Elevate Your Trading Game with Swing Trading EA

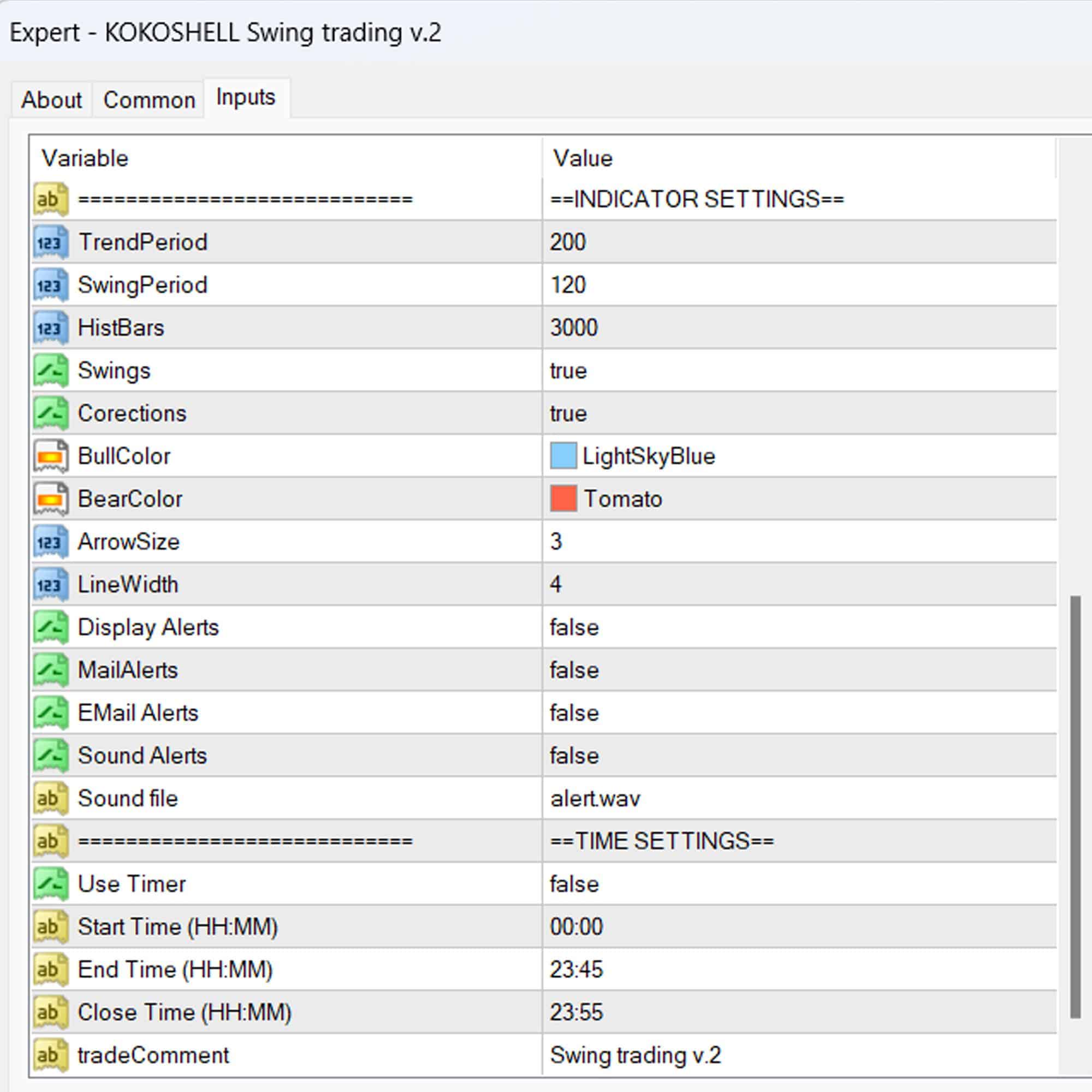

Unlock the full potential of swing trading with the Swing Trading EA (Expert Advisor) for MT4 (Metatrader 4). As the first expert advisor designed specifically to detect trend direction swings and potential reversal swings, this powerful tool leverages a baseline swing trading approach widely acclaimed in trading literature.

