Discover how to make money using Swing Trading strategies, learn proven profitable techniques, and optimize your trading methods with this comprehensive guide. Swing Trading strategies have long been popular among traders for their simplicity and effectiveness in capturing market swings. Leveraging these strategies can lead to consistent profits when executed correctly, particularly when automated using Expert Advisors (EAs) like the Swing Trading EA. This comprehensive guide will walk you through making money using Swing Trading strategies, from mastering backtesting techniques to optimizing trading hours and implementing effective risk management. By understanding these concepts, you can refine your trading approach, increase profitability, and achieve long-term success in the financial markets.

Learn Success: Make Money Using Swing Trading Strategies

Swing Trading strategies rely on technical indicators to identify and follow market trends. The Swing Trading EA uses the Swing Trading indicator, which is based on Trend Period and Swing Period to determine entry and exit points for trades. Furthermore, by automating the trading process, this EA helps traders capitalize on market trends with minimal manual intervention, thereby increasing efficiency and consistency. To maximize your trading success, it is crucial to learn Swing Trading strategies thoroughly.

Discover the Key Features of Swing Trading EA

- Swing Trading Indicator: Utilizes the Trend Period and Swing Period for trend identification, providing clear buy and sell signals. This helps traders easily identify the direction of the market and make informed decisions about when to enter or exit trades.

- Customizable Risk Management: Allows traders to set stop loss (SL) and take profit (TP) levels according to their risk appetite. This ensures that traders can protect their capital and lock in profits without having to constantly monitor the markets.

- Martingale Strategy: Supports Martingale strategy for trade recovery, increasing trade size after losses to recoup losses faster. This can be particularly useful in volatile markets where prices can swing rapidly.

- Adjustable Trading Hours: Offers flexibility to trade during optimal market sessions for better performance. Traders can set the EA to only trade during the most volatile and profitable times of the day.

- Dashboard and Alerts: Provides a visual dashboard and configurable alerts for better trade monitoring and decision-making. Consequently, this feature helps traders stay informed about the status of their trades and make quick adjustments if needed.

Real-World Example: Maximizing Gains with Swing Trading EA

Consider a trader using the Swing Trading EA to trade EUR/USD. By setting the EA to trade only during the London session, which is known for its high volatility, the trader can take advantage of significant price movements. The EA’s customizable risk management features allow the trader to set a stop loss of 1500 points and a take profit of 5000 points, ensuring a favorable risk-reward ratio. Additionally, by using the Martingale strategy, the trader can recover losses more quickly and improve overall profitability. Learning Swing Trading strategies, including the Martingale technique, can greatly enhance trading outcomes.

Mastering Backtesting Techniques: Make Money Using Swing Trading Strategies

The Critical Role of Backtesting: Why It Matters

Backtesting is the process of testing a trading strategy on historical data to evaluate its performance. It helps traders understand how a strategy would have performed in the past, identify potential weaknesses, and refine their approach before deploying it in live markets. It is essential to learn Swing Trading strategies to master backtesting effectively.

Unveiling the Benefits of Backtesting:

- Validation: Confirms the viability of a trading strategy by showing how it would have performed historically. This, in turn, can prevent traders from using ineffective strategies in live trading.

- Performance Metrics: Provides insights into key metrics such as profitability, drawdown, and risk-reward ratios. Understanding these metrics can help traders gauge the potential success of their strategy.

- Optimization: Helps identify the best parameters for the strategy, allowing for fine-tuning and improved performance. Consequently, traders can test different settings to find the optimal combination that maximizes profits and minimizes risks.

- Confidence Building: Increases trader confidence by demonstrating potential success. Knowing that a strategy has performed well in the past can give traders the confidence to stick with it during live trading.

