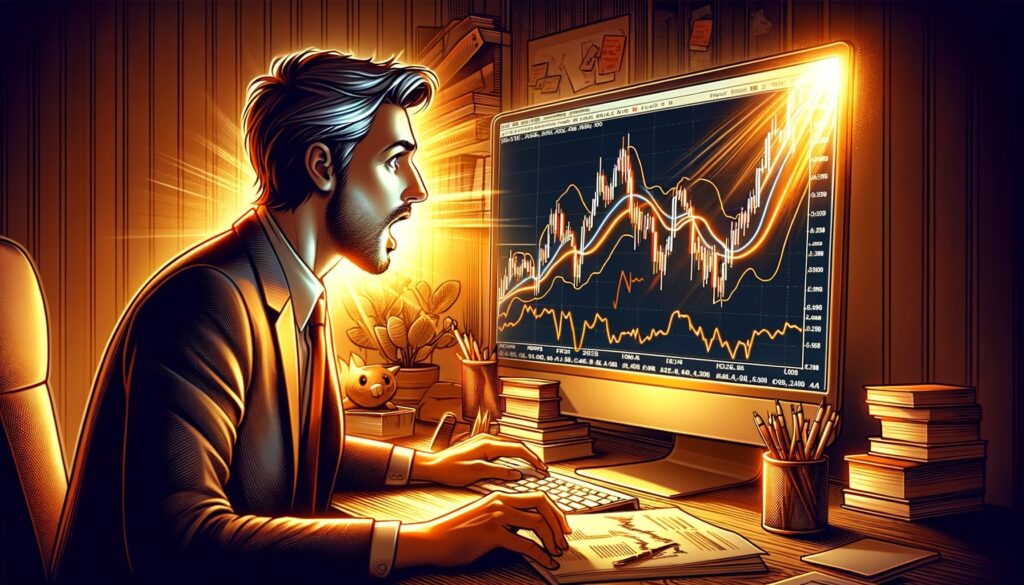

In the ever-changing world of Forex trading, mastering the art of trend analysis is crucial for success. Among the plethora of technical indicators available, moving averages stand out for their simplicity and effectiveness. This comprehensive guide delves deep into using MA Indicator for trend analysis in Forex markets, providing traders with the insights needed to harness this tool for better decision-making and strategy development.

Unlocking the Potential of Moving Averages

Understanding Moving Averages

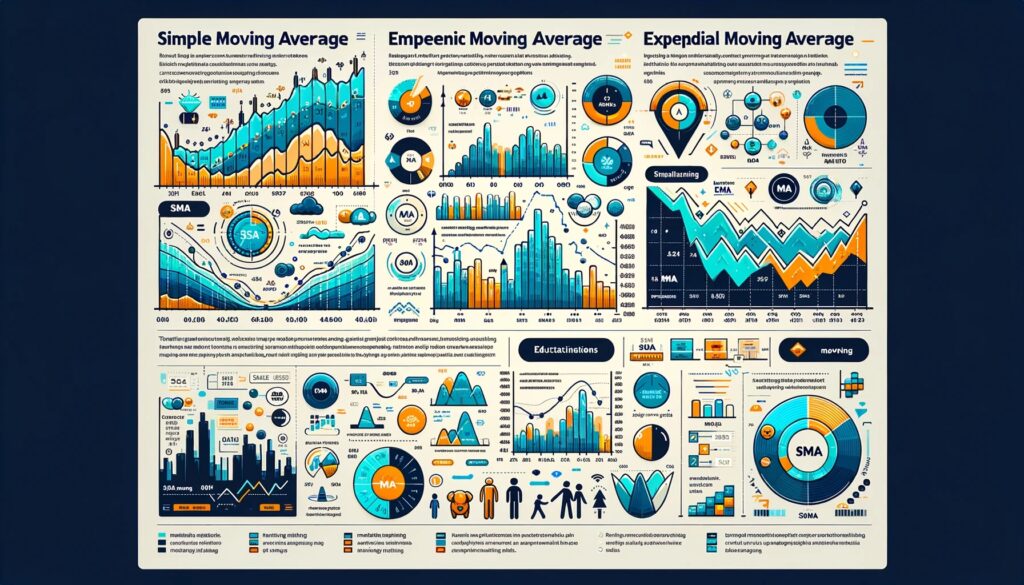

At its core, a moving average smooths out price data over a specific time frame to mitigate the effects of short-term volatility, offering a clearer view of the trend direction. The two primary types of MA Indicator are:

- Simple Moving Average (SMA): Calculates the average price of a currency pair over a specific number of periods, giving equal weight to each price point.

- Exponential Moving Average (EMA): Similar to SMA but gives more weight to recent prices, making it more responsive to new information.

Why Use Moving Averages for Trend Analysis?

Moving averages serve as a foundation for identifying market trends, signaling potential reversals, and providing dynamic support and resistance levels. By accurately interpreting MA Indicator, traders can:

- Detect bullish or bearish market trends.

