Learn Success and How to Get Rich with Bot Metatrader 4 in Johannesburg, South Africa

Introduction: Unlock the Secrets to Getting Rich with Bot Metatrader 4 in Johannesburg, South Africa

Getting rich with Bot Metatrader 4 in Johannesburg, South Africa involves leveraging essential tips, utilizing precise signals, and understanding the key principles and strategies for both beginners and experts using advanced Bot Metatrader 4 systems and forex platforms. Bot Metatrader 4, the practice of using automated systems to trade financial markets, offers a promising path to wealth if approached with the right knowledge and strategies. This article will delve into the essential aspects of Bot Metatrader 4, providing you with the necessary tools to get started and succeed.

Bot Metatrader 4 systems in Johannesburg, South Africa involve using sophisticated systems and platforms to execute trades automatically based on predefined criteria, particularly in the forex market. These systems have gained popularity due to their ability to eliminate human emotion, execute trades at lightning speed, and work around the clock. Beginners might find the concept daunting, but with the right guidance and the use of advanced Bot Metatrader 4 systems and forex platforms, anyone can learn to navigate the world of Bot Metatrader 4 in Johannesburg, South Africa.

Imagine waking up each morning knowing that your trading strategies are hard at work, capitalizing on opportunities around the clock. The freedom and potential of Bot Metatrader 4 in Johannesburg, South Africa, facilitated by sophisticated systems and forex platforms, can transform your financial future, providing a steady stream of income while you focus on other pursuits.

Key Points: Bot Metatrader 4 Tips for Beginners

- Getting Rich with Bot Metatrader 4 in Johannesburg, South Africa: Understanding the fundamentals and advanced techniques is crucial for success.

- Bot Metatrader 4 Tips: Employ best practices and strategies to enhance your trading efficiency.

- Johannesburg, South Africa Bot Metatrader 4 Platforms: Use reliable platforms to facilitate your Bot Metatrader 4 activities.

- Bot Metatrader 4 Strategies in Johannesburg, South Africa: Develop and implement effective strategies tailored to the Johannesburg, South Africa market.

- Forex Bot Metatrader 4 in Johannesburg, South Africa: Leverage forex signals to make informed trading decisions.

By integrating these key points into your trading strategy, you can position yourself on the path to financial success. Moreover, the journey to getting rich with Bot Metatrader 4 in Johannesburg, South Africa starts with exploring these foundational concepts.

Unleash the Power of Simple Bot Metatrader 4 Systems in Johannesburg, South Africa

