Maximize Your Day Trading Efficiency with Day Trading EA

Discover the ultimate tool for short-term traders with the Day Trading EA (Expert Advisor) for MT4 (Metatrader 4). Specifically designed to detect price reversals using advanced price action analysis and the Donchian channel, this expert advisor is your go-to solution for precise, non-repainting trade signals.

Furthermore, perfect for shrewd traders aiming to enhance their trade timing and maximize profits, Day Trading EA stands out as a reliable and efficient trading assistant.

How It Works: Leveraging Price Action and Donchian Channels

Day Trading EA operates using sophisticated price action analysis combined with the Donchian channel to identify potential reversals in a zig-zag fashion. Consequently, here’s a closer look at how it works:

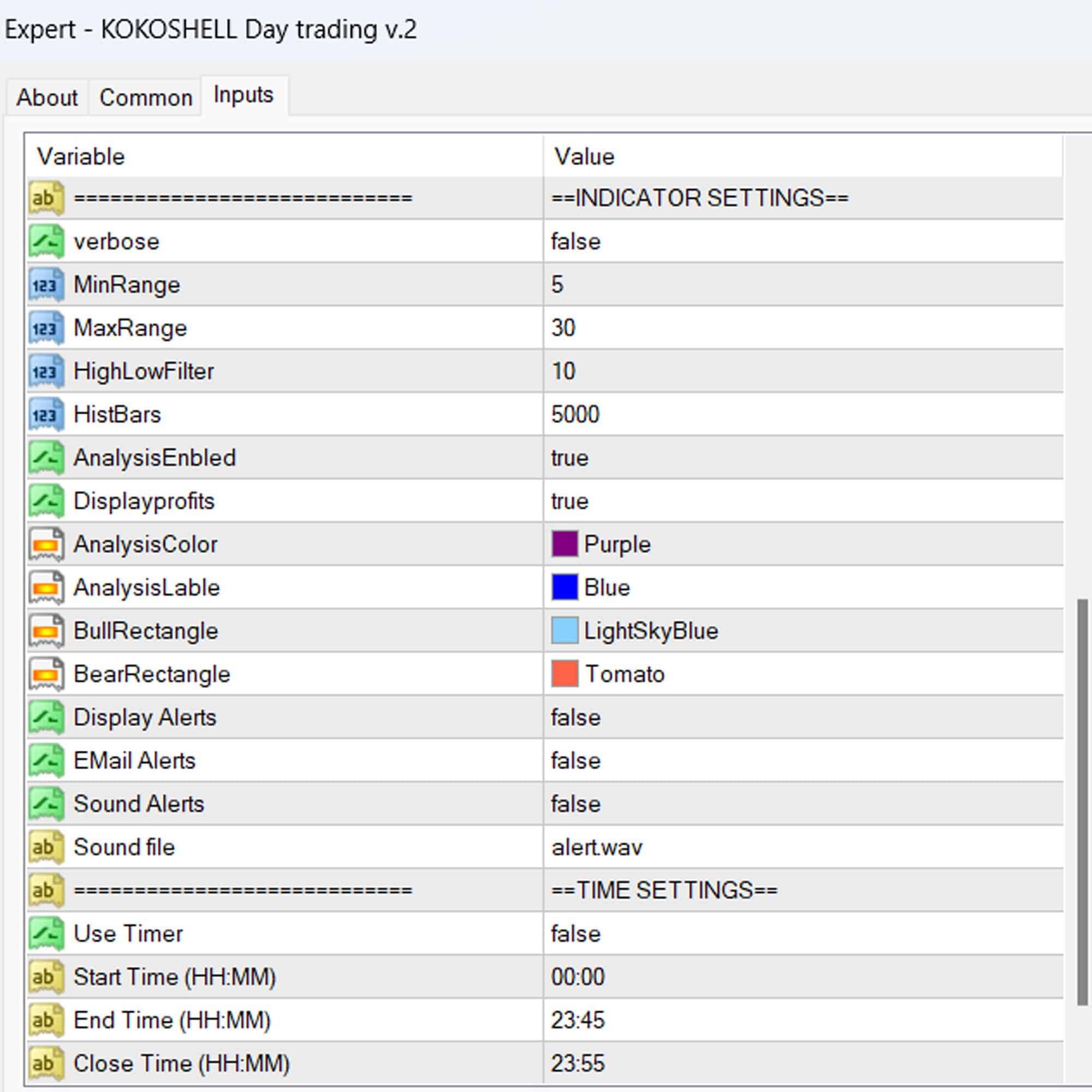

- Price Action Analysis: Monitors market movements to detect potential reversals without relying on repainting indicators. Additionally, it ensures accurate detection of market changes.

- Donchian Channel: Uses upper and lower bands to determine breakout and breakdown points, thereby signaling potential trade opportunities. Thus, it helps in capturing profitable trades.

- Trade Execution: Automatically initiates trades at optimal points based on identified price reversals. Moreover, it guarantees precise entry and exit points.

