Elevate Your Trading Strategy with DeMarker EA

Unlock the full potential of your trading strategy with the DeMarker EA (Expert Advisor) for MT4 (Metatrader 4) by KOKOSHELL. Specifically designed to optimize your trading decisions using the powerful DeMarker indicator, this expert advisor (MT4 EA) offers a comprehensive suite of features. Whether you are a beginner or an experienced trader, DeMarker Expert Advisor enhances your trading efficiency and performance.

How It Works: Leveraging DeMarker for Automated Trading

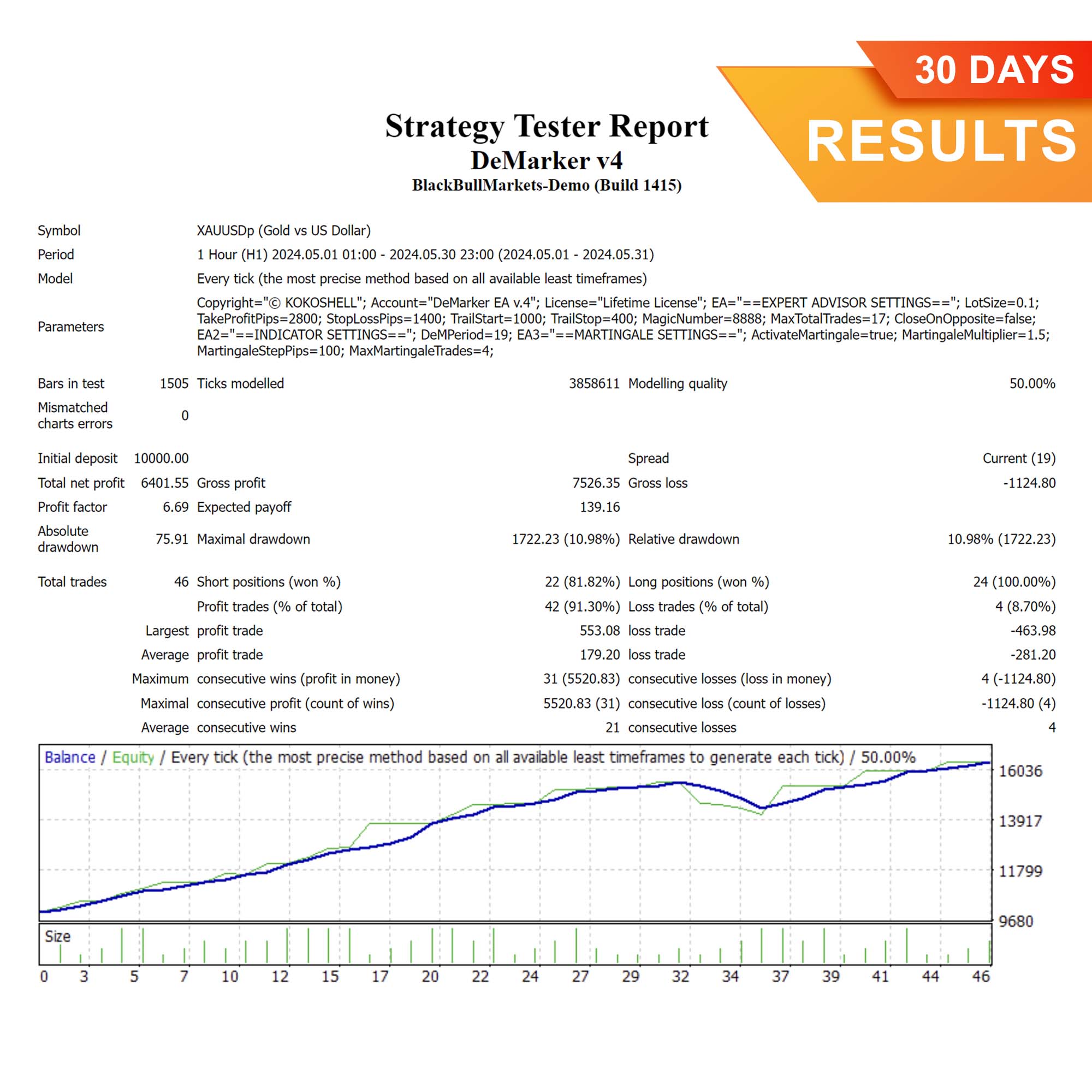

DeMarker EA operates by analyzing market conditions using the DeMarker indicator, which measures the demand of the market. When the DeMarker crosses above 0.3, the EA opens buy orders, indicating a potential upward trend. Conversely, it opens sell orders when the DeMarker crosses below 0.7, suggesting a potential downtrend.