Exploring Backtesting: Essential Tips to Get Rich with Bot Metatrader 4

Understanding Backtesting: The First Step to Success

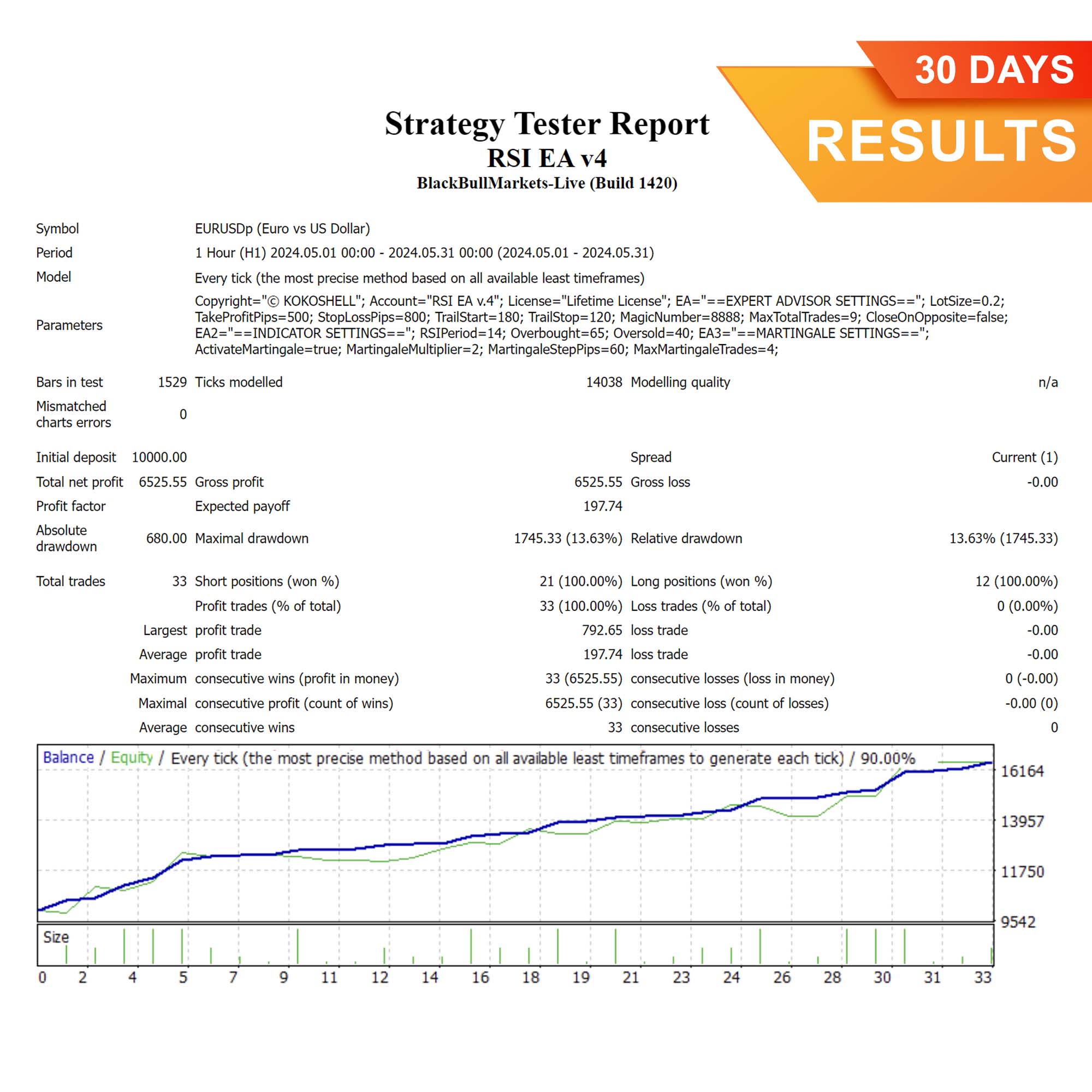

Backtesting your strategy is crucial to ensure its viability in real-market conditions. To get rich with Bot Metatrader 4 in Johannesburg, South Africa, you must meticulously test your strategies using historical data. This process involves running your trading algorithm on past market data to evaluate its performance. By doing so, you can identify potential flaws and optimize your strategy before risking real money.

Backtesting is akin to a dress rehearsal for your trading strategy, allowing you to see how it would have performed under various market conditions. Consequently, this practice helps you understand the strengths and weaknesses of your strategy, giving you the confidence to deploy it in live trading.

Imagine having a crystal ball that allows you to see into the future. Backtesting provides a similar advantage, enabling you to refine your strategies and increase your chances of success. It’s like practicing for a big game, ensuring you’re ready to perform at your best when it counts.

Steps for Backtesting: Bot Metatrader 4 Tips for Beginners

- Gather Historical Data: Obtain accurate and comprehensive historical data for the asset you wish to trade. For example, if you are trading stocks, you can use data from sources like Yahoo Finance or Quandl. High-quality data is the foundation of effective backtesting.

- Simulate Real Conditions: Include transaction costs, slippage, and latency in your backtest to mimic real-world trading conditions. This ensures your strategy’s performance is realistic and reliable.

- Evaluate Performance Metrics: Focus on key performance indicators such as:

- Profit Factor: The ratio of gross profit to gross loss.

- Drawdown: The peak-to-trough decline during a specific period.

- Win Rate: The percentage of profitable trades. These metrics provide a comprehensive view of your strategy’s effectiveness.

- Adjust and Iterate: Based on the backtest results, tweak your strategy and re-test until you achieve satisfactory performance. This iterative process is crucial for refining your strategy to maximize profitability.

