Maximize Your Trading Potential with Pips Power EA

To begin with, the Pips Power EA for MT4 (Metatrader 4) is a powerful and versatile Expert Advisor designed to enhance your forex trading strategy. Additionally, this cutting-edge EA leverages advanced indicators and automated trading logic to optimize your trading performance. Whether you are an experienced trader or just starting, Pips Power MT4 Expert Advisor provides the tools and automation you need to achieve consistent results in the forex market.

Discover the secret to financial success with our latest guide on trading Pips Power EA! Learn how to optimize your strategies, manage risks, and unlock consistent profits in the dynamic forex market. Whether you’re a seasoned trader or just starting, our step-by-step instructions and expert tips will empower you to maximize your earnings. Don’t miss this chance to transform your trading experience. Dive into the guide now and take control of your financial future! Visit How to Be Profitable and Make Money Trading Pips Power EA and start your journey to consistent trading success today!

How It Works: Intelligent Trading with Advanced Indicators

Furthermore, Pips Power EA utilizes a sophisticated combination of the Commodity Channel Index (CCI) and Moving Average (MA) indicators to generate accurate buy and sell signals. Specifically, the EA monitors market conditions and executes trades based on these indicators:

- Buy Signal: When the CCI crosses above -100 and the MA is trending upwards, the EA initiates a buy order.

- Sell Signal: When the CCI crosses below 100 and the MA is trending downwards, the EA opens a sell order.

Moreover, the EA includes customizable parameters for lot size, take profit, stop loss, and trailing stops, allowing you to tailor the settings to match your trading style and risk tolerance.

Key Features: Powerful Tools for Enhanced Trading

In addition, Pips Power EA offers a range of powerful tools to enhance your trading:

- Precision Signal Generation: Combines CCI and MA indicators for reliable buy and sell signals.

- Customizable Parameters: Adjust lot size, take profit, stop loss, and trailing stops to suit your trading strategy.

- Martingale Strategy: Optional Martingale feature to increase trade sizes after losses, potentially enhancing profitability.

- Automated Execution: Executes trades automatically based on predefined criteria, reducing manual intervention and errors.

- Comprehensive Risk Management: Implements robust risk management tools to protect your capital and minimize losses.

- Lifetime License: Enjoy continuous updates and support with a one-time purchase.

Why Choose Pips Power EA: Your Path to Consistent Trading Success

Pips Power EA stands out for its intelligent use of CCI and MA indicators, thus providing a reliable trading solution. Additionally, the extensive customization options let you fine-tune your strategy. The automated execution ensures timely and efficient trades.

The optional Martingale strategy offers an added edge, potentially increasing profitability. By choosing Pips Power Expert Advisor for Metatrader 4, you gain a competitive advantage, achieving consistent and enhanced trading results.

Transform Your Trading with Pips Power EA

Ultimately, elevate your trading performance with the KOKOSHELL Pips Power EA for Metatrader 4. This Expert Advisor delivers a comprehensive, automated trading solution, leveraging the proven effectiveness of CCI and MA indicators. Furthermore, with extensive customization, robust risk management, and an optional Martingale strategy, Pips Power Expert Advisor is designed to optimize your trading performance.

