Revolutionize Your Bitcoin Trading with BTC Swing Trading EA

The BTC Swing Trading EA is a sophisticated Expert Advisor designed for MT4 (MetaTrader 4), offering an automated solution to enhance your Bitcoin trading strategies. Moreover, this EA is meticulously crafted to exploit market swings, ensuring you capture optimal entry and exit points for profitable trades.

How It Works: Harnessing the Power of Technical Indicators

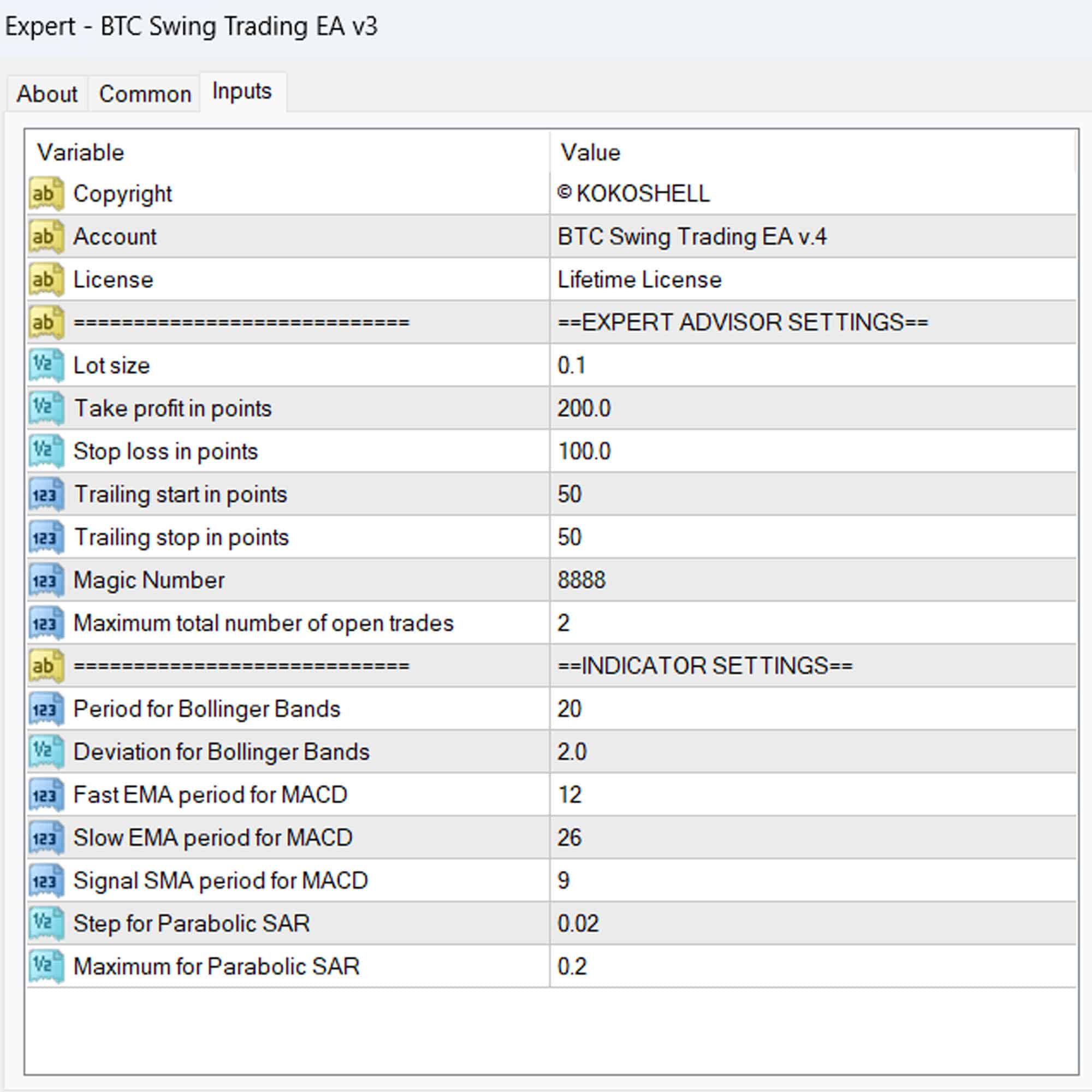

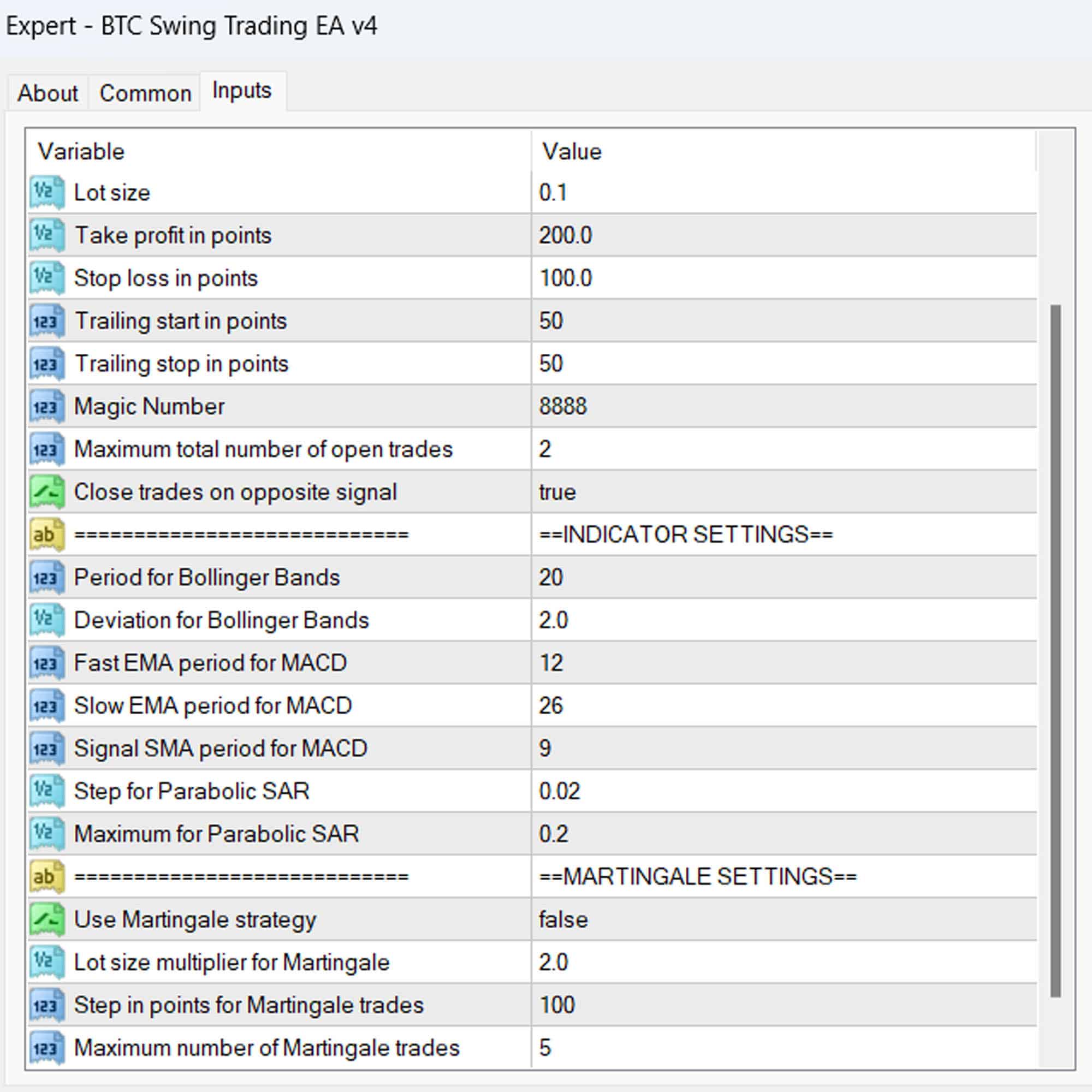

Bitcoin Swing Trading EA leverages a combination of powerful technical indicators to determine the best trading opportunities. The algorithm utilizes Bollinger Bands, MACD, and Parabolic SAR to identify market conditions and execute trades with precision.

- Bollinger Bands: Additionally, helps in identifying overbought and oversold conditions.

- MACD: Consequently, analyzes momentum and trend strength.

- Parabolic SAR: Furthermore, aids in setting trailing stops to lock in profits.

When the market conditions align with the predefined criteria, the BTC Swing Trading EA opens trades and manages them efficiently, thus ensuring maximum profitability with minimal risk.

Key Features: Enhance Your Trading Experience

- Automated Trading: Executes trades automatically based on preset parameters. Therefore, it reduces the need for constant monitoring.

- Advanced Indicators: Utilizes Bollinger Bands, MACD, and Parabolic SAR for precise trade signals. Moreover, it ensures timely execution.

- Martingale Strategy: Optional Martingale feature to enhance profitability during market fluctuations. Consequently, it offers higher potential returns.

- Trailing Stop: Dynamic trailing stop to protect profits. Additionally, it secures gains effectively.

- Risk Management: Adjustable lot size, take profit, and stop loss settings for tailored risk management. Furthermore, it allows flexibility in risk control.

- Customizable Parameters: Flexibility to adjust indicator settings to match your trading style. Hence, it adapts to various market conditions.

Why Choose BTC (Bitcoin) Swing Trading EA?

