Discover the Power of Momentum EA

Unlock your trading potential with the Momentum EA (Expert Advisor) for MT4 (Metatrader 4). Specifically designed to capitalize on market momentum, this expert advisor provides accurate and timely buy and sell signals based on the Momentum indicator. Whether you are a novice or experienced trader, the Momentum EA for Metatrader 4 offers a powerful, automated solution to enhance your trading strategy and consequently boost your profitability.

How It Works: Harnessing Market Momentum for Success

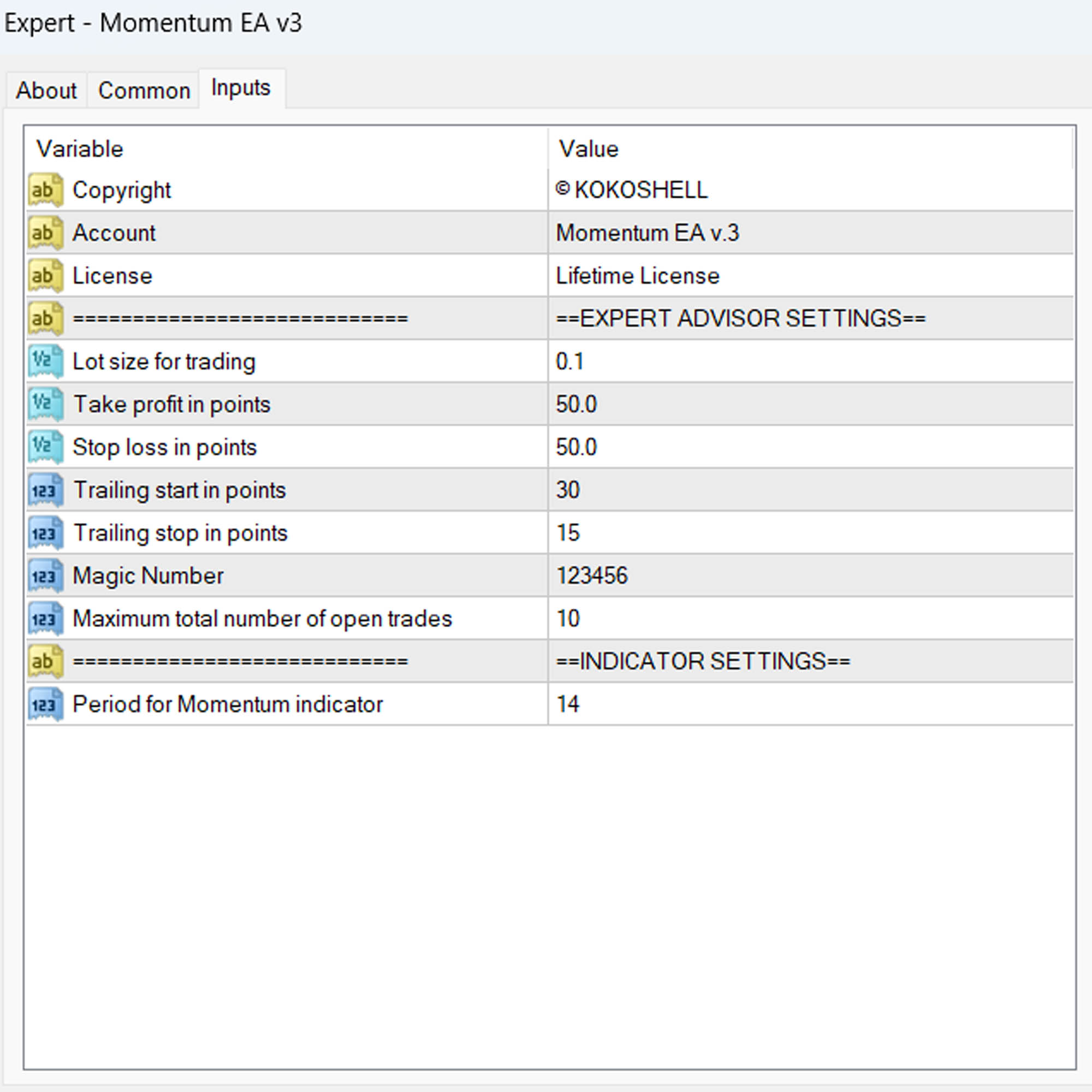

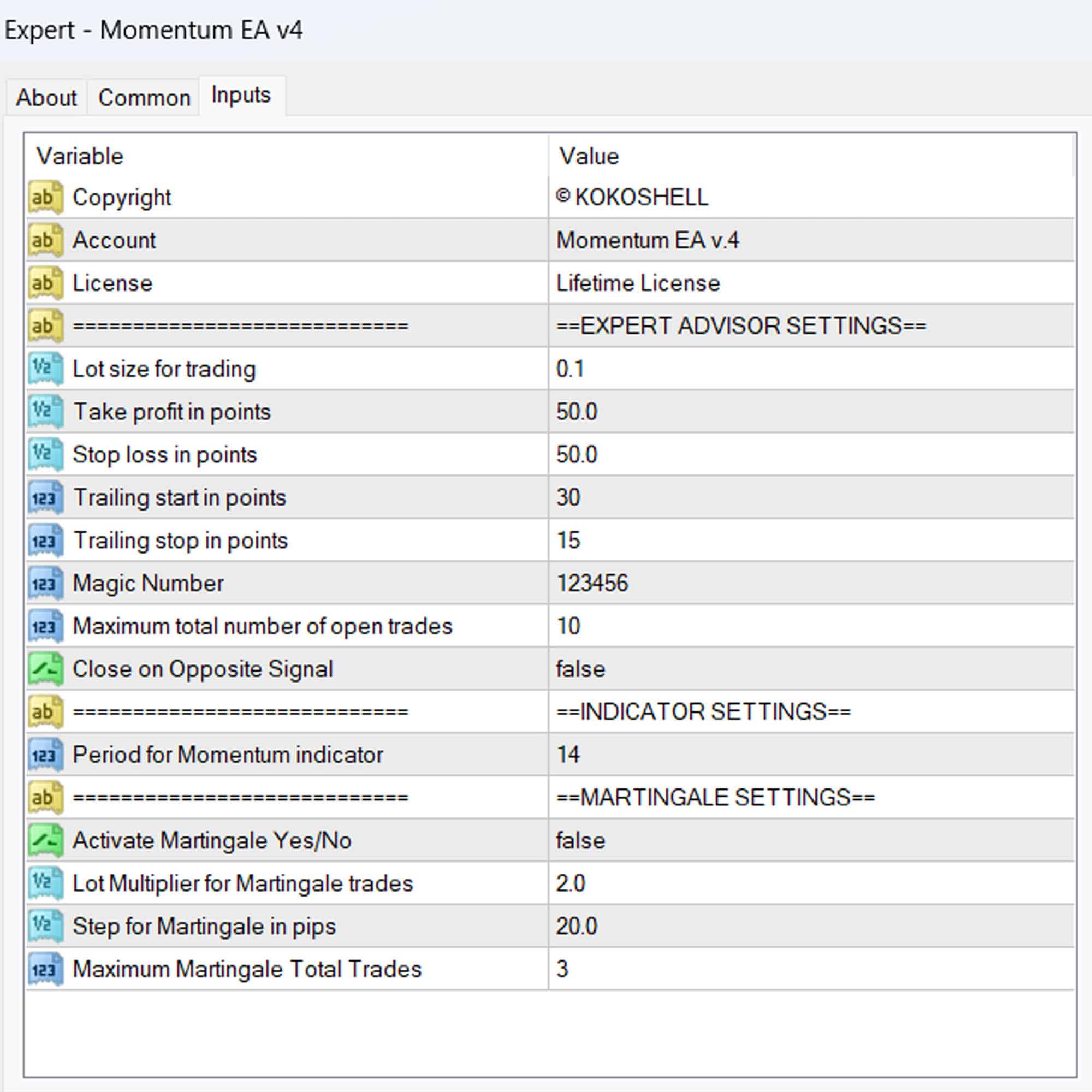

The Momentum EA uses the Momentum indicator to identify potential trading opportunities. When the Momentum indicator crosses key levels, the EA generates buy or sell signals. Furthermore, you can activate the built-in Martingale strategy to increase lot sizes after losses, thereby aiming to recover losses more quickly.

Moreover, the EA includes robust risk management tools such as customizable lot sizes, take profit, stop loss, and trailing stops. Thus, it ensures you manage trades effectively and efficiently.

Key Features: Advanced Trading

- Accurate Signals: The Momentum indicator generates precise buy and sell signals.

- Customizable Settings: Adjust lot size, take profit, stop loss, and trailing stops to suit your trading style.

- Martingale Strategy: The optional Martingale system increases lot sizes after losses, enhancing recovery potential.

- Risk Management: Comprehensive risk management features protect your investments.

- Automated Trading: Fully automated trading allows you to set it and forget it.

- Lifetime License: One-time purchase with lifetime access and updates.

Why Choose Momentum EA: Enhance Your Trading Strategy

Momentum EA stands out due to its robust and reliable performance. By leveraging the power of the Momentum indicator, it identifies trading opportunities that other strategies might miss. Additionally, its customizable settings allow you to tailor the EA to your specific needs, whether you’re looking for aggressive growth or steady, conservative gains.

