Are you ready to leverage Automated Trading platforms and achieve the financial milestone of $100k per month through Automated Trading? This comprehensive Automated Trading guide will, therefore, walk you through every essential step to reach this ambitious goal using advanced trading algorithms and strategies. Additionally, we’ll introduce our expert advisors, designed to maximize your trading efficiency and profitability through learning Automated Trading.

The Basics of Learning Automated Trading: Your First Step to $100k Per Month

Automated Trading leverages computer programs to execute trades based on predefined criteria. This approach eliminates the emotional biases and errors that often plague human traders, providing a more efficient and potentially profitable trading experience. By harnessing the power of algorithms and learning Automated Trading, you can achieve consistent results and scale your trading operations to reach impressive financial goals, such as making $100k per month with Automated Trading. Leverage Automated Trading to transform your approach to the financial markets. This Automated Trading guide will, undoubtedly, help you understand these basics comprehensively.

Steps to Make $100k Per Month with Automated Trading

Step 1: Mastering the Fundamentals of Learning Automated Trading

Grasping the Basics

Understanding Automated Trading is the cornerstone of your journey to financial success. It involves the use of algorithmic trading, market structures, and different trading instruments such as stocks, forex, and commodities. A solid grasp of these fundamentals sets the stage for developing and implementing advanced strategies to achieve $100k per month with Automated Trading.

- Example: When trading forex, it’s crucial to understand how currency pairs operate and the factors influencing their values. For instance, geopolitical events, economic indicators, and central bank policies can significantly impact currency prices.

Deep Dive into Financial Markets

Delving deeper into the dynamics of financial markets is, therefore, essential for informed trading. This includes understanding market trends, economic indicators, and the drivers behind market movements. Consequently, the more you immerse yourself in this knowledge, the better equipped you’ll be to strategize effectively and reach $100k per month with Automated Trading.

- Tip: Regularly read financial news on platforms like Bloomberg or Reuters to stay informed. Subscribing to financial newsletters can also keep you updated with market insights and trends. For example, knowing when major economic reports are released can help you anticipate market movements and leverage Automated Trading to your advantage.

Exploring Automated Trading Strategies

Algorithmic trading strategies are your tools for navigating the markets. Strategies like mean reversion, trend following, and arbitrage are pivotal. Each strategy has its own set of rules and can be applied in various market conditions to optimize your trading outcomes and help you achieve $100k per month with Automated Trading.

- Example: A mean reversion strategy involves buying a stock when its price is significantly below its historical average and selling it when it returns to the mean. This requires a good understanding of historical price data and statistical analysis. Leveraging Automated Trading can, therefore, make implementing these strategies more efficient.

Unleash the Power of Simple Automated Trading Systems

Step 2: Selecting the Best Automated Trading Platforms: MetaTrader 4

Why MetaTrader 4 is the Best Choice to Leverage Automated Trading

MetaTrader 4 (MT4) stands out as one of the most reliable and powerful Automated Trading platforms for Automated Trading. It offers extensive features that cater to both novice and experienced traders, making it the go-to platform for achieving your $100k per month goal with Automated Trading.

Why MetaTrader 4 is the Best Choice

MT4 offers a multitude of advantages that make it the preferred choice for traders aiming for $100k per month with Automated Trading.

- Comprehensive Technical Analysis Tools: MT4 provides a wide range of technical analysis tools, including advanced charting capabilities and over 30 built-in technical indicators. Moreover, these tools help you make informed trading decisions.

- Expert Advisors (EAs): MT4 supports the use of Expert Advisors, which are Automated Trading systems that execute trades based on predefined algorithms. This feature allows you to implement complex trading strategies without manual intervention. Leveraging Automated Trading through these EAs can significantly enhance your trading efficiency.

- User-Friendly Interface: Despite its powerful features, MT4 boasts a user-friendly interface that makes it easy to navigate and use, even for beginners.

- Security: MT4 offers robust security protocols, including encryption and two-factor authentication (2FA), to protect your trading data and funds.

Setting Up MetaTrader 4 with Automated Trading: Guide

Getting started with MT4 is straightforward. Here’s a step-by-step guide to help you make $100k per month with Automated Trading:

- Download and Install: Visit the official MetaTrader 4 website or your automated trading brokers to download the platform. Then, follow the installation instructions.

- Create an Account: Next, open a demo or live trading account with a reputable Automated Trading broker that supports MT4.

- Customize Your Workspace: Subsequently, familiarize yourself with the platform’s interface and customize your charts and tools according to your preferences.

- Install Expert Advisors: If you have custom trading algorithms or want to use our expert advisors, then install them by adding the EA files to the “Experts” folder in the MT4 directory. Consequently, this setup will help you leverage Automated Trading to its fullest potential.

Maximizing the Potential of MetaTrader 4

To fully leverage MT4’s capabilities and aim for $100k per month with Automated Trading, take advantage of its extensive resources:

- Community Support: Join the MT4 community forums to share insights and learn from other traders.