Example: Real-World Application of Backtesting Tips

Imagine you are backtesting a moving average crossover strategy on historical stock data. You gather five years of data, simulate trades with a 0.1% transaction cost, and evaluate the strategy’s profit factor and drawdown. If the profit factor is below 1.5 or the drawdown exceeds 20%, you adjust the moving average periods and re-test until the metrics improve.

By meticulously testing and refining your strategy, you can enhance its performance and increase your chances of success in live trading.

Backtesting is like building a sturdy foundation for a house. Without a solid base, the structure cannot stand. Similarly, without thorough backtesting, your trading strategy may crumble under real-market pressures. Embrace this critical step with diligence and precision.

For an in-depth guide on backtesting, visit KOKOSHELL Backtesting Guide and discover how to fine-tune your strategies for optimal performance.

Fine-Tune Your Input Parameters: Advanced Tips to Get Rich with Bot Metatrader 4 in Johannesburg, South Africa

Optimizing Parameters: Unlock the Full Potential of Your Strategy

Fine-tuning your input parameters is essential to enhance the performance of your Bot Metatrader 4 strategies in Johannesburg, South Africa. Precise adjustments can significantly impact your trading outcomes, turning a mediocre strategy into a highly profitable one.

Parameter optimization involves adjusting the variables in your trading algorithm to find the most effective combination. Therefore, this meticulous process can be the difference between consistent profits and disappointing losses.

Imagine your Bot Metatrader 4 strategy in Johannesburg, South Africa as a high-performance sports car. To achieve peak performance, every component must be finely tuned. Similarly, optimizing your input parameters ensures your strategy runs at its best, maximizing your potential for profit.

Steps for Fine-Tuning: Expert Bot Metatrader 4 Tips

- Identify Key Parameters: Focus on crucial inputs like entry and exit signals, stop-loss, and take-profit levels. For example, if you are using a moving average strategy, the period of the moving average is a key parameter.

- Optimize One Parameter at a Time: Change one parameter while keeping others constant to isolate its effect. This method, known as grid search, helps identify the optimal value for each parameter.

- Use Optimization Tools: Leverage tools and software such as MetaTrader 4 (MT4)’s Strategy Tester or Python’s Backtrader library for parameter optimization. These tools can automate the optimization process, saving you time and effort.

- Avoid Overfitting: Ensure your strategy is robust and not overly tailored to historical data. Overfitting can lead to poor performance in live trading, as the strategy may not adapt well to new market conditions.

Example: Practical Fine-Tuning of Strategies

Suppose you are trading Forex with an RSI-based strategy. Your key parameters are the RSI period and the overbought/oversold levels. You start with an RSI period of 14 and optimize it between 10 and 20, testing each value incrementally. Once you find the optimal period, you then optimize the overbought/oversold levels.

Through careful optimization, you can significantly improve your strategy’s performance, increasing your chances of getting rich with Bot Metatrader 4 in Johannesburg, South Africa.

Fine-tuning is like adjusting the sails of a ship to catch the wind perfectly. Indeed, small changes can lead to significant improvements in your journey towards financial success. Thus, embrace this process with patience and precision, and watch your profits soar.

Boost your Profits with Elite Bot Metatrader 4 Systems in Johannesburg, South Africa

Embrace Risk Management: Tips for Long-Term Success

Risk Management: The Key to Sustainable Wealth

Effective risk management is the cornerstone of long-term success in Bot Metatrader 4 in Johannesburg, South Africa. Without proper risk control, even the best strategies can lead to significant losses. Consequently, by managing risk effectively, you protect your capital and ensure the longevity of your trading career.

Risk management involves setting limits on how much you are willing to lose on any given trade and taking steps to minimize those losses. Specifically, this discipline is essential for preserving your trading capital and achieving consistent profits.

Imagine risk management as a safety net that protects you from the inevitable falls in trading. With a solid risk management plan, you can recover quickly and continue your journey toward wealth and financial freedom.