Moreover, the optional Martingale strategy adds an extra layer of potential profitability. Therefore, it makes Momentum EA a versatile tool in any trader’s arsenal.

Elevate Your Trading with Momentum MT4 Expert Advisor

Incorporate the Momentum EA into your trading strategy and experience the benefits of automated, precise, and profitable trading. With its advanced features and robust risk management, this expert advisor helps you achieve consistent trading success. Consequently, don’t miss out on the opportunity to elevate your trading game—try the Momentum Metatrader 4 Expert Advisor by KOKOSHELL today.

Matthew Clark –

Incredible tool! Boosted my trading.

Anna Thompson –

Useful EA, improved my trade accuracy.

William Carter –

Great results with this EA. Highly efficient and easy to use for trading.

Julia Taylor –

Decent product.

Benjamin –

Excellent tool! Easy to set up and delivers consistent, reliable results. My trading has improved drastically.

Chloe Wilson –

Good EA, but could use more flexibility. Still very useful for catching trends.

Jacob Harris –

This EA is fantastic! It has significantly boosted my trading efficiency.

Sophie Martin –

Very helpful. My trading has become more consistent. Great for identifying trends.

Lucas Robinson –

Amazing results! Easy to set up and use. Highly recommended for serious traders.

Isabella Moore –

It’s okay, but the interface could be more intuitive. Overall, it helps catch trends.

Ethan Thompson –

Excellent EA. It has made a significant difference in my trading strategy.

Lily Walker –

Good tool for trading. Helps to stay on top of market trends effectively.

Alexander King –

This EA has transformed my trading. It’s reliable and easy to use. Highly recommend it.

Grace Lewis –

Solid EA. It’s helped me maintain consistency in my trades. Worth trying.

Matthew Gonzalez –

I’ve tried many trading tools, but this one stands out by a mile. The setup was quick and easy, and the profits have been incredible. The strategy it employs is highly effective, and the risk management is excellent. This advisor has truly transformed my trading experience. I highly recommend it!