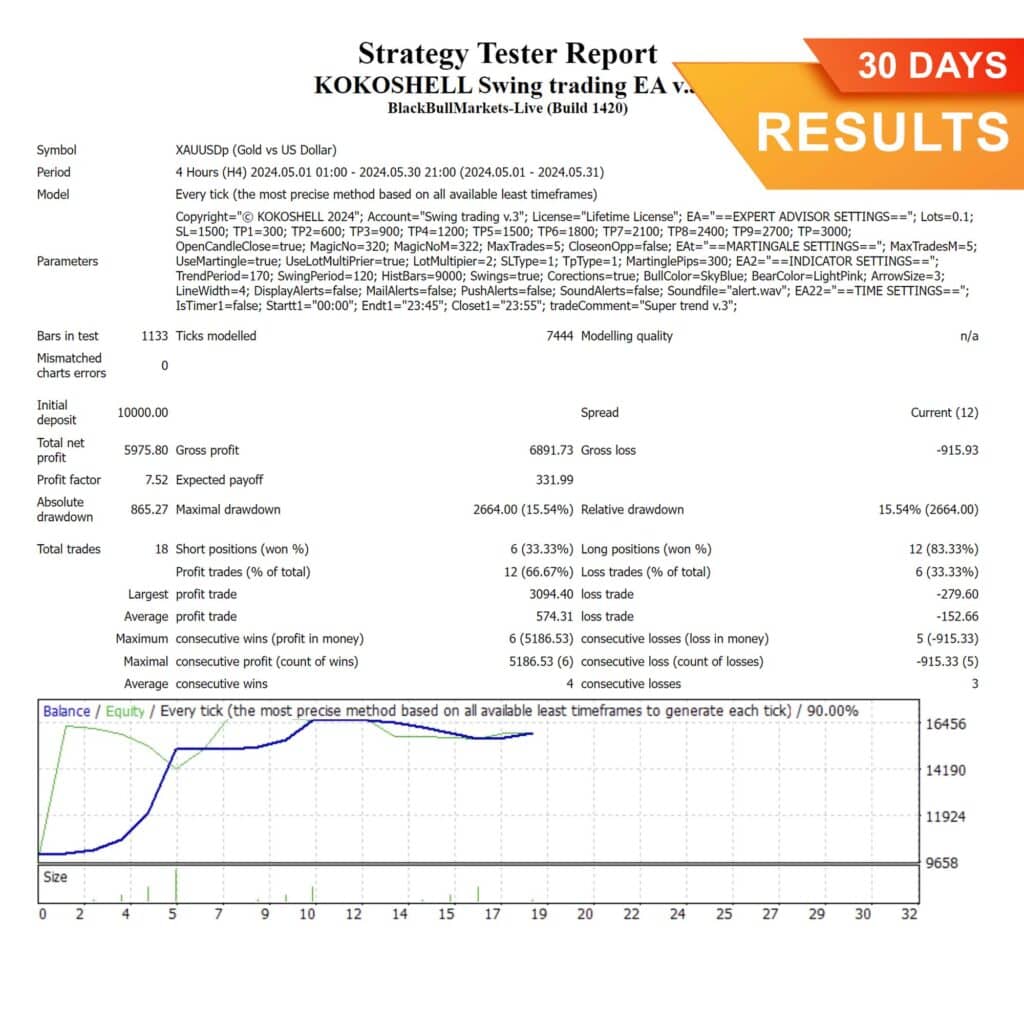

Step-by-Step Guide: Practical Backtesting Example

Consider you are testing the Swing Trading EA. Here’s how you can backtest it:

- Set Up the EA:

- Load the EA onto a MetaTrader 4 chart.

- Configure the input parameters, such as lot size, stop loss, take profit levels, and trading hours.

- Select Historical Data:

- Choose a time frame and historical data period for testing.

- For example, use the past five years of EUR/USD hourly data to get a comprehensive view of how the strategy would have performed over different market conditions.

- Run the Backtest:

- Use MetaTrader 4’s strategy tester to run the EA on the selected data.

- Next, analyze the results, focusing on metrics like net profit, drawdown, and win rate. Look for patterns in the data that can help you identify strengths and weaknesses in the strategy.

- Optimize Parameters:

- Adjust the EA parameters based on backtest results to improve performance.

- For instance, if the initial backtest reveals frequent stop-outs, increase the stop loss distance or adjust the Swing Period settings.

- Finally, repeat the backtest with the optimized settings to ensure the adjustments lead to better performance.

Additionally, by regularly backtesting and optimizing the EA, you can ensure that your trading strategy remains effective under various market conditions. This continuous improvement process is key to maintaining a competitive edge in the markets. To master profitable Swing Trading strategies, continuous learning and adaptation are crucial.

For comprehensive insights into mastering backtesting techniques, explore The Ultimate Guide for Backtesting. This resource is designed to elevate your trading strategy, ensuring you maximize the potential of your Wealth Wave EA. Remember, mastering backtesting techniques is a critical step to learn Swing Trading strategies effectively.

Fine-Tuning Swing Trading EA: Proven Strategies for Maximum Profit

Unlocking the Power of Optimization: Key Parameters to Adjust

Optimizing the parameters of your EA can significantly enhance its profitability. Key parameters to consider include:

- Lot Size: Determines the risk per trade. Adjusting the lot size based on your account equity can help manage risk more effectively.