Risk Management Practices: Expert Tips for Success

- Set Risk Limits: Define the maximum amount of capital you’re willing to risk on a single trade, typically a percentage of your total trading capital. For instance, risk no more than 1-2% of your capital on any single trade. This approach prevents catastrophic losses that can wipe out your account.

- Diversify Your Portfolio: Spread your investments across various assets to reduce risk. For instance, this can include stocks, Forex, commodities, and cryptocurrencies. Therefore, diversification helps mitigate the impact of poor performance in any single market.

- Use Stop-Loss Orders: Automatically close losing positions to prevent excessive losses. For example, set a stop-loss order at 2% below your entry price. Stop-loss orders are a vital tool for limiting your downside risk.

- Regularly Review Your Strategy: Continuously monitor and adjust your risk management rules based on market conditions. Markets are dynamic, and your risk management approach should adapt accordingly.

Example: Implementing Effective Risk Management

Consider a trader with a $10,000 account who decides to risk 1% per trade. They set a stop-loss order for each trade that limits their loss to $100. Additionally, they diversify their portfolio by trading stocks, Forex, and commodities, reducing the impact of poor performance in any single market.

By implementing these risk management practices, you can protect your capital and ensure long-term success in Bot Metatrader 4 in Johannesburg, South Africa.

Risk management is like the brakes on a car. It allows you to control your speed and avoid accidents, thereby ensuring you reach your destination safely. Hence, embrace these practices with discipline and commitment, and you’ll be well on your way to financial success.

Optimize Trading Hours: Choosing the Best Times for Success

The Power of Timing: Maximize Your Profits with Optimal Trading Hours

Choosing the best trading hours can greatly influence your Bot Metatrader 4 in Johannesburg, South Africa success. Different markets and assets have varying levels of volatility and liquidity throughout the day. By trading during optimal hours, you can maximize your profits and minimize your risks.

Trading hours impact the effectiveness of your strategy. High volatility and liquidity provide more trading opportunities, while low activity periods can lead to poor trade execution and increased slippage.

Imagine trading at the perfect time when the market is most active and opportunities abound. By optimizing your trading hours, you can capitalize on these moments, enhancing your potential for profit.

Tips for Choosing Trading Hours: Proven Strategies

- Analyze Market Hours: Understand the opening and closing times of major financial markets. For example, the Forex market operates 24 hours, with peak activity during the London and Johannesburg, South Africa sessions. Knowledge of market hours helps you identify periods of high activity.

- Identify Peak Trading Times: Focus on periods with high trading activity and liquidity. For instance, stock markets are most active during the first and last hours of trading. These periods often present the best trading opportunities.

- Consider Your Strategy Type: Match your trading hours to your strategy, whether it’s day trading, swing trading, or scalping. Day traders may prefer the first few hours of the trading day, while swing traders might not require constant monitoring.

- Test Different Hours: Backtest your strategy across various time frames to find the most profitable periods. Testing different trading hours can reveal the optimal times for your strategy.

Example: Optimizing Trading Hours for Success

A Forex trader might find that their strategy performs best during the overlap of the London and Johannesburg, South Africa sessions, from 8 AM to 12 PM EST, when market liquidity and volatility are at their peak. By focusing on these hours, they can maximize their trading opportunities.

By carefully selecting your trading hours and utilizing advanced systems and platforms, you can enhance the performance of your Bot Metatrader 4 in Johannesburg, South Africa strategy and increase your chances of getting rich, especially in the forex market.

Timing is everything in trading. By identifying the best hours to trade, you align yourself with the market’s rhythm, thereby increasing your chances of success. Consequently, embrace this strategy with precision, and watch your profits grow.

To find the best trading hours for your strategy, visit Forex Time Zone Converter and start optimizing your trading schedule today.

Maximize your Profits with PRO Bot Metatrader 4 Systems in Johannesburg, South Africa

Selecting the Ideal Time Frame: Tips to Get Rich with Bot Metatrader 4

Choosing the Right Time Frame: The Foundation of Successful Trading

Selecting the appropriate time frame for your Bot Metatrader 4 strategies in Johannesburg, South Africa is crucial for maximizing profitability. The time frame impacts how signals are generated and trades are executed. Different time frames offer various advantages and disadvantages, and choosing the right one is key to your trading success.