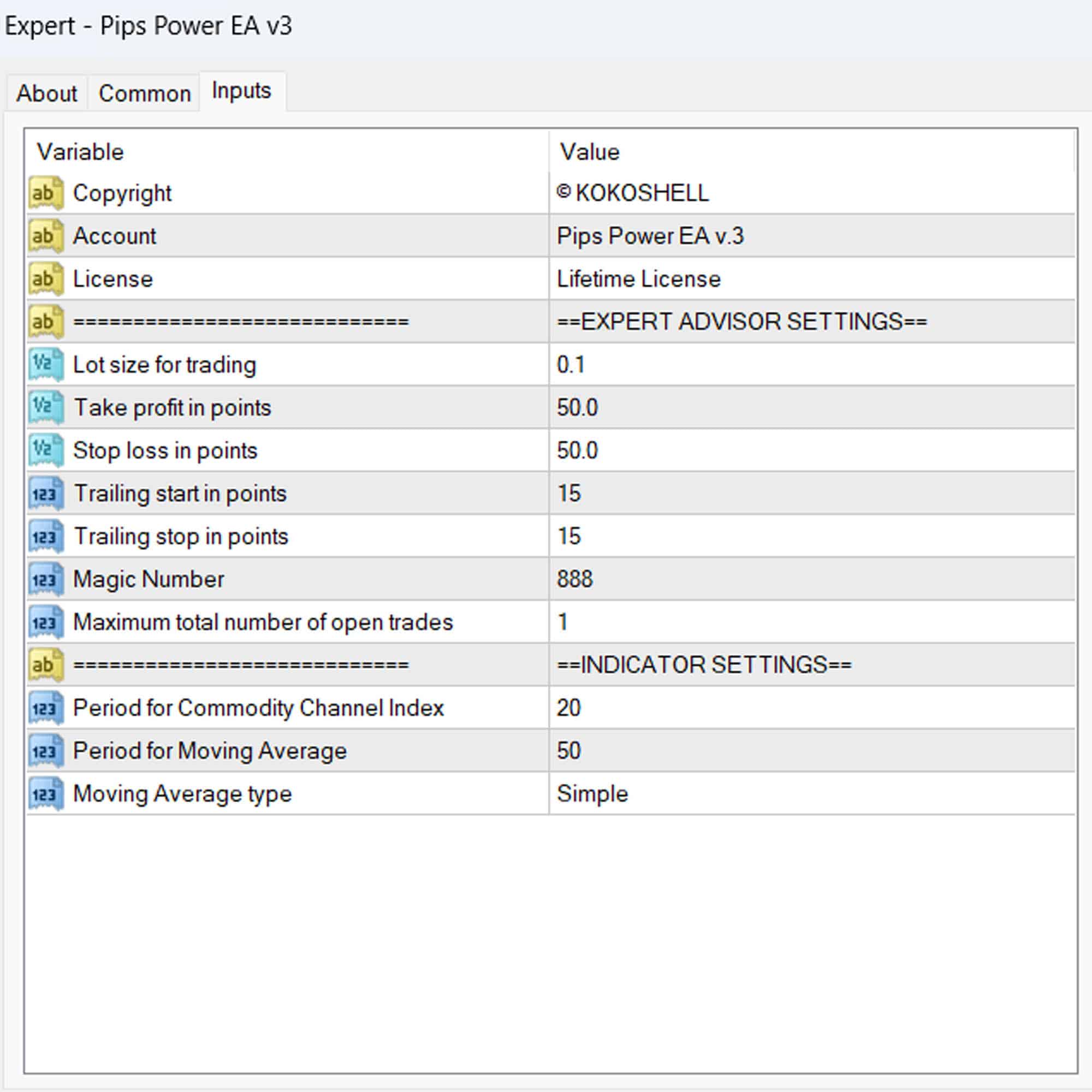

Expert Advisor Settings:

- Lot size for trading: The size of each trade lot.

- Take profit in points: Defines the number of points at which a trade will automatically close in profit. For example, if set to 2000 points, the trade will close when it gains 2000 points.

- Stop loss in points: Defines the number of points at which a trade will automatically close to limit losses. For example, if set to 800 points, the trade will close when it loses 800 points.

- Trailing start in points: The number of points in profit a trade must reach before the trailing stop mechanism is activated. For example, if set to 400 points, the trailing stop will activate once the trade is 400 points in profit.

- Trailing stop in points: The number of points to trail the stop loss behind the current price once the trailing start is activated. For example, if set to 400 points, the stop loss will trail 400 points behind the current price.

- Magic Number: A unique identifier for the trades placed by this Expert Advisor, used to distinguish its trades from others.