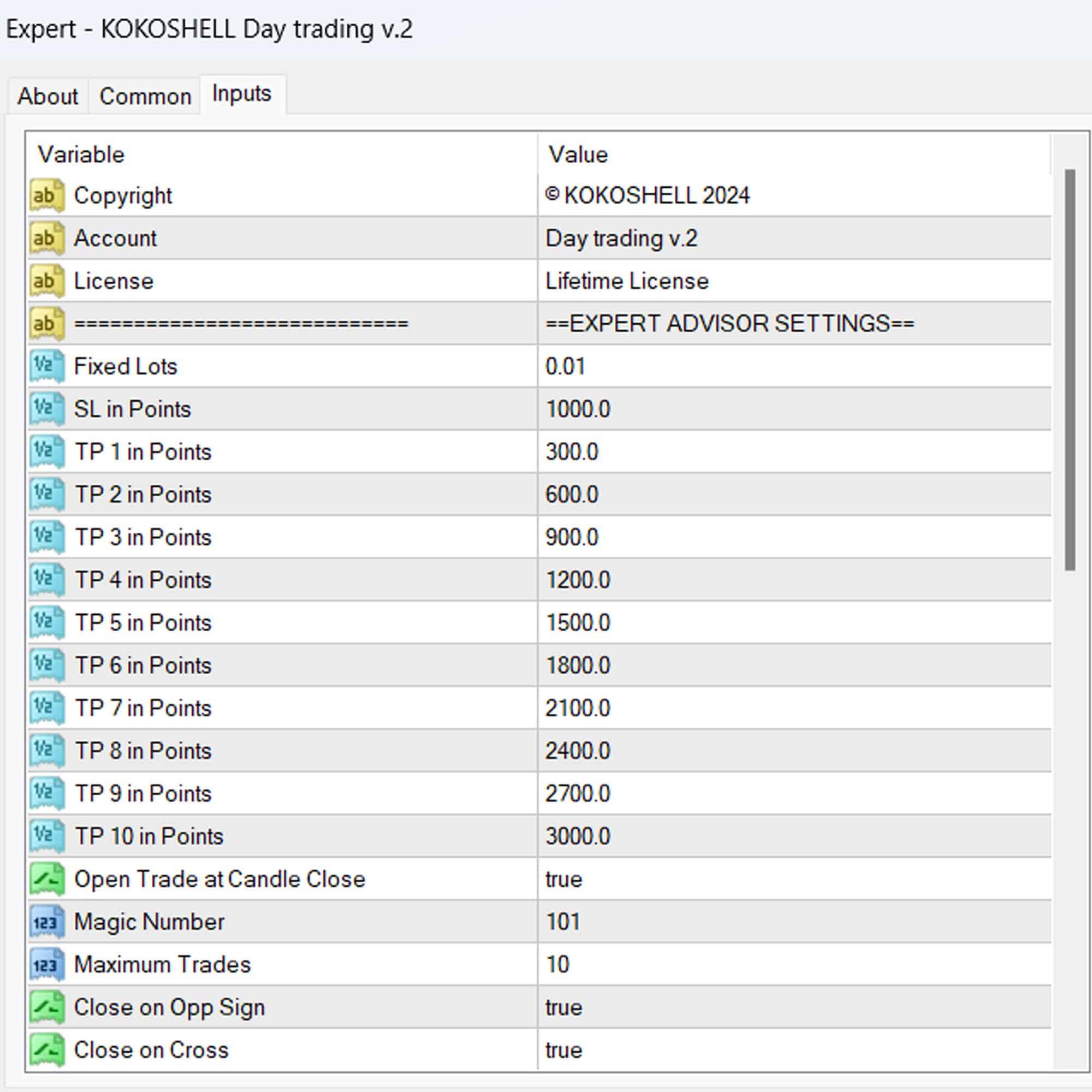

- Risk Management: Employs adjustable stop-loss and take-profit settings to ensure effective risk management. Therefore, it safeguards your investments.

Key Features: Advanced Tools for Superior Trading

Day Trading EA (Expert Advisor) for Metatrader 4 (MT4) comes packed with features that make it an indispensable tool for traders:

- Accurate Reversal Detection: Utilizes price action and Donchian channels to detect precise reversal points. Consequently, it enhances trade accuracy.

- Non-Repainting Signals: Ensures reliable signals without the confusion of repainting or backpainting. Therefore, it maintains consistency in trading signals.

- Customizable Settings: Offers flexible parameters for lot size, stop-loss, take-profit, and more. Additionally, it allows personalization according to trading preferences.

- Martingale Strategy: Includes an optional Martingale feature to help recover losses efficiently. Hence, it aids in loss management.

- Automated Alerts: Provides customizable alerts for trade signals, thus ensuring timely responses. Moreover, it keeps you updated on market movements.

Why Choose Day Trading EA?

Opting for Day Trading EA (Expert Advisor) for MT4 (Metatrader 4) means choosing a tool that combines precision, reliability, and flexibility. Thus, here’s why it’s the ideal choice:

- Optimized for Short-Term Trading: Perfect for day traders seeking quick and accurate trade signals. Additionally, it enhances trading efficiency.

- Versatile Application: Suitable for various markets, including forex and stocks. Consequently, it offers broad market coverage.

- Comprehensive Risk Management: Advanced risk control through customizable settings. Moreover, it protects your trading capital effectively.

- Lifetime License: Enjoy continuous updates and support with a one-time purchase. Therefore, it provides long-term value and support.