- Stop Loss (SL) and Take Profit (TP): Define the exit points for trades. Finding the right balance between SL and TP is crucial for maximizing profits while minimizing losses.

- Trend Period and Swing Period: Used by the Swing Trading indicator to calculate trend strength. Adjusting these settings can help the EA adapt to different market conditions.

- Trading Hours: Specify when the EA is allowed to open trades. Trading during the most volatile times of the day can improve the performance of your strategy.

Success Stories: Examples of Effective Parameter Adjustments

- Lot Size Adjustment:

- If your account equity is growing, you might want to increase the lot size proportionally to maintain a consistent risk level.

- For example, if starting with a $10,000 account, you might trade with 0.1 lots. As your account grows to $20,000, you might increase the lot size to 0.2 lots. This ensures that your risk remains proportional to your account size.

- Stop Loss and Take Profit Optimization:

- By backtesting different SL and TP levels, you can find the sweet spot that maximizes profitability while minimizing risk.

- For example, backtest with SL at 1500 points and TP at 5000 points, then adjust to see if SL at 1200 points and TP at 4500 points perform better. This iterative process helps you find the optimal settings for your strategy.

- Trend Period and Swing Period Settings:

- Adjusting the Trend Period and Swing Period can help the EA better adapt to the current market volatility, improving trade entries and exits.

- For instance, if the default Trend Period is 200 and Swing Period is 120, backtest with Trend Period of 180 and Swing Period of 100 to see if it enhances performance. This adjustment can make the EA more responsive to market changes.

- Trading Hours:

- By selecting the optimal trading hours, you can ensure that your EA trades during the most volatile and profitable times of the day.

- For example, if backtesting shows that trades during the early London session have a higher success rate, set the EA to trade only during those hours. This focus on high-volatility periods can improve overall profitability.

Proven Benefits of Customization: Why Tailoring Your EA Matters

Customizing the EA parameters allows traders to tailor the strategy to their specific trading goals and market conditions. Moreover, this flexibility helps in adapting to different asset classes, volatility levels, and trading styles, ultimately leading to more consistent profits. Learn Swing Trading strategies to fully leverage the benefits of customization.

The Competitive Edge: Advantages of Customization

- Adaptability: Tailor the EA to various market conditions and asset classes. For example, different settings might be needed for trading forex versus commodities.

- Risk Management: Adjust parameters to align with your risk tolerance. Consequently, this ensures that you can trade comfortably without taking on excessive risk.

- Profit Optimization: Fine-tune settings to maximize profitability. By continuously optimizing your strategy, you can stay ahead of market changes and improve your returns.

- Personalization: Create a trading strategy that suits your individual trading style and objectives. This helps you stay disciplined and follow your plan, leading to better trading outcomes.

Therefore, by regularly reviewing and optimizing these settings based on backtesting and live trading results, you can ensure that your EA remains effective and profitable. This ongoing process of refinement is essential for long-term success in trading. Proven and profitable Swing Trading strategies often involve such customization to adapt to various market conditions.

Implementing Profitable Risk Management with Swing Trading Strategies

Essential Risk Management Techniques: Safeguarding Your Investments

Effective risk management is crucial for long-term trading success. Key techniques include:

- Position Sizing: Adjusting lot sizes based on account equity to manage risk. This ensures that you are not overexposed on any single trade.

- Stop Loss Orders: Setting stop losses to limit potential losses on each trade. This helps protect your capital and prevents large drawdowns.

- Take Profit Orders: Using take profit levels to lock in gains. This ensures that you capture profits at predetermined levels.

- Diversification: Spreading risk across different assets or markets. Thus, this reduces the impact of any single trade or market on your overall portfolio.

Real-World Applications: Effective Risk Management in Action

In the Swing Trading EA, you can set a fixed lot size for trades and specify the stop loss and take profit points. For instance, with a stop loss of 1500 points and a take profit of 5000 points, the EA aims for a favorable risk-reward ratio. Additionally, the Martingale strategy can be used to recover losses by increasing the lot size of subsequent trades after a loss. Learning Swing Trading strategies that incorporate risk management is key to long-term success.

Why Risk Management is a Game-Changer

- Capital Preservation: Protects your trading capital from significant losses. This is essential for long-term success in trading.

- Consistency: Ensures a steady growth of your trading account. By managing risk effectively, you can achieve consistent returns over time.

- Peace of Mind: Reduces stress and emotional trading decisions. Knowing that your risk is managed helps you trade with confidence.