- Maximum total number of open trades: The maximum number of trades that can be open at any one time. For example, if set to 1, the EA will not open more than 1 trade simultaneously.

Indicator Settings:

- Period for Commodity Channel Index (CCI): The number of periods used to calculate the Commodity Channel Index (CCI) indicator.

- Period for Moving Average: The number of periods used to calculate the Moving Average (MA) indicator.

- Moving Average type: The type of Moving Average (e.g., SMA, EMA) used to calculate the MA indicator.

Achieving success with this Expert Advisor (EA) relies heavily on understanding and correctly configuring each input parameter. The parameters allow for precise control over the trading strategy, including how trades are opened, managed, and closed. By tailoring these settings to suit your trading goals and market conditions, you can optimize the performance of the EA. Proper configuration of the Take Profit, Stop Loss, and Trailing mechanisms ensures effective risk management, while the use of indicators like CCI and Moving Average helps in identifying optimal entry and exit points. Understanding and leveraging these parameters correctly can significantly enhance your trading strategy and increase the likelihood of achieving consistent success.

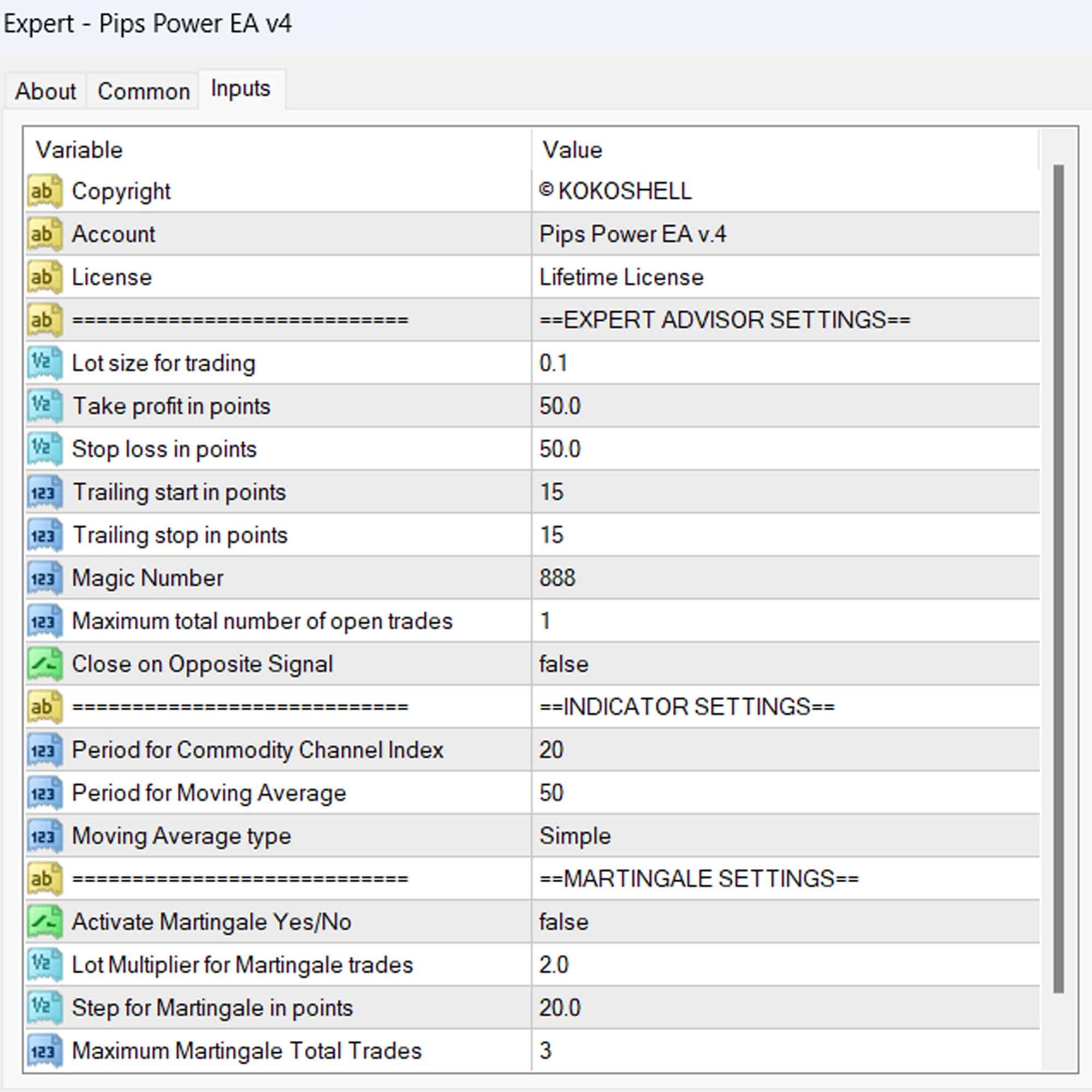

Expert Advisor Settings:

- Lot size for trading: The size of each trade lot.

- Take profit in points: Defines the number of points at which a trade will automatically close in profit. For example, if set to 2000 points, the trade will close when it gains 2000 points.

- Stop loss in points: Defines the number of points at which a trade will automatically close to limit losses. For example, if set to 800 points, the trade will close when it loses 800 points.

- Trailing start in points: The number of points in profit a trade must reach before the trailing stop mechanism is activated. For example, if set to 400 points, the trailing stop will activate once the trade is 400 points in profit.

- Trailing stop in points: The number of points to trail the stop loss behind the current price once the trailing start is activated. For example, if set to 400 points, the stop loss will trail 400 points behind the current price.

- Magic Number: A unique identifier for the trades placed by this Expert Advisor, used to distinguish its trades from others.

