Unleash the Potential of BTC Day Trading EA

Learn how to make money with BTC Day Trading EA, be profitable, and optimize your trading strategy using the BTC Day Trading EA. This expert advisor is crafted to capitalize on day trading opportunities in the BTC market, utilizing sophisticated algorithms to identify and exploit market trends. BTC, known for its high volatility, offers excellent opportunities for day trading. Automating your trading with BTC Day Trading EA allows you to focus on strategic analysis while the EA executes trades efficiently, reducing the stress of manual trading.

Furthermore, this EA features a comprehensive suite of tools designed for traders aiming to maximize their returns. It includes customizable settings for lot sizes, stop losses, take profits, and trailing stops, enabling adaptation to various market conditions and trading styles. The EA’s advanced use of technical indicators such as MACD, RSI, and ATR ensures you capitalize on market movements. Additionally, risk management tools like Martingale strategies and daily profit/loss limits help safeguard your investments.

To unlock the full potential of BTC Day Trading EA, understanding and utilizing its capabilities is essential. This guide will explore the significance of backtesting, fine-tuning input parameters, implementing risk management strategies, and selecting optimal trading hours to help you be profitable with this versatile EA.

How to Make Money with BTC Day Trading EA Through Backtesting

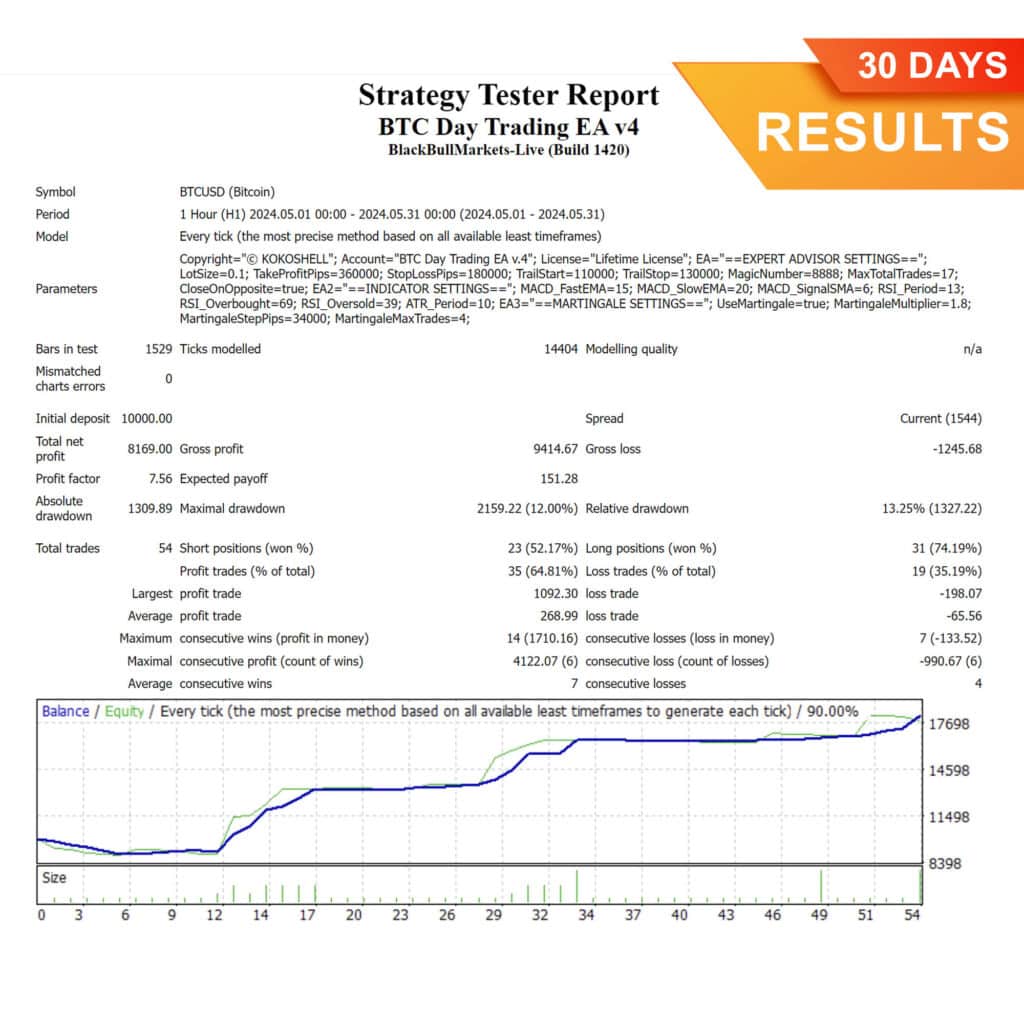

Backtesting is crucial to know how to optimize and make money with BTC Day Trading EA and be profitable. This process simulates trading with historical data, offering insights into how the EA would perform under various market conditions. Identifying the most effective input parameters tailored to your trading style and risk tolerance is a major benefit of backtesting.

Why Backtesting is Essential

- Discover Ideal Settings: Testing different parameter combinations through backtesting helps find the most profitable settings for the EA. Additionally, adjusting take profit and stop loss levels can significantly impact performance.

- Analyze Performance Metrics: Through backtesting, you can review key metrics such as win rate, average profit/loss per trade, and maximum drawdown. These metrics provide a clearer picture of the EA’s potential profitability and risk.