- Long-Term Success: Increases the likelihood of sustainable profitability. Effective risk management is a key component of any successful trading strategy. Profitable Swing Trading strategies always include robust risk management techniques.

Optimizing Trading Hours: Make Money Using Proven and Profitable Swing Trading Strategies

Optimal Trading Sessions: When to Trade for Maximum Gains

Trading during specific sessions can enhance the performance of Swing Trading strategies. The most active trading periods, such as the London and New York sessions, offer higher volatility and better trading opportunities.

Key Trading Sessions for Profitability

- London Session: High volatility and liquidity, especially in forex markets. This session often sets the tone for the rest of the day.

- New York Session: Significant market movements and overlaps with the London session. This overlap period is particularly volatile and offers many trading opportunities.

- Asian Session: Lower volatility, suitable for range-bound strategies. While not as volatile as the London or New York sessions, it can still offer profitable trades for certain strategies.

Leveraging Key Trading Times: The Advantages

Trading during high-liquidity periods ensures tighter spreads and quicker execution of trades. It also increases the likelihood of significant price movements, which are essential for trend-following strategies.

The Benefits of Trading During Optimal Times

- Tighter Spreads: Lower transaction costs due to higher liquidity. This can significantly reduce trading costs over time.

- Faster Execution: Quicker order fills and reduced slippage. This ensures that your trades are executed at the desired prices.

- More Opportunities: Increased chances of capturing profitable trades. Higher volatility means more price movements and trading opportunities.

- Enhanced Strategy Performance: Better alignment with market volatility. Trading during peak times can improve the performance of trend-following strategies. Proven and Profitable Swing Trading strategies often focus on trading during optimal sessions.

Practical Adjustments: Tailoring Trading Hours for Better Results

In the EA settings, you can specify trading hours to align with the most active market sessions. For example, setting the trading start time at 09:00 (London open) and the end time at 17:00 (New York close) can optimize the EA’s performance by focusing on the most volatile trading hours.

Success Story: Optimizing Trading Hours for Maximum Profit

If you find that trading during the overlap of the London and New York sessions results in better performance, you can set the EA to only trade during this period. This adjustment can enhance your overall profitability by focusing on the most lucrative trading times. Proven and Profitable Swing Trading strategies often include optimizing trading hours to match market activity.

If you don’t know the trading hours, visit forex.timezoneconverter.com. Select your time zone to instantly view market open and close times.

Conclusion: Proven and Profitable Strategies to Make Money Using Swing Trading Strategies

Swing Trading strategies, when combined with robust risk management, proper backtesting, and optimization of trading hours, can lead to consistent trading profits. The Swing Trading EA offers a powerful tool for traders to automate and enhance their trading based on these strategies. By fine-tuning the EA parameters and leveraging the strengths of the Swing Trading indicator, traders can maximize their profits and achieve long-term success. To learn Swing Trading strategies and incorporate them into your trading plan is essential for success.

By understanding and applying the principles outlined in this article, you can take full advantage of the Swing Trading strategies to boost your trading performance. Remember, the key to success lies in continuous learning, regular backtesting, and disciplined risk management. Furthermore, as you gain more experience and refine your approach, you’ll be better positioned to navigate the markets and achieve your trading goals. Proven and profitable Swing Trading strategies require consistent effort and adaptation.

In summary, the Swing Trading EA provides a comprehensive and customizable approach to trading, allowing you to optimize every aspect of your strategy. By leveraging backtesting, fine-tuning your parameters, implementing strong risk management, and optimizing your trading hours, you can make informed decisions that lead to sustainable profitability. The journey to successful trading is continuous, and by applying these proven strategies, you can enhance your chances of success in the financial markets.

FAQs on Make Money Using Profitable Swing Trading Strategies

Can I Make Money Using Swing Trading Strategies with Different Assets?

Yes, Swing Trading strategies can be applied to various assets, including forex, commodities, indices, and cryptocurrencies. The key is to adjust the EA parameters to suit the specific volatility and behavior of each asset. Each market has unique characteristics, and tailoring your approach can lead to more consistent results. Hence, learn Swing Trading strategies specific to each asset class to maximize profitability.

Real-World Example: Tailoring Swing Trading EA for Different Assets

If you’re trading commodities like gold, you might need to adjust the Trend Period and Swing Period to account for gold’s unique volatility patterns compared to forex pairs. For instance, using a higher Swing Period can help better capture the price swings in gold. Similarly, if you’re trading cryptocurrencies, you might need to set tighter stop losses due to the higher volatility in those markets. Adapting your strategy to different assets ensures you are using the best settings for each market’s behavior.

