Elevate Your Trading with Trade Titan EA

Introducing Trade Titan EA (Expert Advisor) for MT4 (Metatrader 4), the latest innovation designed to revolutionize your forex trading experience. Moreover, this Expert Advisor harnesses advanced technical indicators and robust algorithms to deliver unparalleled trading performance. Whether you’re a novice trader or an experienced professional, Trade Titan Expert Advisor provides a seamless, automated solution to help you achieve consistent profits.

Explore the guide now at How to Make Money Trading Trade Titan EA.

How It Works: Intelligent Automation for Optimal Results

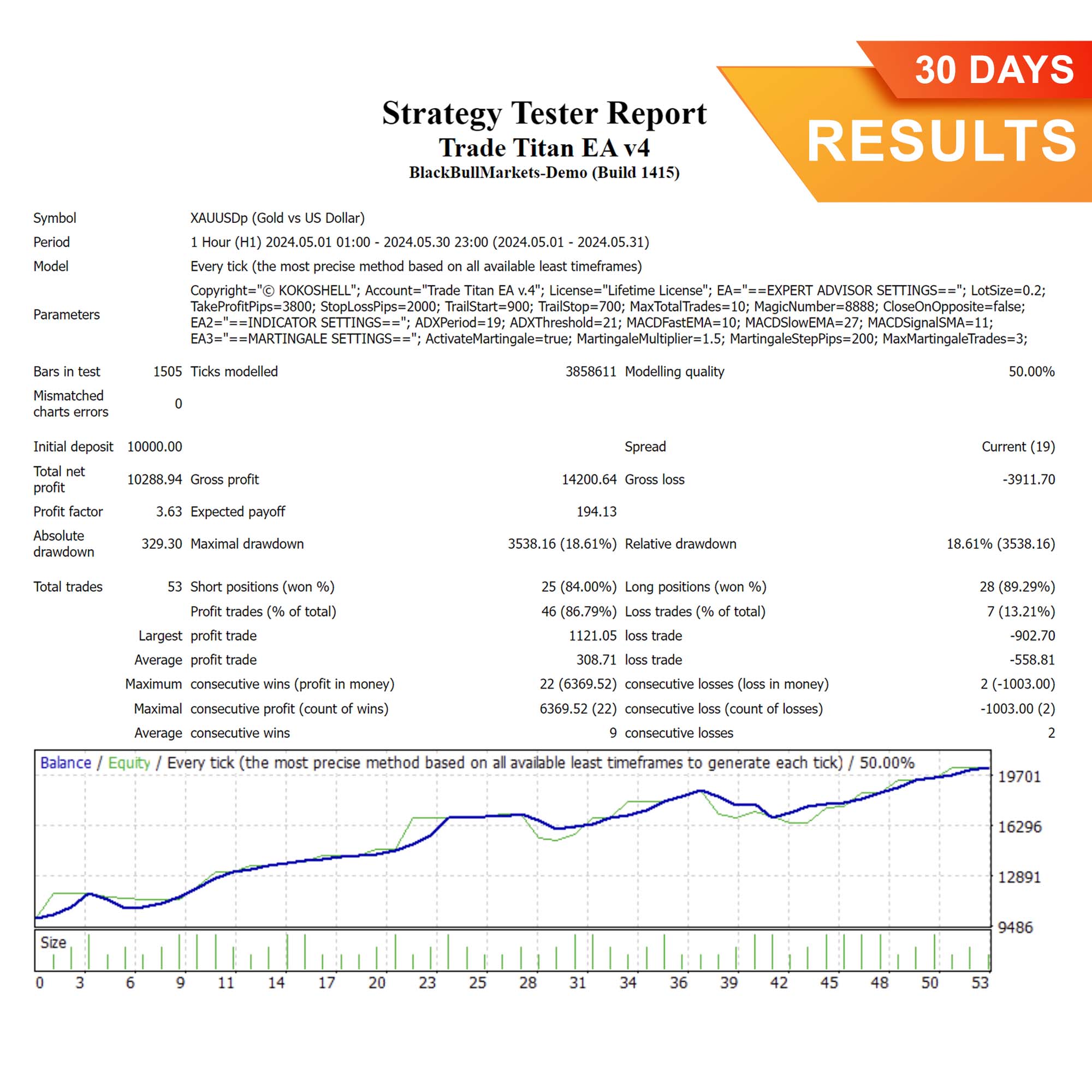

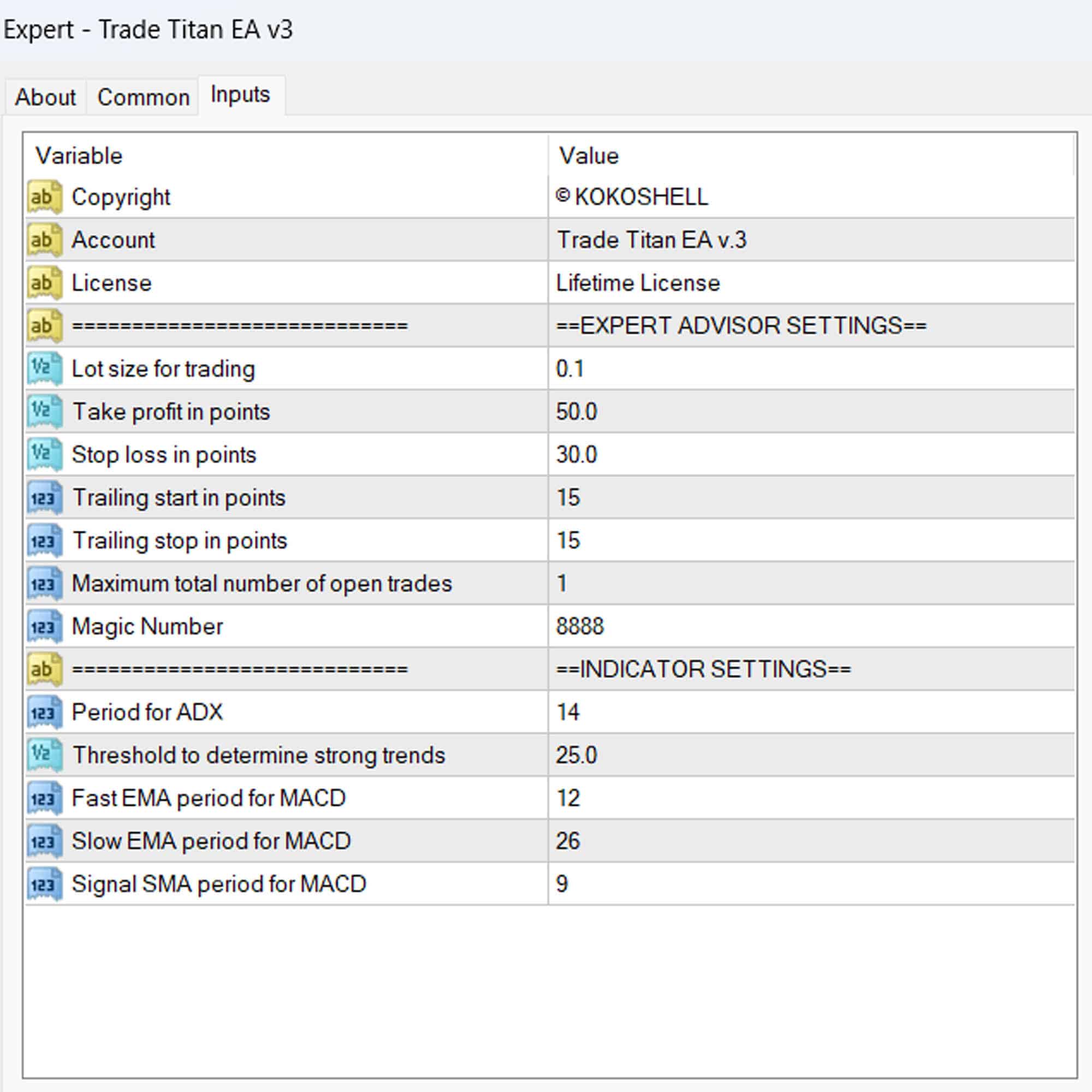

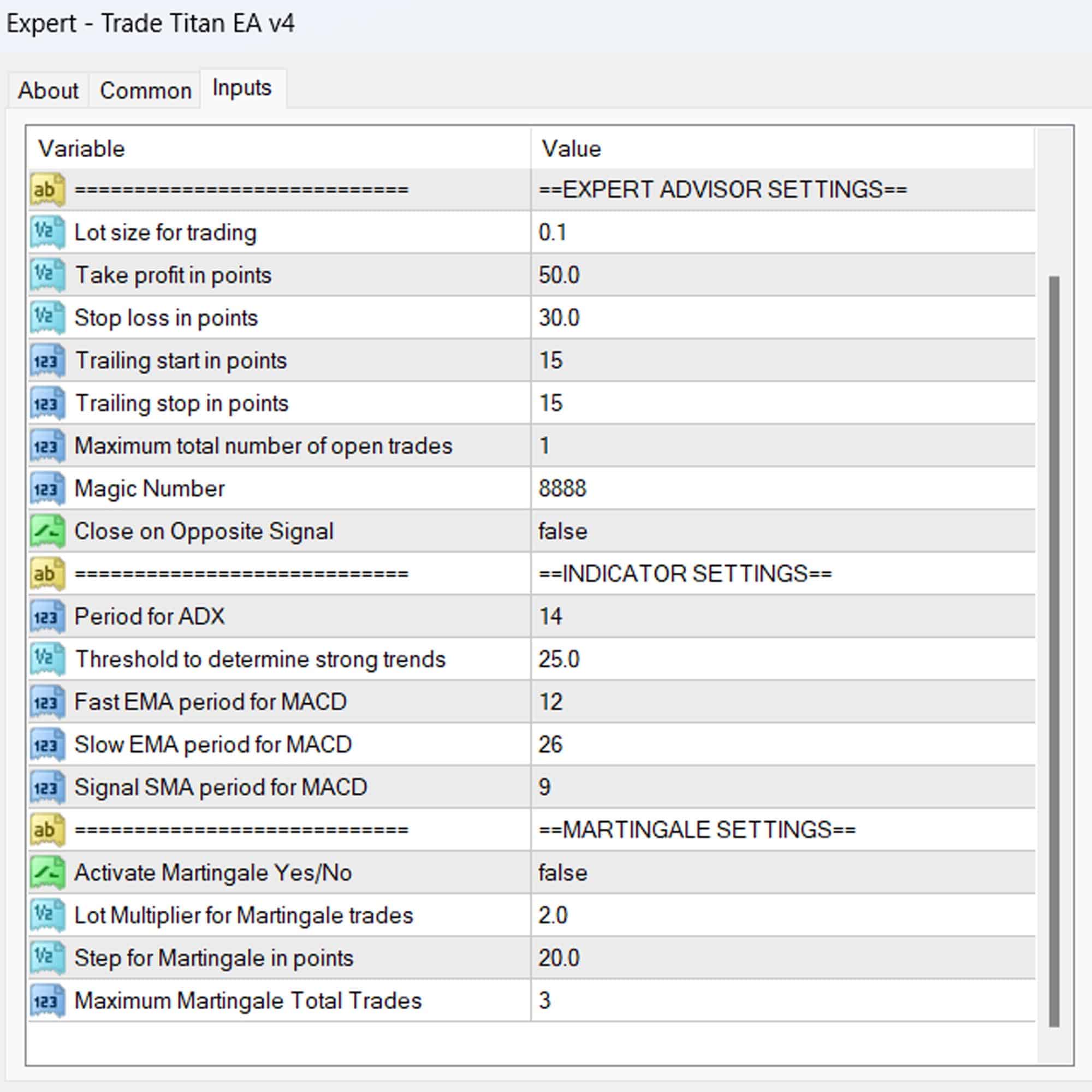

Trade Titan EA operates by analyzing market conditions using the Average Directional Index (ADX) and Moving Average Convergence Divergence (MACD) indicators. When the ADX signals a strong trend, the EA evaluates MACD crossovers to identify precise entry points for buy or sell orders. Additionally, Trade Titan Expert Advisor incorporates a trailing stop mechanism to secure profits and an optional Martingale strategy to manage and recover from losses.

Key Features: Advanced Tools for Superior Trading

- Precision Entry Signals: Utilizes ADX and MACD indicators for accurate buy and sell signals.

- Dynamic Trailing Stops: Adjusts stop-loss levels as the trade moves in your favor, thereby securing profits effectively.

