Maximize Your Trading Efficiency with EURUSD Swing Trading EA

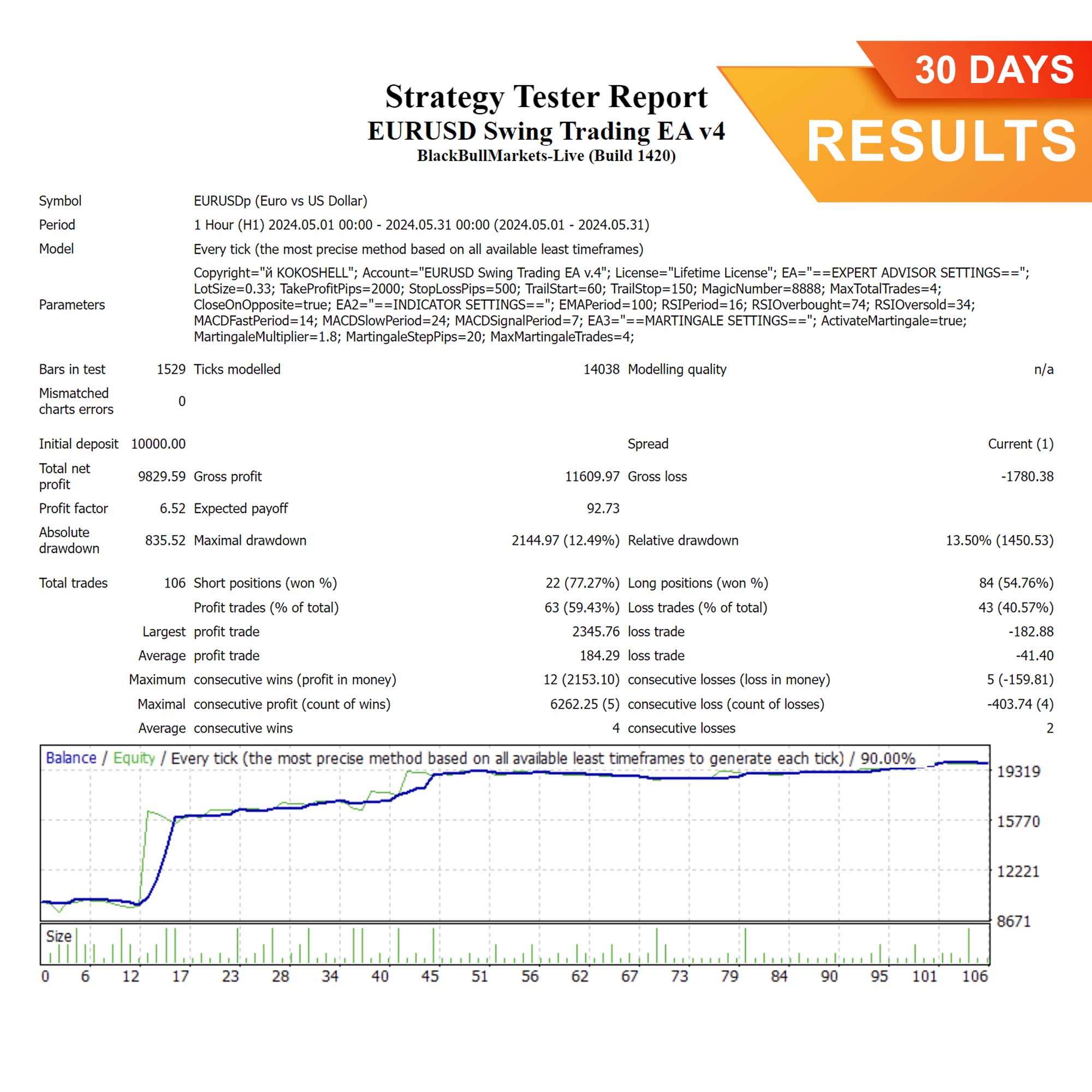

Experience the future of forex trading with the EURUSD Swing Trading EA (Expert Advisor) for MT4 (Metatrader 4) by KOKOSHELL. This Expert Advisor helps traders capture significant market moves and maximize profits. Whether you are a beginner or an experienced trader, the EURUSD Swing Trading Expert Advisor provides a powerful, automated solution to enhance your trading strategy and ensure consistent profitability.