How Does Swing Trading EA Utilize Technical Indicators?

The EA uses the Swing Trading indicator, which is based on Trend Period and Swing Period, to identify and follow market trends. It generates buy and sell signals when the price crosses above or below the indicator line, indicating a potential trend reversal or continuation. Learning Swing Trading strategies that effectively utilize these indicators is crucial.

Practical Insight: Indicator-Based Trading with Swing Trading EA

When the price of EUR/USD crosses above the Swing Trading line, the EA generates a buy signal, indicating a potential upward trend. Conversely, if the price crosses below the Swing Trading line, it generates a sell signal, indicating a potential downward trend. This helps traders make informed decisions based on clear technical signals. Additionally, the EA can be configured to only enter trades at the close of a candle, ensuring that the signal is confirmed, thereby reducing the likelihood of false signals. Profitable Swing Trading strategies rely on accurate and timely signals from these indicators.

What Common Mistakes Should I Avoid When Using Swing Trading EA?

Common mistakes include over-leveraging, ignoring backtesting results, not adjusting parameters to suit different market conditions, and neglecting risk management principles. Ensuring proper backtesting, parameter optimization, and risk management can mitigate these mistakes. Learning from these errors can significantly improve your trading outcomes.

Avoiding Pitfalls: Key Mistakes to Steer Clear Of

- Over-Leveraging: Risking too much capital on a single trade can lead to significant losses. Always use appropriate position sizing based on your account equity.

- Ignoring Backtesting: Failing to validate your strategy on historical data can result in poor performance in live trading. Regularly backtest your strategy to ensure its effectiveness.

- Poor Risk Management: Not setting appropriate stop losses and take profits can lead to large drawdowns. Always use SL and TP levels that match your risk tolerance.

- Lack of Adaptation: Not adjusting your strategy for different market conditions can lead to missed opportunities. Continuously optimize your EA settings based on market changes. Proven and profitable Swing Trading strategies often emphasize the importance of avoiding these common mistakes.

How Can I Tailor Swing Trading EA to My Specific Trading Goals?

You can tailor the EA by adjusting its input parameters, such as lot size, stop loss, take profit levels, Trend Period settings, and trading hours. Regularly reviewing and optimizing these settings based on backtesting and live trading results will help align the EA with your trading goals. Understanding your goals and how the EA can meet them is crucial for success. Learn Swing Trading strategies to tailor your EA effectively.

Personalizing Your Strategy: Practical Tips

- Set Clear Goals: Define your risk tolerance and profit targets. For example, if you aim for a 10% monthly return, adjust your EA settings to align with this goal.

- Adjust Parameters: Based on your goals, adjust the EA settings to match your desired risk-reward ratio. For instance, if you are a conservative trader, you might set a lower lot size and tighter stop loss.

- Continuous Monitoring: Regularly review the EA’s performance and make adjustments as needed. Consequently, this ongoing process ensures that your strategy remains effective in different market conditions. Additionally, keeping a trading journal can help track performance and identify areas for improvement. To achieve your trading goals, learning Swing Trading strategies tailored to your needs is essential.

Can I Make More Money Using a VPS for Swing Trading EA Strategies?

Yes, using a Virtual Private Server (VPS) ensures that the EA runs continuously without interruptions due to internet or power outages. A VPS also provides low-latency execution, which is crucial for timely trade entries and exits, especially in fast-moving markets. Proven and profitable Swing Trading strategies often recommend using a VPS for optimal performance.

Enhancing Performance: Benefits of Using a VPS

- Continuous Operation: Ensures the EA runs 24/7 without interruptions. This is especially important for traders who cannot monitor their trades constantly.

- Low Latency: Faster execution times, reducing slippage. This ensures that your trades are executed at the best possible prices.

- Reliability: Reduces the risk of missed trades due to technical issues. A VPS offers a stable and secure environment for your trading operations.

- Security: Enhanced security measures to protect your trading environment. VPS providers often offer advanced security features to safeguard your data and trading activities.

Moreover, by leveraging the benefits of a VPS, you can enhance the performance of your Swing Trading EA and increase your chances of making more money in the financial markets. This investment in technology can lead to smoother and more profitable trading operations. Additionally, learning Swing Trading strategies that incorporate the use of a VPS can further boost your trading efficiency. Profitable Swing Trading strategies often integrate the use of VPS to maintain consistent and reliable performance.