Time frames range from very short (seconds) to very long (months). Additionally, each time frame presents different opportunities and challenges, and the best choice depends on your trading style and objectives.

Tips for Choosing the Best Time Frame: Advanced Strategies

- Understand Different Time Frames: Learn about various time frames, from minutes to months. Shorter time frames generate more signals but may be noisier, while longer time frames offer clearer trends but fewer signals. Understanding these nuances is crucial for selecting the optimal time frame.

- Align with Your Trading Style: Match the time frame to your trading approach (short-term, medium-term, or long-term). For example, scalpers might use 1-minute charts, while swing traders prefer daily charts. Your trading style should dictate your choice of time frame.

- Evaluate Signal Frequency: Ensure the time frame provides a sufficient number of trading signals. Too few signals can lead to missed opportunities, while too many can cause overtrading. Balance is key to effective trading.

- Consider Market Conditions: Adapt your time frame based on current market volatility and trends. Higher volatility may require shorter time frames to capture quick movements. Flexibility in your approach can enhance your trading outcomes.

Example: Practical Application of Time Frame Selection

A trader using a trend-following strategy might choose a 4-hour chart to capture significant market movements while avoiding the noise of shorter time frames. By analyzing the market conditions and testing different time frames, they can determine the optimal period for their strategy.

Selecting the right time frame is a critical step in developing successful Bot Metatrader 4 strategies in Johannesburg, South Africa. Additionally, by aligning your time frame with your trading style and market conditions, you can improve your trading results and increase your chances of getting rich with Bot Metatrader 4 in Johannesburg, South Africa.

The right time frame is like finding the perfect gear for your car. It ensures you move smoothly and efficiently towards your destination. Thus, choose wisely, and you’ll navigate the market with confidence and success.

Master Your Trades with Bot Metatrader 4 Systems in Johannesburg, South Africa

Conclusion: Getting Rich with Bot Metatrader 4 in Johannesburg, South Africa and Achieve Financial Freedom

Achieve Financial Freedom: The Path to Success

Exploring Bot Metatrader 4 in Johannesburg, South Africa is a journey that requires dedication, continuous learning, and strategic adjustments using advanced Bot Metatrader 4 systems and platforms, especially in the dynamic forex market. By following the tips outlined in this guide, you can set yourself on the path to get rich with Bot Metatrader 4. From backtesting your strategy and fine-tuning input parameters to embracing risk management and choosing the best trading hours and time frames, each step is crucial for achieving success.

Imagine a life where your investments work for you, generating income while you sleep, travel, or spend time with loved ones. This dream can become a reality through the disciplined practice of Bot Metatrader 4 in Johannesburg, South Africa.

Final Tips: Stay Ahead in Bot Metatrader 4 in Johannesburg, South Africa

- Stay Updated: Keep abreast of market news and developments that may impact your trading. Staying informed allows you to adapt quickly and make informed decisions.

- Educate Yourself: Continuously learn about new strategies, tools, and technologies in Bot Metatrader 4 in Johannesburg, South Africa. Education is the key to staying ahead in the ever-evolving world of trading.

- Be Patient: Success in Bot Metatrader 4 takes time and persistence. Stay disciplined and stick to your plan. Patience and perseverance are your allies in the journey to financial freedom.

By implementing these strategies and maintaining a disciplined approach, you can significantly increase your chances of success and ultimately achieve financial freedom through Bot Metatrader 4 in Johannesburg, South Africa. Start your Bot Metatrader 4 journey today and move closer to financial freedom. With determination and the right approach, you can unlock the wealth and opportunities that Bot Metatrader 4 has to offer.

Every great journey begins with a single step. Therefore, take that step today, armed with the knowledge and insights from this guide. Furthermore, embrace the potential of Bot Metatrader 4 in Johannesburg, South Africa, and watch as your financial dreams turn into reality.