- Maximum total number of open trades: The maximum number of trades that can be open at any one time. For example, if set to 1, the EA will not open more than 1 trade simultaneously.

- Close on Opposite Signal: Determines whether to close trades when an opposite trading signal is generated. If set to true, the EA will close open trades when the conditions for an opposite trade are met.

Indicator Settings:

- Period for Commodity Channel Index (CCI): The number of periods used to calculate the Commodity Channel Index (CCI) indicator.

- Period for Moving Average: The number of periods used to calculate the Moving Average (MA) indicator.

- Moving Average type: The type of Moving Average (e.g., SMA, EMA) used to calculate the MA indicator.

Martingale Settings:

- Activate Martingale Yes/No: Determines whether the Martingale strategy is enabled. If set to true, the Martingale strategy will be used.

- Lot Multiplier for Martingale Trades: The factor by which the lot size is increased after a losing trade. For example, if set to 2.0, the lot size will double after each loss.

- Step for Martingale in Pips: The number of pips of loss required to trigger the next Martingale trade. For example, if set to 20 pips, the next trade will be triggered after a 20-pip loss.

- Maximum Martingale Total Trades: The maximum number of Martingale trades that can be open at any one time. For example, if set to 3, no more than 3 Martingale trades will be opened.

Achieving success with this Expert Advisor (EA) relies heavily on understanding and correctly configuring each input parameter. The parameters allow for precise control over the trading strategy, including how trades are opened, managed, and closed. By tailoring these settings to suit your trading goals and market conditions, you can optimize the performance of the EA. Proper configuration of the Take Profit, Stop Loss, and Trailing mechanisms ensures effective risk management, while the use of indicators like CCI and Moving Average helps in identifying optimal entry and exit points. Enabling and configuring the Martingale settings can help recover losses, but must be used cautiously due to the high risk involved. Understanding and leveraging these parameters correctly can significantly enhance your trading strategy and increase the likelihood of achieving consistent success.

