Elevate Your Trading Strategy with RSI EA

Introducing the RSI EA (Expert Advisor) for MT4 (Metatrader 4), a cutting-edge trading tool that leverages the Relative Strength Index (RSI) to optimize your trading performance. Designed for both novice and experienced traders, this Expert Advisor (EA) automates your trading strategy.

Moreover, it ensures precision, efficiency, and consistency in capturing profitable opportunities in the forex market. Consequently, with RSI EA, you can confidently navigate market fluctuations and achieve your trading goals with ease.

How It Works: Harnessing the Power of RSI

The RSI EA continuously analyzes the Relative Strength Index, a momentum oscillator that measures the speed and change of price movements. When the RSI indicates overbought or oversold conditions, the EA triggers buy or sell orders. This helps to capitalize on potential market reversals.

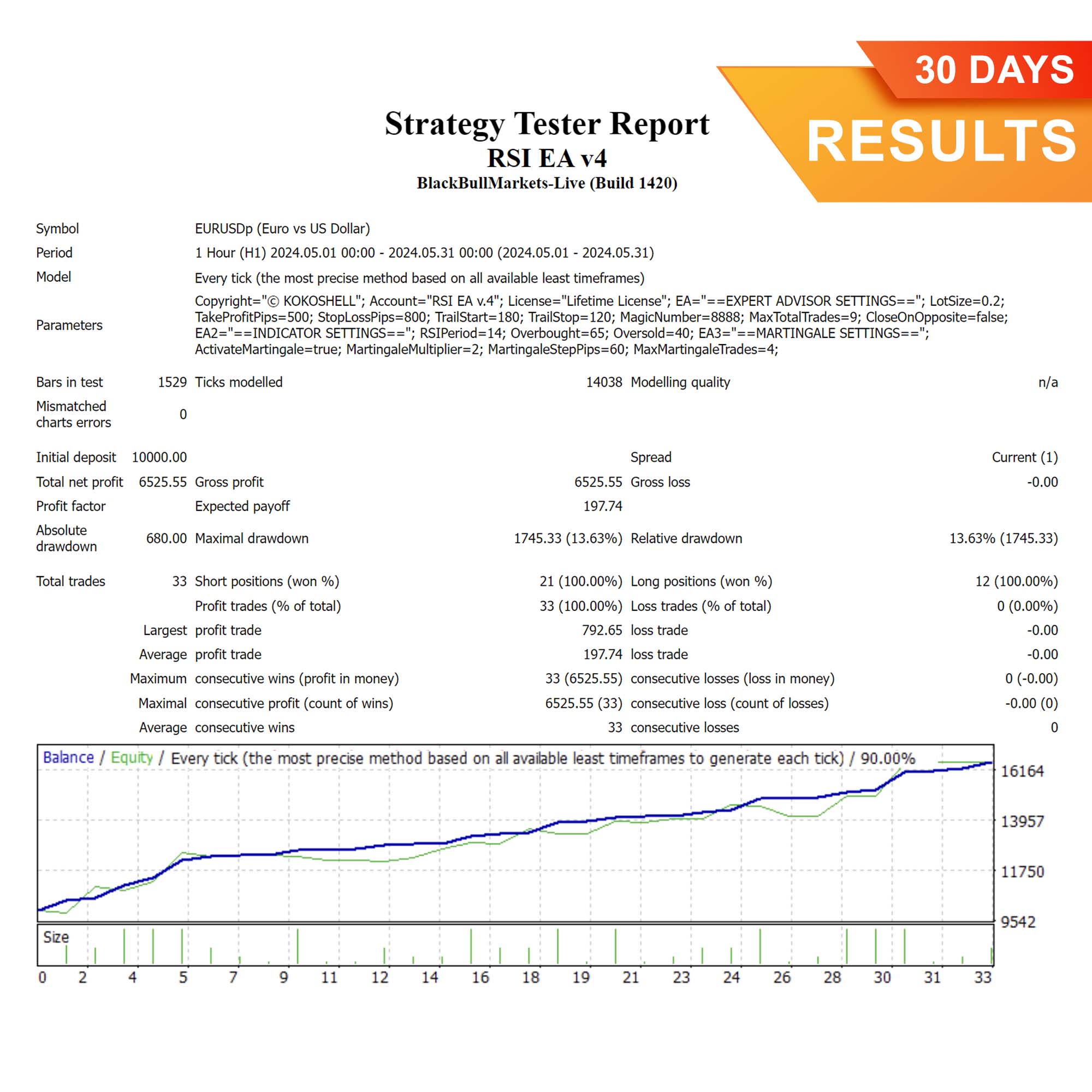

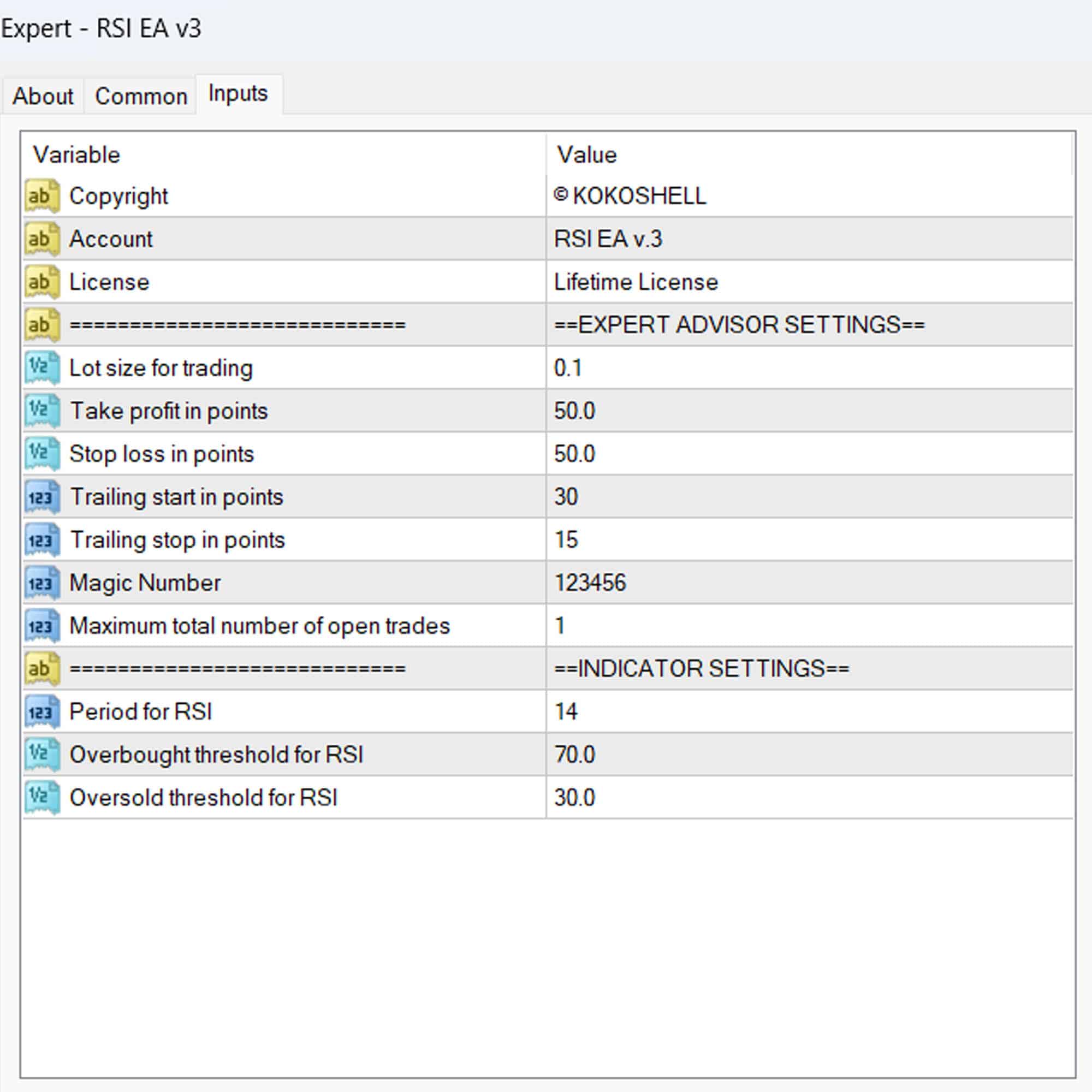

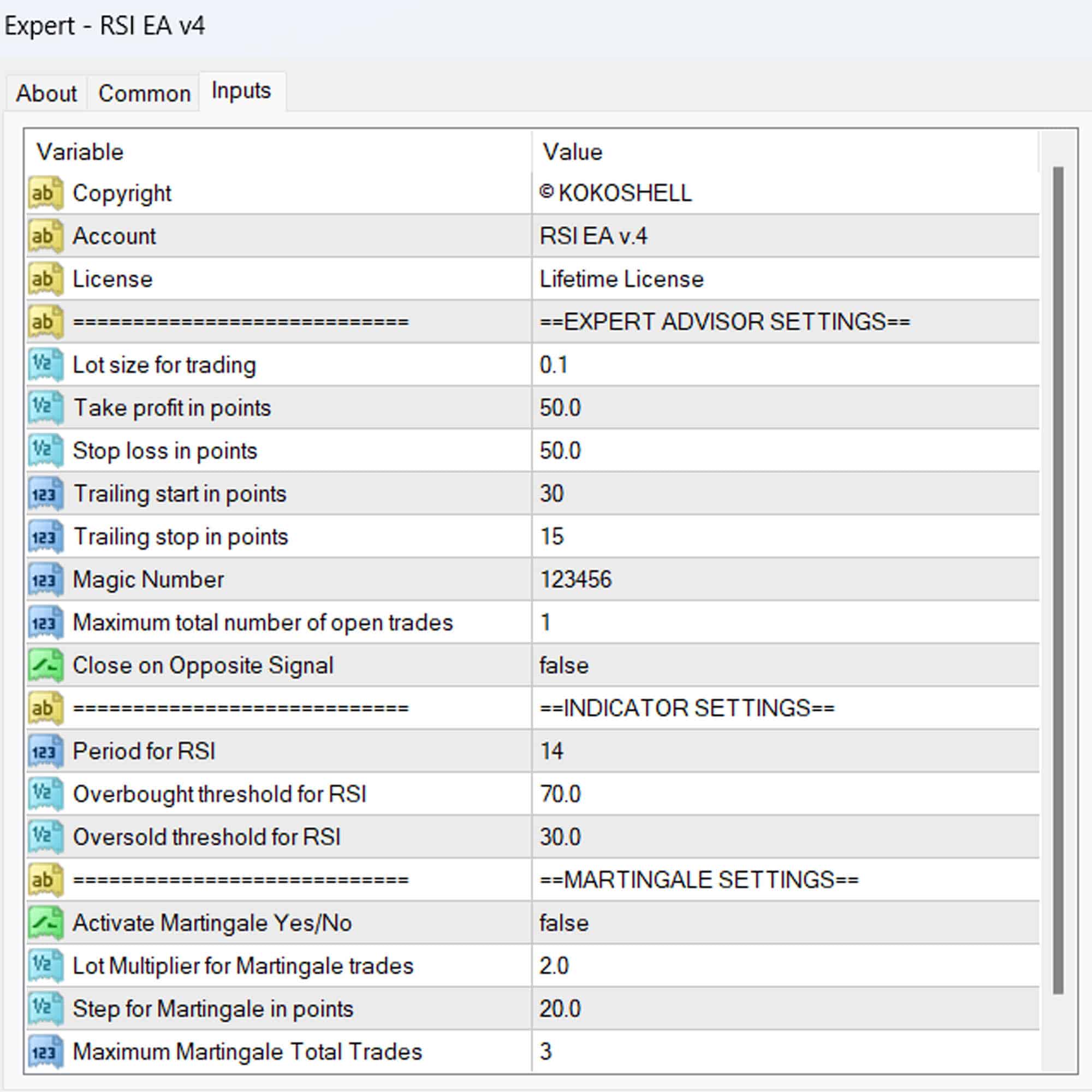

Furthermore, the EA is equipped with customizable settings for lot sizes, take profit, stop loss, and trailing stops. This ensures flexibility to suit your trading preferences. Additionally, the RSI Expert Advisor offers an optional Martingale strategy, which can enhance profitability by adjusting trade sizes after losses.

Key Features: Unmatched Trading Efficiency

- Accurate Signals: Utilizes the RSI indicator to identify overbought and oversold conditions, thus providing precise entry and exit points.

