Elevate Your Trading with ATR EA

Unlock the full potential of your trading strategy with the ATR EA (Expert Advisor) for MT4 (Metatrader 4) by KOKOSHELL. Moreover, this expert advisor is specifically designed to enhance your trading decisions by using the powerful Average True Range (ATR) indicator. Whether you are new to trading or an experienced professional, the ATR Expert Advisor for Metatrader 4 provides the necessary tools to achieve consistent and profitable trading results.

How It Works: Automated Trading with the ATR Indicator

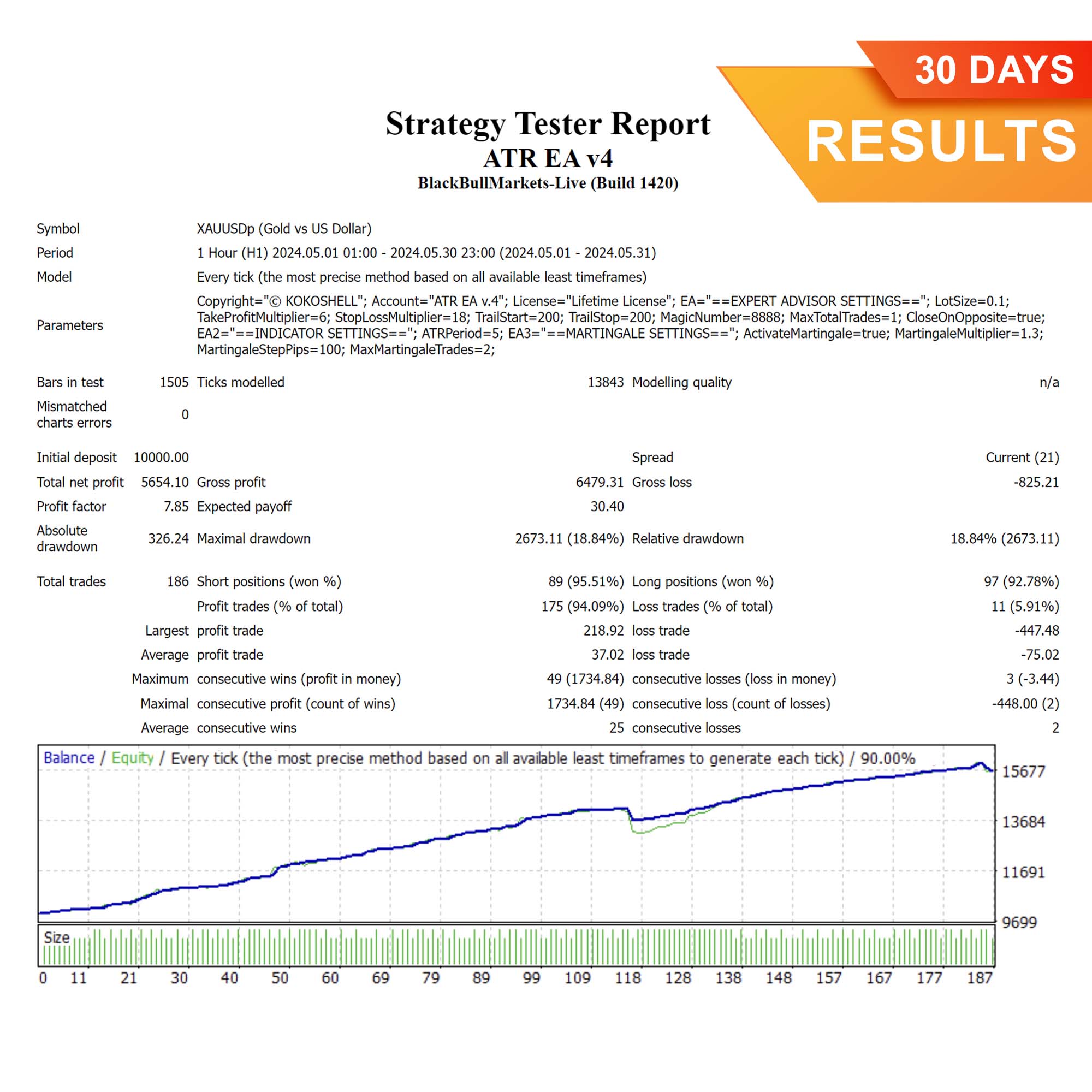

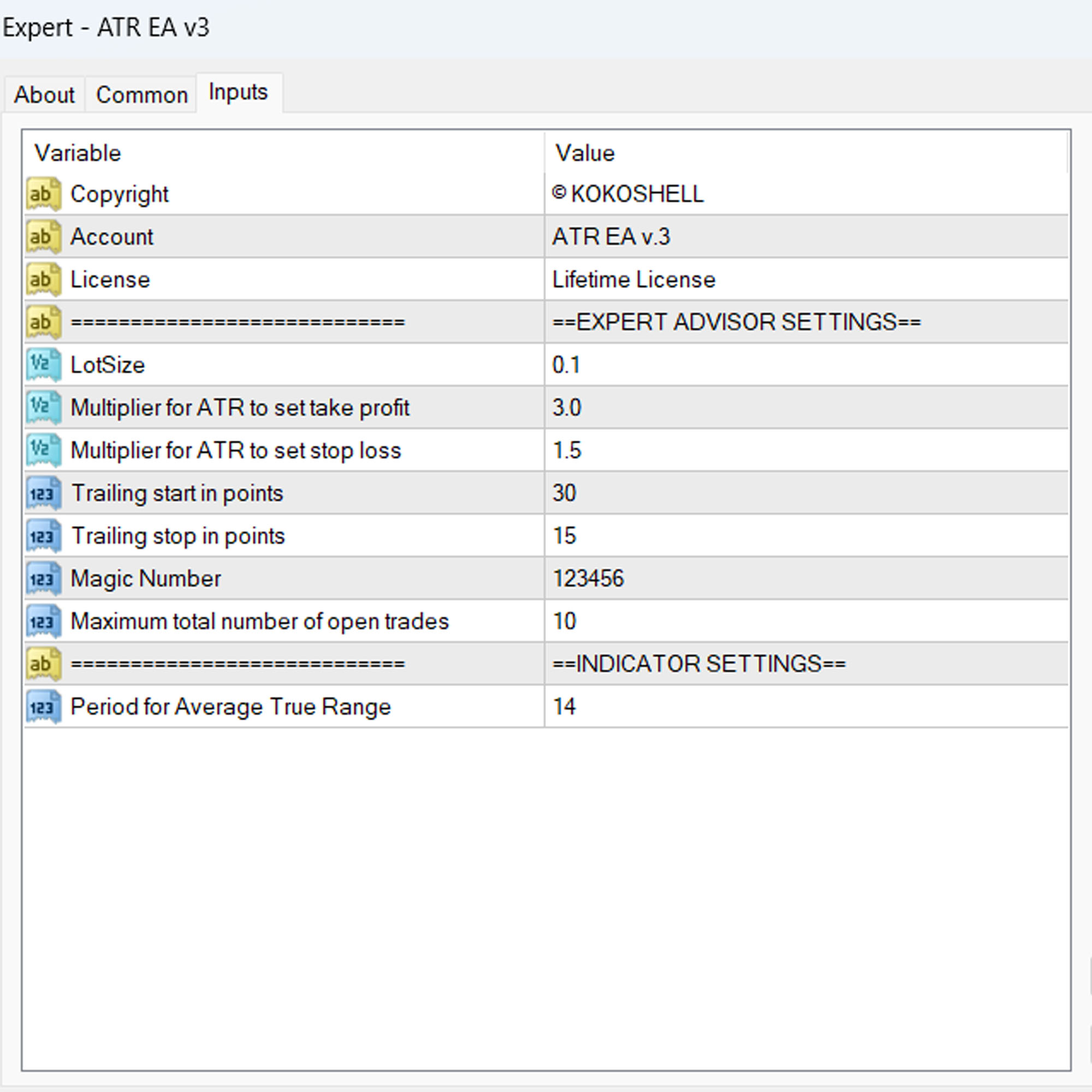

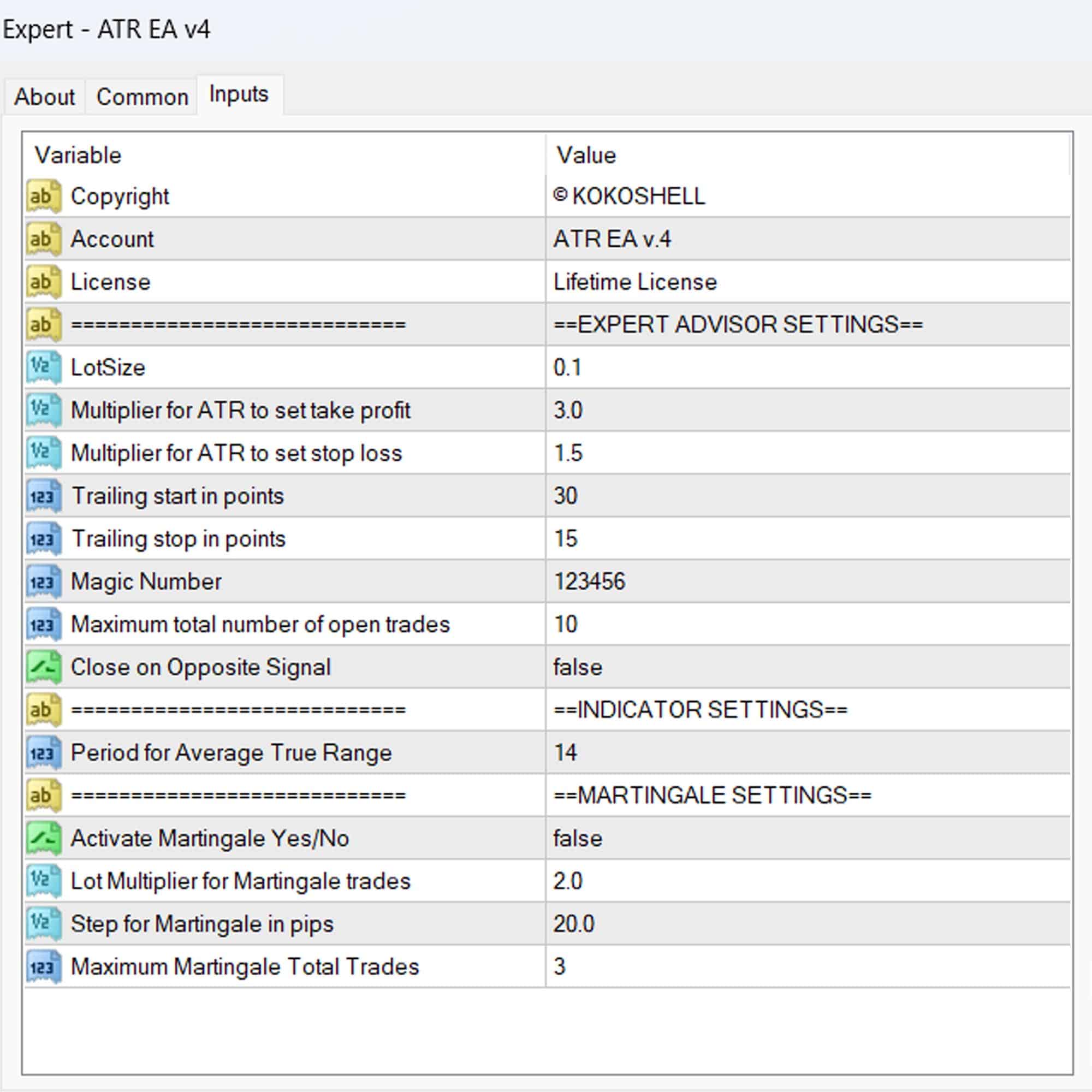

The ATR EA leverages the Average True Range indicator to measure market volatility and set precise entry and exit points. By analyzing the ATR values, the EA determines optimal stop loss and take profit levels. Consequently, this ensures effective risk management.

Furthermore, you can customize parameters such as lot size, take profit multiplier, stop loss multiplier, and trailing stops to match your trading strategy. Additionally, an optional Martingale strategy can be activated to increase lot sizes after losses. Thus, it aims to recover losses and secure profits.