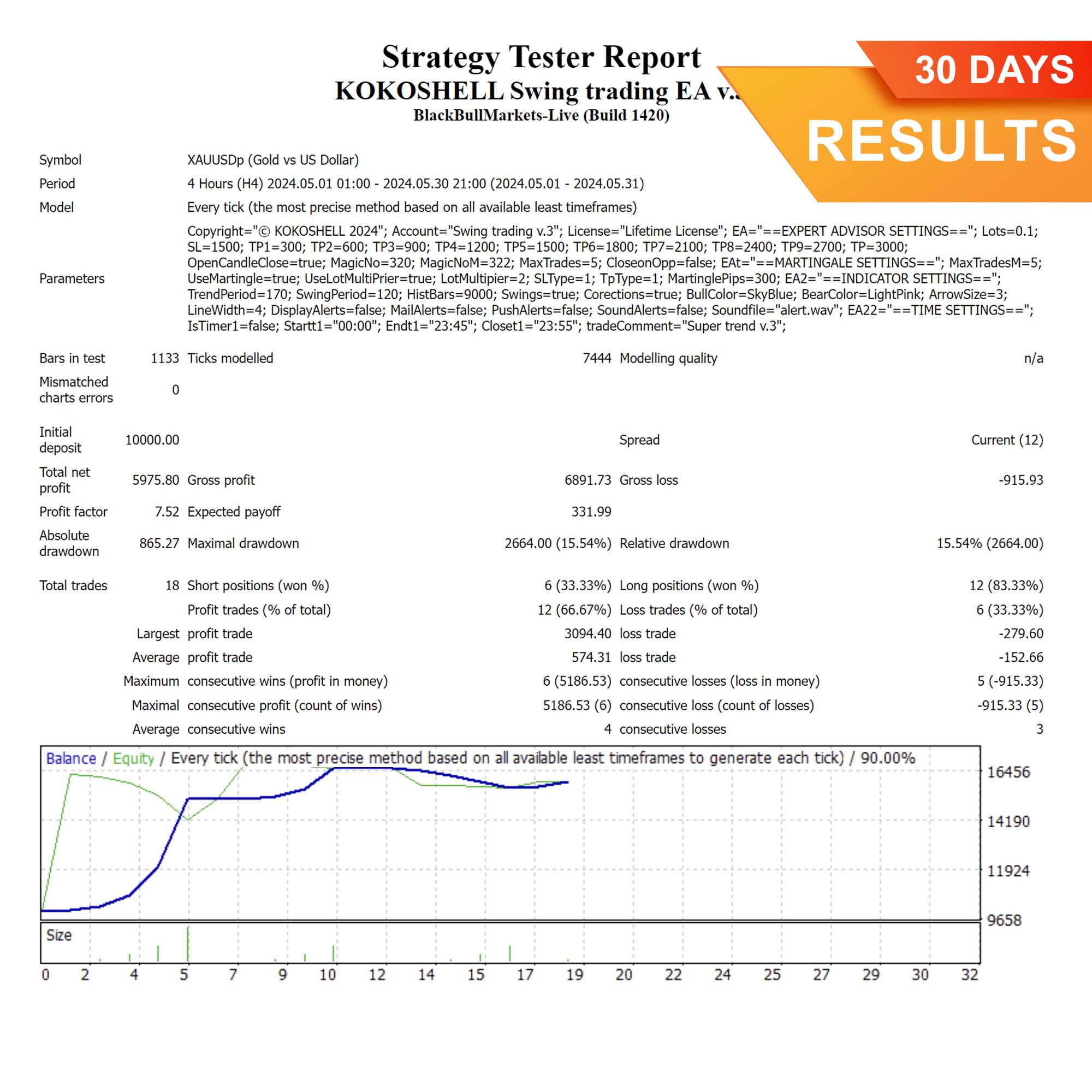

Boasting an impressive winning ratio of around 80%, Swing Trading EA is your key to mastering market trends and maximizing profits. Moreover, this EA offers a user-friendly interface suitable for both novice and experienced traders.