- Identify potential entry and exit points.

- Gauge market momentum.

Strategic Applications of Moving Averages

Single Moving Average Trend Analysis

A single moving average can help identify the overall trend direction. For instance, if the price consistently remains above a 50-day SMA, it suggests an uptrend. Conversely, prices below this average indicate a downtrend.

The Power of Dual Moving Averages

Implementing a dual moving average strategy involves using two SMAs or EMAs with different time frames (e.g., a 50-day and a 200-day). The crossover of these moving averages becomes a powerful signal:

- Golden Cross: When the shorter-term moving average crosses above the longer-term average, it signals a potential bullish trend.

- Death Cross: Conversely, if the shorter-term average crosses below the longer-term average, it may indicate a bearish trend.

EMA for Quick Trend Confirmation

EMAs are invaluable for traders looking for quicker trend confirmations. For example, applying a 12-EMA and a 26-EMA to a volatile pair like EUR/JPY can offer early signals for entering or exiting trades, based on the faster response of EMAs to price changes.

Practical Examples and Insights

Analyzing Trend Strength with SMAs

Consider the GBP/USD pair with applied 100-day and 200-day SMAs. If both moving averages are trending upwards and the price is above both SMAs, it indicates a strong uptrend. A widening gap between the two SMAs can further confirm the trend’s strength.

Dynamic Support and Resistance Levels

Moving averages can act as dynamic support and resistance levels. In a scenario where the USD/CHF pair retraces towards a rising 50-day EMA and bounces off, this EMA serves as a dynamic support level, offering traders a potential buying opportunity.

Best Practices for Enhancing Trend Analysis with Moving Averages

Optimizing Time Frame Selection

The selection of time frames for moving averages should align with your trading style. Day traders may prefer shorter periods (like 10-EMA or 20-SMA), while swing traders or long-term investors might opt for longer periods (such as 50-SMA or 200-EMA) to filter out market noise and focus on significant trends.

Combining Moving Averages with Other Technical Tools

For a holistic approach, pair moving averages with other technical indicators like the MACD for momentum analysis or the RSI for overbought/oversold signals. This combination can validate trend signals and enhance trade accuracy.

Conclusion

Moving averages are a cornerstone of effective trend analysis in Forex trading, offering clarity amidst market volatility. By mastering moving averages — understanding their types, implementing strategic applications, and learning from practical examples — traders can significantly improve their ability to spot trends, time their trades, and navigate the Forex markets with confidence. Remember, the key to leveraging MA Indicator successfully lies in continuous learning, practice, and integrating them within a comprehensive trading strategy that includes sound risk management practices.

FAQs on Moving Averages for Trend Analysis

What is a moving average in Forex trading?

A moving average is a technical analysis tool that smooths out price data over a specified period by creating a constantly updated average price. It’s used to identify the direction of the trend, smooth out price volatility, and can serve as support or resistance levels.

How do I choose between a Simple Moving Average (SMA) and an Exponential Moving Average (EMA)?

The choice between SMA and EMA depends on your trading style and objectives. SMAs are better suited for identifying long-term trends as they give equal weight to all prices in the period. EMAs, on the other hand, place more emphasis on recent prices, making them more responsive to new information and better for short-term trading decisions.

Can moving averages predict future market movements?

While moving averages can provide insights into potential market directions based on past price data, they cannot predict future market movements with certainty. They are best used as part of a broader analysis strategy that includes other indicators and market analysis techniques.

How do I use moving averages to identify a trend?

To identify a trend using moving averages, look at the direction of the moving average line. If it’s moving upwards, the market is likely in an uptrend. If it’s moving downwards, the market is likely in a downtrend. A flat moving average suggests a sideways or consolidating market.

What is a moving average crossover, and how can it inform my trading?

A moving average crossover occurs when two moving averages of different lengths cross over each other. A bullish crossover (where the short-term moving average crosses above the long-term average) can signal the beginning of an uptrend, while a bearish crossover (where the short-term average crosses below the long-term average) might indicate the start of a downtrend.

How do I determine the best period for a MA Indicator in Forex trading?

The “best” period for a moving average varies based on your trading strategy and the market conditions. Shorter periods (like 10 or 20) are more responsive and useful for short-term trading, while longer periods (like 50 or 200) are better for identifying long-term trends. Experimentation and backtesting on historical data can help determine the most effective periods for your specific trading style.

Can I use moving averages as a standalone trading strategy?

While moving averages can be an effective tool for trend analysis, relying on them as a standalone trading strategy is not recommended. They work best when combined with other technical indicators and fundamental analysis to confirm signals and enhance trading decisions.

How do I adjust MA Indicator for volatile Forex markets?

In highly volatile markets, traders might adjust moving averages by shortening the period to make the moving average more responsive to price changes. Alternatively, applying more weight to the moving average (switching from SMA to EMA) can also help in quickly capturing market movements.