Key Features

- ATR-Based Strategy: Uses the ATR indicator to gauge market volatility and set accurate stop loss and take profit levels.

- Customizable Settings: Adjust lot sizes, take profit multipliers, stop loss multipliers, and trailing stops to fit your trading style.

- Martingale System: Includes an optional feature that increases trade sizes after losses to recover and achieve profits.

- Effective Risk Management: Provides settings for maximum total trades, trailing stops, and close-on-opposite-signal features to manage risk effectively.

- Fully Automated Trading: Executes trades automatically based on your predefined settings, thereby reducing the need for manual intervention and emotional decision-making.

Why Choose ATR EA?

ATR EA offers reliability, flexibility, and performance. Designed to cater to various trading styles, from conservative to aggressive, this EA helps traders maximize their potential with accurate and timely trading signals. Additionally, the user-friendly interface makes it easy to set up and customize.

Moreover, the advanced features ensure you have the tools needed to succeed in the forex market. Consequently, choosing ATR Expert Advisor gives you an edge in the competitive forex market. Therefore, you can capitalize on market volatility effectively.

Achieve Consistent Success

Transform your trading experience with ATR EA by KOKOSHELL. By integrating advanced technical indicators and customizable strategies, this expert advisor empowers you to make profitable trades. Therefore, optimize your trading strategy, manage risk effectively, and achieve consistent success with ATR MT4 Expert Advisor.

Carlos Lopez –

Good tool!

Olivia Wilson –

This EA has transformed my trading strategy.

Benjamin Scott –

Good results, but needs more customization options.

Chloe White –

Fantastic tool, very accurate.

Lucas Harris –

Excellent performance, very reliable.

Sofia Thompson –

Good EA, but takes time to get used to.

Ethan Walker –

Amazing results, highly recommend.

Michael Johnson –

I was blown away by how effective this trading advisor is. It’s incredibly user-friendly and the results speak for themselves. My profits have skyrocketed, and the risk management is impeccable. The setup was quick and easy, making it perfect even for beginners. If you’re serious about trading, you need this in your toolkit!