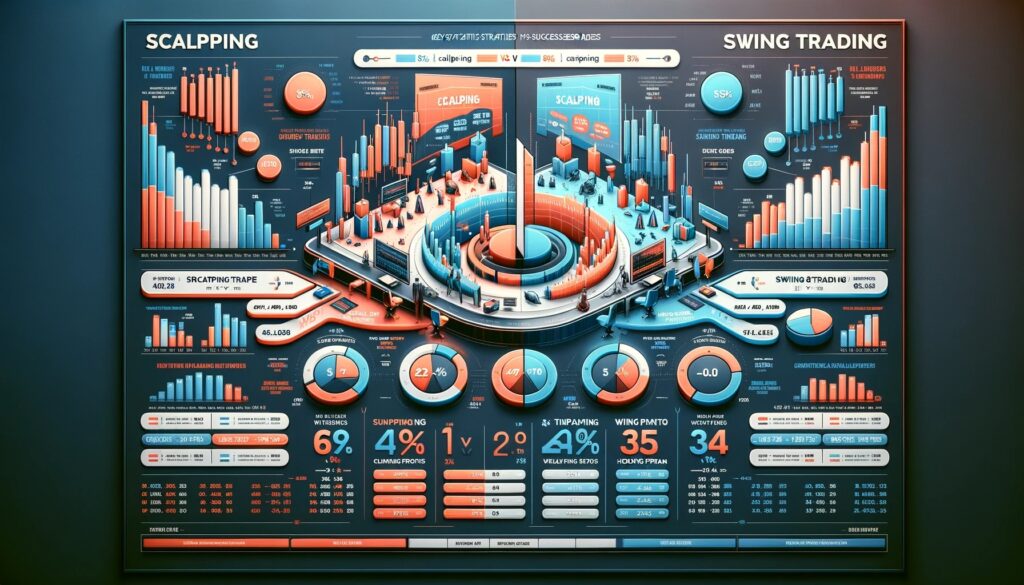

In the world of financial markets, two popular strategies that often come into the spotlight are scalping and swing trading. These methodologies cater to different trader profiles, each with its unique pace, risk exposure, and potential rewards. Understanding the nuances of Scalping vs Swing Trading is essential for traders looking to align their trading style with their personal goals, risk tolerance, and time availability. This detailed exploration aims to shed light on each strategy, offering insights to help you make an informed decision.

Understanding the Basics

What is Scalping?

Scalping is a high-frequency trading strategy focused on making numerous trades to capture small price changes. Imagine a day trader, eyes glued to multiple monitors, fingers ready to execute trades at a moment’s notice. This trader isn’t looking for the next big market move; instead, they capitalize on the tiny ebbs and flows that occur within minutes or even seconds. The essence of scalping lies in volume; by making dozens, sometimes hundreds of trades a day, scalpers aim to accumulate significant profits from these minor adjustments. The key here is speed and precision, as even the smallest market movements can become opportunities for profit.

What is Swing Trading?

Swing trading sits on the other side of the spectrum. This strategy is about patience and foresight, holding positions for days, weeks, or even months to capture substantial market moves. Swing traders are the strategists of the trading world, analyzing charts for patterns that indicate a potential significant swing in market sentiment. Unlike scalpers, they are not swayed by the minute-to-minute pulsations of the market but look for overarching themes that suggest a more substantial shift is on the horizon. For instance, a swing trader might analyze a stock that has been steadily gaining over several days and decide to ride the trend, predicting further increases before making their move to sell.

Scalping vs Swing Trading: A Detailed Comparison

Time Commitment and Lifestyle

Scalping is akin to sprinting; it’s fast-paced, intense, and requires undivided attention during trading hours. It suits traders who can dedicate their full day to the markets, constantly scanning for opportunities. On the other hand, swing trading is more of a marathon, with traders spending a few hours each day analyzing the market to make informed decisions. It’s an ideal strategy for those who cannot or prefer not to watch the markets every minute of the trading day.

Capital Requirements

Scalping often involves leveraging small price differences, which means it typically requires a larger bankroll to be effectively profitable. The use of leverage amplifies both gains and losses, necessitating a strong risk management strategy. Swing trading, conversely, may require less capital per trade because the expected profit per trade is generally higher, allowing traders to leverage their positions less aggressively.

Risk Management

Risk management in scalping involves setting very tight stop-loss orders to minimize losses on each trade. The cumulative effect of many small losses can be significant, so scalpers must have a disciplined approach to cutting losses quickly. Swing traders, meanwhile, often employ a broader risk management strategy, as their trades are fewer but carry the potential for larger losses. They might use wider stop-loss orders, allowing the market more room to fluctuate before deciding whether a trend is truly reversing.

