In the ever-evolving world of Forex trading, where market conditions can shift with lightning speed, having a reliable set of tools to navigate these changes is crucial. Among the myriad of technical indicators available, the Commodity Channel Index (CCI) stands out as a hidden gem. Originally designed for commodities, the CCI has proven its worth in the Forex market, offering traders a unique perspective on market momentum, trend direction, and potential reversal points. This detailed blog post delves into the workings of the CCI, showcasing its application in Forex trading and how it can enhance your trading strategy.

Understanding the Commodity Channel Index

The Commodity Channel Index (CCI) is a technical analysis indicator developed by Donald Lambert in 1980. It measures the variation of a currency’s price from its statistical mean, highlighting potential overbought or oversold conditions in the market. The CCI is calculated using the average of the high, low, and closing prices over a specific period, typically 20 days, and then comparing that average with the average price over the same period.

The Mechanics of CCI

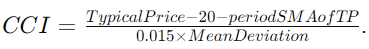

The CCI is more than just a measure of price variation; it’s a versatile tool that can indicate momentum, trend strength, and market reversals. Its calculation involves several steps:

- Calculate the Typical Price for each period: (High + Low + Close) / 3.

- Compute the 20-period Simple Moving Average (SMA) of the Typical Price.

- Calculate the Mean Deviation.

- Finally, compute the CCI using the formula:

The “0.015” in the formula is a constant used to ensure that approximately 75% of the CCI values fall within the -100 to +100 range, highlighting the deviation of price from its statistical mean.

Applying CCI in Forex Trading

Identifying Overbought and Oversold Conditions

One of the primary uses of the CCI in Forex trading is to identify overbought and oversold conditions. A CCI reading above +100 signals that the currency is overbought and may be primed for a price reversal or pullback. Conversely, a reading below -100 indicates an oversold condition, suggesting a potential upward bounce in price.

Spotting Trend Reversals

The CCI can also be a valuable tool in spotting trend reversals. Divergence between the CCI and the price action of a currency pair is a strong indicator of an impending reversal. For instance, if the price of a currency pair is making new highs while the CCI fails to surpass its previous highs, it could signal a weakening trend and a possible reversal.

Momentum Trading with CCI

Momentum traders can use the CCI to gauge the strength of a market trend. A consistently high CCI value (above +100) indicates strong bullish momentum, while a consistently low CCI value (below -100) suggests strong bearish momentum. These conditions can offer traders opportunities to join the trend until signs of weakening appear.

Strategies for Using CCI in Forex Trading

Entry and Exit Points

The CCI can help traders identify optimal entry and exit points. Entering a trade when the CCI moves out of the overbought or oversold territory can catch the early momentum of a price correction or reversal. Similarly, exiting a trade when the CCI reaches extreme levels again can help lock in profits before the momentum fades.

Combining CCI with Other Indicators

For a more robust analysis, traders often combine the CCI with other indicators, such as the Relative Strength Index (RSI) or Moving Averages. This combination can help confirm signals provided by the CCI, reducing the likelihood of false signals and improving the overall accuracy of the trading strategy.

Conclusion: Unleashing the Potential of CCI in Forex Trading

The Commodity Channel Index is a powerful and versatile indicator that, when used correctly, can significantly enhance a trader’s ability to make informed decisions in the Forex market. Its ability to identify overbought and oversold conditions, spot potential trend reversals, and gauge market momentum makes it an invaluable tool in a trader’s arsenal. By understanding how to apply the CCI effectively and combining it with other technical analysis tools, traders can uncover new trading opportunities and refine their strategies for greater success in the Forex market.

FAQs About Commodity Channel Index (CCI) in Forex Trading

What is the Commodity Channel Index (CCI) used for in Forex trading?

The Commodity Channel Index (CCI) is a versatile technical analysis tool used in Forex trading to identify overbought and oversold conditions, gauge market momentum, and spot potential trend reversals. By measuring the deviation of a currency pair’s price from its statistical average, the CCI helps traders make informed decisions on entry and exit points.

How is the Commodity Channel Index (CCI) calculated?

The CCI is calculated by determining the difference between a currency pair’s typical price and its simple moving average (SMA) over a specific period, typically 20 days. This difference is then divided by 0.015 times the mean deviation of the typical price. The formula encapsulates price movement and volatility to provide a standardized indicator value.

What do the Commodity Channel Index levels indicate?

CCI levels can indicate different market conditions:

- A CCI value above +100 suggests that the currency pair is overbought, potentially signaling a price pullback or reversal.

- A CCI value below -100 indicates that the currency pair is oversold, hinting at a possible upward price correction.

- Values within the -100 to +100 range are considered within the normal fluctuation range, indicating no strong buying or selling pressure.

Can the Commodity Channel Index be used to identify trend reversals?

Yes, the CCI is effective in spotting potential trend reversals, especially when divergences occur between the CCI and price action. For example, if a currency pair’s price hits a new high but the CCI fails to reach a new high, it may indicate a weakening trend and potential reversal.

How can traders use Commodity Channel Index for momentum trading?

Momentum traders can utilize the CCI by looking for sustained high or low values that indicate strong market momentum. A consistently high CCI (above +100) may suggest strong bullish momentum, while a consistently low CCI (below -100) indicates bearish momentum, helping traders decide when to enter or exit trades based on trend strength.

Is the Commodity Channel Index only suitable for short-term trading?

While the CCI is popular among short-term traders due to its sensitivity to price changes, it can also be adjusted for longer-term analysis by increasing the calculation period. By doing so, traders can smooth out the indicator’s fluctuations and use it for medium to long-term trend analysis and trading decisions.

How should the CCI be interpreted in conjunction with other indicators?

The CCI works best when used in conjunction with other indicators to confirm signals and reduce the likelihood of false positives. For instance, pairing the CCI with trend indicators like moving averages or momentum indicators like the Relative Strength Index (RSI) can provide a more comprehensive view of market conditions and enhance trading strategies.

What are the limitations of using the CCI in Forex trading?

The primary limitation of the CCI is its tendency to produce false signals during periods of extreme market volatility or when price movements are erratic. Additionally, relying solely on the CCI without considering broader market trends or economic indicators may lead to misleading interpretations of market sentiment.

Can the CCI predict market tops and bottoms?

While the CCI can indicate overbought and oversold conditions, suggesting potential market tops or bottoms, it should not be used as a standalone predictor. Traders should look for additional confirmation through price action, other technical indicators, or fundamental analysis before making trading decisions based on CCI signals.

How can traders adjust the sensitivity of the CCI?

Traders can adjust the sensitivity of the CCI by changing the period over which it is calculated. A shorter period will make the CCI more sensitive to price changes, producing more frequent signals. Conversely, a longer period will smooth out the indicator, reducing sensitivity and producing fewer signals, which may be more significant for longer-term trends.