a novice trader or an experienced professional, the OsMA Expert Advisor provides an efficient and reliable solution. Consequently, it enhances your trading strategies and helps you achieve consistent success in the forex market.

How It Works: Harnessing the Power of OsMA

The OsMA MT4 Expert Advisor operates by continuously analyzing the OsMA indicator to detect optimal entry and exit points for trades. When the OsMA indicator crosses key levels, the EA automatically executes buy or sell orders. This automation ensures that trades are made at the most advantageous times, thereby capitalizing on market movements with precision.

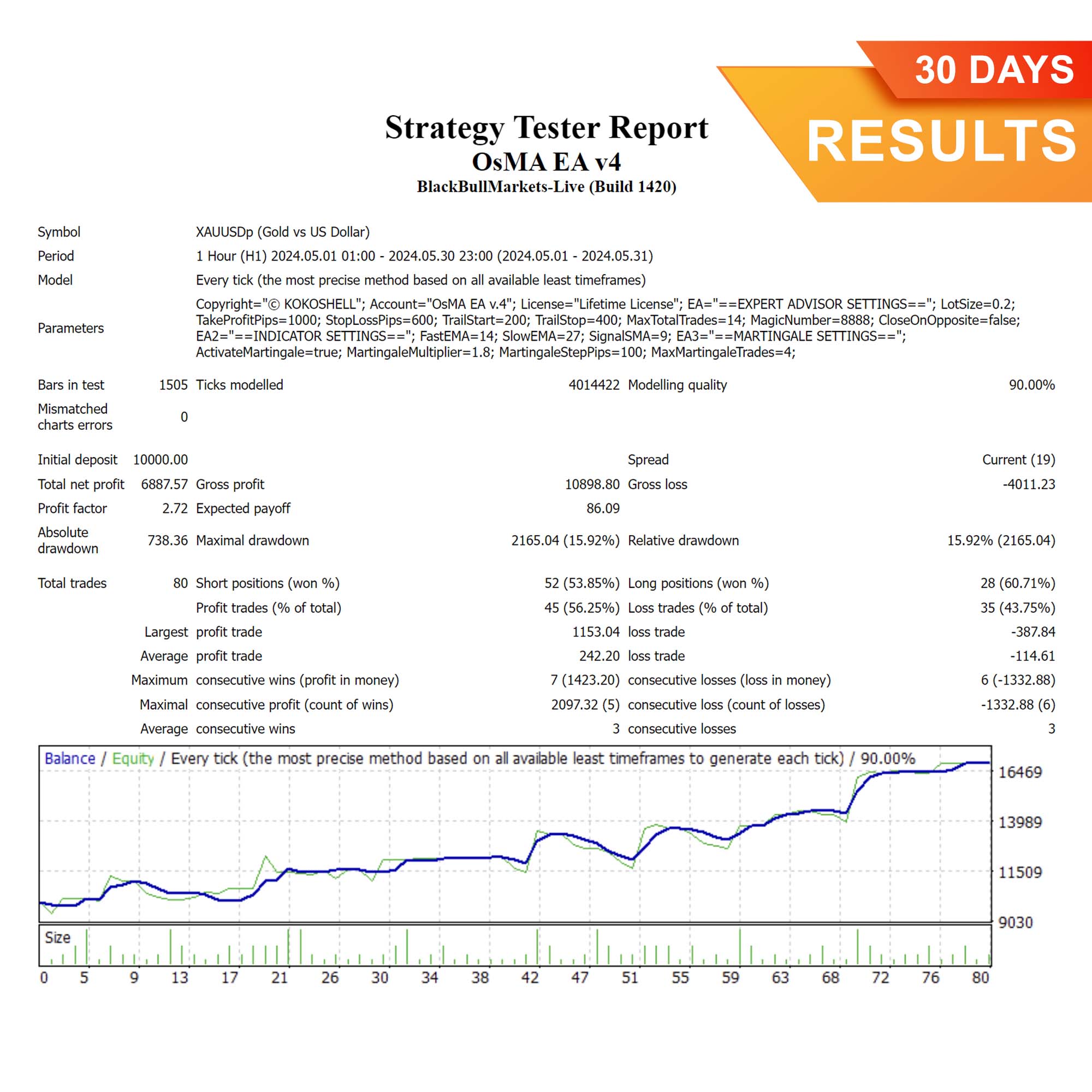

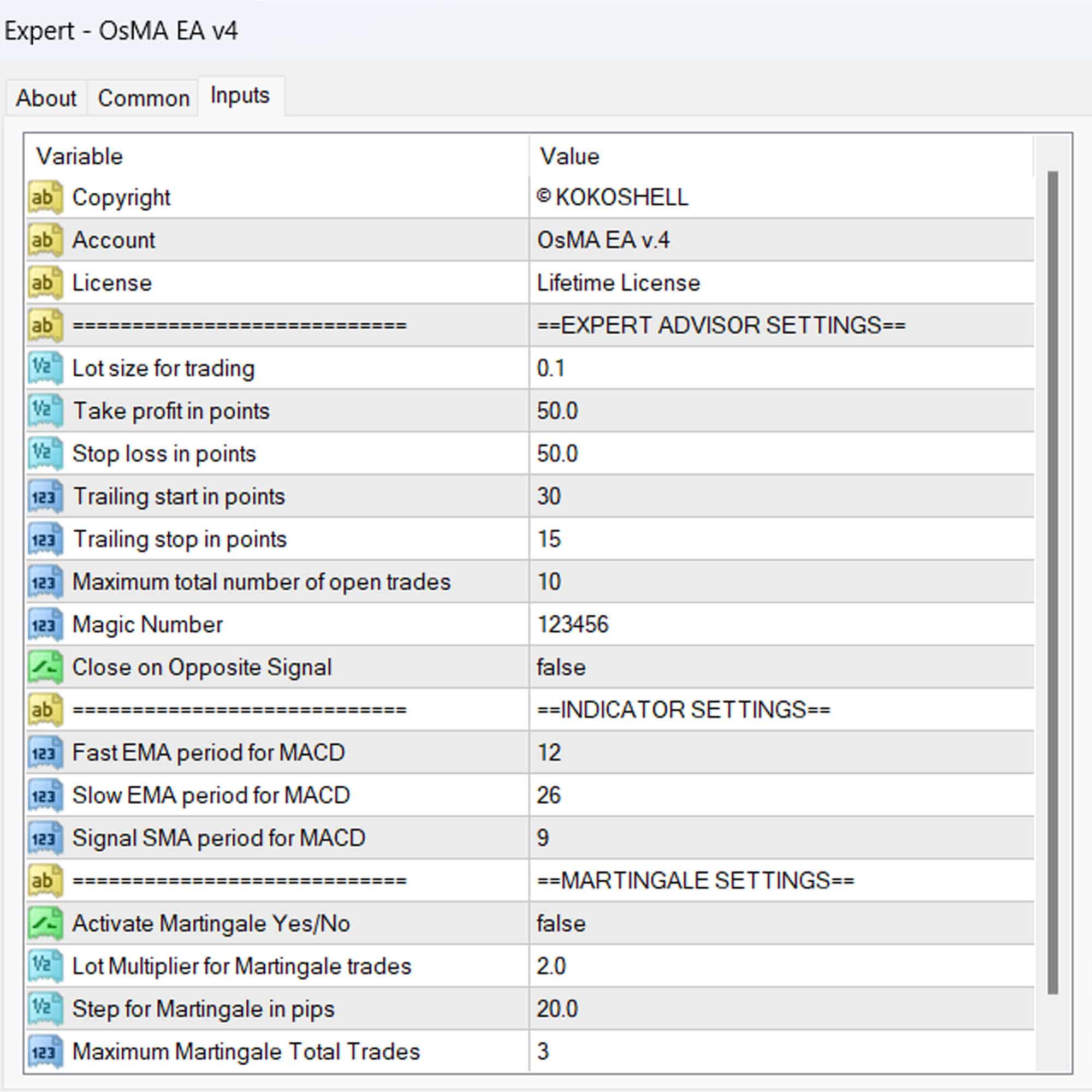

Furthermore, the EA includes an optional Martingale strategy, which increases the lot size following a loss to potentially recover and increase profits. Moreover, the EA features sophisticated risk management tools, including adjustable lot sizes, take profit, stop loss, and trailing stops to protect your investments.

Key Features: Advanced Capabilities for Superior Trading

- Accurate Signals: Utilizes the OsMA indicator to provide reliable buy and sell signals.

