Empower Your Trading with Fibonacci EA

The Fibonacci EA (Expert Advisor) for MT4 (Metatrader 4) revolutionizes your trading experience. It integrates robust Fibonacci retracement and extension levels into your strategy. This expert advisor provides an automated solution to identify and capitalize on potential price reversals. Consequently, you make the most of every trading opportunity. Whether you’re new to forex trading or a seasoned professional, Fibonacci EA equips you with the tools for consistent profitability.

How It Works: Automated Trading Using Fibonacci Levels

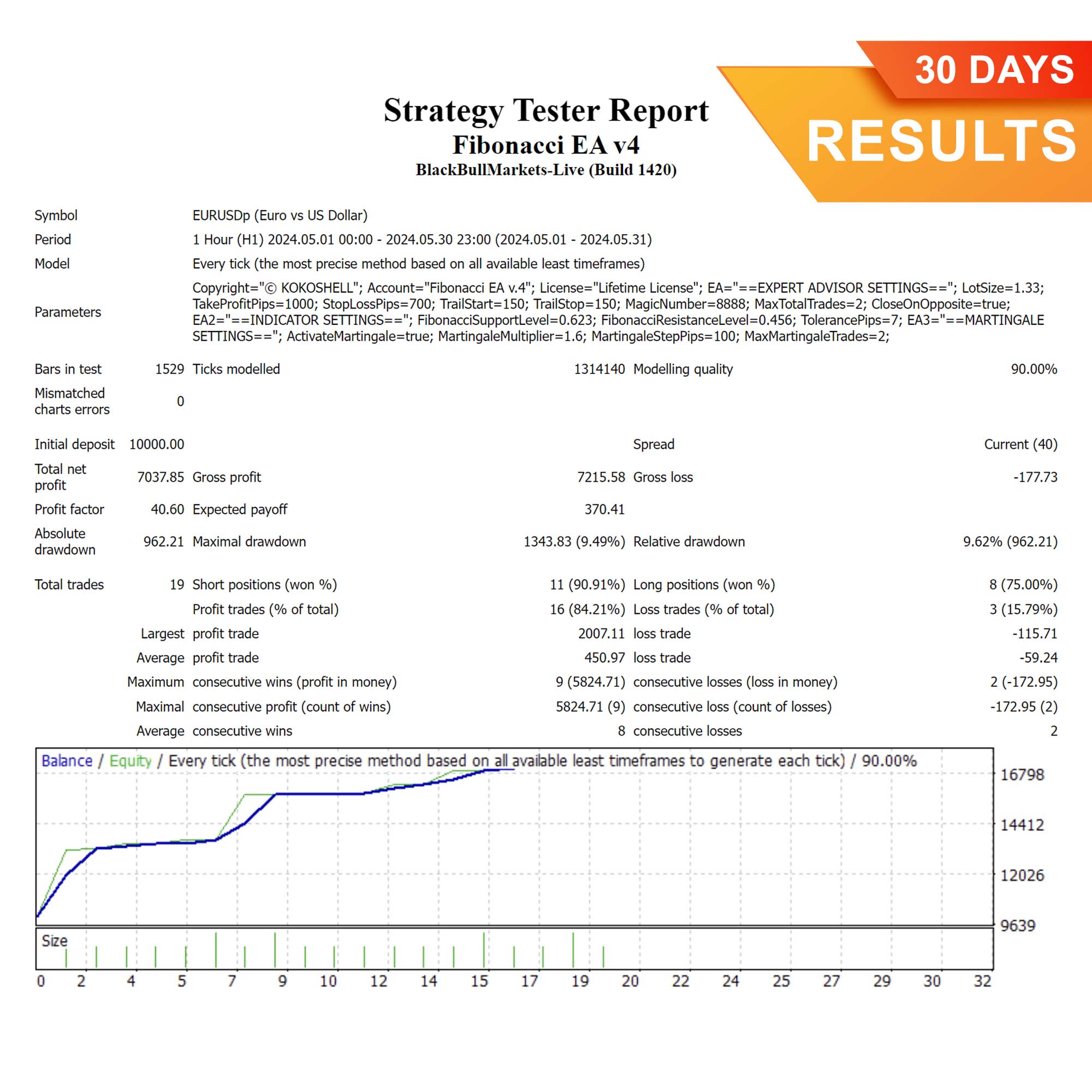

Fibonacci EA leverages Fibonacci retracement and extension levels. These are powerful tools that identify potential support and resistance areas. Specifically, the EA monitors the price in relation to these levels and makes trading decisions based on these readings.

When the price is near a Fibonacci support level, the Metatrader 4 EA opens buy orders. This signals a potential upward reversal. Conversely, when the price is near a Fibonacci resistance level, it opens sell orders. This indicates a potential downward reversal.