In the latest v.5 of the Pips Power EA, two new input parameters have been introduced to significantly enhance risk management and trading efficiency: Daily Target Settings and Time Settings. These features provide traders with advanced control over their trading activities, ensuring disciplined and optimized trading strategies. By setting specific parameters for daily profit and loss limits, as well as defining precise trading hours, these new settings help traders achieve consistent success while minimizing risks. Below, we explore the detailed functionalities of these settings and their importance in effective trading.

Daily Target Settings

- Activate Max Daily Loss: This parameter enables the feature to set a maximum loss limit for the day. By activating this setting, traders can ensure that their total daily losses do not exceed a predefined threshold, protecting their capital from significant drawdowns.

- Maximum Daily Loss in USD: This setting defines the maximum allowable loss in USD for a single trading day. If the total losses reach this amount, the EA will stop opening new trades, preventing further losses and helping to preserve the trading account.

- Activate Max Daily Profit: This parameter enables the feature to set a maximum profit target for the day. Activating this setting allows traders to lock in their profits once a certain profit level is achieved, ensuring that gains are secured without the risk of market reversals eroding the profit.

- Maximum Daily Profit in USD: This setting specifies the maximum profit target in USD for a single trading day. Once this profit target is met, the EA will halt trading activities, thereby securing the gains for the day and preventing overtrading.

Time Settings

- Enable Open/Close Time: This parameter allows traders to define specific times during which trades can be opened. By enabling this setting, traders can restrict trading activities to specific hours of the day, aligning trading operations with preferred market conditions or personal schedules.

- Open Trades Time (HH:MM): This setting specifies the exact time when the EA is allowed to start opening new trades. It ensures that trades are initiated only during the predefined trading window.

- Close Trades Time (HH:MM): This setting defines the exact time when the EA should stop opening new trades. By setting a closing time, traders can avoid entering new positions late in the day or during less favorable market conditions.

- Enable Close All Time: This parameter activates the feature to close all open trades at a specific time. It ensures that no trades are left open beyond a certain time, thereby avoiding overnight risks or unplanned exposure.

- Close all Trades Time (HH:MM): This setting specifies the exact time when all open trades should be closed. It helps in wrapping up trading activities for the day and managing the risks associated with holding positions beyond the intended trading hours.

The introduction of Daily Target Settings and Time Settings in v.5 of the automated trading software represents a significant advancement in trading risk management. The Daily Target Settings allow traders to cap daily losses and secure profits, ensuring that trading activities remain within safe and predefined limits. This is crucial for preserving capital and maintaining a disciplined approach to trading. The Time Settings offer traders the ability to control trading windows, aligning their activities with optimal market conditions and personal schedules. By defining precise trading hours and ensuring that trades are not left open beyond intended periods, these settings help minimize risks associated with unfavorable market conditions and overexposure. Together, these new features provide a robust framework for achieving consistent and profitable trading outcomes, making them indispensable for traders aiming to optimize their strategies and enhance their trading success.

Install the Expert Advisor

- Download and Run MetaTrader 4 App

- Visit the MetaTrader 4 official website and download the application.

- Follow the installation instructions to set up MetaTrader 4 on your computer.

- Select ‘File’ from the Main Menu

- Open MetaTrader 4 and look at the top menu bar.

- Click on ‘File’ to open a dropdown menu.

- Open Data Folder

- From the dropdown menu, click on ‘Open Data Folder.’ This action will open a new folder panel.

- Navigate to the ‘MQL4’ Folder

- Inside the new folder panel, find and open the ‘MQL4’ folder.

- Within ‘MQL4,’ locate the ‘Experts’ folder.

- Drag and Drop Your EA File

- Drag and drop your Expert Advisor (EA) file into the ‘Experts’ folder.

- Restart MetaTrader 4

- Close and reopen MetaTrader 4 to apply the changes and load your EA.

Verify Broker Compatibility

- Ensure your broker supports EAs and has no restrictions on automated trading.

