Transform Your Trading with WTI Day Trading EA

WTI Day Trading EA by KOKOSHELL is a cutting-edge Expert Advisor designed for MT4 (MetaTrader 4). Tailored to help traders capitalize on daily market movements in the WTI market, this sophisticated trading tool utilizes advanced indicators and strategies to provide clear, actionable signals. Consequently, it is ideal for traders looking to maximize their profits while minimizing risks. Experience the future of trading with WTI Day Trading EA.

How It Works: Leveraging Advanced Indicators for Optimal Trades

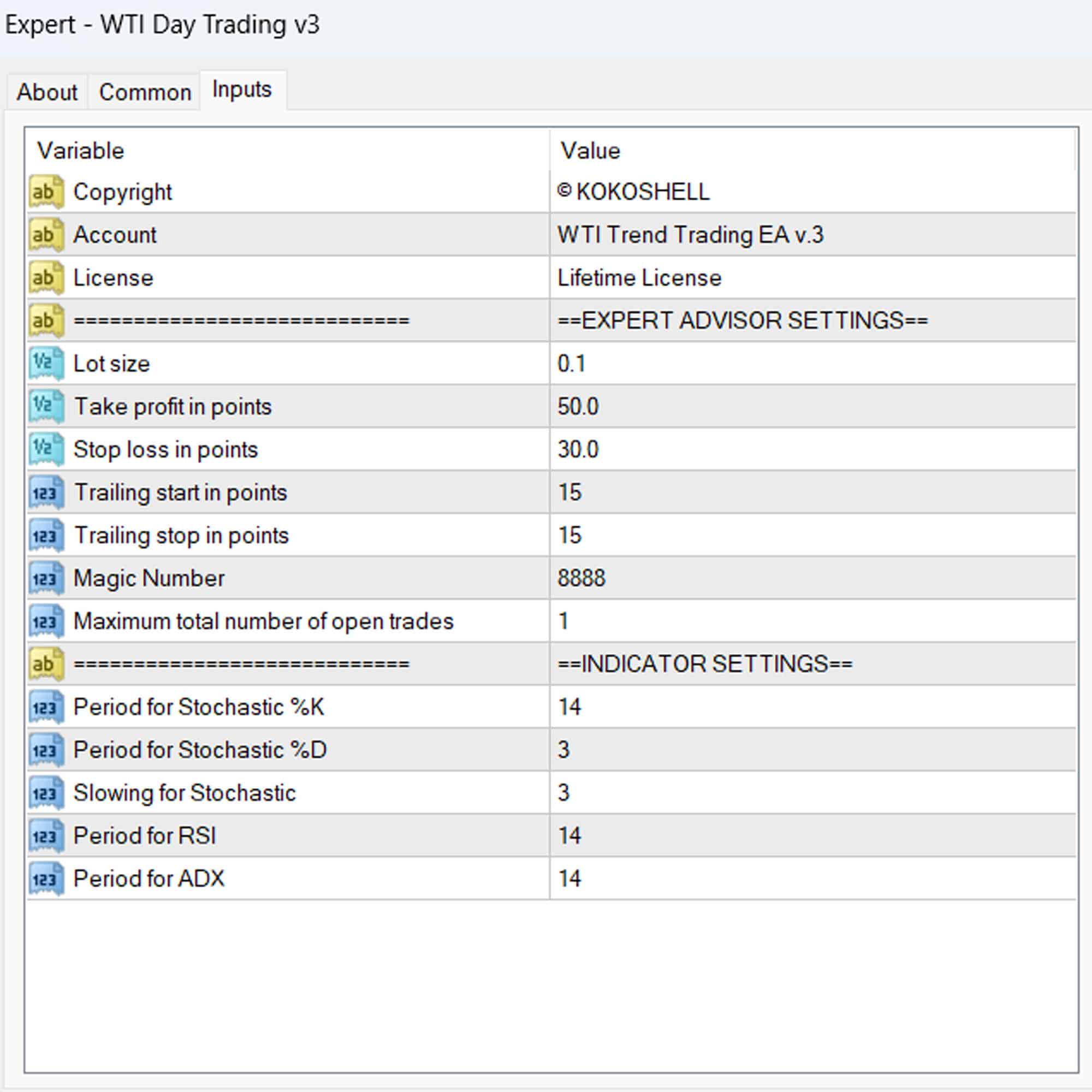

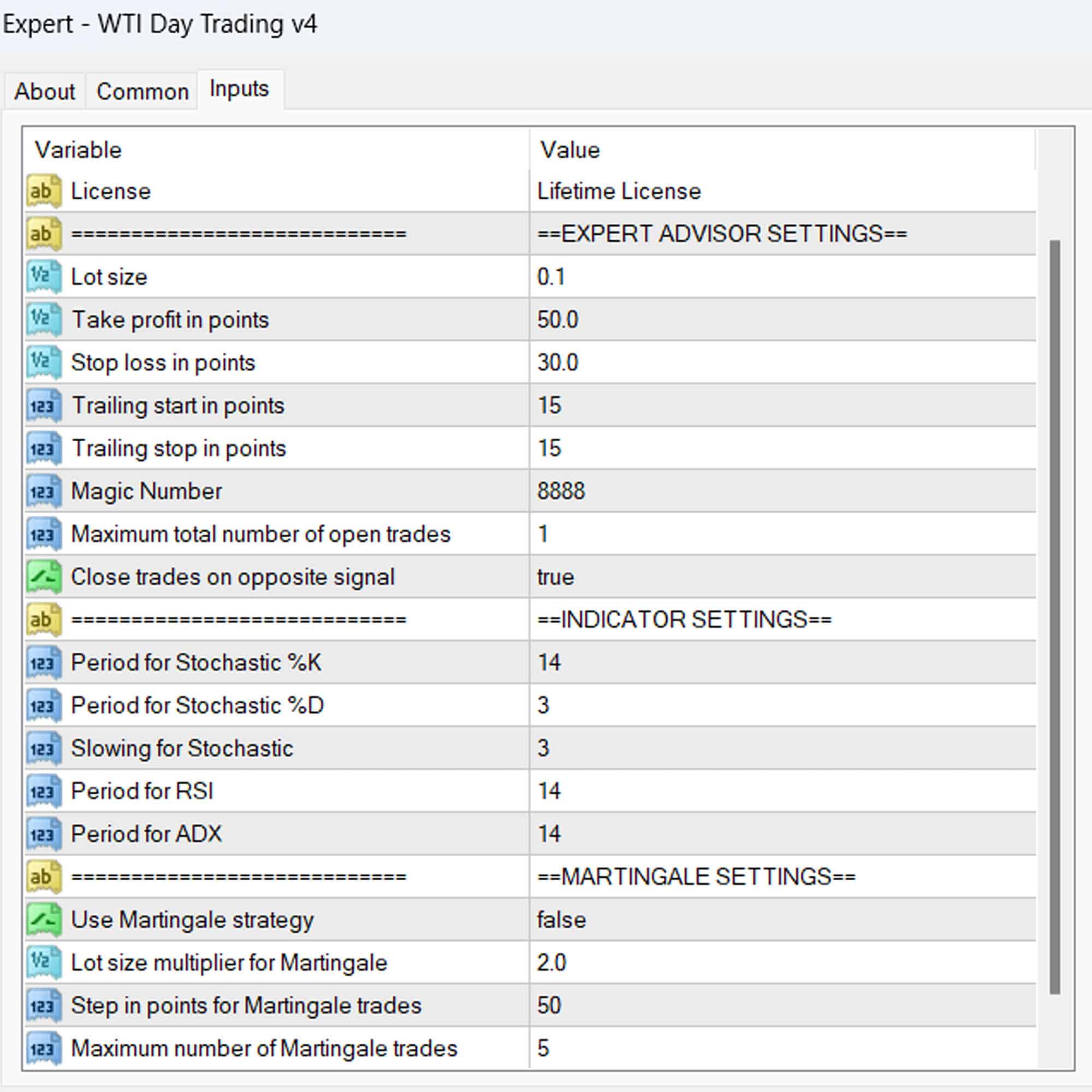

WTI Day Trading EA for Metatrader 4 employs a combination of the Stochastic Oscillator, Relative Strength Index (RSI), and Average Directional Index (ADX) to identify high-probability trading opportunities. Therefore, the EA continuously scans the market, generating buy and sell signals based on predefined conditions:

- Buy Signal: Triggered when the Stochastic %K and %D are below 20, RSI is below 30, and ADX is above 25.

- Sell Signal: Triggered when the Stochastic %K and %D are above 80, RSI is above 70, and ADX is above 25.

Additionally, the EA includes a trailing stop feature to protect profits and an optional Martingale strategy for those seeking to enhance their trading with progressive lot sizing.

Key Features: Powerful Tools for Successful Trading

- Advanced Indicators: Utilizes Stochastic Oscillator, RSI, and ADX for precise signal generation. Thus, it ensures accurate trade entries.

- Trailing Stop: Automatically adjusts stop loss to secure profits as the market moves in your favor. Consequently, it protects your gains.

- Martingale Strategy: An optional feature to increase lot size progressively, maximizing profit potential. Additionally, it provides a strategy for loss recovery.

- Customizable Settings: Adjust lot size, take profit, stop loss, and indicator parameters to suit your trading style. Therefore, it offers flexibility.

- Automated Trading: Executes trades automatically based on predefined criteria, eliminating emotional bias. Consequently, it simplifies trading.

- Robust Risk Management: Includes settings for maximum total trades and closing trades on opposite signals to manage risk effectively. Moreover, it ensures safer trading.