FAQs About Getting Rich with Bot Metatrader 4 in Johannesburg, South Africa

What is Forex Trading and How Does it Work?

Forex trading, also known as foreign exchange trading, involves buying and selling currencies in the forex market in Johannesburg, South Africa with the aim of making a profit. The forex market in Johannesburg, South Africa is the largest and most liquid market in the world, with a daily trading volume exceeding $6 trillion. Traders speculate on the price movements of currency pairs, such as EUR/USD or GBP/JPY.

Forex trading in Johannesburg, South Africa works by simultaneously buying one currency and selling another. Currencies are traded in pairs, and the value of a currency pair is influenced by various factors including economic indicators, political events, and market sentiment. For example, if you believe the euro will strengthen against the US dollar, you might buy the EUR/USD pair. If the euro does indeed appreciate, you can sell the pair at a higher price, thus making a profit.

How Can I Start and Get Rich in Forex with Bot Metatrader 4 in Johannesburg, South Africa?

To start Bot Metatrader 4 in Johannesburg, South Africa in forex, follow these steps:

- Choose a Reliable Broker: Select a broker that offers Bot Metatrader 4 in Johannesburg, South Africa services. Ensure the broker is regulated and has a good reputation.

- Select an Bot Metatrader 4 Platform: Choose a trading platform that supports Bot Metatrader 4, such as MetaTrader 4 (MT4). These platforms offer various tools and features for automated trading.

- Develop or Choose a Trading Strategy: You can either develop your own trading strategy or use an existing one. Many platforms offer pre-built strategies that you can use or customize.

- Set Up Your Trading Algorithm: If you are developing your own strategy, you will need to code your algorithm using the platform’s scripting language (e.g., MQL4 for MT4). Alternatively, you can purchase or subscribe to a ready-made trading algorithm from KOKOSHELL Trading Bots.

- Backtest Your Strategy: Before deploying your strategy in a live trading environment, backtest it using historical data to ensure it performs well under various market conditions.

- Deploy and Monitor: Once you are satisfied with your strategy’s performance, deploy it on a live trading account. Regularly monitor its performance and make adjustments as needed.

What Are the Benefits of Bot Metatrader 4 in Johannesburg, South Africa in Forex?

Bot Metatrader 4 in Johannesburg, South Africa in forex offers several benefits:

- Elimination of Emotions: Bot Metatrader 4, facilitated by advanced systems and robust platforms, removes human emotions from the trading process, reducing the risk of impulsive decisions based on fear or greed.

- Consistency: Bot Metatrader 4 systems in Johannesburg, South Africa follow predefined rules, ensuring consistent execution of trades through reliable platforms. This consistency can improve long-term trading results.

- Speed and Efficiency: Bot Metatrader 4 in Johannesburg, South Africa systems and platforms can execute trades at lightning speed, taking advantage of market opportunities that may only exist for a fraction of a second.

- 24/5 Trading: The forex market in Johannesburg, South Africa operates 24 hours a day, five days a week, allowing Bot Metatrader 4 systems and platforms to monitor and trade the market around the clock.

- Backtesting and Optimization: Bot Metatrader 4 in Johannesburg, South Africa systems and platforms allow you to backtest and optimize your strategies using historical data, improving their effectiveness before deploying them in a live environment.

What Are Bot Metatrader 4 in Johannesburg, South Africa Signals and How Do They Work?