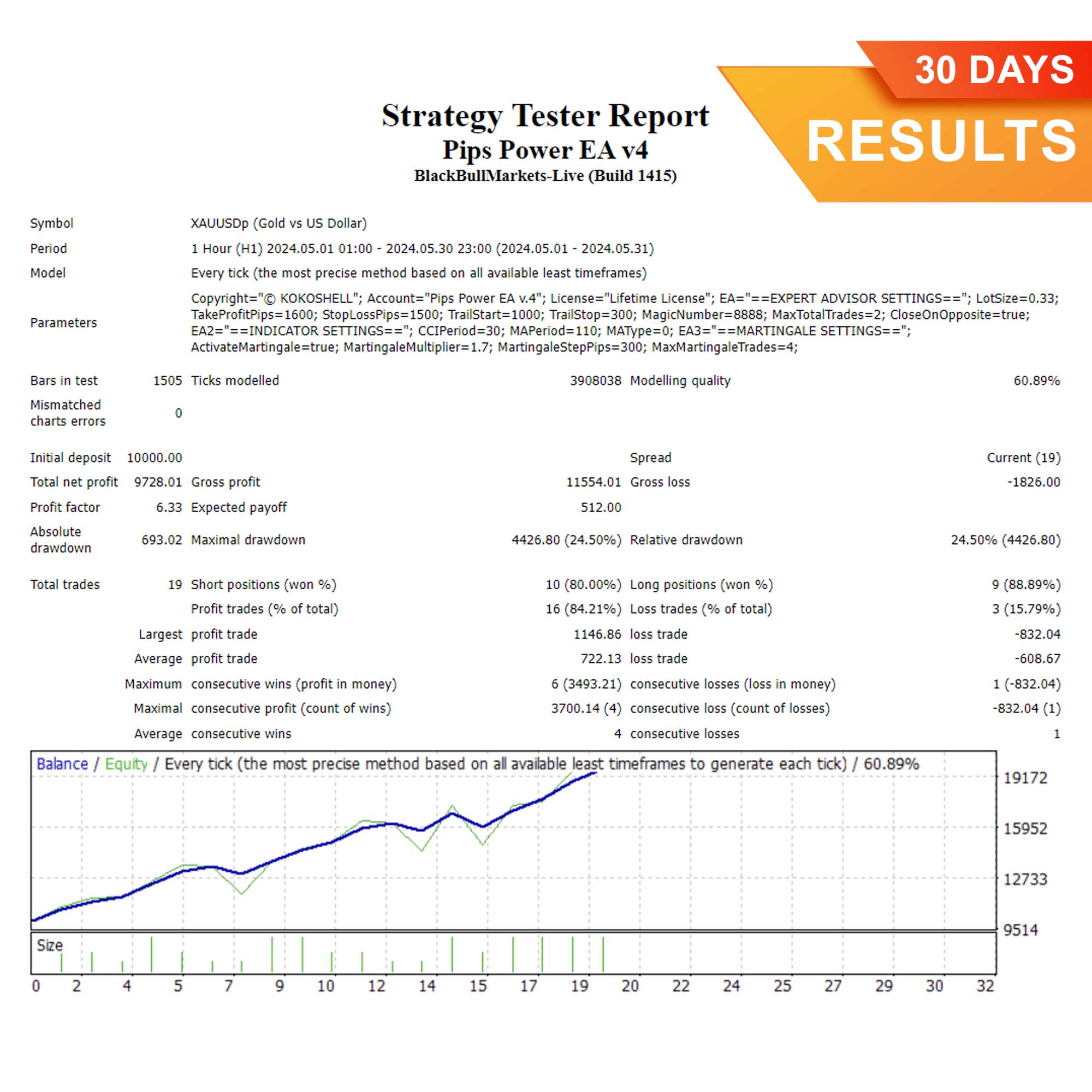

Backtest the EA's Strategy

- Open Strategy Tester Terminal

- In MetaTrader 4, press

Ctrl + R or go to ‘View’ and select ‘Strategy Tester.’

