Enhance Your Trading with Alpha Automator EA

Unlock the full potential of your trading strategy with the Alpha Automator EA (Expert Advisor) for MT4 (Metatrader 4). Consequently, this powerful Expert Advisor is designed to streamline your trading operations, leveraging advanced technical indicators like MACD and RSI to make precise, automated trades. Additionally, whether you’re a seasoned trader or a newcomer, Alpha Automator Expert Advisor offers a sophisticated solution to achieve consistent profitability in the forex market.

How It Works: Leveraging MACD and RSI for Optimal Trades

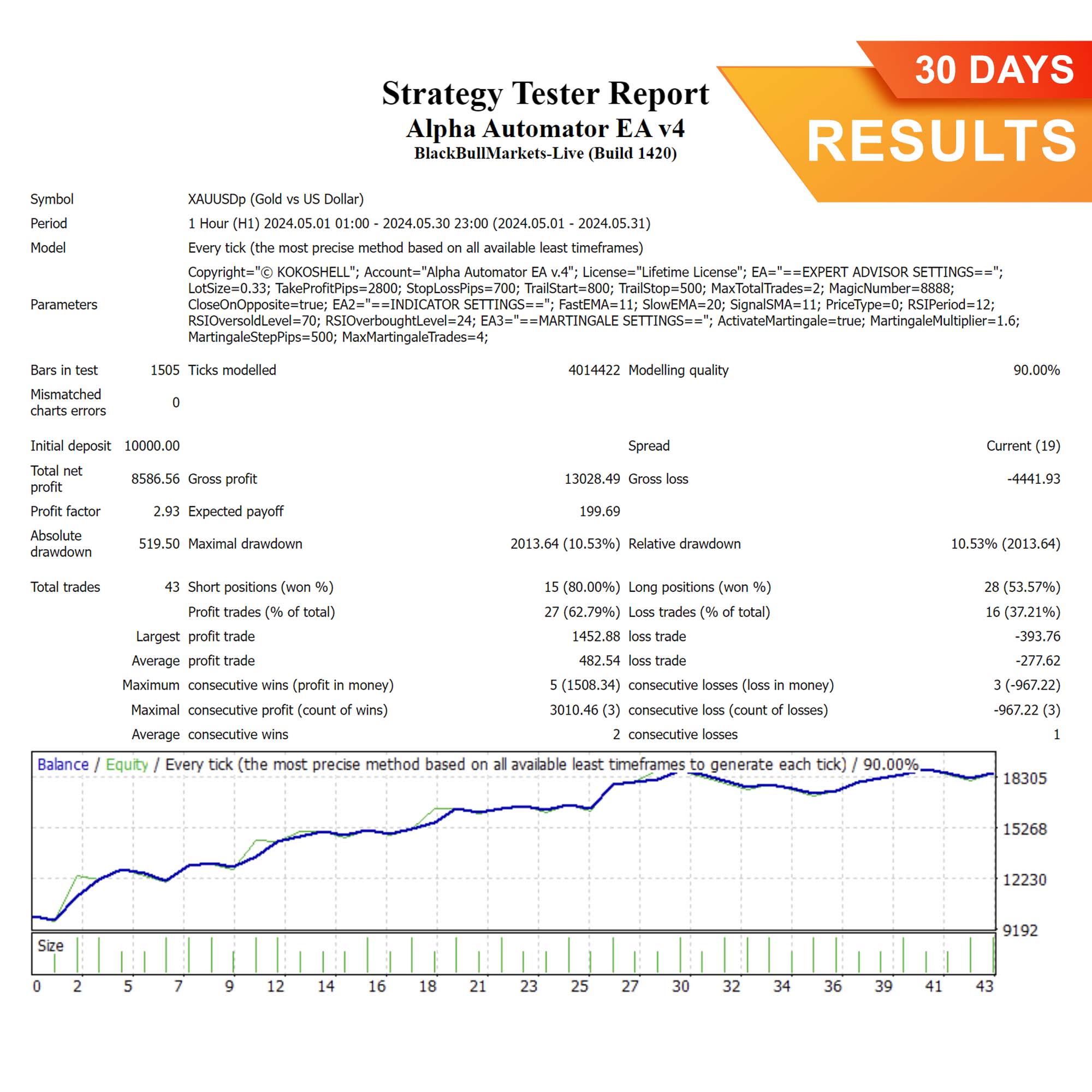

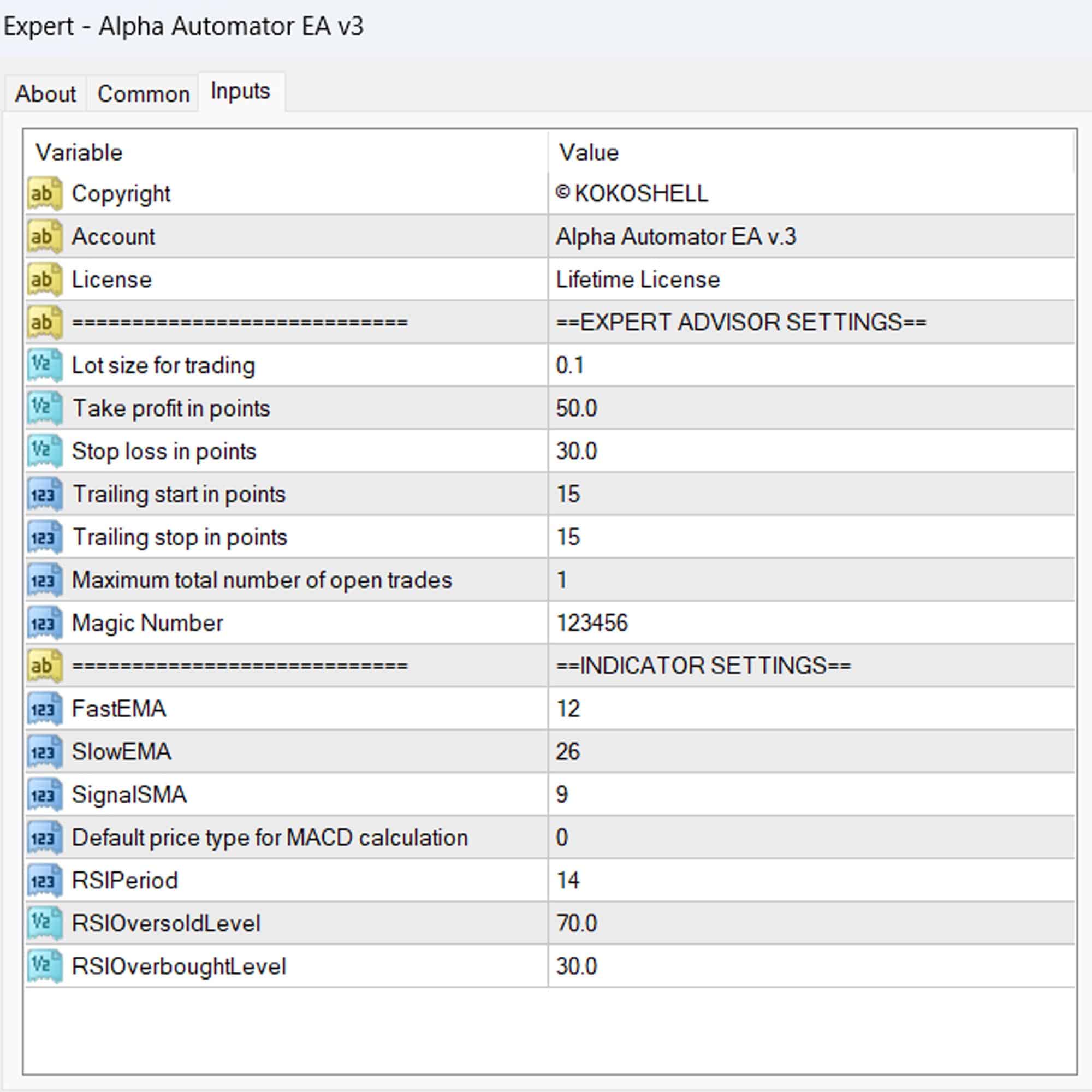

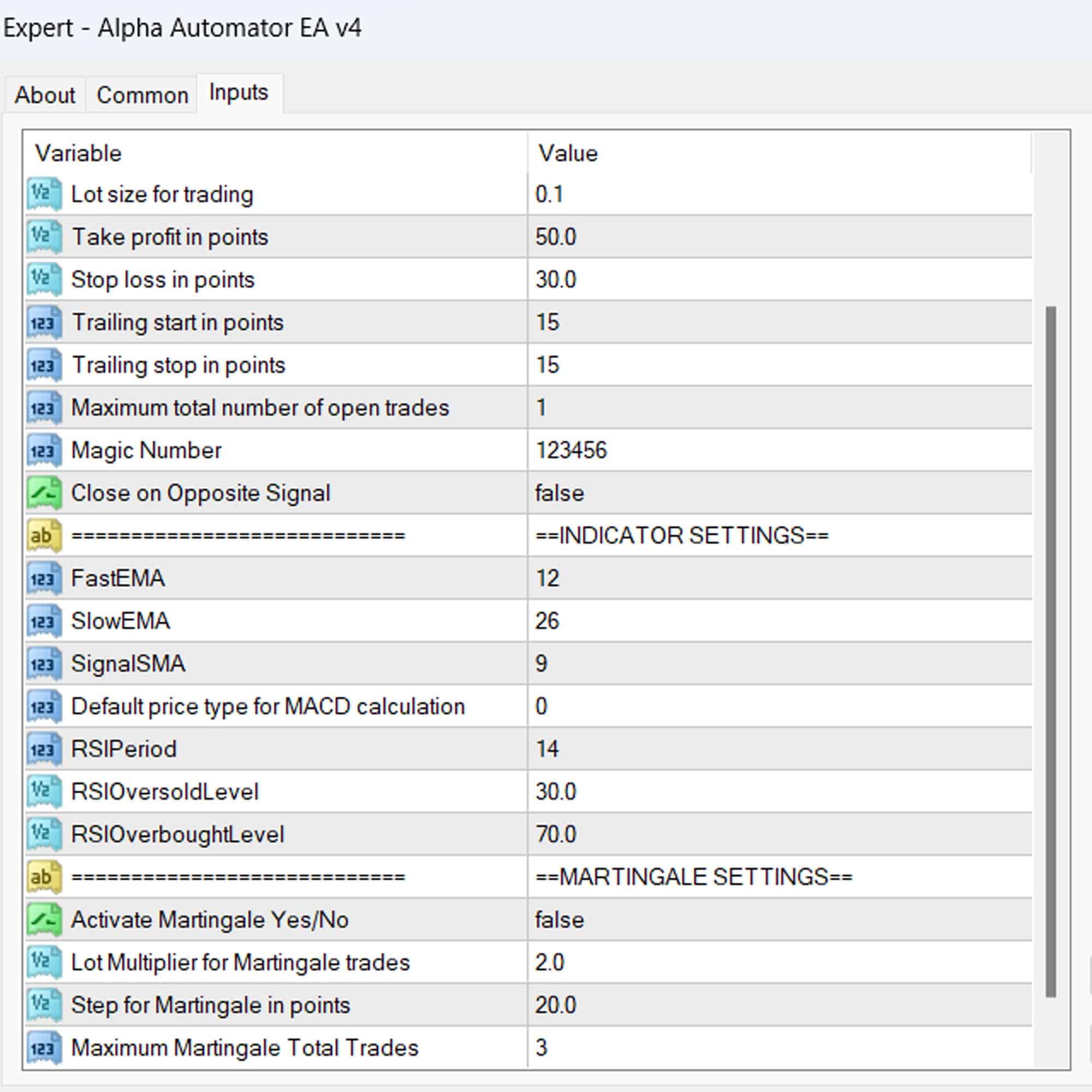

Firstly, Alpha Automator EA operates by analyzing market conditions using the MACD (Moving Average Convergence Divergence) and RSI (Relative Strength Index) indicators. The EA identifies buy and sell signals based on MACD crossovers confirmed by RSI levels, thereby ensuring high-probability trades.

With customizable parameters for lot size, take profit, stop loss, and trailing stops, the EA adapts to your trading preferences. Moreover, an optional Martingale strategy enhances recovery from losses by adjusting trade sizes dynamically.

Key Features: Advanced Tools for Superior Trading

- Precision Trading: Utilizes MACD and RSI indicators for accurate buy and sell signals, thereby maximizing trading opportunities.