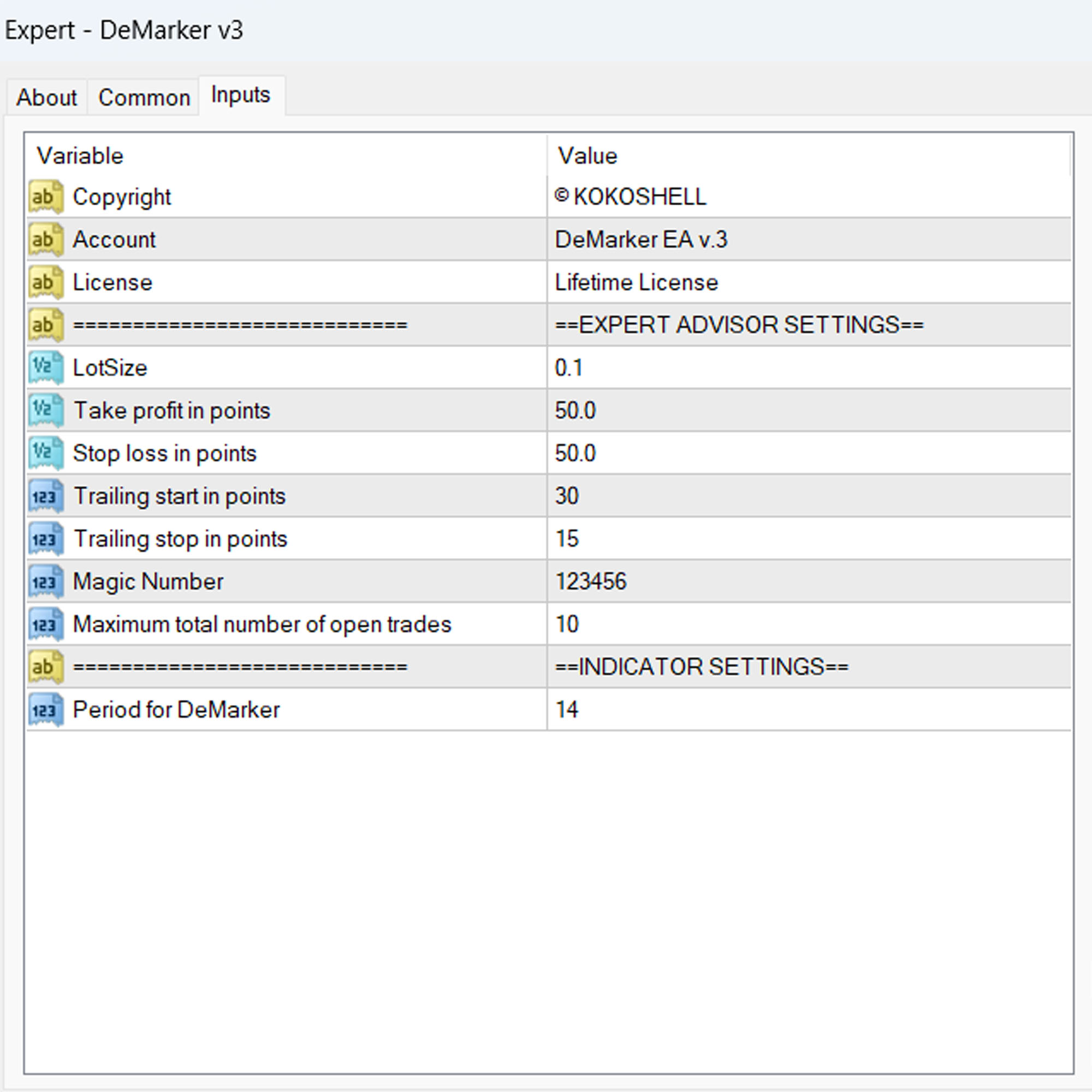

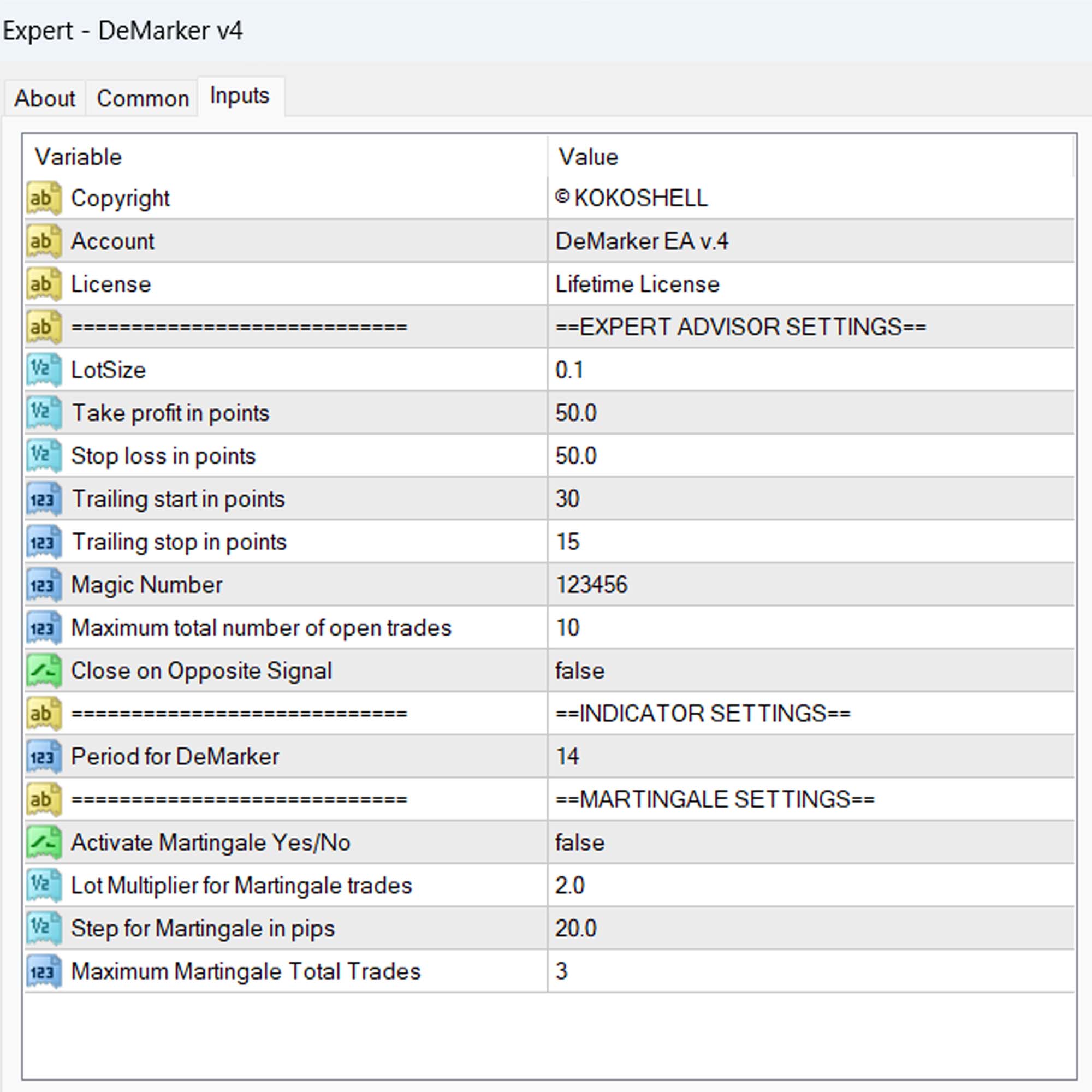

Additionally, the EA’s functionality includes customizable parameters, allowing you to set your preferred lot size, take profit, stop loss, and trailing stop values. Furthermore, you can activate an optional Martingale strategy to increase lot sizes after losses, aiming to recover losses and secure profits efficiently.

Key Features

- DeMarker Indicator Strategy: Utilizes the DeMarker indicator to detect and capitalize on market demand.

- Customizable Settings: Adjust parameters such as lot size, take profit, stop loss, and trailing stops to suit your trading style and risk tolerance.

- Martingale System: An optional feature that increases lot sizes after losses to enhance recovery and profitability.

- Robust Risk Management: Features include maximum total trades, trailing stops, and a close-on-opposite-signal function to manage risk effectively.

- Fully Automated Trading: Executes trades automatically based on predefined settings, reducing the need for manual intervention and minimizing emotional decision-making.

Why Choose DeMarker EA?

DeMarker EA stands out for its reliability, flexibility, and performance. It accommodates a wide range of trading styles, from conservative to aggressive. Moreover, the EA’s user-friendly interface and advanced features enable traders to maximize their trading potential. By leveraging the DeMarker indicator, DeMarker Expert Advisor provides accurate market analysis and timely trade execution, leading to consistent results.

Therefore, choosing DeMarker Expert Advisor gives you a competitive edge in the forex market, ensuring you can capitalize on market demand effectively.

