Enhance Your Trading Strategy with Smart Signals EA

Welcome to the Smart Signals EA (Expert Advisor) for Metatrader 4 (MT4) – your ultimate trading companion designed to deliver accurate and timely market signals. Moreover, this innovative EA leverages advanced technical indicators and pattern recognition to help you make informed trading decisions. Whether you’re a beginner or an experienced trader, Smart Signals EA empowers you to navigate the forex market with confidence and precision.

How It Works: Intelligent Market Analysis for Optimal Trades

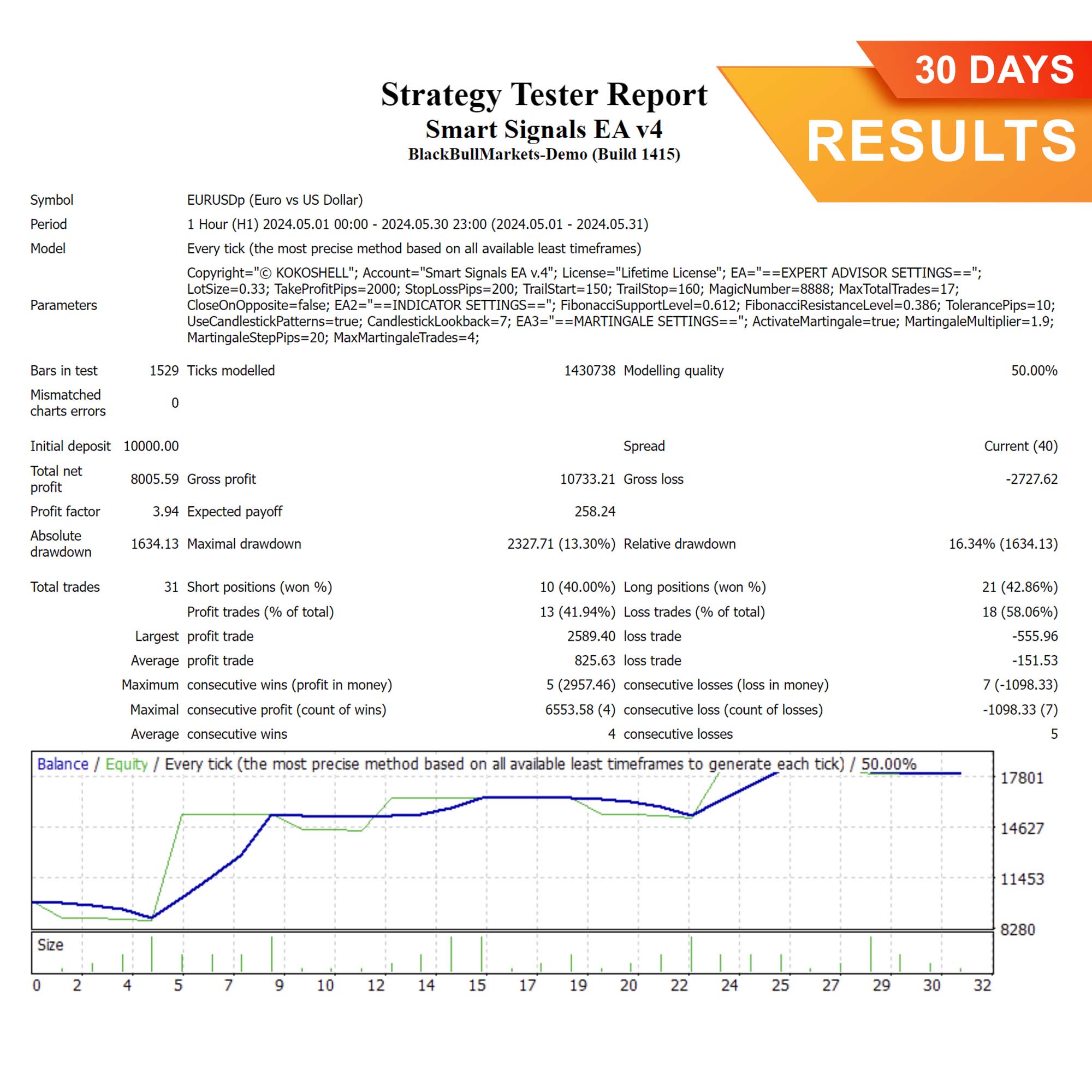

Smart Signals EA combines Fibonacci levels, candlestick patterns, and advanced risk management strategies to generate high-probability trading signals. Here’s how it operates:

- Buy Signal: When the current price nears a predefined Fibonacci support level and a bullish candlestick pattern appears within a certain tolerance, the EA triggers a buy order.

- Sell Signal: The EA initiates a sell order when the current price approaches a Fibonacci resistance level and identifies a bearish candlestick pattern within the specified tolerance.

- Martingale Strategy: Optionally, the EA employs a Martingale strategy to enhance potential profits by increasing trade sizes after losses.

- Trailing Stop Mechanism: Furthermore, the EA includes a trailing stop feature to lock in profits as the market moves favorably.

Key Features: Unlock the Power of Smart Signals EA

- Precision Signal Generation:

- Fibonacci Levels: Utilizes Fibonacci support and resistance levels for accurate market entry points.

- Candlestick Pattern Detection: Recognizes key candlestick patterns to validate trading signals.

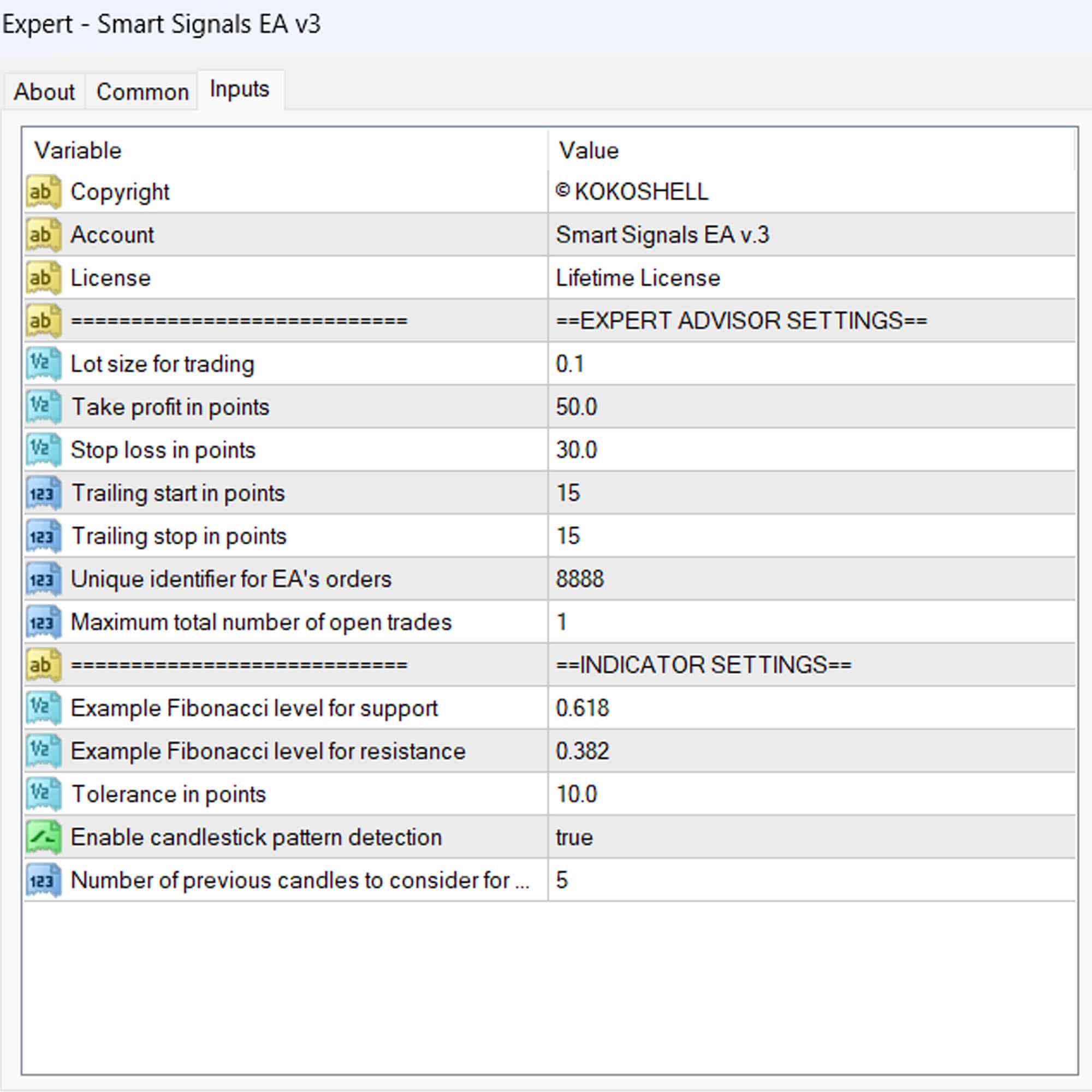

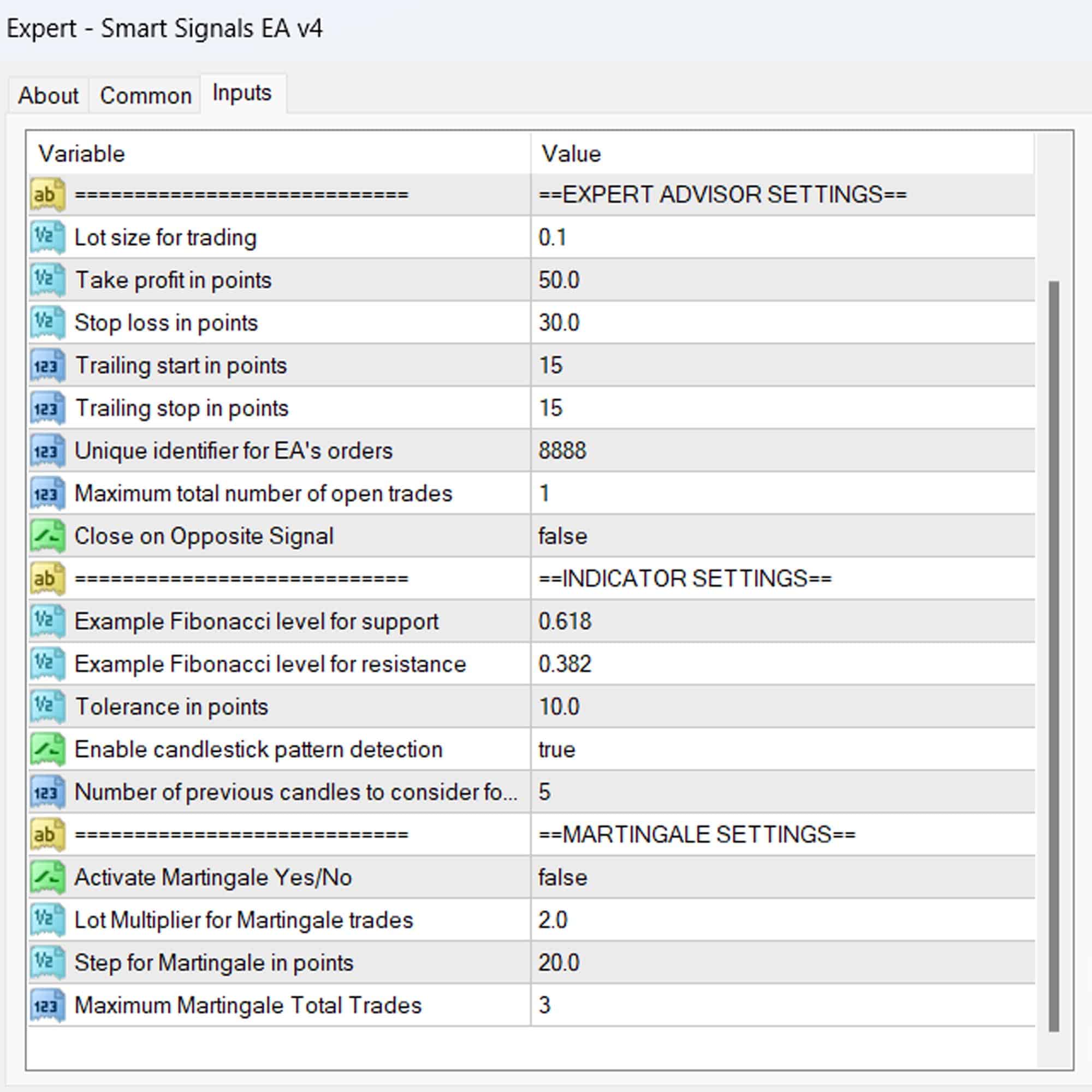