- Customizable Settings: Tailor the EA to your trading style with adjustable lot size, take profit, stop loss, and trailing stops.

- Martingale Strategy: An optional feature to increase trade sizes after losses, thus aiming to recover and enhance profitability.

- Automated Execution: Conducts trades automatically based on pre-defined criteria, thereby reducing manual intervention and errors.

- Robust Risk Management: Implements comprehensive risk management tools to protect your investments and minimize losses.

- Lifetime License: Enjoy continuous access and updates with a one-time purchase, therefore ensuring long-term value.

Why Choose Alpha Automator EA: Your Edge in Forex Trading

Alpha Automator EA for Metatrader 4 stands out for its ability to combine the strengths of MACD and RSI indicators, providing a powerful and reliable trading solution. Its advanced customization options allow you to fine-tune your strategy, while the automated execution ensures timely and efficient trades.

Furthermore, the inclusion of a Martingale strategy offers an added advantage, potentially increasing profitability. By choosing Alpha Automator MT4 Expert Advisor, you gain a competitive edge, thus achieving consistent and enhanced trading results.

Revolutionize Your Trading with Alpha Automator EA

Transform your trading experience with the KOKOSHELL Alpha Automator EA. This Expert Advisor delivers a comprehensive, automated trading solution, leveraging the proven effectiveness of MACD and RSI indicators. With robust customization, risk management, and an optional Martingale strategy, Alpha Automator Expert Advisor for Metatrader 4 is designed to optimize your trading performance. Therefore, don’t miss the chance to revolutionize your trading journey with Alpha Automator EA.

James Anderson –

Alpha Automator EA transformed my trading experience. Highly effective and reliable.

Ava Mitchell –

Great tool for improving trades. Took a bit to get used to, but worth it.

Ethan Davis –

Outstanding results! My trading profits have increased significantly.

Mia Brown –

Solid performance. Helps me stay consistent with my trading strategies.

Lucas Wilson –

Fantastic EA! My trades are now more accurate and profitable.

Olivia White –

Very helpful tool, but could use more customization options.

Jack Taylor –

This EA has made a huge difference in my trading. Highly recommend it.

Emma Harris –

Effective tool, but takes some time to master. Overall, very satisfied with the performance.

Noah Johnson –

Alpha Automator EA has significantly improved my trading outcomes.

Sophia Lee –

Good tool for refining trading strategies. Worth the investment.

Emily Johnson –

I can’t believe how much my trading game has improved since I started using this advisor. The setup process was straightforward, and the returns have been phenomenal. Its strategic insights are spot on, and the risk management gives me peace of mind. If you’re serious about trading, this is the tool you need.