Maximize Your Profits with OsMA EA: A Trading Guide for Beginners

Discover how to make money trading the OsMA Indicator, achieve consistent profitability, and optimize your trading strategies with the powerful OsMA EA. This comprehensive OsMA indicator trading guide will help you leverage the OsMA Indicator to spot market trends and execute profitable trades. By automating your trading with OsMA EA, you can focus on strategic analysis while the EA handles trade execution, reducing the emotional burden of manual trading.

The OsMA EA is equipped with customizable tools designed to maximize returns. You can adjust lot sizes, take profits, stop losses, and trailing stops to suit various market conditions. The EA’s use of the OsMA Indicator ensures you can capitalize on market trends, thereby enhancing the effectiveness of your trading strategy. Moreover, advanced risk management tools like Martingale strategies and daily profit/loss limits safeguard your investments.

To understand how to be profitable with OsMA EA, it’s essential to utilize its features effectively. Consequently, this guide delves into backtesting, refining input parameters, implementing risk management techniques, and selecting optimal trading hours to ensure your OsMA EA trading experience is successful. To get the most out of this guide, you’ll learn about various OsMA trading strategies and how to optimize OsMA EA for the best results.

Learn Success: Make Money Trading OsMA Indicator

Harness the Power of OsMA EA for Profitable Trading

Learn how to make money trading the OsMA Indicator, be profitable, and optimize your strategies using the OsMA EA. Additionally, this expert advisor uses the OsMA Indicator to measure market trends and execute trades efficiently. By automating your trading process, OsMA EA increases consistency and reduces emotional trading.

Key Features of OsMA EA for Profitable Trading

- Lot Size Adjustment: In addition to controlling the volume of trades, customize the lot size to manage risk effectively.

- Take Profit and Stop Loss: Moreover, set specific levels to lock in profits and limit losses, thereby ensuring better risk management.

- Trailing Stop: Furthermore, this feature automatically adjusts the stop loss as the trade gains profit, thus securing gains and minimizing losses.

- OsMA Indicator: Additionally, it utilizes the OsMA Indicator to identify market trends for timely trade entries.

- Martingale Strategy: Not only does it support the Martingale strategy, but it also helps recover losses by incrementally increasing trade sizes.

Real-World Example: Maximizing Gains with OsMA EA

Consider a trader using the OsMA EA to trade EUR/USD. By setting the EA to trade only during the New York session (8:00 AM to 5:00 PM GMT-5), which is known for high volatility, the trader can take advantage of significant price movements. The EA’s customizable risk management features allow the trader to set a stop loss based on OsMA levels and multiple take profit points, ensuring a favorable risk-reward ratio. Additionally, by using the Martingale strategy, the trader can recover losses more quickly and improve overall profitability. Learning OsMA trading strategies, including the Martingale technique, can greatly enhance trading outcomes.

