Enhance Your Trading with the S&P500 Swing Trading EA

Unlock the full potential of your trading with the S&P500 Swing Trading EA (Expert Advisor) for MT4 (Metatrader 4), expertly developed by KOKOSHELL. This advanced trading algorithm is specifically designed for the S&P500 index. It utilizes sophisticated technical indicators to capture profitable swing trading opportunities.

Whether you are a beginner or a seasoned trader, the S&P500 Swing Trading Expert Advisor simplifies the trading process, allowing you to achieve consistent results with minimal effort.

How It Works: Intelligent Strategies for Maximized Profits

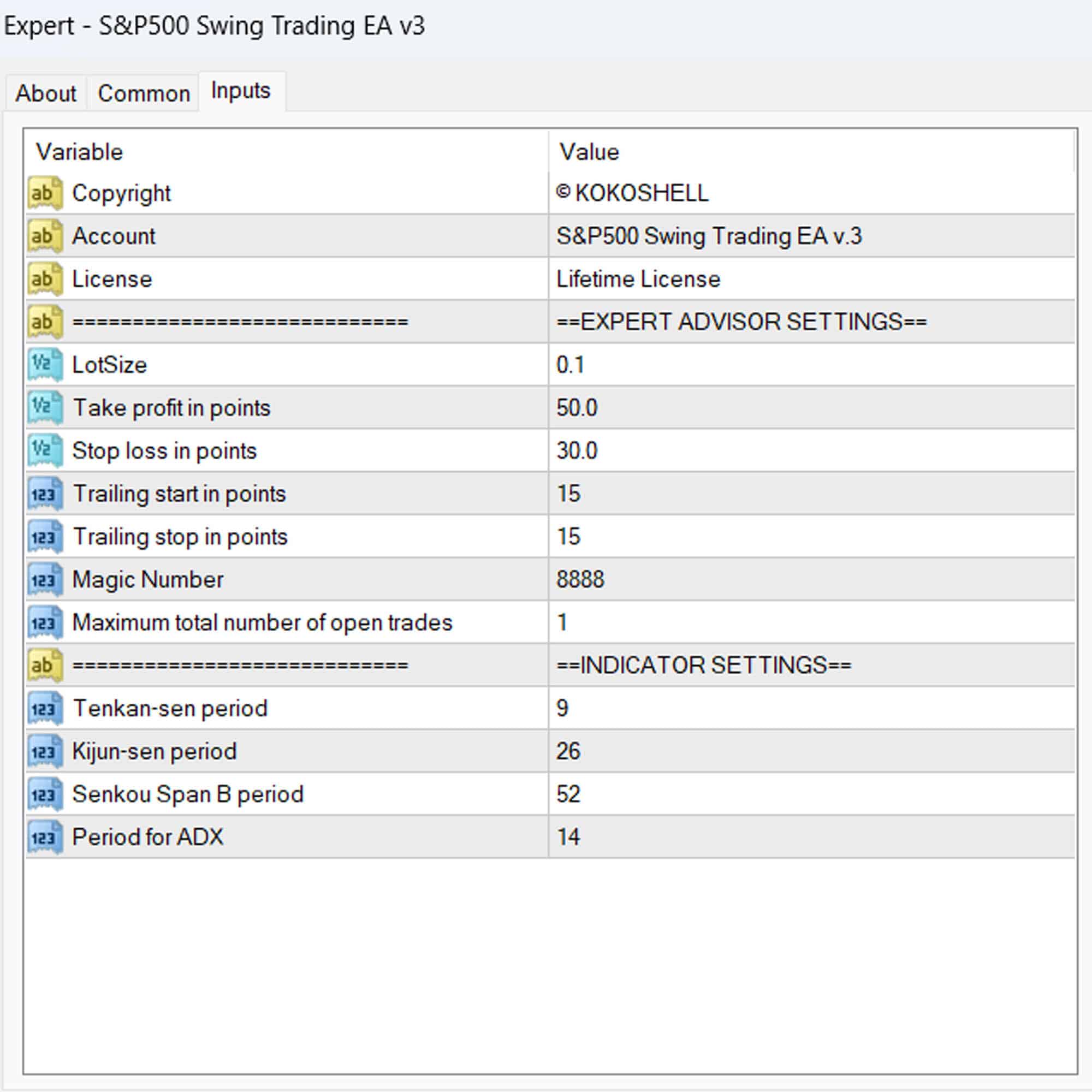

The S&P500 Swing Trading EA operates by analyzing market conditions using key indicators such as the Ichimoku Cloud and ADX. Here’s how it identifies high-probability trades:

- Buy Signal: The EA triggers a buy order when the price is above both Senkou Span A and Senkou Span B. Additionally, Tenkan-sen is above Kijun-sen, and the ADX value exceeds 25, indicating a strong trend.

- Sell Signal: Conversely, a sell order is initiated when the price is below both Senkou Span A and Senkou Span B. Moreover, Tenkan-sen is below Kijun-sen, and the ADX value is greater than 25, confirming a downward trend.

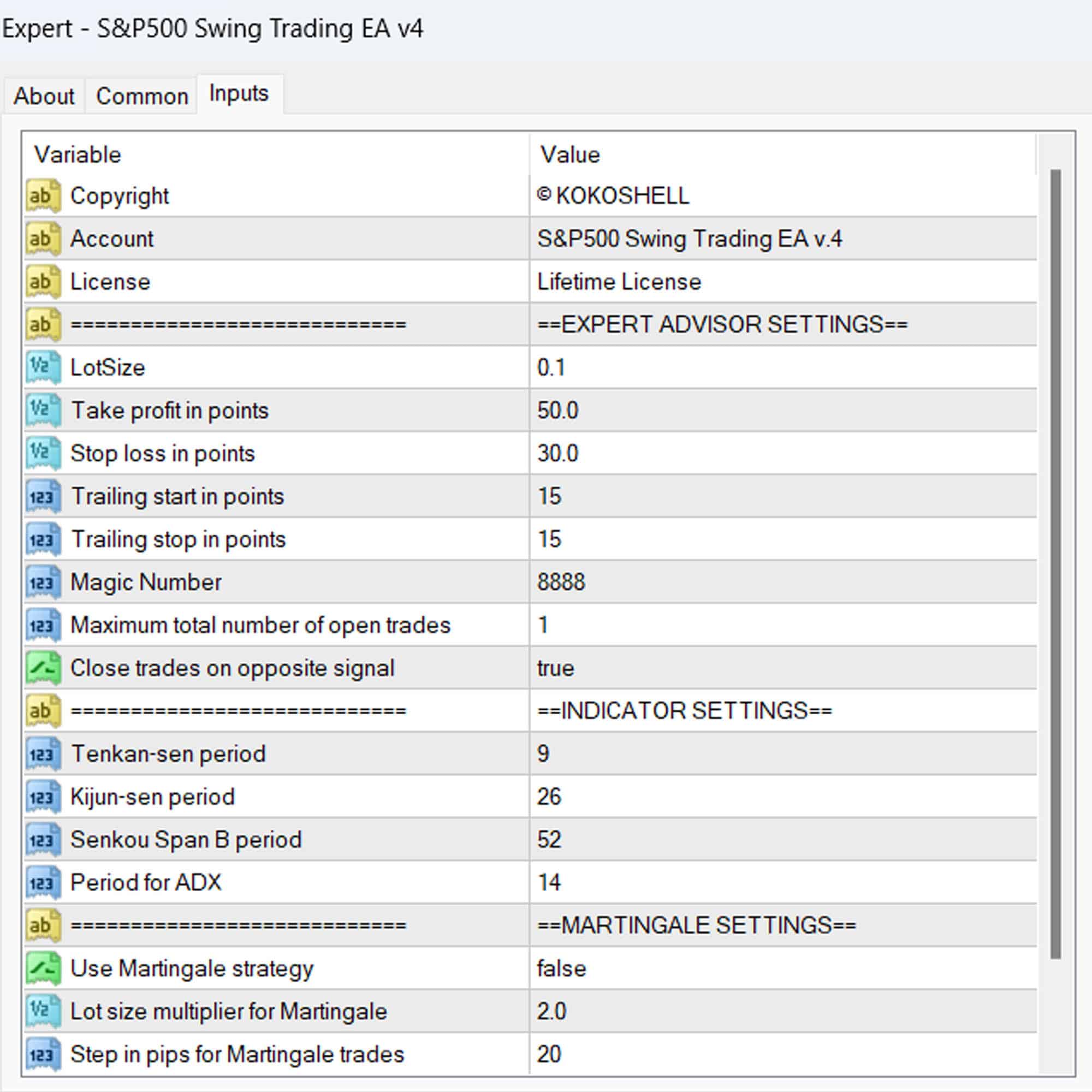

Additionally, the S&P500 Swing Trading EA incorporates a trailing stop mechanism to lock in profits as trades move favorably. Furthermore, it includes an optional Martingale strategy to recover from losses efficiently.

Key Features: Advanced Tools for Superior Trading Performance

- Precision Entry Signals: It utilizes Ichimoku Cloud and ADX for accurate buy and sell signals. Furthermore, these signals are essential for timely decision-making.

- Dynamic Trailing Stops: These adjust stop-loss levels as the trade progresses in your favor, thereby securing profits effectively. Moreover, they ensure optimal risk management.

- Martingale Strategy: An optional feature allows multiplication of lot sizes on losing trades, enhancing recovery potential. Additionally, it provides a strategic advantage in volatile markets.

- Customizable Settings: You can tailor parameters such as lot size, take profit, stop loss, and trailing stop to match your trading style. This customization ensures flexibility and adaptability.

- Automatic Trade Closure: The EA closes trades based on opposite signals to optimize performance. Consequently, it minimizes potential losses during market reversals.

Why Choose S&P500 Swing Trading EA?

Opting for the S&P500 Swing Trading EA means equipping yourself with a powerful tool designed to maximize your trading potential. Here’s why it stands out:

- Specialized for S&P500: It is specifically tailored for the S&P500 index, ensuring precise performance. Moreover, this specialization guarantees accuracy in trading signals.