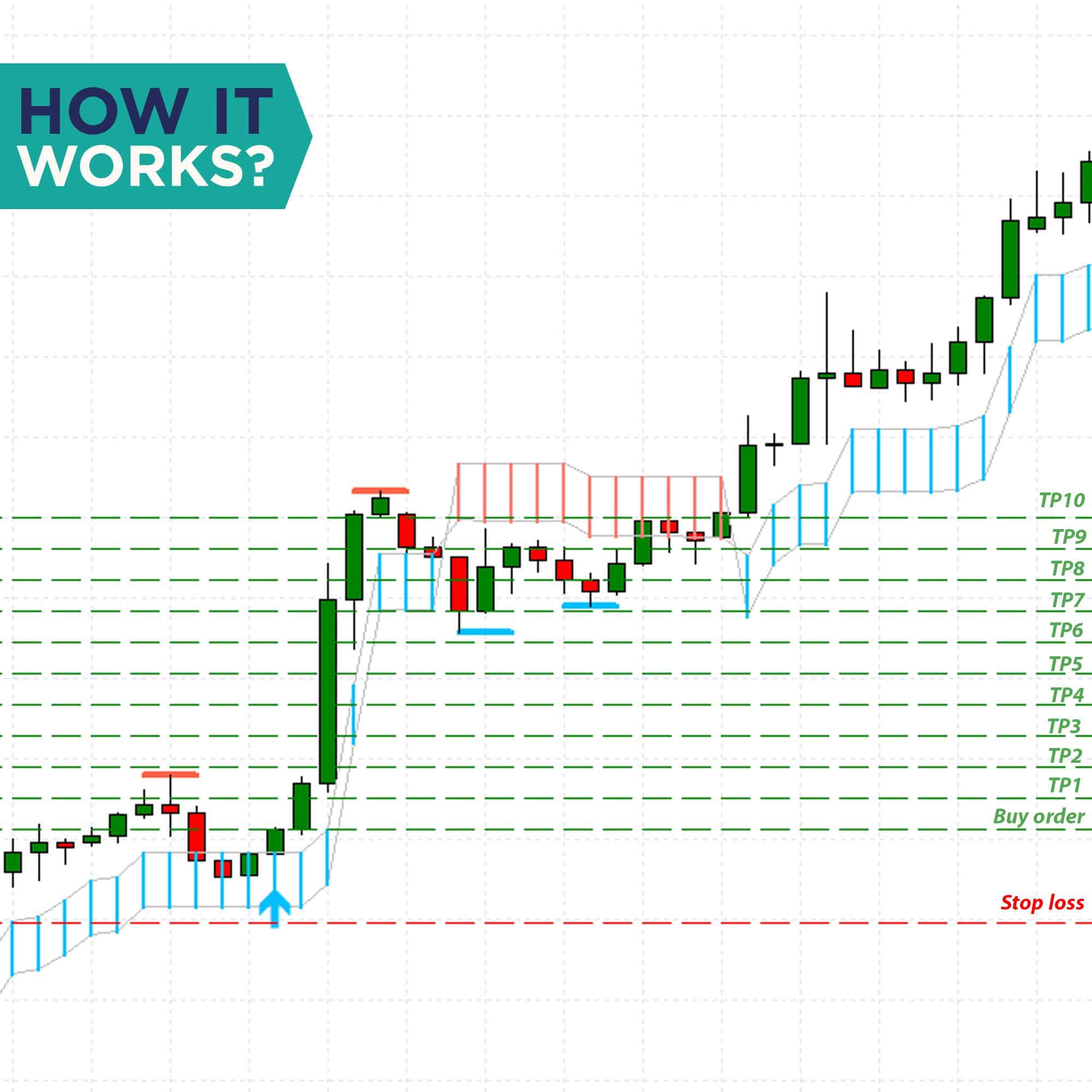

How It Works: Harnessing Advanced Trading Techniques

Swing Trading EA employs sophisticated algorithms to analyze multiple price and time vectors, ensuring precise trend direction detection. Here’s how it works:

