Enhance Your Trading with Parabolic SAR EA

Introducing the Parabolic SAR EA (Expert Advisor) for MT4 (Metatrader 4), a sophisticated trading tool designed to leverage the Parabolic SAR indicator for optimal trading decisions. This Expert Advisor (EA) automates your trading strategy.

Moreover, it allows you to capitalize on market trends with precision and efficiency. Whether you are a seasoned trader or just starting out, the Parabolic SAR EA offers the reliability and performance needed to achieve consistent success in the forex market.

How It Works: Utilizing Parabolic SAR for Precise Trades

The Parabolic SAR MT4 Expert Advisor operates by analyzing the Parabolic SAR indicator, which identifies potential reversal points in the market. When the indicator signals a trend reversal, the EA executes buy or sell orders to capitalize on these movements.

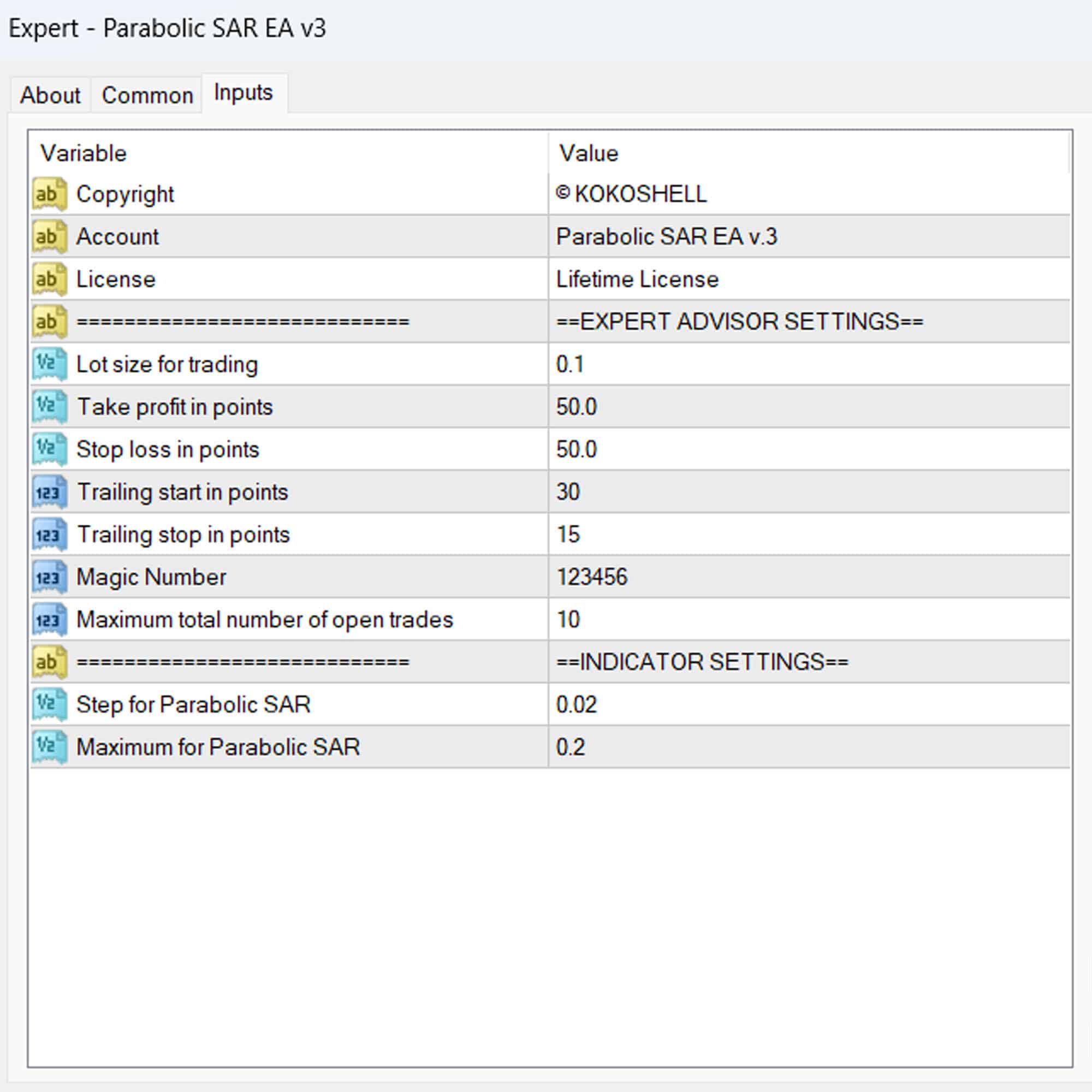

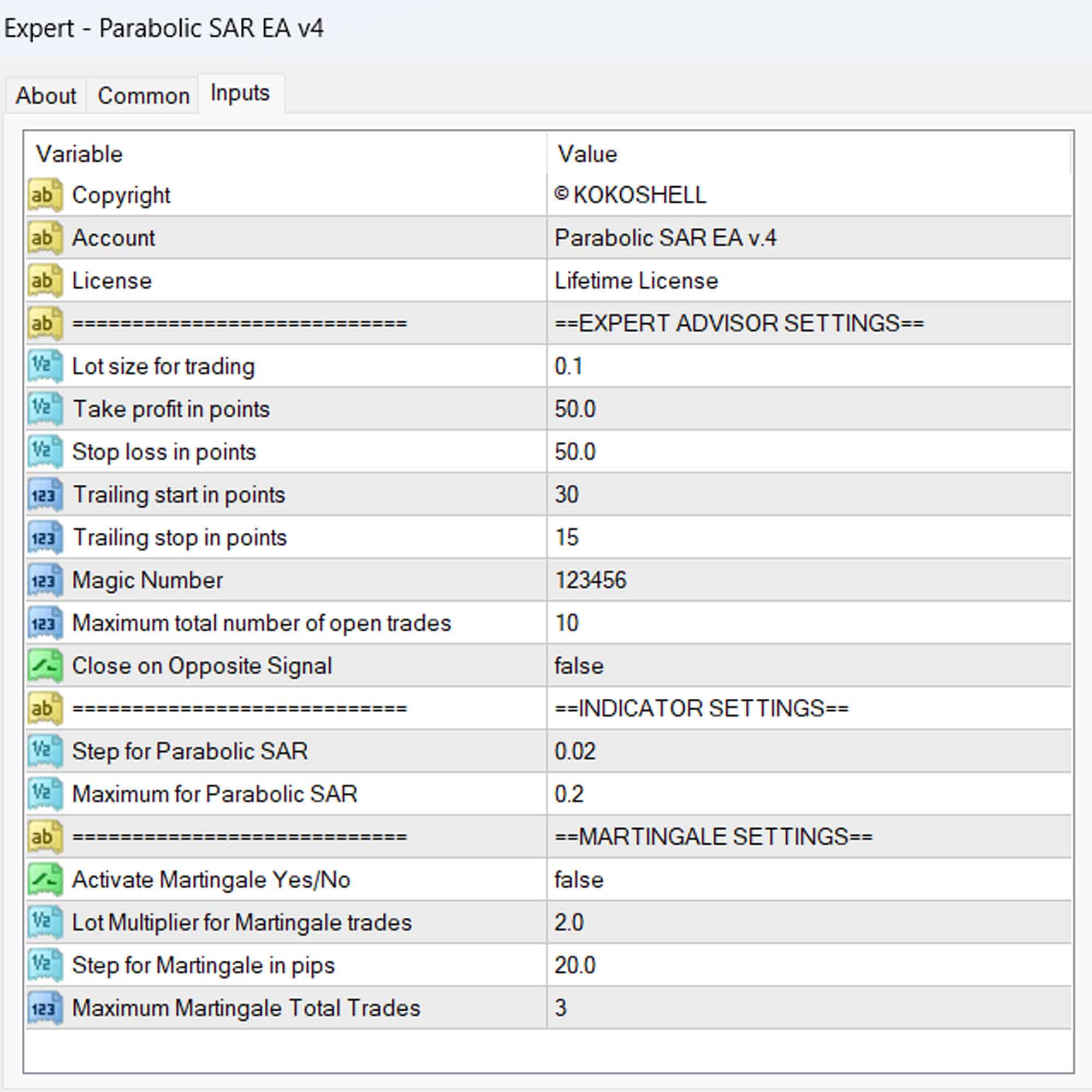

Furthermore, the EA includes advanced features like trailing stops, adjustable lot sizes, and risk management settings. These features optimize your trading performance. Additionally, it offers an optional Martingale strategy, which can enhance profitability by adjusting trade sizes after losses.

Key Features: Advanced Trading Capabilities

- Accurate Trading Signals: Leverages the Parabolic SAR indicator to detect precise entry and exit points.

- Fully Customizable: Moreover, offers adjustable settings for lot size, take profit, stop loss, and trailing stops to match your trading preferences.

- Martingale Strategy: Additionally, includes an optional feature to enhance recovery and profitability by increasing trade sizes after losses.

- Comprehensive Risk Management: Furthermore, protects your investments with robust risk management tools.

- Automated Trading: Consequently, executes trades automatically based on the Parabolic SAR signals, allowing for hands-free trading.

- Lifetime License: Ultimately, provides a one-time purchase with lifetime access, offering ongoing value and continuous updates.

Why Choose Parabolic SAR EA: Achieve Superior Trading Performance