Why Choose WTI Day Trading EA? Achieve Consistent Success

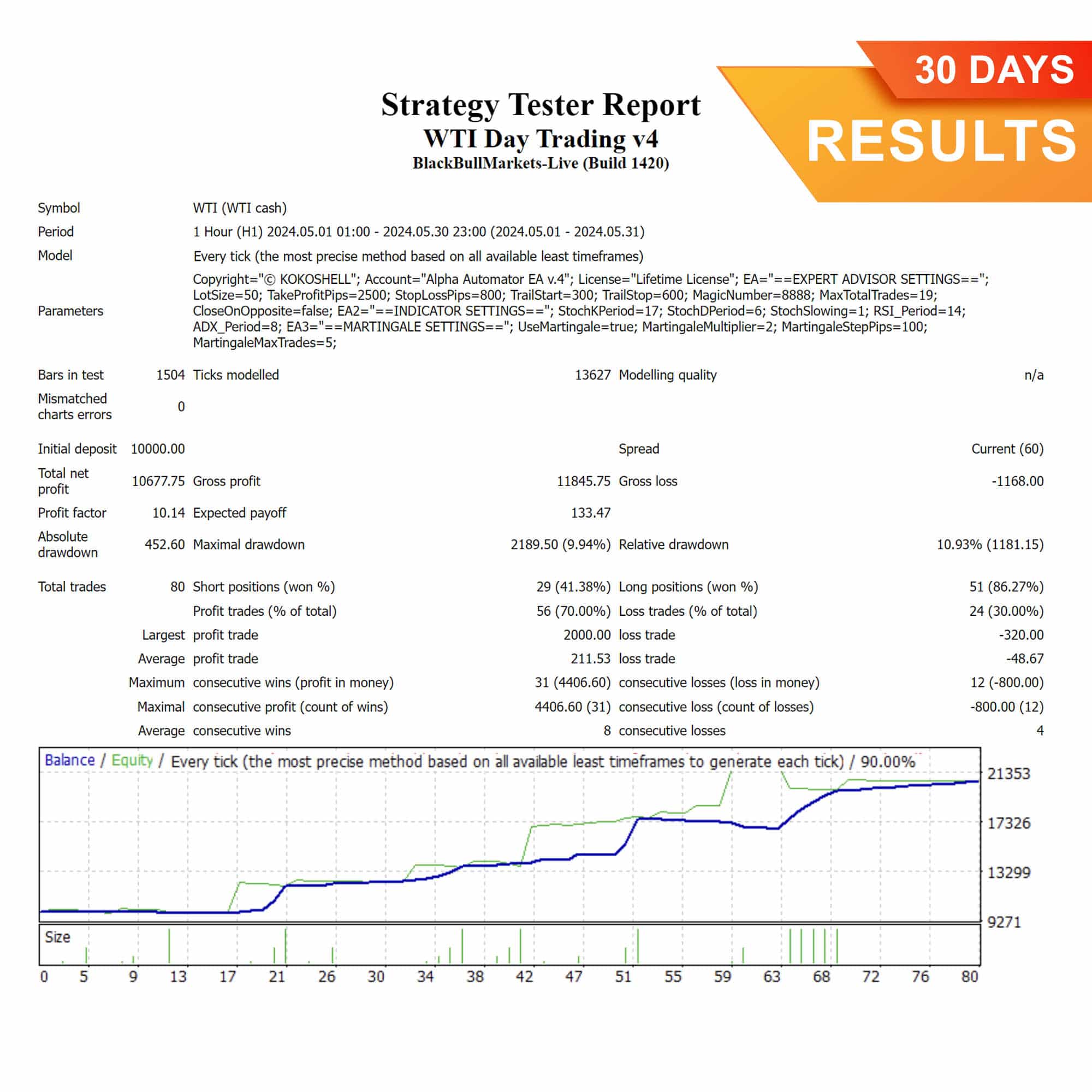

- Proven Strategy: Developed with extensive backtesting and real-time performance analysis to ensure reliability. Thus, it provides trustworthy results.

- Ease of Use: Simple setup and user-friendly interface make it accessible to traders of all levels. Additionally, it is easy to navigate.

- 24/7 Monitoring: Continuously monitors the market, ensuring no trading opportunities are missed. Consequently, it maximizes trading opportunities.

- Customizability: Fully customizable to match your unique trading preferences and risk tolerance. Therefore, it adapts to your needs.

- Support and Updates: Regular updates and dedicated customer support ensure you always have the best tools at your disposal. Moreover, it keeps you up-to-date.

Elevate Your Trading Game

WTI Day Trading EA is your ultimate partner for navigating the complexities of the WTI market. Its powerful combination of advanced indicators, automated trading, and robust risk management provides you with the tools needed to achieve consistent trading success.

Whether you are a beginner or an experienced trader, WTI Day Trading EA helps you make informed trading decisions, maximize your profits, and minimize your risks. Therefore, start trading smarter today with WTI Day Trading Expert Advisor for MT4 (Metatrader 4).

Timothy Smith –

This tool is phenomenal! My day trading profits have doubled.

Mia –

Trading results improved significantly.

Jason Garcia –

Effective tool for day trading. Needs more input options for customization.

Elena Johnson –

Outstanding! Profits have increased dramatically.

Brandon Martinez –

Decent tool, but lacks input parameters. Good price. Needs thorough backtesting.

Ava –

My trading strategy has transformed. Consistent profits and minimal stress.

Robert Hernandez –

Reliable for day trading. Signals are accurate, but more input options would be beneficial.

Christian Lee –

Incredible tool! Profits soared. Easy to use and very effective.

John Clark –

This trading advisor is phenomenal. The setup was quick and easy, and the profits have been impressive. The strategy is highly effective, and the risk management features are excellent. It has transformed my trading experience into something highly profitable and enjoyable. This tool is a game-changer!