- Robust Indicator Combination: The EA combines the strengths of Ichimoku Cloud and ADX for reliable signal generation. Additionally, this synergy enhances signal confirmation.

- Comprehensive Risk Management: It offers extensive settings for effective risk control and profitability enhancement. Furthermore, these risk management features mitigate potential trading risks.

- Lifetime License: This is a one-time purchase with lifetime access and updates, offering exceptional value. Hence, it provides long-term cost savings and continuous support.

Elevate Your Trading with S&P500 Swing Trading Expert Advisor

The S&P500 Swing Trading EA for Metatrader 4 by KOKOSHELL is your gateway to achieving consistent trading success. By harnessing advanced technical indicators and robust risk management strategies, this EA offers a reliable solution for traders looking to optimize their performance in the S&P500 market.

Invest in your trading future with the S&P500 Swing Trading Expert Advisor for MT4 (Metatrader 4) and take control of your trading journey today. Secure your lifetime license and start trading smarter.

Caleb –

Consistent profits, excellent tool!

Maria Johnson –

My trading has improved dramatically. Highly recommend!

Anthony –

Reliable performance, great swing trading EA.

Anthony –

Excellent strategy, consistent gains.

Brian –

Decent results, but lacks input parameters. Still worth it for the price.

Elena Davis –

Amazing EA! It has significantly boosted my trading success.

Andrew Wilson –

Great returns, highly effective.

Jason –

Good EA, but could use more input parameters.

Luis Rodriguez –

Excellent returns, reliable and profitable.

Natalie Brown –

Profitable and easy to use. My trading has never been better.

Jason Walker –

Simply amazing! The setup was quick and easy, and the profits have been consistent. The strategy is highly effective, and the risk management features are excellent. This advisor has made trading so much more rewarding for me. If you’re serious about trading, you need this tool.