Mastering Backtesting Techniques to Make Money Trading OsMA Indicator

The Critical Role of Backtesting: Why It Matters

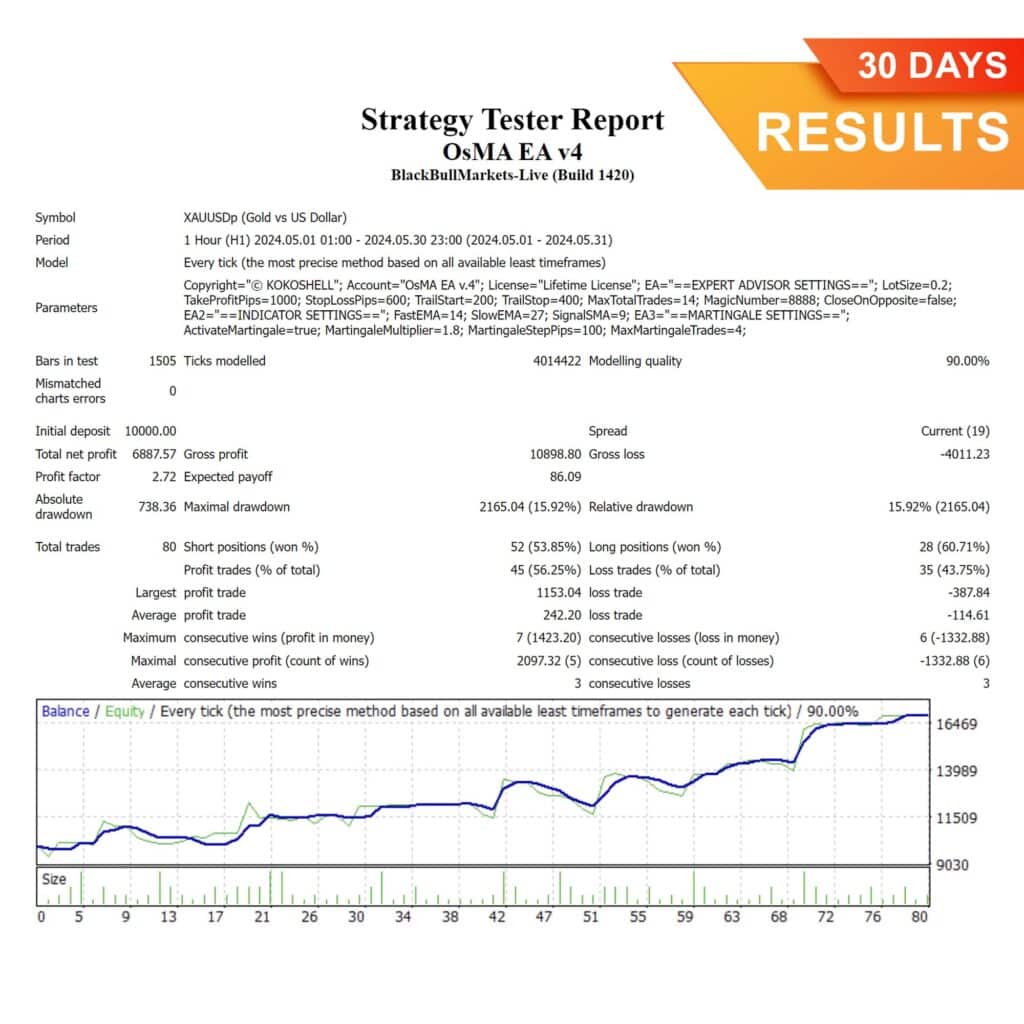

Backtesting is crucial for knowing how to make money trading the OsMA Indicator and achieving profitable trading with the OsMA indicator. Simulating trades with historical data provides insights into the EA’s performance under various market conditions. Therefore, identify the most effective input parameters tailored to your trading style and risk tolerance through backtesting.

Benefits of Backtesting

- Optimize Settings: Furthermore, experiment with different parameter combinations to identify the most profitable settings for the EA.

- Analyze Performance Metrics: Additionally, evaluate key metrics such as win rate, average profit/loss per trade, and maximum drawdown.

- Build Confidence: Moreover, historical performance boosts confidence in the EA’s ability to manage live trading scenarios.

- Stay Adaptable: Consequently, regular backtesting ensures your strategy remains relevant to current market conditions.

Step-by-Step Guide: Practical Backtesting Example

- Set Up the EA:

- Load the EA onto a MetaTrader 4 chart.

- Configure the input parameters, such as lot size, stop loss, take profit levels, and trading hours.

- Select Historical Data:

- Choose a time frame and historical data period for testing.

- For example, use the past five years of EUR/USD hourly data.

- Run the Backtest:

- Initially, use MetaTrader 4’s strategy tester to run the EA on the selected data.

- Then, analyze the results, focusing on metrics such as net profit, drawdown, and win rate.

- Optimize Parameters:

- Subsequently, adjust the EA parameters based on backtest results to improve performance.

- Finally, repeat the backtest with the optimized settings to ensure the adjustments lead to better performance.

By regularly backtesting and optimizing the EA, you can ensure that your trading strategy remains effective under various market conditions. For comprehensive insights into mastering backtesting techniques, explore How to Backtest Effectively and elevate your trading skills. This is a key step in any OsMA indicator trading guide. Therefore, optimize OsMA EA through continuous backtesting to achieve consistent results. These practices are fundamental in developing robust OsMA Indicator trading strategies.

Fine-Tuning OsMA EA to Make Money Trading OsMA Indicator

Unlocking the Power of Optimization: Key Parameters to Adjust

Optimizing the parameters of your EA can significantly enhance its profitability. Key parameters to consider include:

- Lot Size: Adjust the lot size to influence trade volume and potential profit or loss.

- Take Profit: Set an optimal take profit level to secure profits when the market moves in your favor.

- Stop Loss: A well-placed stop loss protects your capital from significant market reversals.

- Trailing Stop: This feature locks in profits by moving the stop loss level as the trade gains profitability.

- Indicator Settings: Fine-tune settings for the OsMA Indicator to generate accurate trading signals.