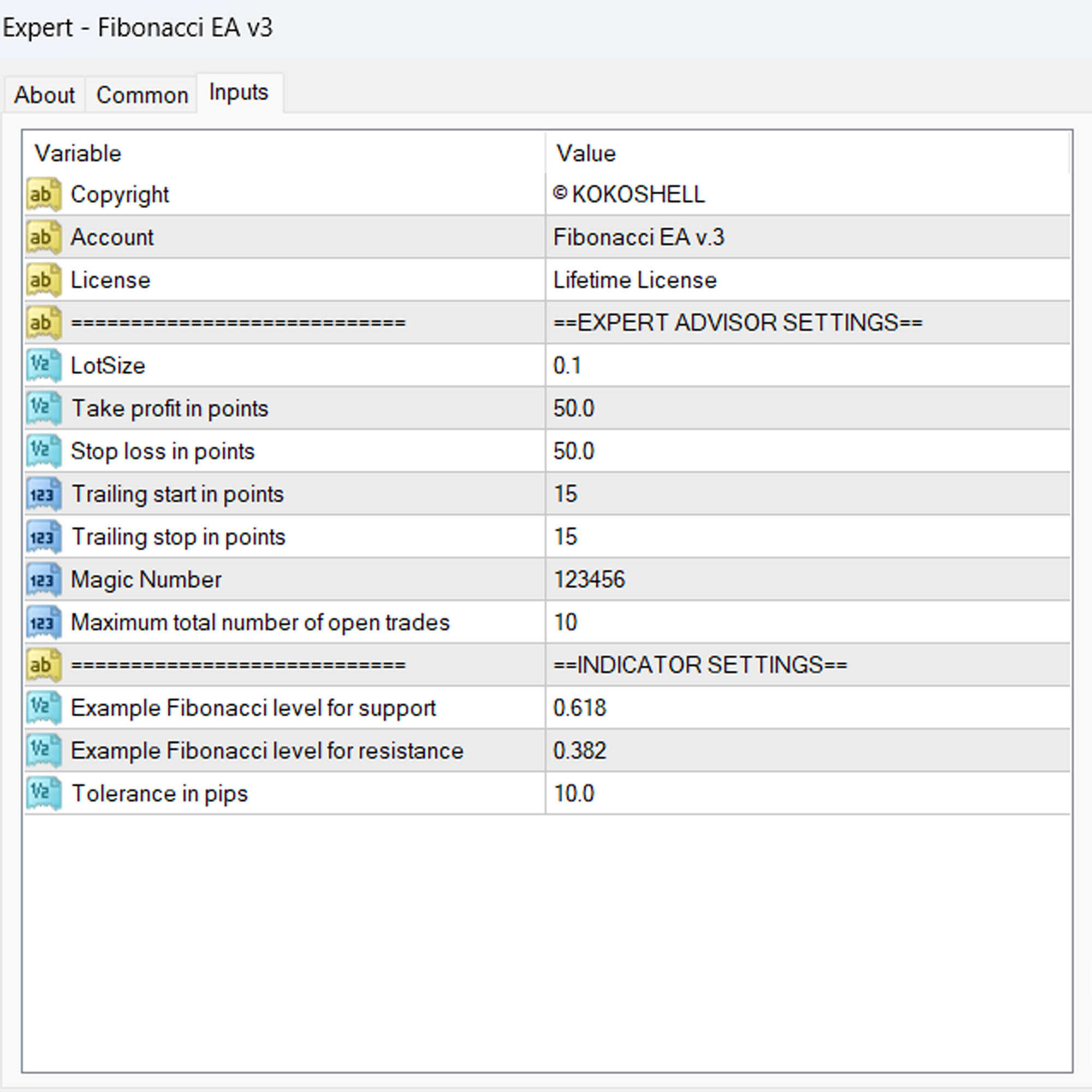

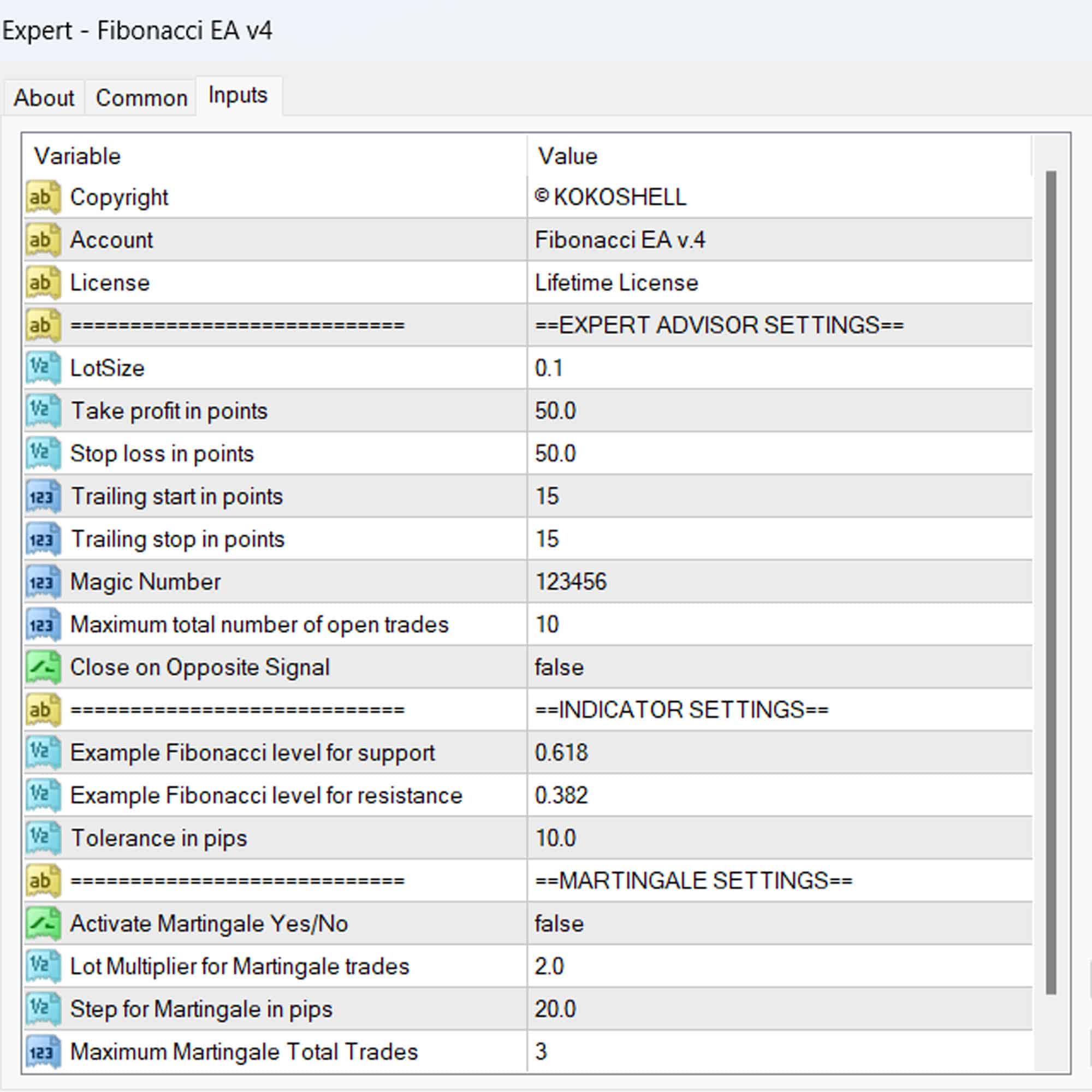

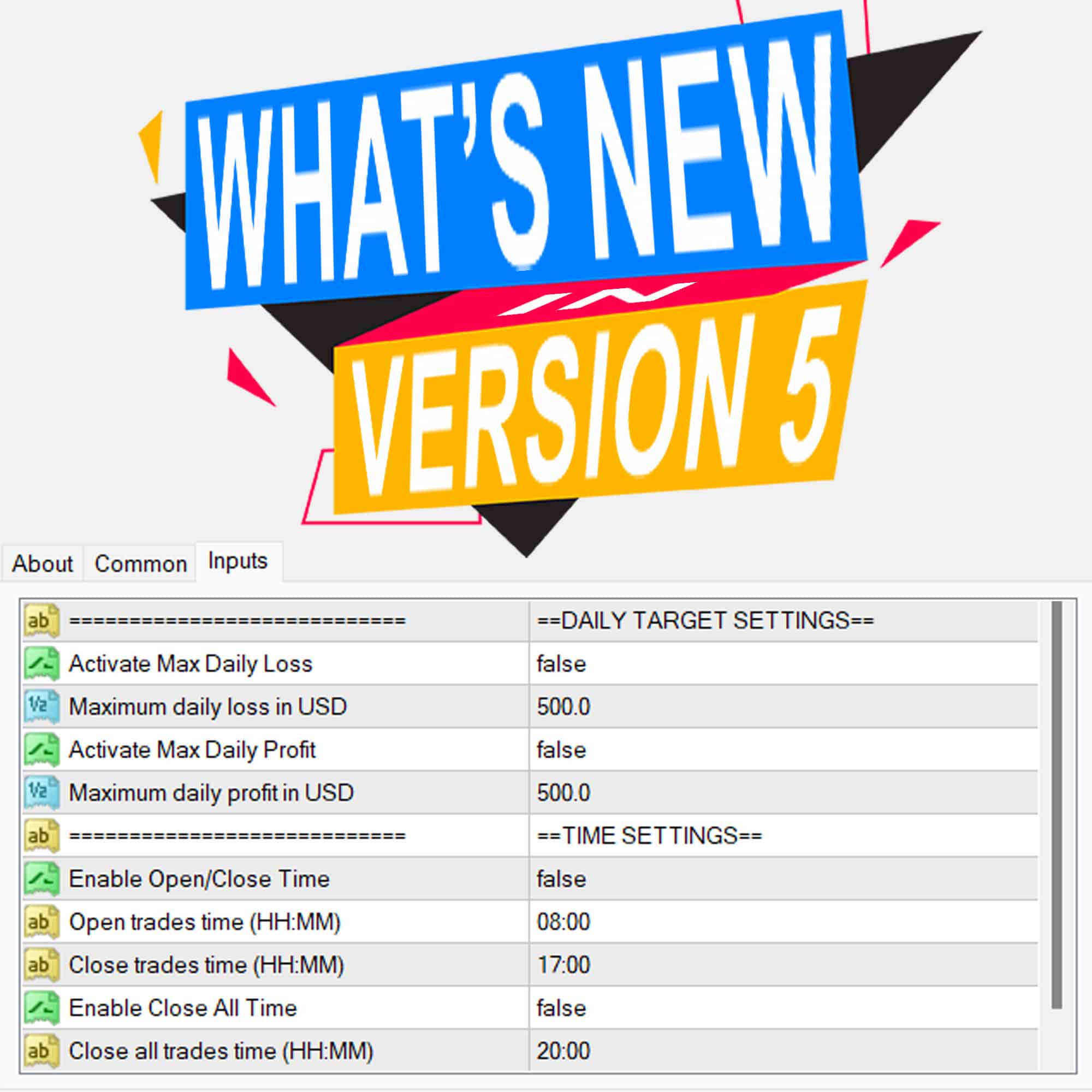

Moreover, the EA comes with a range of customizable settings. You can tailor its operation to your specific trading style. For example, you can adjust the lot size, take profit, stop loss, and trailing stop values to match your risk tolerance and goals.

Additionally, for those looking to implement a more aggressive strategy, the optional Martingale feature can be activated. This feature increases lot sizes after losses to enhance recovery and profitability.

Key Features

- Fibonacci Strategy: Utilizes Fibonacci retracement and extension levels to provide accurate market analysis and identify potential price reversals.

- Customizable Parameters: Flexible settings for lot size, take profit, stop loss, and trailing stops, allowing you to optimize your trading strategy.

- Martingale System: Includes an optional Martingale strategy to increase lot sizes after losses, designed to recover losses and achieve profits more quickly.