- Martingale Strategy: Offers an optional feature to multiply lot sizes on losing trades, thus aiming to recover losses quickly.

- Customizable Settings: Allows you to tailor parameters like lot size, take profit, stop loss, and more to fit your trading style.

- Risk Management: Limits the maximum number of open trades and manages risk with intelligent stop-loss strategies.

Why Choose Trade Titan EA: Unmatched Performance and Reliability

Trade Titan EA for Metatrader 4 stands out for its robust and reliable performance in various market conditions. Furthermore, its sophisticated algorithms and customizable settings ensure that traders can optimize their strategies for maximum profitability. Consequently, backed by KOKOSHELL’s commitment to quality and innovation, Trade Titan Expert Advisor is your trusted partner in navigating the complexities of forex trading.

Take Control of Your Trading Future

Invest in your trading success with Trade Titan Expert Advisor for Metatrader 4. This powerful Expert Advisor combines advanced technical analysis with intelligent automation to deliver consistent results. Therefore, whether you’re looking to enhance your current strategy or fully automate your trading, Trade Titan MT4 Expert Advisor offers the tools and reliability you need. Ultimately, join the ranks of successful traders who trust KOKOSHELL for their trading needs.

Emily Thompson –

Trade Titan EA has been a game-changer for my trading strategy. I’m consistently seeing better results and higher profits. Highly recommend!

Carlos Fernandez –

This tool is incredibly useful. It has significantly improved my trade accuracy and efficiency.

Olivia Brown –

Fantastic EA! It’s easy to use and has boosted my trading performance tremendously.

Liam Johnson –

My trading has improved significantly with Trade Titan EA. I’m now hitting my profit targets more consistently.

Sofia Martinez –

A solid tool that helps refine trading strategies. It’s a bit complex at first but worth it.

Jack Davis –

This EA is excellent. It has made a huge difference in my trading results. Highly reliable and effective.

Ava White –

Very helpful tool. It has improved my trades, though it takes some time to master all features.

Ethan Clark –

Trade Titan EA has transformed my trading. I’m seeing consistent gains and better decision-making.

Isabella Harris –

Good performance overall. This EA has helped me stay consistent and make better trades.

Benjamin Lee –

Highly recommend this EA for any serious trader. My trading success has significantly increased.

Mia Roberts –

Effective and reliable tool. It’s helped me achieve better trading outcomes consistently.

Matthew Clark –

This trading advisor is phenomenal! The setup was quick and easy, and the profits have been substantial. The strategy it employs is highly effective, and the risk management is excellent. It has significantly improved my trading results and made the whole process much more enjoyable. Highly recommended!