- Customizable Settings: Adjust lot size, take profit, stop loss, and trailing stops to match your trading strategy and risk tolerance.

- Martingale Strategy: An optional feature that increases trade sizes after losses to maximize recovery and potential gains.

- Automated Trading: Executes trades automatically based on RSI signals, thereby allowing for hands-free trading.

- Comprehensive Risk Management: Protects your investments with robust risk management tools, thereby ensuring your trading remains safe and profitable.

- Lifetime License: A one-time purchase with lifetime access, offering ongoing value and continuous updates.

Why Choose RSI EA: Superior Trading Results

Choosing RSI EA means equipping yourself with a powerful tool. It combines the reliability of the RSI indicator with advanced trading features. Moreover, the EA’s ability to accurately interpret RSI signals ensures timely and effective trades. Its customizable settings provide flexibility to adapt to various market conditions.

Furthermore, the optional Martingale strategy adds an extra layer of potential profitability. Therefore, with RSI Expert Advisor, you can achieve consistent trading success, optimize your returns, and elevate your trading strategy to new heights.

Transform Your Trading with RSI EA

The KOKOSHELL RSI EA (Expert Advisor) for MT4 (Metatrader 4) is your ultimate solution for automated, efficient, and profitable trading. By leveraging the powerful RSI indicator, this Expert Advisor delivers precise and timely trading signals.

Additionally, it is backed by comprehensive risk management and customization options. Therefore, whether you aim for steady gains or aggressive growth, the RSI Expert Advisor adapts to your needs, thereby providing a reliable and efficient trading solution.

John –

This tool has really helped streamline my trading. I love how it identifies potential entry and exit points with precision. My trading has become more efficient since using it.

Michael –

Fantastic EA! It’s user-friendly and has improved my trading accuracy. I especially like the alerts for overbought and oversold conditions. Highly recommended.

Karen –

I’m very satisfied with this EA. It’s easy to set up and has significantly improved my trading performance. I’ve recommended it to several friends already.

Emily Davis –

It’s a decent EA, but it took me a while to understand how to use it effectively. Some more detailed instructions would be helpful. Performance is solid once you get the hang of it.

David –

Great product! It’s reliable and helps me stay disciplined in my trading. The signals are accurate, and I’ve seen better results since I started using it.

Sarah –

The EA works well, but I wish there were more customization options. It’s good for standard trading strategies but could be better for more advanced users.

Steven Robinson –

I’m thrilled with this trading advisor! The setup was incredibly easy, and the profits have been impressive. The strategy it employs is highly effective, and the risk management features are superb. This tool has made trading so much more rewarding. Highly recommend it to all traders!