How It Works: Advanced Indicators for Swing Trading

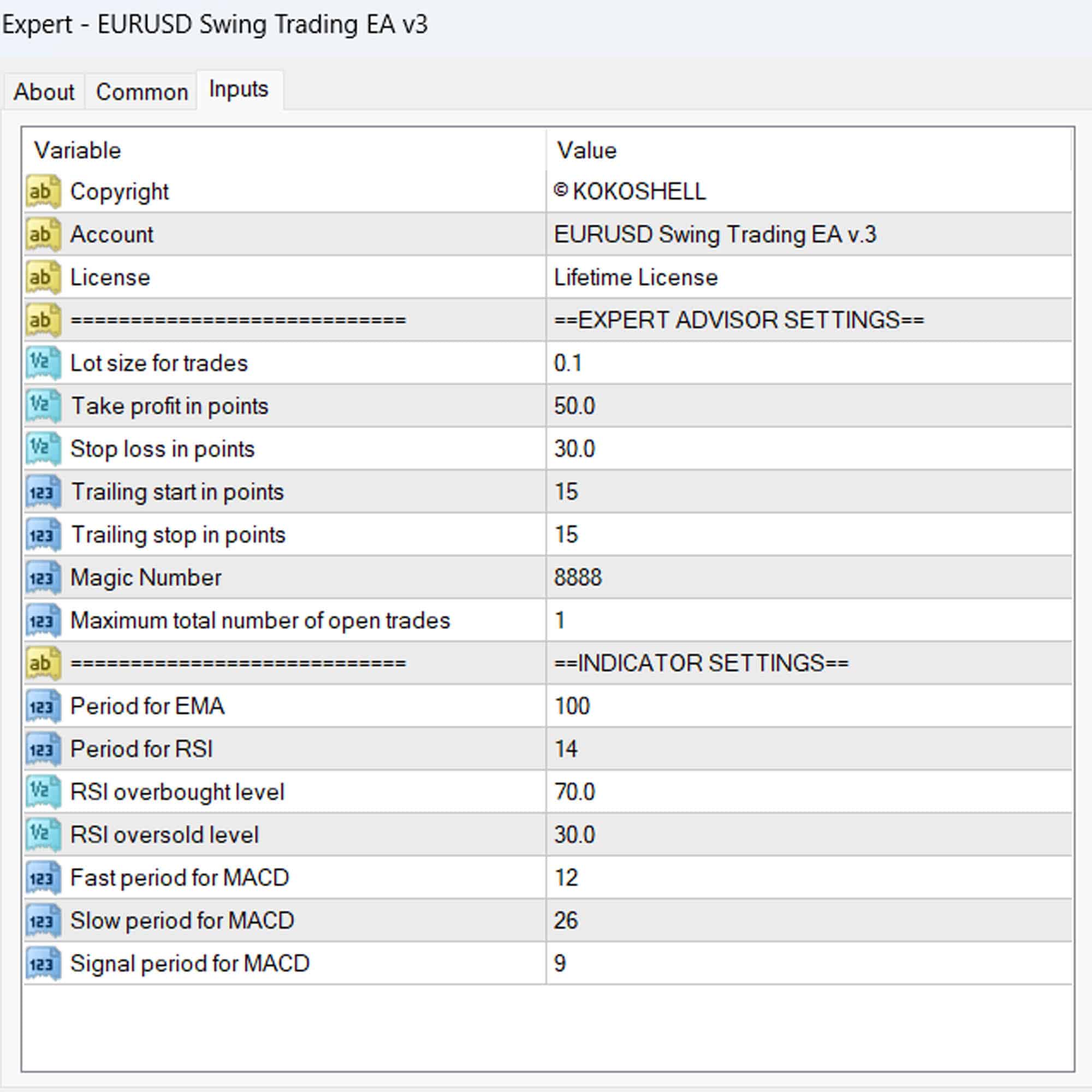

EURUSD Swing Trading EA leverages a combination of technical indicators to identify optimal swing trading opportunities. It analyzes the Exponential Moving Average (EMA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) to generate precise buy and sell signals:

- Buy Signal: The EA triggers a buy order when the price is above the EMA, RSI is in a favorable range, and MACD shows a bullish signal.

- Sell Signal: Conversely, the EA executes a sell order when the price is below the EMA, RSI indicates a potential downturn, and MACD confirms a bearish trend.

This method ensures accurate and timely trades, maximizing your profit potential. Therefore, it helps you stay ahead in the market.

Key Features: Cutting-Edge Tools for Maximum Profitability

- Precision Signal Generation: Utilizes EMA, RSI, and MACD for accurate buy and sell signals. Thus, you can trust the signals to be timely and precise.