Profit Potential

The profit potential of scalping comes from the accumulation of small gains from a large number of trades. This strategy requires consistency and discipline, as profit margins are thin, and transaction costs can erode earnings. Swing trading, in contrast, seeks to maximize profits from significant market moves, so while trades are less frequent, the profit from each can be substantial. The key to success in swing trading lies in capturing large market swings effectively.

Technical Analysis and Tools

Both strategies rely on technical analysis but utilize different tools and indicators. Scalpers might use tick charts and one-minute charts, focusing on volume indicators and price action to make quick decisions. They might also rely heavily on trading platforms that offer rapid execution and real-time data feeds. Swing traders, conversely, might analyze daily to weekly charts, using tools like moving averages, RSI (Relative Strength Index), and Fibonacci retracements to identify potential entry and exit points based on longer-term market trends.

Psychological Aspects

The psychological demands of each strategy are notably different. Scalping can be a high-stress strategy requiring constant alertness and the ability to make quick decisions without hesitation. It’s not for the faint-hearted or indecisive. Swing trading requires patience and the discipline to stick to a trading plan over days or weeks, resisting the urge to react to every market tick.

Market Conditions

Scalping is most effective in highly liquid markets, where small price movements are frequent. It’s less about the direction of the market and more about capturing volatility. Swing trading, however, thrives in conditions where clear trends are present, either in bullish or bearish directions, allowing traders to leverage these movements for profit.

Choosing the Right Strategy for You

Your choice between scalping and swing trading should consider your lifestyle, risk tolerance, and trading capital. If you thrive on fast-paced environments and can dedicate significant time to trading, scalping may be your calling. Conversely, if you’re looking for a less time-intensive approach that taps into larger market movements, swing trading could be more your speed.

In either case, success requires education, practice, and a solid understanding of market indicators and risk management techniques. Start with a demo account to hone your skills and develop a strategy that fits your trading style.

Enhancing Your Trading Skills

Regardless of your chosen path, the journey to becoming a proficient trader is ongoing. Keep abreast of market trends, continually refine your strategies, and never underestimate the value of a well-kept trading journal. This document is your best tool for self-assessment, allowing you to learn from both successes and mistakes.

Conclusion on Scalping vs Swing Trading

The debate between Scalping vs Swing Trading doesn’t yield a one-size-fits-all answer. Both strategies offer pathways to profitability but cater to different trader profiles. By understanding your preferences and market approach, you can choose a strategy that not only suits your trading style but also aligns with your financial goals and lifestyle. Remember, the key to successful trading lies not in the strategy itself but in how well you execute it. Stay disciplined, stay informed, and may your trading journey be prosperous.

FAQs on Scalping vs Swing Trading

What defines scalping in trading?

Scalping is a trading strategy that involves making numerous trades over the course of a day to profit from small price changes. Scalpers aim to enter and exit trades quickly, often holding positions for just minutes or even seconds, to capture rapid market movements.

How does swing trading differ from scalping?

Swing trading is a strategy that focuses on capturing gains in a stock (or any financial instrument) over a period of a few days to several weeks. Swing traders primarily use technical analysis due to the short-term nature of the trades, but they may also use fundamental analysis to inform their decisions. Unlike scalping, which seeks small gains in frequent trades, swing trading aims for larger gains per trade at a lower frequency.

Is scalping more profitable than swing trading?

The profitability of scalping versus swing trading depends on the trader’s skills, risk management, and market conditions. Scalping can be highly profitable for experienced traders who can commit the time and have the discipline to execute many trades quickly and efficiently. Swing trading can also be very profitable, particularly for those who prefer analyzing longer-term market trends and have more patience to wait for their trading setups to unfold.

Which strategy is better for beginners, scalping or swing trading?

Swing trading is often considered better for beginners compared to scalping. This is because swing trading allows for more time to analyze and make decisions, which can be less stressful and more forgiving than the fast-paced nature of scalping. Additionally, swing trading requires less time in front of the screen, making it more suitable for individuals who cannot commit to trading full-time.

Can I use both scalping and swing trading strategies?

Yes, some traders use both scalping and swing trading strategies, depending on market conditions and personal preferences. However, it’s important to understand the distinct approaches and risk management requirements of each strategy. Successfully applying both strategies typically requires a good deal of experience and the ability to switch mindsets based on the trading scenario.

Do scalping and swing trading work in all markets?

Scalping is most effective in highly liquid markets where traders can take advantage of small price movements with minimal slippage. Swing trading can be applied in a wider range of markets, including those that are less liquid, as it focuses on larger price movements over a longer timeframe. Both strategies can be adapted to different markets, but their effectiveness will vary depending on market volatility and liquidity.

What are the main risks of scalping and swing trading?

The main risk of scalping lies in its high-frequency trading nature, which can lead to significant losses if not managed properly with strict stop-loss orders and discipline. The use of leverage can also amplify losses. For swing trading, the risk comes from holding positions for longer periods, which may expose traders to overnight and weekend market gaps. Both strategies require effective risk management to ensure long-term success.