Examples of Effective Parameter Adjustments

- Lot Size Adjustment:

- If your account equity grows, increase the lot size proportionally to maintain a consistent risk level.

- For instance, if starting with a $10,000 account, trade with 0.1 lots. As your account grows to $20,000, increase the lot size to 0.2 lots.

- Stop Loss and Take Profit Optimization:

- Backtest different SL and TP levels to find the sweet spot that maximizes profitability while minimizing risk.

- Trading Hours:

- Select the optimal trading hours based on backtesting results to ensure trading during the most volatile and profitable times.

Proven Benefits of Customization for Profitable Trading

Customizing the EA parameters allows traders to tailor the strategy to their specific trading goals and market conditions. This flexibility helps in adapting to different asset classes, volatility levels, and trading styles, ultimately leading to more consistent profits. Thus, implement various OsMA Indicator trading strategies to maximize your trading success.

Advantages of Customization

- Adaptability: Comparatively, tailor the EA to various market conditions and asset classes.

- Risk Management: Correspondingly, adjust parameters to align with your risk tolerance.

- Profit Optimization: Moreover, fine-tune settings to maximize profitability.

- Personalization: Thus, create a trading strategy that suits your individual trading style and objectives.

Regularly reviewing and optimizing these settings based on backtesting and live trading results ensures that your EA remains effective and profitable. Therefore, optimize OsMA EA to achieve the best results. This approach is a vital part of any OsMA indicator trading guide. This iterative process is also crucial for developing reliable OsMA Indicator trading strategies.

Implementing Profitable Risk Management with OsMA EA to Make Money

Essential Risk Management Techniques to Make Money Trading OsMA Indicator

Effective risk management is crucial for long-term trading success. Key techniques include:

- Position Sizing: Accordingly, adjust lot sizes based on account equity to manage risk effectively.

- Stop Loss Orders: Additionally, set stop losses to limit potential losses on each trade.

- Take Profit Orders: Hence, use take profit levels to lock in gains.

- Diversification: Similarly, spread risk across different assets or markets.

Real-World Applications for Profitable Trading

In the OsMA EA, set a fixed lot size for trades and specify the stop loss and take profit points. For instance, with a stop loss based on OsMA Indicator levels and various take profit levels, the EA aims for a favorable risk-reward ratio. Additionally, the Martingale strategy can be used to recover losses by increasing the lot size of subsequent trades after a loss. Consequently, incorporate these OsMA Indicator trading strategies to enhance your profitability.

Why Risk Management is Crucial for Profitable Trading OsMA Indicator

- Capital Preservation: Protects your trading capital from significant losses.

- Consistency: Ensures a steady growth of your trading account.

- Peace of Mind: Reduces stress and emotional trading decisions.

- Long-Term Success: Increases the likelihood of sustainable profitability.

Optimize Trading Hours to Make Money Trading OsMA Indicator

Optimal Trading Sessions

Trading during specific sessions can enhance the performance of OsMA EA. The most active trading periods, such as the London and New York sessions, offer higher volatility and better trading opportunities.

Key Trading Sessions for Profitability

- London Session: High volatility and liquidity, especially in forex markets.

- New York Session: Significant market movements and overlaps with the London session.

- Asian Session: Lower volatility, suitable for range-bound strategies.

Leveraging Key Trading Times to Make Money Trading OsMA Indicator

Trading during high-liquidity periods ensures tighter spreads and quicker execution of trades. It also increases the likelihood of significant price movements, essential for trend-following strategies. Therefore, optimize OsMA EA by focusing on these optimal trading times.

Practical Adjustments: Tailoring Trading Hours for Better Results

In the EA settings, specify trading hours to align with the most active market sessions. For example, setting the trading start time at 08:00 AM New York time (GMT-5) and the end time at 5:00 PM New York time (GMT-5) can optimize the EA’s performance by focusing on the most volatile trading hours.

Success Story: Optimizing Trading Hours to Make Money Trading OsMA Indicator

If backtesting shows that trades during the overlap of the London and New York sessions result in better performance, set the EA to trade only during this period. Consequently, focus on the most lucrative trading times. For detailed trading hours, visit forex.timezoneconverter.com. Thus, optimize OsMA EA settings to maximize trading efficiency during these periods.