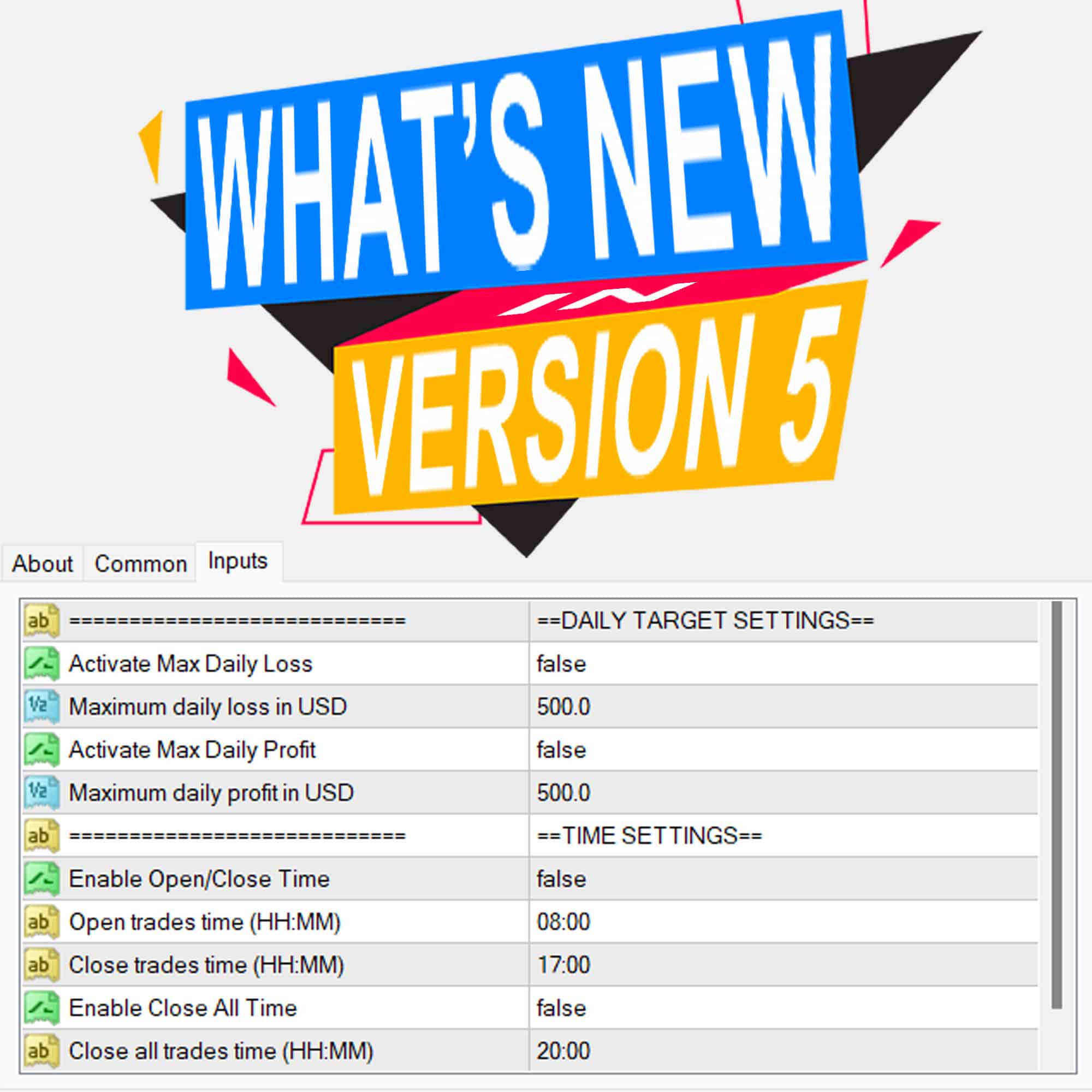

- Customizable Settings: Adjust lot size, take profit, stop loss, and trailing stops to fit your trading style. Additionally, you can modify these settings as market conditions change.