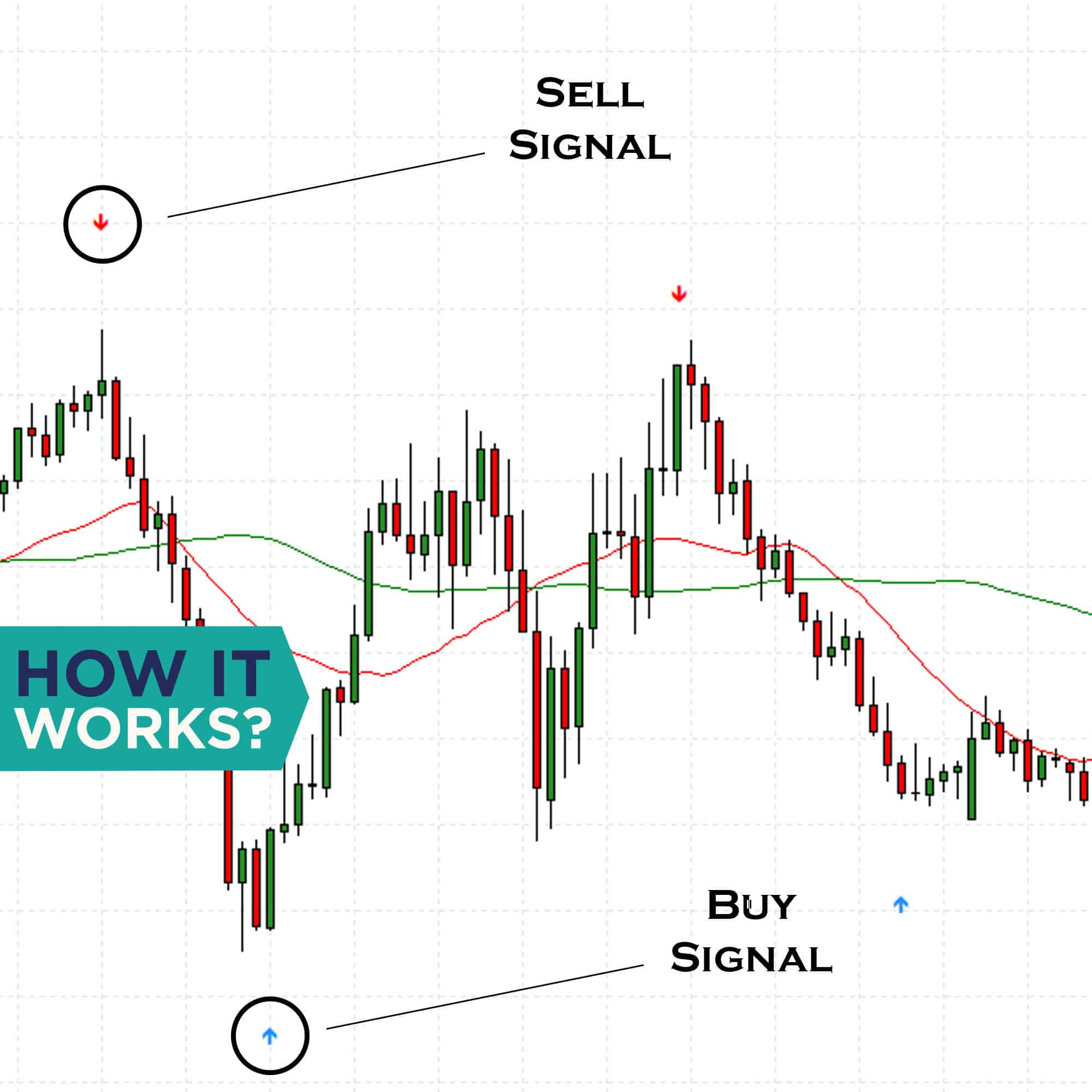

Bot Metatrader 4 in Johannesburg, South Africa signals are alerts or indicators generated by trading algorithms based on specific market conditions. These signals inform traders of potential trading opportunities, such as when to buy or sell a currency pair. Bot Metatrader 4 in Johannesburg, South Africa signals, generated by sophisticated systems and platforms, are alerts or indicators based on specific market conditions.

For example, a simple moving average crossover strategy might generate a buy signal when the short-term moving average crosses above the long-term moving average, and a sell signal when the short-term moving average crosses below the long-term moving average. These signals can be programmed into an Bot Metatrader 4 in Johannesburg, South Africa system to execute trades automatically when the conditions are met.

Another important aspect of Bot Metatrader 4 signals is their ability to alert traders in real-time, allowing for quick decision-making. Traders can rely on these signals to navigate volatile markets and capitalize on short-lived opportunities.

Bot Metatrader 4 in Johannesburg, South Africa signals also help traders to remain disciplined by adhering strictly to predefined trading criteria, thus minimizing the impact of emotional decision-making.