Conclusion: Make Money Trading OsMA Indicator

To be profitable and know how to make money trading the OsMA Indicator, adopting a strategic approach, conducting thorough backtesting, and implementing robust risk management practices is crucial. This powerful tool can transform your trading experience by automating processes and maximizing efficiency. However, the true potential of the EA is unlocked when you take the time to customize and optimize its settings to align with your unique trading style and goals. Therefore, optimize OsMA EA for optimal results.

Backtesting remains your ally in this journey. It allows you to fine-tune your parameters and understand the EA’s performance under various market conditions. Continuously refining your strategy helps you adapt to ever-changing market dynamics and stay ahead of the curve. Consequently, this process is an integral part of any OsMA indicator trading guide.

Prioritize risk management always. Implementing strict daily profit and loss limits, and using strategies like Martingale cautiously, will protect your capital and ensure long-term success. Additionally, adjusting your trading hours to coincide with periods of high liquidity and volatility will enhance your trading outcomes. Therefore, employ various OsMA Indicator trading strategies to maintain a robust trading approach.

By embracing these principles and diligently working on your trading approach, you can indeed be profitable and know how to make money trading the OsMA Indicator. The journey to trading success is paved with continuous learning, adaptation, and disciplined execution. With the OsMA Indicator EA by your side, you’re well-equipped to navigate the complexities of the forex market and achieve your financial goals. Always remember to optimize OsMA EA to stay profitable.

Frequently Asked Questions about OsMA Indicator EA

Can I use OsMA Indicator EA with other assets?

Although OsMA Indicator EA is specifically designed for forex trading, it can be adapted to other currency pairs or commodities. However, thorough backtesting and optimization are crucial for each new asset to ensure the EA performs effectively. Different assets have unique characteristics, such as volatility and liquidity, which may require adjustments to the EA’s parameters. Always start with a demo account to test the EA on the new asset before using it in a live trading environment to mitigate risks and optimize OsMA Indicator EA for diverse market conditions. This adaptability is part of a comprehensive OsMA indicator trading guide.

How does OsMA Indicator EA utilize technical indicators?

OsMA Indicator EA employs the OsMA Indicator to spot profitable trading opportunities. The OsMA Indicator helps identify market trends, signaling potential entry and exit points. By integrating this indicator, the EA can make informed decisions to optimize trading performance and maximize profits. Thus, it effectively implements various OsMA Indicator trading strategies.

What pitfalls should I avoid when using OsMA Indicator EA?

To maximize your success with OsMA Indicator EA, it is essential to avoid common pitfalls:

- Overtrading: Avoid setting the EA to trade excessively, as this can lead to higher transaction costs and increased risk.

- Ignoring Risk Management: Therefore, always implement strict risk management strategies, such as setting stop losses and profit targets.

- Lack of Regular Updates: Regularly update and optimize the EA to adapt to changing market conditions and maintain its effectiveness.

- Neglecting Market News: Furthermore, stay informed about economic news and events that can impact the market, as sudden volatility can affect the EA’s performance.

By being mindful of these pitfalls, you can improve your trading outcomes and maintain consistent profitability.

How can I tailor OsMA Indicator EA to meet my trading goals?

Customizing OsMA Indicator EA to suit your specific trading goals involves adjusting various parameters and settings:

- Trading Style: Define whether you prefer aggressive or conservative trading and adjust the lot sizes, stop losses, and take profits accordingly.

- Timeframes: Choose the trading timeframes that align with your strategy, such as short-term (minutes) or long-term (hours).

- Indicators: Modify the technical indicators and their settings to better fit your analysis approach.

- Risk Tolerance: Set parameters that reflect your risk tolerance, such as maximum drawdown limits and trailing stops.

By tailoring these settings, you can align the EA with your trading preferences and goals, thereby enhancing its effectiveness. Consequently, incorporate various OsMA Indicator trading strategies to maximize success.

Can I make more money using a VPS offer for OsMA Indicator EA?

Using a VPS (Virtual Private Server) for OsMA Indicator EA offers several benefits:

- 24/7 Operation: Specifically, a VPS allows the EA to run continuously, without interruptions due to power outages or internet connectivity issues.

- Lower Latency: Moreover, VPS servers are often located near trading servers, resulting in faster execution speeds and reduced slippage.

- Enhanced Security: Additionally, VPS providers typically offer robust security measures to protect your trading data and account.

- Resource Management: Thus, a VPS dedicates specific resources to your EA, ensuring optimal performance without affecting your local computer’s resources.

Overall, using a VPS can significantly improve the reliability and performance of your OsMA Indicator EA, helping you achieve better trading results. This optimization is part of the comprehensive OsMA indicator trading guide.