- Comprehensive Risk Management: Provides settings for maximum total trades, trailing stops, and close-on-opposite-signal functionality to manage risk effectively.

- Automated Trading: Executes trades automatically based on predefined settings, minimizing the need for manual intervention and reducing emotional trading decisions.

Why Choose Fibonacci EA?

Fibonacci EA offers a unique combination of reliability, flexibility, and performance. This EA caters to various trading styles, helping traders maximize potential with accurate and timely signals. Additionally, the user-friendly interface makes it easy to set up and customize.

Moreover, the advanced features ensure you have the tools needed to succeed in the forex market. By choosing Fibonacci EA, you gain a significant advantage. Therefore, you can effectively capitalize on potential price reversals and achieve consistent trading success.

Optimize Your Trading with Fibonacci Expert Advisor

The Fibonacci EA by KOKOSHELL is an indispensable tool for traders looking to enhance their strategy. This expert advisor uses Fibonacci levels and customizable features to help you make informed trades. Consequently, with Fibonacci EA, you can optimize your trading approach, manage risks, and achieve consistent success in the forex market.

Lucas –

Great EA! Improved my trades.

Olivia Garcia –

Useful tool. It enhanced my trading strategy.

Liam Johnson –

This EA has been a game-changer for my trading. Accurate, reliable, and easy to use.

Emma Brown –

Decent product but can be a bit complex for beginners. Needs better documentation.

Noah Thompson –

Fantastic EA! My trading efficiency has improved significantly. Easy to set up and use.

Sophie Wilson –

Good performance overall. Helps me stay on top of trends, but could use more flexibility.

Ethan Roberts –

Excellent tool! Identifying market trends is much easier now. Trading success has increased dramatically. Highly recommend it for serious traders.

Joseph Hernandez –

I’m amazed by how effective this trading advisor is. The setup was quick and hassle-free, and the profits have been outstanding. The strategy it employs is highly efficient, and the risk management is excellent. This tool has significantly improved my trading results. If you want to boost your profits, this is the way to go!