Elevate Your Trading with XAUUSD Technical Analysis EA

Experience the cutting-edge capabilities of the XAUUSD Technical Analysis EA (Expert Advisor) for MT4 (Metatrader 4) by KOKOSHELL. Designed for traders seeking to maximize performance in the gold market, this Expert Advisor (EA) uses advanced technical indicators to deliver precise trading signals. Whether you are a beginner or an experienced trader, the XAUUSD Technical Analysis MT4 Expert Advisor offers an automated solution to refine your strategy and boost profitability.

How It Works: Intelligent Analysis for Optimal Trading Decisions

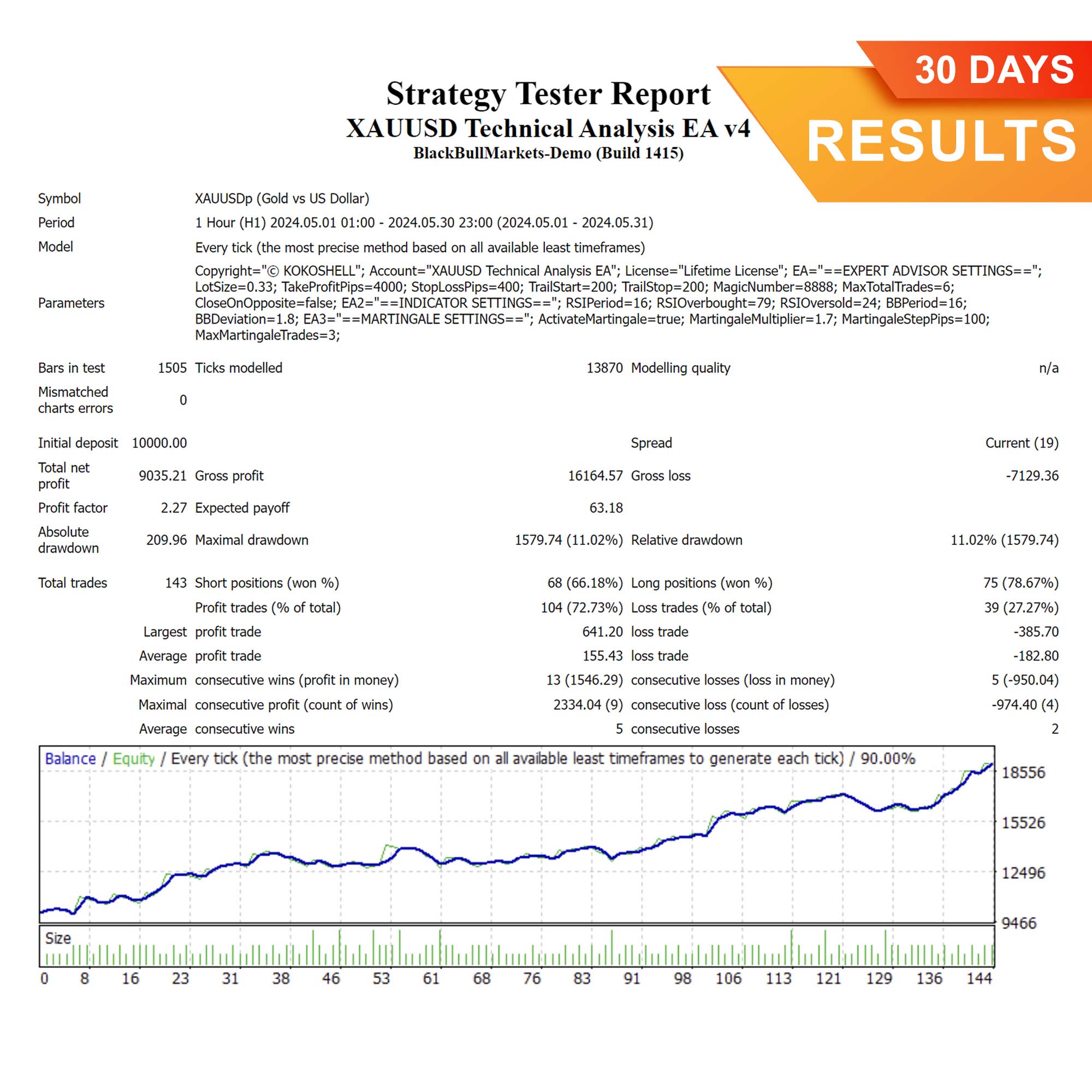

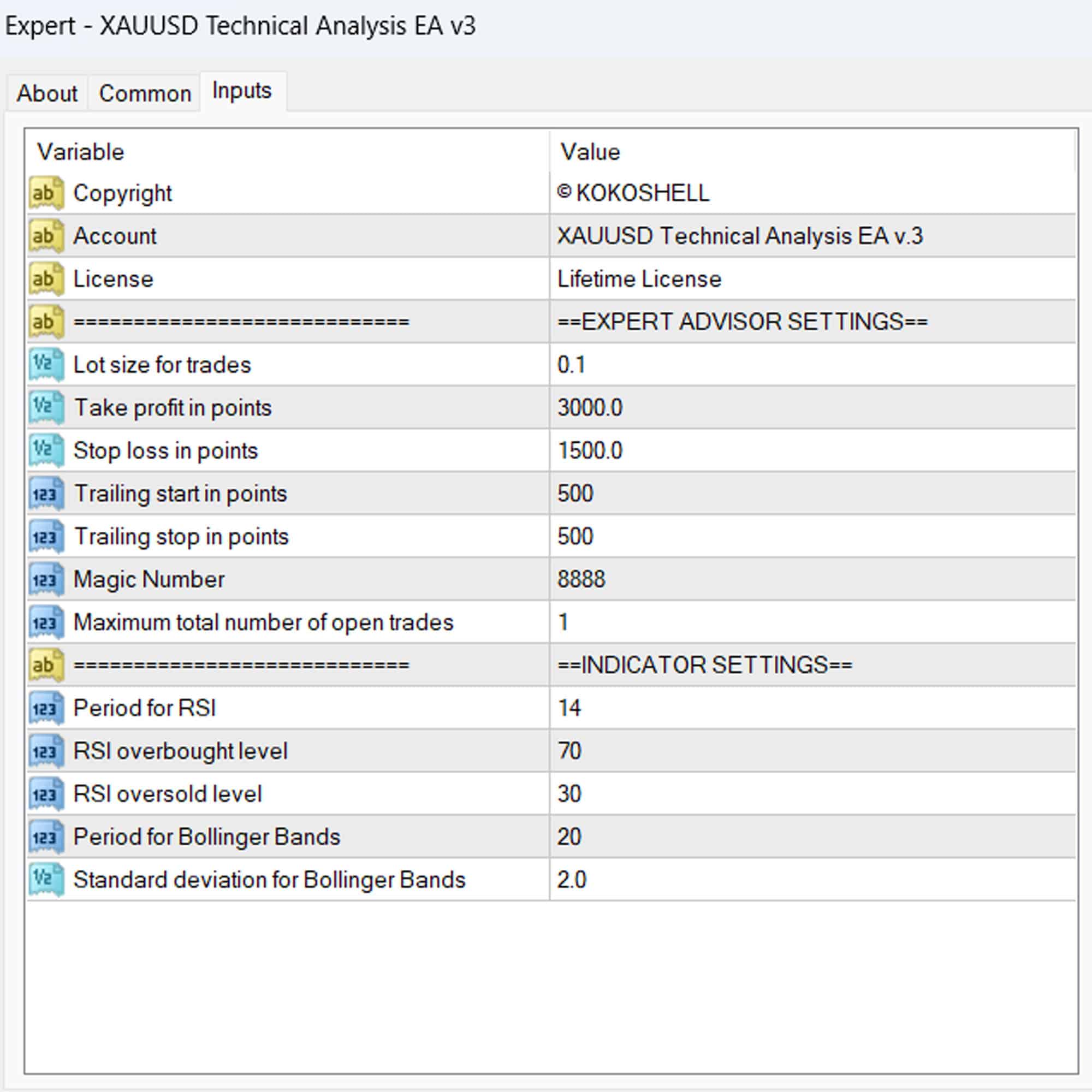

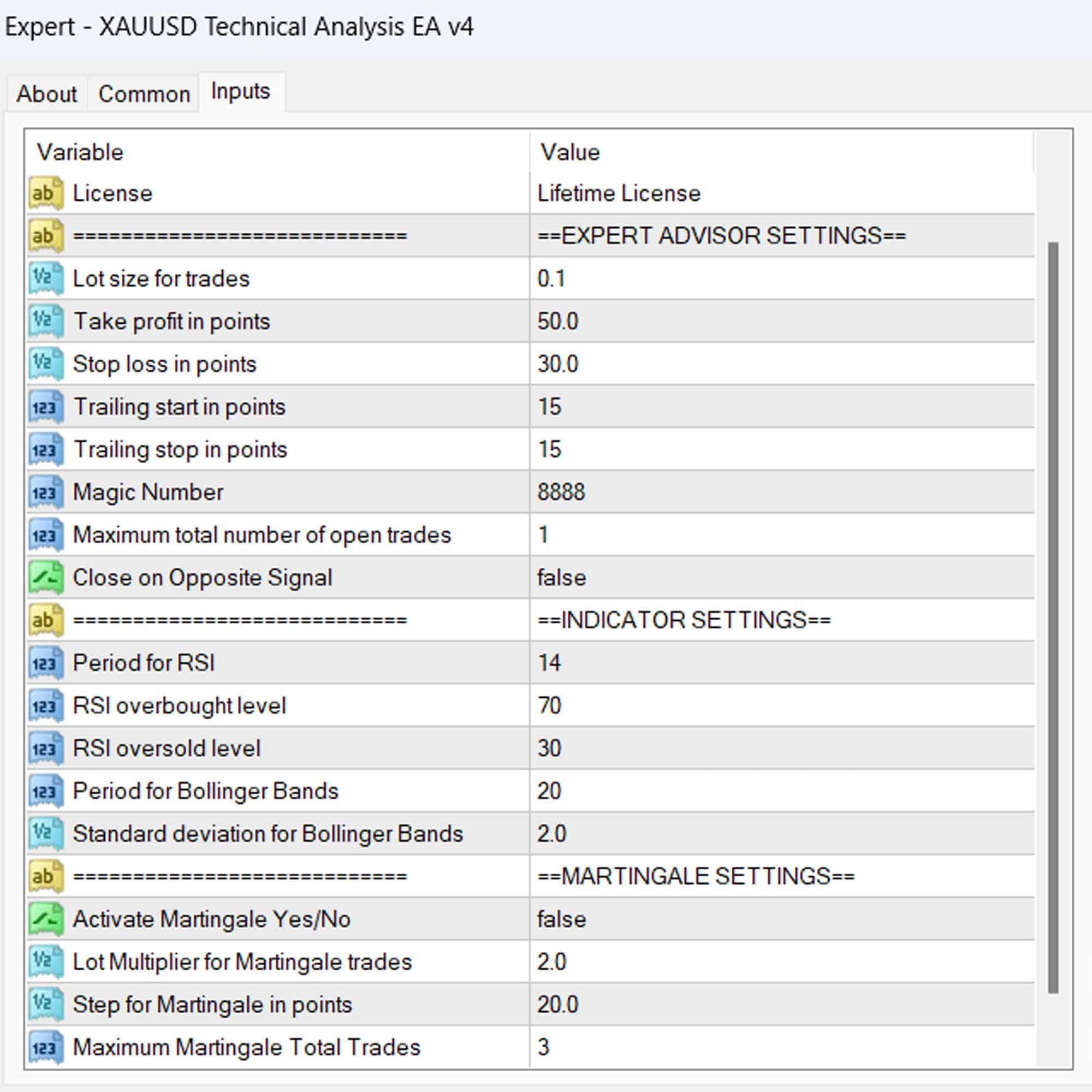

XAUUSD Technical Analysis EA analyzes market conditions using key technical indicators such as the Relative Strength Index (RSI) and Bollinger Bands. When the RSI reaches overbought or oversold levels and the price interacts with the Bollinger Bands, the EA generates accurate buy or sell signals.

Additionally, this EA features an optional Martingale strategy that increases lot sizes after losses to expedite recovery. Robust risk management tools, including customizable lot sizes, take profit, stop loss, and trailing stops, ensure you manage your trades effectively and efficiently.

Key Features: Advanced Tools for Superior Trading Performance

Discover the XAUUSD Technical Analysis EA’s robust features designed to elevate your trading strategy:

- Precision Entry Signals: Utilizes RSI and Bollinger Bands to generate accurate buy and sell signals. Moreover, it ensures timely trade executions.

- Dynamic Trailing Stops: Adjusts stop-loss levels as the trade moves in your favor, securing profits effectively. Therefore, it helps you maximize gains.

- Martingale Strategy: Optional feature to multiply lot sizes on losing trades, enhancing recovery potential. Furthermore, it provides an additional layer of profitability.

- Customizable Settings: Tailor parameters such as lot size, take profit, stop loss, and trailing stop to match your trading style. Additionally, you can adjust settings as market conditions change.

- Risk Management: Comprehensive risk management features protect your investments. Consequently, it minimizes potential losses.

- Automated Trading: Fully automated trading, allowing you to set it and forget it. Therefore, it saves you time and effort.

- Lifetime License: One-time purchase with lifetime access and updates. This feature provides long-term value.

Why Choose XAUUSD Technical Analysis EA: Achieve Consistent Success

XAUUSD Technical Analysis EA for Metatrader 4 stands out for its robust and reliable performance. By leveraging advanced indicators, it identifies trading opportunities that other strategies might overlook.

Moreover, its customizable settings enable you to tailor the EA to your specific needs, whether you’re pursuing aggressive growth or steady, conservative gains. The optional Martingale strategy adds an extra layer of potential profitability, making it a versatile tool in any trader’s arsenal.

Transform Your Trading with XAUUSD Technical Analysis Expert Advisor

Integrate XAUUSD Technical Analysis EA into your trading strategy and enjoy the benefits of automated, precise, and profitable trading. Furthermore, with its advanced features and comprehensive risk management, this Expert Advisor is designed to help you achieve consistent trading success. Don’t miss out on the opportunity to elevate your trading game.

Try the XAUUSD Technical Analysis Expert Advisor for Metatrader 4 by KOKOSHELL today.

Joseph –

Highly profitable! Great tool!

Michael Garcia –

Amazing profits and solid risk management.

Angela –

Consistent gains with minimal effort.

Emily –

Good performance but needs more input parameters.

Kevin Johnson –

My trading success has improved significantly.

Ethan Davis –

Excellent results! This tool makes trading easier and more profitable.

Lucas Wilson –

Fantastic strategy, reliable and profitable.

Dylan Thomas –

Decent results, but lacksinput parameters. Still a good investment.

Jacob –

Best trading tool I’ve used! Highly effective strategy.

Michael Smith –

Simply amazing! The setup was quick and easy, and the profits have been consistent. The strategy is highly effective, and the risk management features are excellent. This advisor has made trading so much more rewarding for me. If you’re serious about trading, you need this tool.