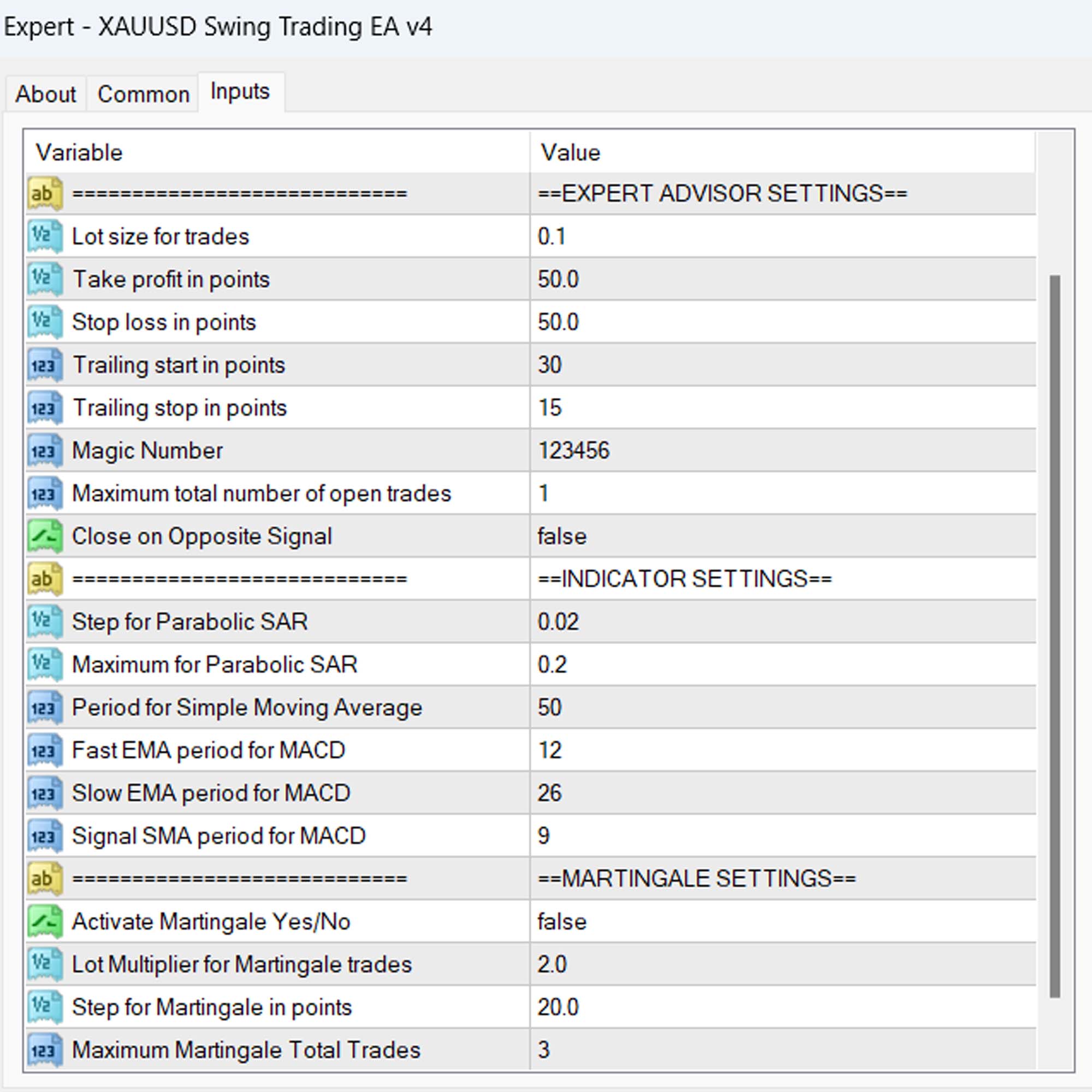

- Martingale Strategy: Optional feature to double lot sizes after losses, enhancing recovery potential. Consequently, it provides a way to recover from losing trades.

- Risk Management: Comprehensive risk management tools to protect your investments. Therefore, it ensures your trading remains within safe limits.

- Automated Trading: Fully automated trading allows you to trade without constant monitoring. Hence, you can focus on other tasks while the EA handles your trades.

- Lifetime License: One-time purchase with lifetime access and updates. Moreover, it ensures you always have the latest features without additional costs.

Why Choose EURUSD Swing Trading EA: Achieve Consistent Success

EURUSD Swing Trading EA for Metatrader 4 stands out due to its robust and reliable performance. By leveraging advanced technical indicators, it identifies swing trading opportunities that other strategies might miss. Its customizable settings allow you to tailor the EA to your specific needs, whether you prefer aggressive or conservative trading approaches.

The optional Martingale strategy provides an extra layer of potential profitability, making it a versatile tool for any trader. Additionally, its user-friendly interface ensures ease of use for all traders.

Elevate Your Trading with EURUSD Swing Trading Expert Advisor

Incorporate EURUSD Swing Trading EA into your trading strategy and experience the benefits of automated, precise, and profitable trading. Moreover, with its advanced features and robust risk management, this Expert Advisor helps you achieve consistent trading success. Furthermore, don’t miss out on the opportunity to elevate your trading game—try EURUSD Swing Trading Expert Advisor for MT4 (Metatrader 4) by KOKOSHELL today.

Jacob S. –

Incredible profits, highly recommend!

Michael –

Simple, effective, and profitable! Love it!

Emma L. –

I’ve seen consistent profits every month. The EA’s risk management is top-notch, giving me peace of mind with every trade.

Ryan F. –

Good performance, but lacks enough input parameters for more control over the strategy.

Olivia P. –

The strategy is good, but the lack of input parameters is a downside. However, the price is very good, making it worth a try. Needs more backtesting to see full potential.

Isabel M. –

Highly effective and profitable EA, but I wish there were more input parameters to tweak the strategy. Overall, very satisfied with the performance.

Carlos R. –

My returns have skyrocketed! The strategy is incredibly reliable and the backtests show impressive results. I couldn’t be happier with this purchase.

David Taylor –

This trading advisor has transformed my trading. The setup was a breeze, and the results were immediate. The strategy it employs is brilliant, and the risk management gives me peace of mind. Trading has become highly profitable and enjoyable. I highly recommend this tool.