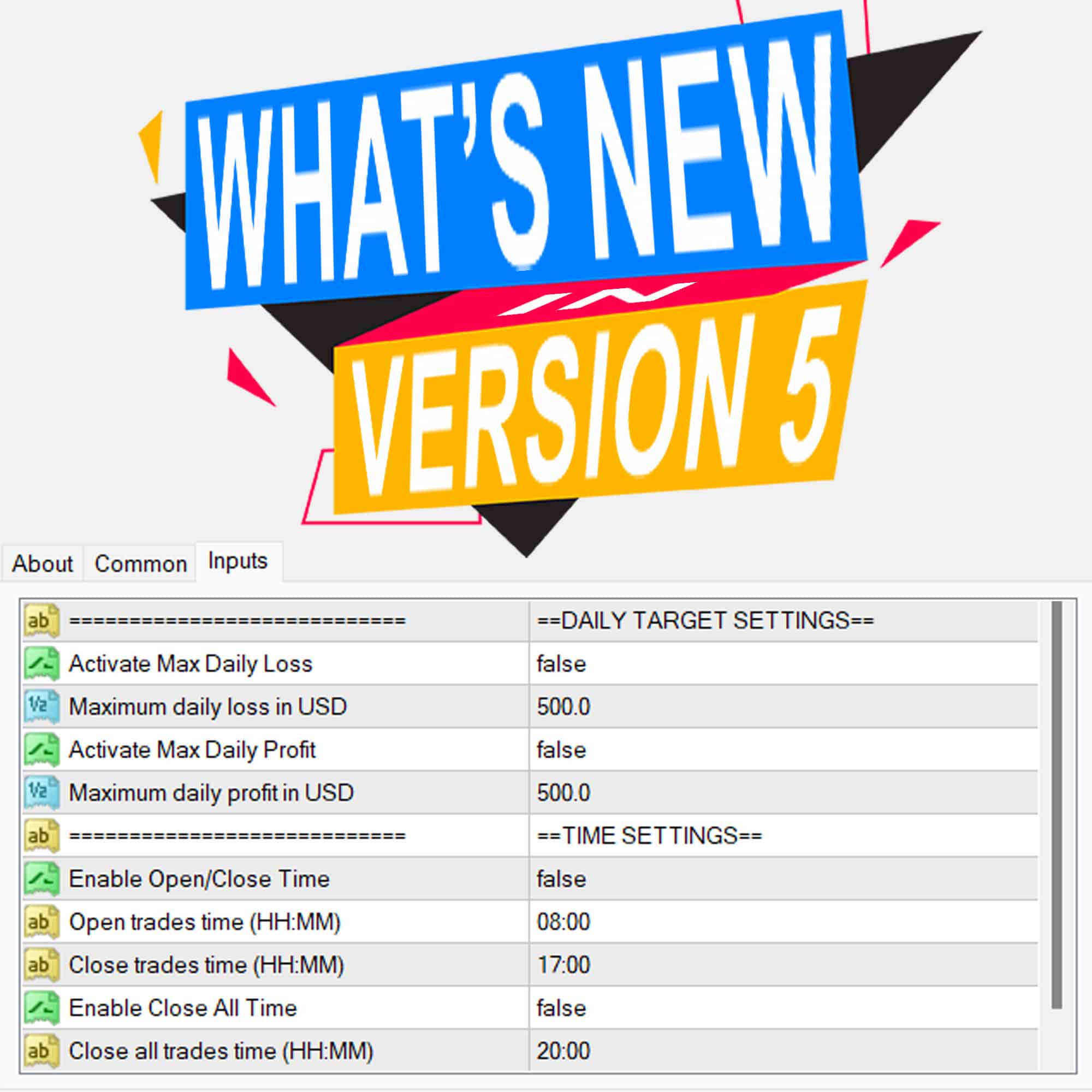

- Customizable Parameters:

- Lot Size Adjustment: Easily set your desired lot size for each trade.

- Take Profit and Stop Loss: Define your profit targets and risk limits with customizable take profit and stop loss settings.

- Trailing Stop: Secure profits with a trailing stop mechanism that adjusts as the market moves.

- Advanced Risk Management:

- Martingale Strategy: Optionally activate the Martingale strategy to increase trade sizes after losses, aiming to recover previous losses and achieve net profits.

- Close on Opposite Signal: Additionally, the EA automatically closes trades when it detects an opposite signal, thus minimizing potential losses.

Why Choose Smart Signals EA: Your Edge in the Forex Market

Smart Signals EA stands out with its intelligent integration of Fibonacci levels and candlestick pattern detection, thus providing a robust and reliable trading solution. Its extensive customization options allow you to tailor the EA to your specific trading style and risk tolerance.