- Trend Detection: Utilizes long-term trend indicators to identify the overall market direction. Furthermore, it ensures accurate market analysis.

- Swing Identification: Pinpoints overbought and oversold conditions, signaling potential trend reversals. Consequently, it aids in timely trade entries and exits.

- Trade Execution: Automatically opens and closes trades based on detected swings and market corrections. Additionally, it optimizes trade management.

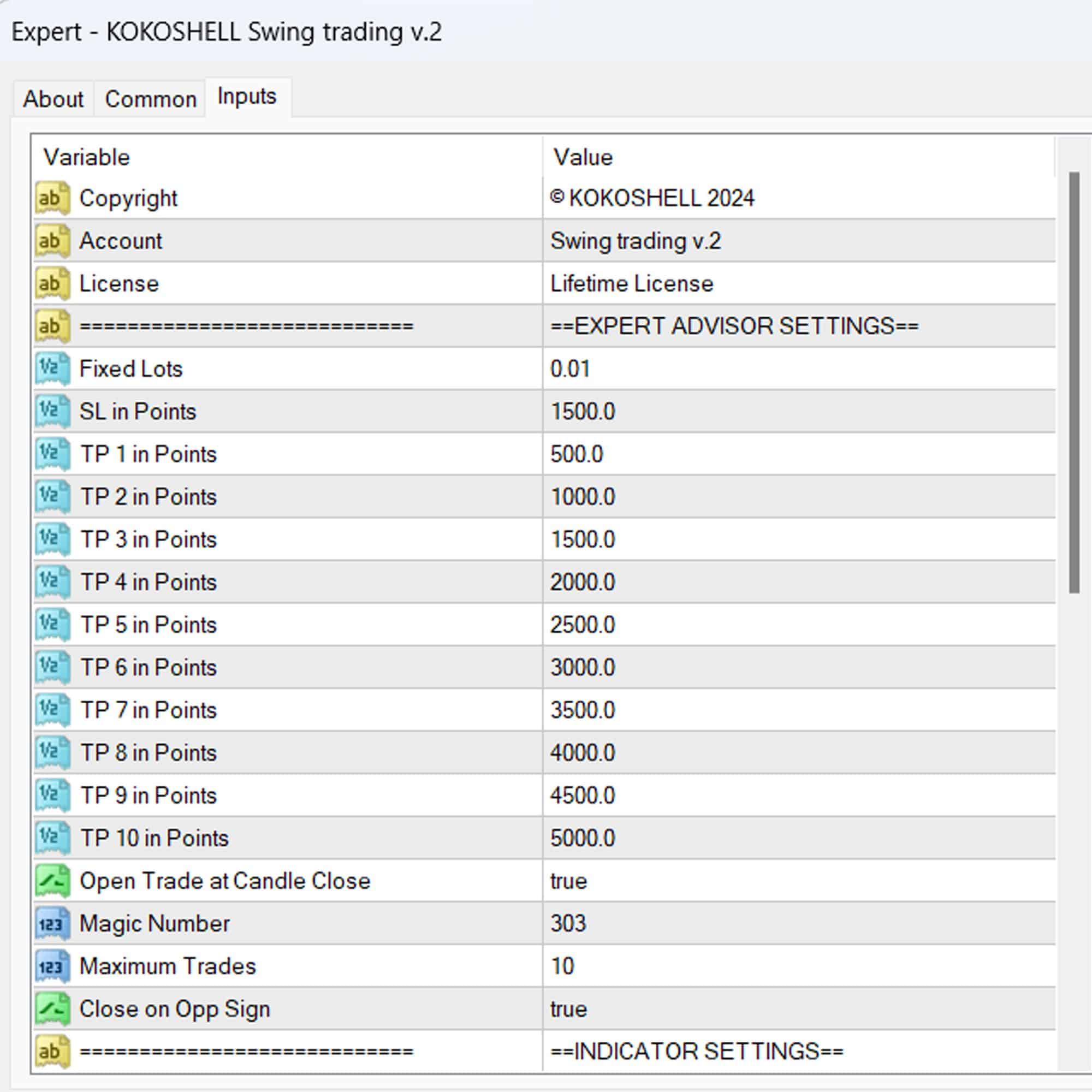

- Risk Management: Incorporates adjustable stop loss, take profit, and trailing stop settings for optimal risk control. Moreover, these settings are fully customizable.

Key Features: Cutting-Edge Tools for Smart Trading

Discover the powerful features of the Swing Trading MT4 EA, designed to optimize your trading strategy:

- Accurate Swing Detection: Leverages advanced indicators to detect market swings and reversals. Furthermore, it ensures precision in trading signals.

- High Win Ratio: Achieves a winning ratio of around 80% through precise trade execution. Consequently, it maximizes profitability.

- Customizable Settings: Offers flexible parameters for lot size, stop loss, take profit, and trailing stops. Additionally, it adapts to various trading styles.

- Martingale Strategy: Includes an optional Martingale feature to recover losses effectively. Moreover, it enhances recovery potential.

- Automated Alerts: Provides customizable alerts for trade signals, ensuring you never miss an opportunity. Consequently, it keeps you informed in real-time.

Why Choose Swing Trading Expert Advisor?

Choosing Swing Trading EA (Expert Advisor) for MT4 (Metatrader 4) means opting for a robust, reliable trading tool designed to enhance your trading performance. Here’s why it stands out:

- Proven Success: Built on a foundation of widely recognized swing trading principles. Therefore, it ensures a reliable trading approach.

- Versatile Application: Suitable for forex and stock markets, catering to various trading strategies. Additionally, it supports different trading instruments.