- Select the EA from the Dropdown

- In the Strategy Tester panel, choose your EA from the dropdown menu.

- Configure the Backtest Settings

- Select the symbol (currency pair) you want to test.

- Choose the model (e.g., every tick) and set the date range for your test.

- Adjust Expert Properties

- Click on ‘Expert Properties’ to adjust the input parameters of your EA, such as LotSize, TakeProfitPoints, and StopLossPoints.

- For each parameter, define a Start value (initial value), a Step value (increment value), and an End value (maximum value). This allows the Strategy Tester to run multiple iterations with different parameter settings to find the optimal configuration.

- Run the Backtest

- Click ‘Start’ to run the backtest. MetaTrader 4 will simulate trades based on historical data.

- Analyze Optimization Results

- After the backtest completes, go to the ‘Optimization Results’ tab to review the performance metrics and results.

Set Up a Demo Account

- Create a demo account in MetaTrader 4 to test your EA in real market conditions without risking real money.

Run the Expert Advisor

- Ensure AutoTrading is On

- In MetaTrader 4, make sure the ‘AutoTrading’ button on the toolbar is activated (green).

- Enable Automated Trading

- From the menu, navigate to ‘Tools’ > ‘Options’ > ‘Expert Advisors.’

- Ensure ‘Allow automated trading’ is checked.

- Load the EA onto a Chart

- Open a chart for the desired symbol and timeframe.

- Drag and drop your EA from the Navigator panel onto the chart.

- Adjust Settings Based on Backtest Results

- Open the EA settings and adjust parameters to match the optimal settings found during backtesting.

- Set the risk parameters to align with your trading strategy and risk tolerance.

Monitor and Adjust the EA

- Continuously monitor the EA's performance, especially in the initial phase.

- Make adjustments as needed based on performance and changing market conditions.

Learning and Support Resources

- Utilize forums, tutorials, and support communities to learn more about using EAs and troubleshooting issues.

Getting started with your Expert Advisor involves a systematic process of installation, backtesting, and execution. Installing the EA on MetaTrader 4 is straightforward but crucial, ensuring that the platform recognizes and can run your EA. Backtesting is an essential step that allows you to evaluate the performance of your EA against historical data, providing insights into its potential profitability and risk management. By analyzing optimization results, you can fine-tune your EA’s parameters for optimal performance. Finally, running the EA on a live chart requires enabling auto-trading and carefully adjusting settings to reflect the findings from your backtesting phase. This meticulous approach not only helps in understanding how the EA operates but also in achieving consistent and successful automated trading results. Backtesting, in particular, is vital as it helps in identifying strengths and weaknesses in your strategy, allowing for informed adjustments before risking real capital. With careful setup and continuous monitoring, your journey into automated trading can be both rewarding and educational.

Only logged in customers who have purchased this product may leave a review.

Miguel Sanchez –

Pips Power EA boosted my trading success. Great gains and reliable performance.

Emma Thompson –

Effective tool, improved my trades significantly. Easy to set up and use.

Carlos Rodriguez –

This EA has transformed my trading. Consistent profits and better decision-making.

Ava Johnson –

Very helpful EA, made my strategy more effective. Could use more customization options.

Juan Martinez –

Fantastic results! My trades are now more accurate and profitable.

Sofia Lopez –

Pips Power EA has increased my trading efficiency. Steady profits and easy to use.

David Brown –

Great tool for refining my trading strategies. Takes some time to master.

Isabella Rivera –

Outstanding EA! My trading results have improved drastically. Highly recommend.

Ethan White –

Solid performance overall. Helps me stay consistent with my trades.

David Martinez –

I’ve tried several trading tools, but this advisor stands out by far. The setup was quick and easy, and the profits have been substantial. The strategy it employs is highly effective, and the risk management features give me great confidence. This has truly transformed my trading experience. Highly recommended!