Is Bot Metatrader 4 in Johannesburg, South Africa Suitable for Beginners?

Bot Metatrader 4 in Johannesburg, South Africa can be suitable for beginners, but it requires a solid understanding of forex trading principles and the functionality of trading platforms. Here are some tips for beginners considering Bot Metatrader 4:

- Educate Yourself: Learn the basics of forex trading in Johannesburg, South Africa, including how the forex market in Johannesburg, South Africa works, key terms, and forex strategies in Johannesburg, South Africa. Many online resources, courses, and tutorials are available to help you get started.

- Start with a Demo Account: Most brokers offer demo accounts that allow you to practice forex trading in Johannesburg, South Africa with virtual money. Use a demo account to familiarize yourself with the Bot Metatrader 4 in Johannesburg, South Africa platform and test your forex strategies in Johannesburg, South Africa without risking real money.

- Choose Simple Strategies: Start with simple, well-known forex strategies in Johannesburg, South Africa before attempting to develop more complex algorithms. This approach allows you to build confidence and gain experience in forex trading in Johannesburg, South Africa.

- Monitor Your Trades: Even though Bot Metatrader 4 in Johannesburg, South Africa systems execute trades automatically, it’s important to regularly monitor their performance. Make adjustments as needed and ensure the system is functioning correctly in the forex market in Johannesburg, South Africa.

- Risk Management: Implement effective risk management practices, such as setting stop-loss orders and limiting the amount of capital you risk on each trade. This helps protect your investment and minimize potential losses in forex trading in Johannesburg, South Africa.

Bot Metatrader 4 in Johannesburg, South Africa for Beginners: Benefits and Tips

Bot Metatrader 4 in Johannesburg, South Africa can be a powerful tool for beginners, offering the potential for consistent and efficient trading in the forex market in Johannesburg, South Africa. However, it’s essential to approach it with caution, continuous learning, and a willingness to adapt and improve your forex strategies in Johannesburg, South Africa.

Moreover, Bot Metatrader 4 in Johannesburg, South Africa signals provide a structured approach for new traders to follow, making it easier to understand market movements and potential entry and exit points in forex trading in Johannesburg, South Africa. Additionally, by using Bot Metatrader 4 signals, beginners can gain insights from experienced traders and algorithms designed to identify profitable forex strategies in Johannesburg, South Africa.

Choosing the Right Broker for Bot Metatrader 4 in Johannesburg, South Africa

Selecting a reliable broker is crucial for beginners starting with Bot Metatrader 4 in Johannesburg, South Africa. Firstly, a good broker will provide a user-friendly platform, educational resources, and responsive customer service. Furthermore, ensure the broker is regulated and has a solid reputation in the market.

Finally, many platforms offer specific features and resources tailored for Bot Metatrader 4 in Johannesburg, South Africa for beginners, helping them learn the ropes and build confidence in their trading abilities. Bot Metatrader 4 for beginners doesn’t have to be daunting; with the right tools and knowledge, it can be a smooth and rewarding experience.

Bot Metatrader 4 in Johannesburg, South Africa signals are particularly beneficial for beginners, as they offer clear guidance on when to execute trades based on established forex strategies in Johannesburg, South Africa and market analysis. By relying on these signals, beginners can avoid common pitfalls and make more informed trading decisions in the forex market in Johannesburg, South Africa.

Additionally, for those looking to advance their trading capabilities, exploring advanced Bot Metatrader 4 in Johannesburg, South Africa strategies can be immensely beneficial. These forex strategies in often incorporate more complex algorithms and require a deeper understanding of market dynamics, but they also offer the potential for higher returns in the forex market in Johannesburg, South Africa.

In conclusion, embracing both fundamental and advanced Bot Metatrader 4 in Johannesburg, South Africa strategies will provide a comprehensive approach to achieving trading success. By continuously refining your methods and staying informed about new developments in forex trading in Johannesburg, South Africa, you can maximize your trading potential and work towards consistent profitability in the forex market in Johannesburg, South Africa.