Unlock Profitable Trading with US30 Swing Trading EA

Discover the power of the US30 Swing Trading EA (Expert Advisor) for MT4 (Metatrader 4), an algorithmic trading tool meticulously crafted by KOKOSHELL. Specifically tailored for the US30 index, this EA leverages advanced technical indicators to capitalize on market swings, thereby enabling traders to achieve consistent profits.

Whether you’re a novice or an experienced trader, the US30 Swing Trading Expert Advisor is your key to unlocking successful trades with minimal effort.

How It Works: Advanced Strategies for Optimal Trading

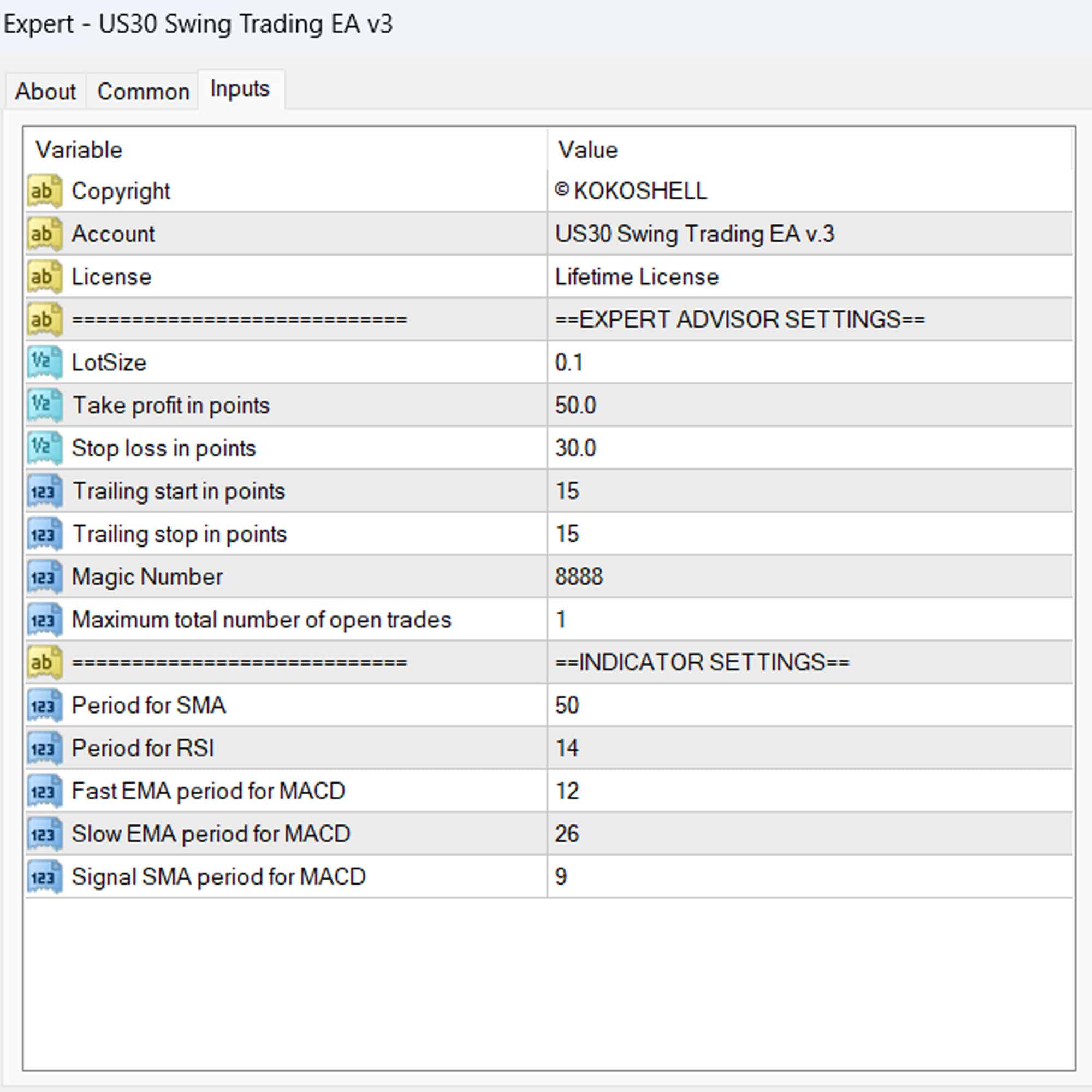

The US30 Swing Trading EA operates by analyzing market conditions using SMA, RSI, and MACD. Here’s how it generates high-probability trade signals:

- Buy Signal: It initiates a buy order when the price is above the 50 SMA. Additionally, when MACD crosses above its signal line and RSI ranges between 50 and 70, the EA identifies optimal buy opportunities.

- Sell Signal: Conversely, a sell order is triggered when the price falls below the 50 SMA. Moreover, when MACD crosses below its signal line and RSI ranges between 30 and 50, the EA signals the ideal moment to sell.

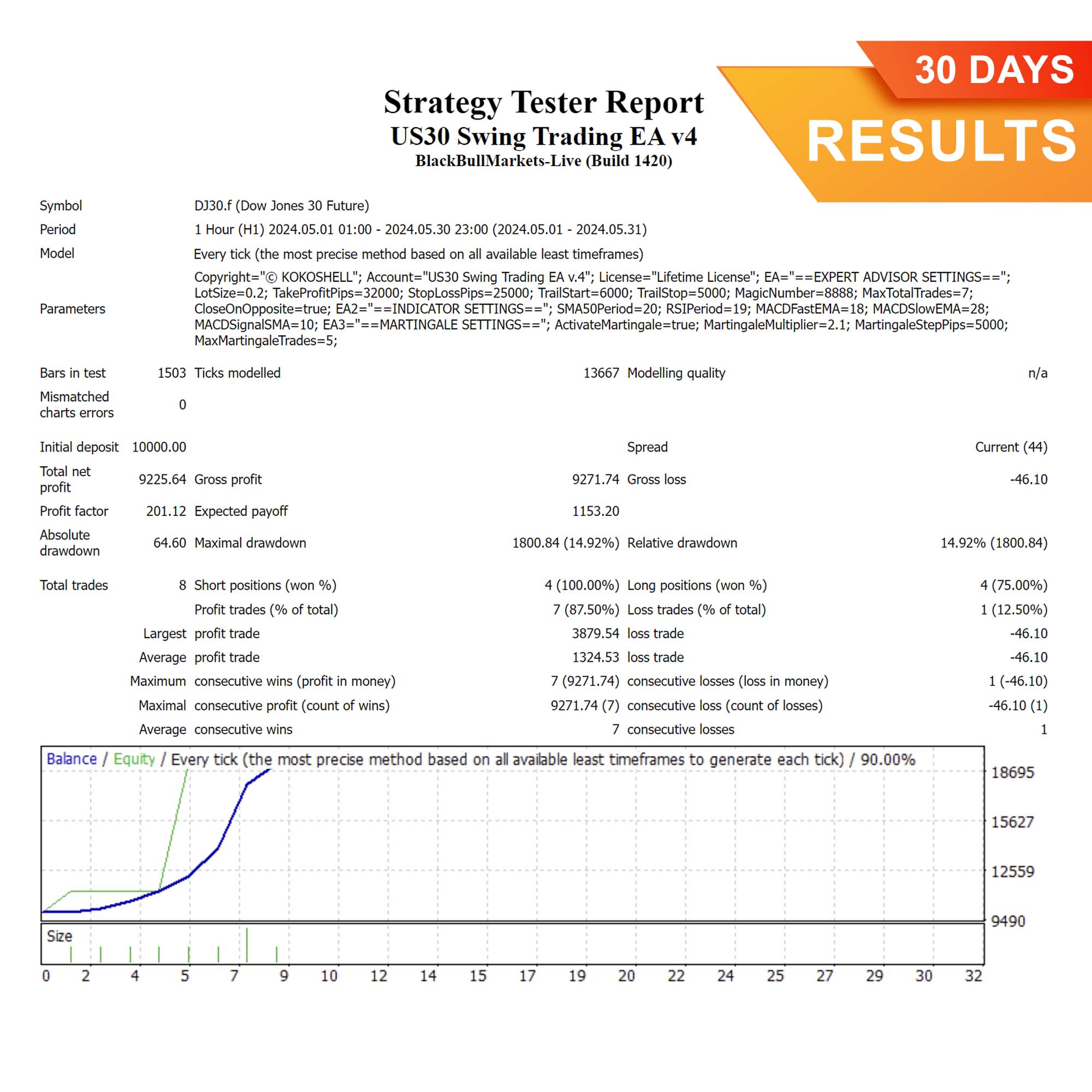

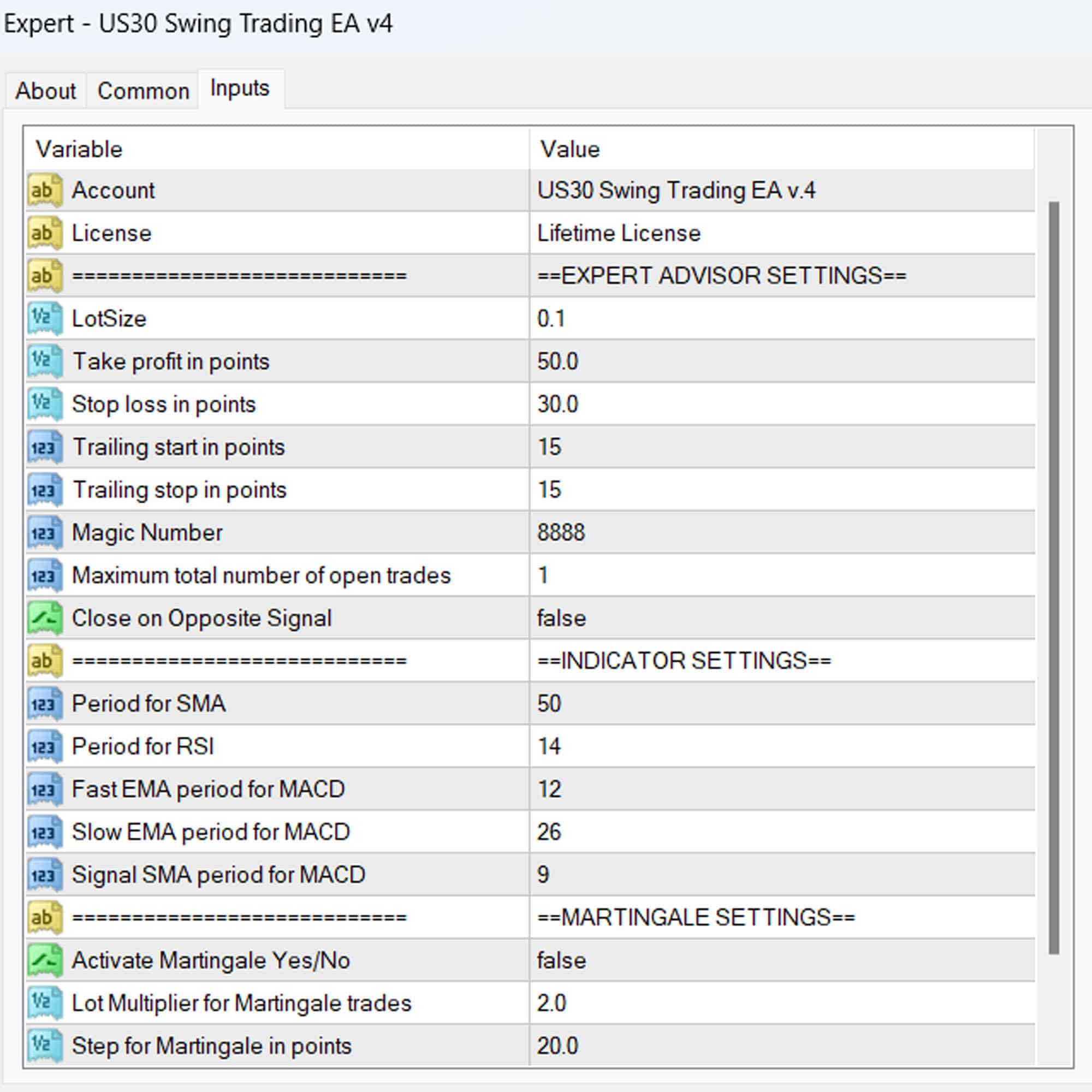

The US30 Swing Trading EA seamlessly integrates a trailing stop mechanism to secure profits as trades move favorably. Furthermore, it offers an optional Martingale strategy to enhance recovery from losses, ensuring adaptability in varying market conditions.

Key Features: Cutting-Edge Tools for Superior Performance

- Precision Signal Generation: Utilizes SMA, RSI, and MACD for accurate buy and sell signals, thereby enhancing trading precision.

- Dynamic Risk Management: You can customize lot sizes, take profit, stop loss, and trailing stop parameters to suit your risk appetite and trading strategy. Additionally, this enables you to adjust your risk exposure effectively.

- Martingale Strategy: This optional feature increases lot sizes for potential loss recovery. Additionally, it adjusts trading volumes based on market conditions, ensuring flexibility and responsiveness.

- Automatic Trade Closure: Trades are efficiently closed based on opposite signals, optimizing overall trading performance. Moreover, this feature minimizes potential losses during market reversals.