Conclusion: Enhance Your Trading Strategy with Day Trading EA

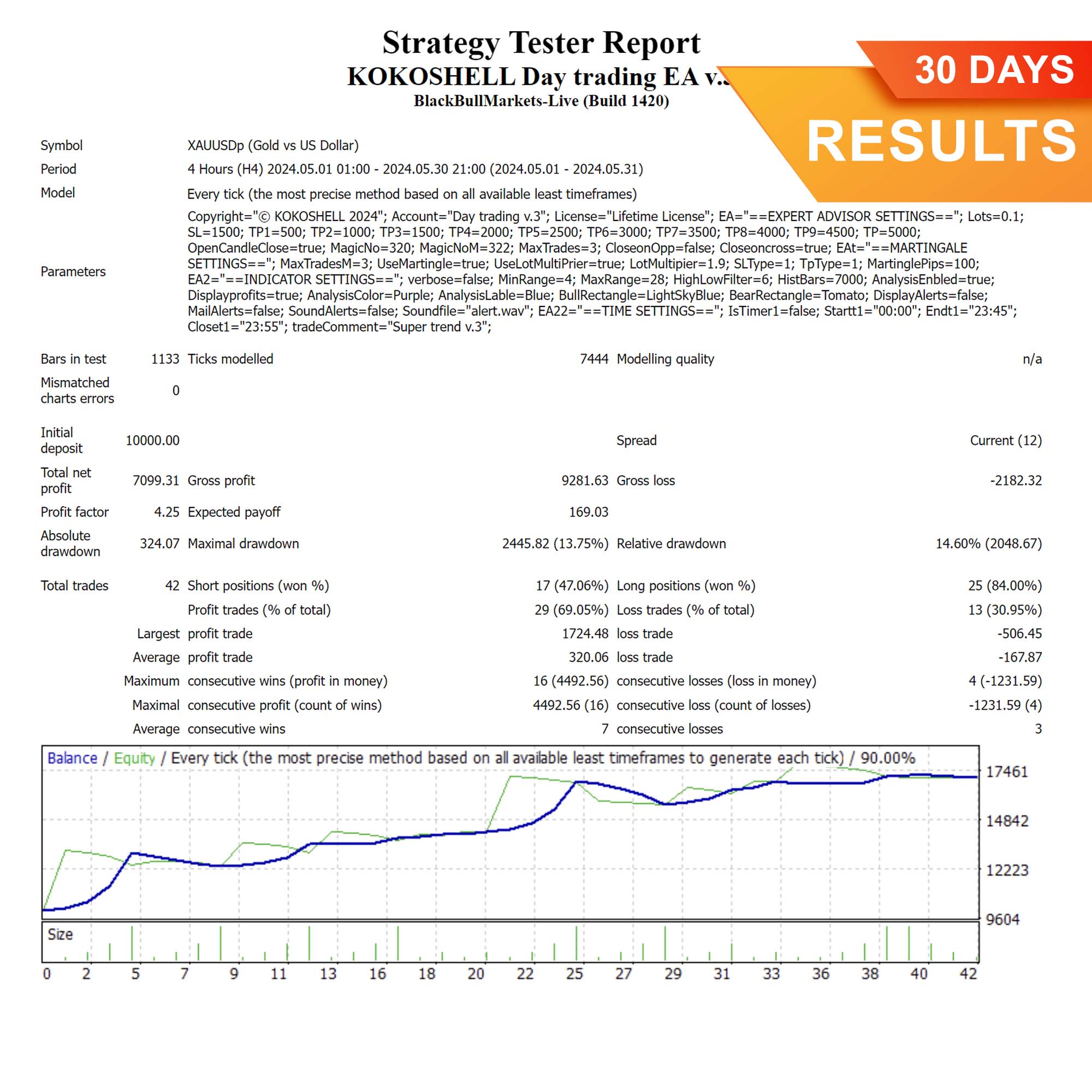

Day Trading EA for Metatrader 4 by KOKOSHELL is an indispensable tool for traders looking to master short-term trading and capitalize on market reversals. By combining advanced price action analysis with the robust Donchian channel, this expert advisor delivers consistent and high-performance trading results. Consequently, invest in Day Trading EA today and take your trading strategy to the next level. Secure your lifetime license and start trading with confidence.

Jessica Green –

Day Trading EA changed my trading game. Indicators are spot on. Big profits now. Backtesting was essential.

Dylan Baker –

Simple to use and delivers consistent results. Very satisfied with the performance.

Victoria Lewis –

The best EA I’ve used. Solid strategy and consistent profits. My trading has improved significantly.

Ella Roberts –

This EA delivers. The simplicity and performance are top-notch. Consistent earnings every day. Backtesting helped me optimize.

David Harris –

This EA has improved my trading accuracy and profits significantly. Highly recommend for serious day traders.

Emma Davis –

Effective EA with solid strategies. The indicators used are very reliable. Just watch out for high-risk trades.

John Taylor –

Amazing results! The simplicity of the EA and its performance are outstanding. I earn consistent profits.

Natalie Adams –

My trading has become much more efficient. Excellent tool with impressive results.

Matthew Turner –

Effective tool, great for day trading. Learning the strategy took a bit but results are solid. Best input parameters were found through backtesting.

Emily Davis –

WOW, just WOW! This trading advisor has completely transformed my trading approach. The setup was simple, and the results were almost immediate. The strategic insights are sharp and precise, and the risk management gives me peace of mind. It’s like having an expert by my side. Don’t miss out on this one!