- Comprehensive Risk Management: Ensures effective risk control through advanced settings. Consequently, it protects your investments.

- Lifetime License: Enjoy lifetime access with a one-time purchase, ensuring continuous updates and support. Furthermore, it offers long-term value.

Transform Your Trading Strategy with Swing Trading Expert Advisor

Swing Trading EA for Metatrader 4 by KOKOSHELL is an essential tool for traders seeking to capitalize on market swings and trend reversals. By combining advanced technical analysis with robust risk management, this expert advisor delivers consistent, high-performance trading results. Invest in Swing Trading EA today and take control of your trading future. Additionally, secure your lifetime license and start trading smarter.

Michael Davis –

Swing Trading EA transformed my trades. Profits have been consistent and significant. Highly recommended.

Jessica Brown –

Very effective tool. Improved my swing trading strategies. Easy to use and reliable.

Matthew Johnson –

Outstanding EA! My trading accuracy has improved drastically. Excellent results.

Ava Williams –

Great performance overall. Helped me stay consistent with my trades. Well worth it.

Liam Taylor –

This EA has made a huge difference in my trading. Profits are up, and risk is manageable.

Emily Wilson –

Solid tool for swing trading. The indicators used are very effective. Satisfied with the results.

Noah Martinez –

Amazing EA! My trading success has increased significantly. Very reliable and efficient.

Olivia Moore –

Good tool for enhancing swing trades. Easy to set up and delivers consistent results.

Michael Johnson –

This trading advisor is a game-changer! From the easy setup to the impressive profits, it has exceeded my expectations. The strategy it uses is incredibly effective, and the risk management features are excellent. Trading has become not only profitable but also enjoyable. Highly recommend this tool to all traders!