Choosing the BTC (Bitcoin) Swing Trading Expert Advisor for MT4 (Metatrader 4) ensures you are equipped with a reliable and effective tool for automated Bitcoin trading. Here’s why traders prefer our EA:

- Consistency: Delivers consistent results by leveraging proven technical indicators. Additionally, it ensures stable performance.

- Efficiency: Saves time and effort by automating the trading process. Consequently, it frees up your time for other activities.

- Adaptability: Easily customizable to suit different market conditions and trading styles. Moreover, it offers versatility.

- Security: Built with robust risk management features to protect your investment. Furthermore, it safeguards your capital.

- Support: Backed by comprehensive customer support and regular updates. Therefore, you always have access to assistance and improvements.

Elevate Your Bitcoin Trading Game

The BTC Swing Trading EA for Metatrader 4 by KOKOSHELL is an essential tool for traders looking to optimize their Bitcoin trading strategies. Its advanced algorithm, combined with customizable features and robust risk management, ensures you stay ahead in the volatile crypto market. Ultimately, invest in Bitcoin Swing Trading EA today and experience the future of automated trading.

Kenneth Martin –

My trading performance improved drastically.

Mia –

Fantastic swing trading results.

Nathan Wright –

Good tool.

Sofia Taylor –

Amazing profits! This tool is essential.

Daniel –

Decent tool but lacks some input parameters. Needs backtesting.

Ava Roberts –

Transformed my trading strategy. Consistent profits.

Joshua Clark –

Reliable signals but needs more options for customization.

Emily Green –

Outstanding! My trading profits have increased significantly.

Ryan –

Easy to use and highly effective. My profits soared.

Daniel White –

Incredible! This trading advisor has made a huge difference in my trading results. The setup was easy, and the profits have been substantial. The strategy is effective, and the risk management is top-notch. Trading has never been this rewarding. This is a must-have tool for any serious trader.