- Boost Confidence: Ultimately, seeing how the EA has performed historically increases your confidence in its ability to handle live trading scenarios. Knowing that your strategy has been successful in the past provides reassurance.

- Adapt to Market Changes: As markets evolve, past performance might not guarantee future success. Consequently, regular backtesting ensures your strategy remains relevant to current market conditions.

Example of a Backtesting Process

Consider testing the BTC Day Trading EA over two years of historical data. Begin with the default parameters and observe the results. If the average drawdown exceeds your risk tolerance, tighten the stop loss to reduce drawdown, even if it affects the win rate. Through continuous tweaking, find a balance where the profit factor is acceptable, and the drawdown is manageable. For instance, adjusting the stop loss from 50 pips to 45 pips might help in reducing drawdown without compromising profitability significantly. This iterative process of backtesting and refining helps optimize your strategy.

For comprehensive insights into mastering backtesting techniques, don’t miss The Ultimate Guide for Backtesting. This resource is designed to elevate your trading strategy, ensuring you maximize the potential of your BTC Day Trading EA. Explore it now at kokoshell.com/backtesting.

How to Optimize BTC Day Trading EA Input Parameters

Although BTC Day Trading EA comes with default settings, fine-tuning these parameters can significantly enhance profitability. Experimenting with different lot sizes, stop losses, take profit levels, trailing stops, and indicator settings is essential to be profitable. Rigorous backtesting helps customize these settings to find what works best for you. Knowing how to make money with BTC Day Trading EA involves constant optimization.

Key Parameters to Adjust

- Lot Size: Adjusting the lot size determines the trade volume and potential profit or loss. Therefore, conservative traders might start with smaller lot sizes to mitigate risk.

- Take Profit: Setting an optimal take profit level ensures that profits are secured when the market moves in your favor.

- Stop Loss: A well-placed stop loss protects your capital from significant market reversals.

- Trailing Stop: Moreover, this feature locks in profits by moving the stop loss level as the trade gains profitability.

- Indicator Parameters: Fine-tuning settings for technical indicators like MACD, RSI, and ATR is crucial for generating accurate trading signals.