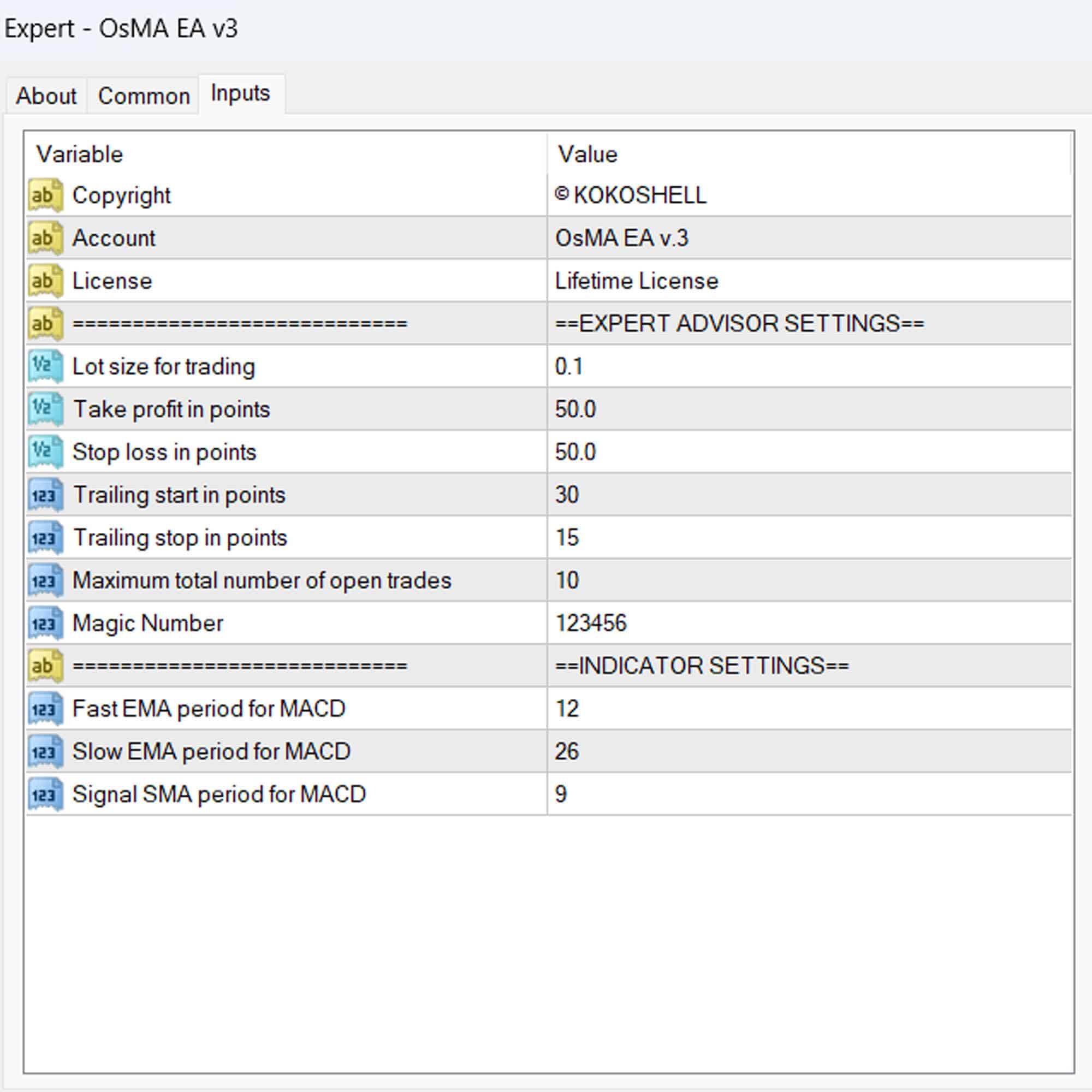

- Fully Customizable: Adaptable settings for lot size, take profit, stop loss, and trailing stops to suit your trading style.

- Martingale Strategy: Includes an optional Martingale system to boost recovery and profitability.

- Comprehensive Risk Management: Provides advanced risk management features to safeguard your trades and minimize losses.

- Automated Trading: Ensures seamless automation for executing trades, allowing for a set-and-forget trading approach.

- Lifetime License: Offers a one-time purchase with lifetime access and updates, thereby ensuring long-term value and performance.

Why Choose OsMA EA: Achieve Consistent Trading Excellence

Choosing OsMA EA means opting for a powerful tool designed for precision and reliability. The EA’s utilization of the OsMA indicator ensures timely and accurate trading signals, thereby enhancing your chances of success. Additionally, its customizable settings allow you to tailor the EA to your specific needs, whether you prefer aggressive growth or steady gains.

Moreover, the optional Martingale strategy offers an additional layer of potential profitability. Therefore, OsMA Expert Advisor for Metatrader 4 becomes an indispensable asset for any trader seeking consistent and substantial returns.

Elevate Your Trading Strategy with OsMA EA

Elevate your trading experience with the OsMA EA for MT4 (Metatrader 4) by KOKOSHELL. This Expert Advisor offers a comprehensive, automated, and precise trading solution, backed by advanced features and robust risk management. Consequently, leverage the power of the OsMA indicator to identify and capitalize on market opportunities effectively. Therefore, visit KOKOSHELL today to learn more and start your journey towards consistent trading success with OsMA Expert Advisor.

Liam O’Connor –

Great tool! Works perfectly.

Emma Harris –

Helped improve my trading strategy. Good results so far.

Lucas Müller –

I’ve seen significant improvements in my trading. Highly recommend this EA for all traders.

Olivia Smith –

Decent EA, but it could use more flexibility in the settings.

Noah Martin –

Amazing product! Easy to set up and use. My trading has never been better.

Sophie Dubois –

Good performance. The EA has helped me stay consistent with my trades. Worth trying.

Ethan Johnson –

Fantastic tool for traders. The accuracy and reliability are top-notch. I’ve recommended it to my friends.

Mia Brown –

Works okay, but the user interface could be more intuitive. Overall, it’s a helpful tool.

William Lee –

Solid EA. It has improved my trading outcomes. Could use a bit more customization options.

Ava Thompson –

This EA is incredible. I’ve seen a marked improvement in my trading success. It’s straightforward to use and very effective.

Oliver Adams –

The EA works well, but it took me some time to get used to it. Once I did, it made a positive impact on my trading results.

Mark Clark –

I’m extremely impressed with this trading advisor. The setup was easy, and the profits started rolling in almost immediately. The strategy it uses is brilliant, and the risk management features give me peace of mind. This tool has significantly improved my trading results. Highly recommend!