Choosing the Parabolic SAR Expert Advisor means investing in a tool that combines precision, reliability, and advanced features to enhance your trading strategy. The EA accurately interprets the Parabolic SAR indicator, ensuring timely and effective trades.

Moreover, its customizable settings allow for flexibility to suit different trading styles and risk appetites. Furthermore, the optional Martingale strategy adds an extra layer of potential profitability. Therefore, with Parabolic SAR EA, you can achieve consistent trading success and maximize your returns.

Elevate Your Trading with Parabolic SAR

The Parabolic SAR EA (Expert Advisor) for Metatrader 4 by KOKOSHELL is your gateway to advanced, automated trading. This Expert Advisor uses the powerful Parabolic SAR indicator to deliver precise and timely trading signals.

Additionally, it is backed by comprehensive risk management and customization options. Whether you aim for steady gains or aggressive growth, the Parabolic SAR EA adapts to your needs. Thus, it provides a reliable and efficient trading solution.

Alex Johnson –

Amazing tool! It really works!

Jessica –

Very helpful. Improved my trading efficiency.

Brian Williams –

I’ve been using this EA, and it’s been a game-changer for my trading strategy.

Melissa Brown –

It’s decent but was a bit challenging to set up initially.

Kevin –

User-friendly and accurate. It’s improved my trading results significantly. Highly recommend this tool.

Amy Thompson –

Good performance overall. It helps me stay on top of trends, though sometimes it feels rigid.

Jason Lee –

Great tool for traders of all levels. Significant improvement in my trades since using it. Highly recommend!

Rachel Green –

Works well but needs backtesting. It’s helped catch more trends.

Mark Davis –

Very useful EA. Accurate in trend detection, though not perfect. Solid tool for enhancing trading strategy.

Donald Lewis –

This trading advisor is a game-changer. The setup was quick and easy, and the profits have been phenomenal. The strategic insights it provides are unmatched, and the risk management features are excellent. This tool has revolutionized my trading experience. I can’t recommend it enough!