Example of Parameter Fine-Tuning

Suppose you start with a lot size of 0.1, a take profit of 100 pips, and a stop loss of 50 pips. During backtesting, you notice better results with a take profit of 90 pips and a stop loss of 45 pips. Setting the trailing stop to activate at 30 pips with a trailing step of 20 pips maximizes profits. Additionally, adjusting the MACD fast EMA period to 12, the slow EMA period to 26, and the signal SMA period to 9, alongside fine-tuning the RSI period from 14 to 12 and the ATR period from 14 to 10, can enhance signal accuracy. This fine-tuning process involves testing various combinations to find the most effective settings to optimize BTC Day Trading EA.

Benefits of Customization

- Maximized Profits: Therefore, finding the optimal take profit and stop loss levels maximizes each trade’s profitability.

- Reduced Drawdowns: Adjusting the stop loss minimizes losses during unfavorable market conditions.

- Enhanced Risk Management: Customizing lot sizes, trailing stops, and indicator parameters aligns the EA’s risk profile with your personal risk tolerance.

How to Embrace Risk Management for Long-Term Success with BTC Day Trading EA

Risk management is vital to know how to make money with BTC Day Trading EA and be profitable. Implementing strategies such as setting daily profit and loss limits, and using the Martingale method cautiously, protects your investments. Ultimately, maximizing gains while minimizing potential losses is the goal.

Risk Management Techniques

- Daily Profit and Loss Limits: Setting these limits ensures that you secure profits and cap losses daily. This prevents overtrading and protects your capital.

- Martingale Strategy: While this strategy can help recover losses quickly, it exponentially increases risk. Use it sparingly and with strict limits.

- Position Sizing: Adjusting your lot size based on account equity helps maintain a consistent risk level.

Practical Example of Risk Management

Imagine setting a daily profit target of $500 and a maximum daily loss of $300. On a particular trading day, the EA hits the profit target by midday, stopping further trading and securing the profits. Conversely, if the EA reaches the maximum daily loss, it halts trading to prevent further losses. This disciplined approach ensures long-term profitability without taking excessive risks.

How Trading Hours Impact Your Strategy with BTC Day Trading EA

Trading during optimal hours can significantly enhance the performance of BTC Day Trading EA. Knowing how to make money with BTC Day Trading EA involves recognizing periods of high market liquidity and volatility. Adjust your EA’s settings to operate within these times to capture the most lucrative trading opportunities.

Optimal Trading Times

- London Session: Characterized by high liquidity and significant price movements.

- New York Session: Often overlaps with the London session, offering excellent trading opportunities.

- Asian Session: Generally quieter but can present steady trends.

Benefits of Trading at Optimal Times

- Increased Liquidity: Higher liquidity means more buyers and sellers, resulting in tighter spreads and better trade execution.

- Higher Volatility: Greater price movements provide more opportunities for profitable trades.

- Reduced Slippage: Therefore, high liquidity periods reduce the risk of slippage, ensuring your trades are executed at desired prices.

If you don’t know the trading hours, visit forex.timezoneconverter.com. Select your time zone to instantly view market open and close times.

Example of Adjusting Trading Hours

Suppose backtesting shows the EA performs best during the London and New York sessions. Set the EA to start trading at 8:00 AM GMT and stop at 5:00 PM GMT. This adjustment ensures the EA operates during peak market hours, thus increasing the likelihood of capturing profitable trades. This step is crucial to optimize BTC Day Trading EA for better performance.

Conclusion: Your Path to Profitable Trading with BTC Day Trading EA

To be profitable and know how to make money with BTC Day Trading EA, adopting a well-thought-out strategy, conducting rigorous backtesting, and implementing robust risk management practices is essential. This powerful tool can transform your trading experience by automating processes and maximizing efficiency. However, the true potential of the EA is unlocked when you take the time to customize and optimize its settings to align with your unique trading style and goals.

Backtesting is your ally in this journey. It allows you to fine-tune your parameters and understand the EA’s performance under various market conditions. Continuously refining your strategy helps you adapt to ever-changing market dynamics and stay ahead of the curve.