Achieve Consistent Success with DeMarker Expert Advisor

Transform your trading experience with DeMarker EA by KOKOSHELL. This expert advisor integrates advanced technical indicators and customizable strategies, empowering you to make informed and profitable trades. Consequently, with DeMarker Expert Advisor for Metatrader 4, you can optimize your trading strategy, manage risk effectively, and achieve consistent success in the forex market.

Emily Johnson –

Great results! Improved my trading.

Carlos Gomez –

Very useful tool. Helped refine my strategy.

Lucas Thompson –

This EA has been a game-changer for my trading. Accurate, reliable, and easy to use.

Maria Sanchez –

Decent product, but it could use more customization options.

Liam O’Connor –

Excellent tool! My trading efficiency has significantly improved. Easy setup and very reliable.

Sofia Mueller –

Good performance overall. Helps stay on top of trends, but could use more flexibility.

Ethan White –

This EA is fantastic! It has significantly boosted my trading efficiency and results.

Isabella Rossi –

Solid tool for trading. Helps maintain consistency and make better decisions.

Noah Anderson –

Incredible results! My trading success has increased dramatically since using this EA. Highly recommend it to serious traders.

William Garcia –

This trading advisor has revolutionized my trading strategy. The setup was straightforward, and the profits have been impressive. The risk management features are exceptional, ensuring my trades are always safe. The strategic insights it provides are unmatched. This tool is a game-changer for any trader looking to make serious gains.