- User-Friendly Configuration: Simplifies parameter adjustments, ensuring alignment with your trading goals and risk tolerance, thus facilitating ease of use.

Why Choose US30 Swing Trading EA?

Opting for the US30 Swing Trading EA equips you with a powerful tool designed to maximize your trading potential. Here’s why it stands out:

- Specialized for US30: Specifically tailored for the US30 index, ensuring precise performance in US30 market conditions. Furthermore, this specialization enhances its effectiveness in US30 trading scenarios.

- Robust Indicator Combination: It integrates multiple indicators, thereby enhancing signal reliability and trade execution. Additionally, this combination provides comprehensive market insights.

- Comprehensive Risk Management: Offers extensive settings for effective risk control and profitability enhancement, thus empowering traders. Moreover, these risk management tools ensure consistent performance.

- Lifetime License: Provides a one-time purchase with lifetime access and updates, delivering exceptional value and long-term benefits. Additionally, this lifetime license guarantees uninterrupted access to future updates.

Elevate Your Trading with US30 Swing Trading Expert Advisor

The US30 Swing Trading EA for Metatrader 4 by KOKOSHELL serves as your gateway to achieving consistent trading success. By harnessing advanced technical indicators and robust risk management strategies, this EA offers a reliable solution for traders seeking to optimize their performance in the US30 market.

Invest in your trading future with the US30 Swing Trading Expert Advisor for MT4 (Metatrader 4) and take control of your trading journey today. Secure your lifetime license and trade smarter.

Carlos Martinez –

Profits skyrocketed!

Olivia Ramirez –

Signals are accurate, easy to use.

Ethan Garcia –

Decent tool, lacks input parameters, good price. Needs backtesting.

Mia –

Outstanding results. My trades are more profitable and less stressful now.

Lucas Rivera –

This tool made a huge difference in my trading success. Consistent and reliable signals.

Sophia Lopez –

Effective for swing trading. Signals are reliable, but more parameters would be nice.

Noah Sanchez –

Excellent performance. Easy to integrate and delivers consistent profits.

Ava Brown –

Great for swing trades. Accurate signals, but needs more customization options.

Emily Johnson –

My trading has never been better. Profits have increased significantly since using this tool. Highly recommend for serious traders.

Jack Hernandez –

Good performance, but lacks customization. Great price, needs backtesting for optimal results.

William Adams –

This trading advisor is outstanding! The setup was quick and easy, and the profits have been substantial. The strategy is effective, and the risk management features are excellent. It has transformed my trading experience into something highly profitable and enjoyable. Highly recommended!