Risk management should always be a priority. Implementing strict daily profit and loss limits, and using strategies like Martingale cautiously, will protect your capital and ensure long-term success. Additionally, adjusting your trading hours to coincide with periods of high liquidity and volatility will enhance your trading outcomes.

By embracing these principles and diligently working on your trading approach, you can indeed be profitable and know how to optimize and make money with BTC Day Trading EA. The journey to trading success is paved with continuous learning, adaptation, and disciplined execution. With the BTC Day Trading EA by your side, you’re well-equipped to navigate the complexities of the forex market and achieve your financial goals. Always remember to optimize BTC Day Trading EA to stay profitable.

Top FAQs about How to Make Money with BTC Day Trading EA

Can I use BTC Day Trading EA with other currency pairs or commodities?

While BTC Day Trading EA is specifically designed for trading Bitcoin, you can potentially adapt it to other currency pairs or commodities. However, it is crucial to conduct thorough backtesting and optimization for each new instrument to ensure the EA performs effectively under different market conditions. Different assets have unique characteristics, such as volatility and liquidity, which may require adjustments to the EA’s parameters. Always start with a demo account to test the EA on the new instrument before deploying it in a live trading environment to mitigate risks and optimize BTC Day Trading EA for diverse market conditions.

How does BTC Day Trading EA utilize technical indicators for trading?

BTC Day Trading EA uses a combination of advanced technical indicators to identify profitable trading opportunities. It primarily leverages MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), and ATR (Average True Range) to analyze market trends and price movements. The MACD helps determine trend direction, RSI helps determine overbought and oversold conditions, signaling potential entry and exit points. ATR measures market volatility and helps set stop loss levels. By integrating these indicators, the EA can make informed decisions to optimize trading performance and maximize profits.

What are the common pitfalls to avoid when using BTC Day Trading EA?

To maximize your success with BTC Day Trading EA, it is essential to be aware of and avoid common pitfalls:

- Overtrading: Avoid setting the EA to trade excessively, as this can lead to higher transaction costs and increased risk.

- Ignoring Risk Management: Always implement strict risk management strategies, such as setting stop losses and profit targets.

- Lack of Regular Updates: Regularly update and optimize the EA to adapt to changing market conditions and maintain its effectiveness.

- Neglecting Market News: Keep an eye on economic news and events that can impact the market, as sudden volatility can affect the EA’s performance.

By being mindful of these pitfalls, you can improve your trading outcomes and maintain consistent profitability.

How can I customize BTC Day Trading EA to suit my trading goals?

Customizing BTC Day Trading EA to suit your specific trading goals involves adjusting various parameters and settings:

- Trading Style: Define whether you prefer aggressive or conservative trading and adjust the lot sizes, stop losses, and take profits accordingly.

- Timeframes: Choose the trading timeframes that align with your strategy, such as short-term (minutes) or long-term (hours).

- Indicators: Modify the technical indicators and their settings, such as MACD, RSI, and ATR, to better fit your analysis approach.

- Risk Tolerance: Set parameters that reflect your risk tolerance, such as maximum drawdown limits and trailing stops.

By tailoring these settings, you can align the EA with your trading preferences and goals, thereby enhancing its effectiveness.

What are the benefits of using a VPS (Virtual Private Server) for BTC Day Trading EA?

Using a VPS (Virtual Private Server) for BTC Day Trading EA offers several benefits:

- 24/7 Operation: A VPS allows the EA to run continuously, without interruptions due to power outages or internet connectivity issues.

- Lower Latency: VPS servers are often located near trading servers, resulting in faster execution speeds and reduced slippage.

- Enhanced Security: VPS providers typically offer robust security measures to protect your trading data and account.

- Resource Management: A VPS dedicates specific resources to your EA, ensuring optimal performance without affecting your local computer’s resources.

Overall, using a VPS can significantly improve the reliability and performance of your BTC Day Trading EA, helping you achieve better trading results.