Moreover, the optional Martingale strategy offers an additional layer of profitability, while the trailing stop feature protects your gains. Furthermore, by choosing Smart Signals Expert Advisor for Metatrader 4, you gain a powerful tool that enhances your trading performance and helps you achieve consistent, profitable results.

Transform Your Journey with Smart Trading

Elevate your trading experience with the KOKOSHELL Smart Signals EA for Metatrader 4. This Expert Advisor delivers a comprehensive, automated trading solution, leveraging the advanced capabilities of Fibonacci levels and candlestick pattern recognition. Furthermore, extensive customization, robust risk management, and an optional Martingale strategy enable Smart Signals Expert Advisor to optimize your trading outcomes.

Additionally, by leveraging the power of Smart Signals MT4 Expert Advisor, you can confidently navigate the complexities of the forex market and achieve your financial goals with precision and ease.

Juan Perez –

Smart Signals EA improved my trades. Profits are up!

Maria Gonzalez –

Impressive tool, really enhanced my trading strategy. Took a bit to learn, but worth it.

David Johnson –

This EA is fantastic! I’ve seen consistent gains and better trade accuracy.

Sofia Rodriguez –

Smart Signals EA has changed my trading game. Profits have increased steadily.

Lucas Martinez –

Great tool for refining strategies. Could use more customization options.

Emma Hernandez –

Outstanding performance! My trading results have significantly improved.

Miguel Rivera –

Solid EA. Helped me stay consistent with my trades.

Ava Brown –

Highly recommend! This EA made my trading more profitable and efficient.

Daniel Wilson –

This trading tool is a game-changer. It was incredibly easy to set up, and I saw impressive profits almost immediately. The strategic insights are invaluable, and the risk management features are excellent. This advisor has significantly improved my trading results. If you’re looking to make serious gains, look no further!