- Educational Materials: Utilize the wealth of educational materials available online, including tutorials, webinars, and user manuals.

- Regular Updates: Ensure your MT4 platform is regularly updated to benefit from the latest features and security enhancements. Moreover, leveraging Automated Trading means staying up-to-date with the best tools and practices.

Master Your Trades with Automated Trading Systems

Step 3: Developing or Acquiring Trading Algorithms

Creating Custom Algorithms

Developing your own trading algorithms allows for a tailored trading approach. If you possess programming skills, languages like MQL4 (MetaQuotes Language 4) which is specific to MT4, can help you code your strategies, giving you full control over your trading processes.

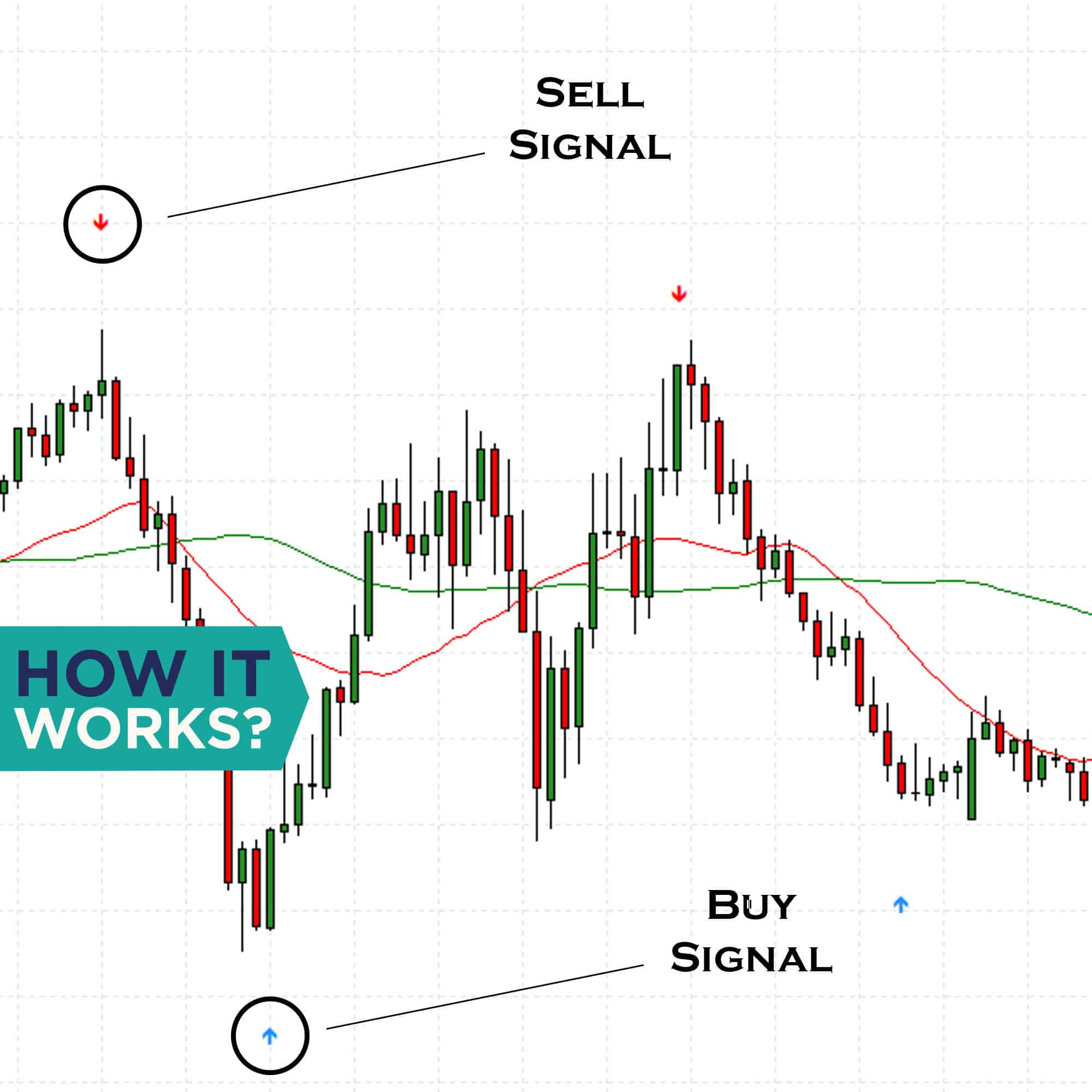

- Example: You can create a moving average crossover strategy where you buy when a short-term moving average crosses above a long-term moving average, and sell when the opposite occurs. Backtesting this strategy using historical data can help you refine its performance, thus moving closer to $100k per month with Automated Trading. Leveraging Automated Trading helps in the efficient execution of such strategies.

Utilizing Automated Trading Systems

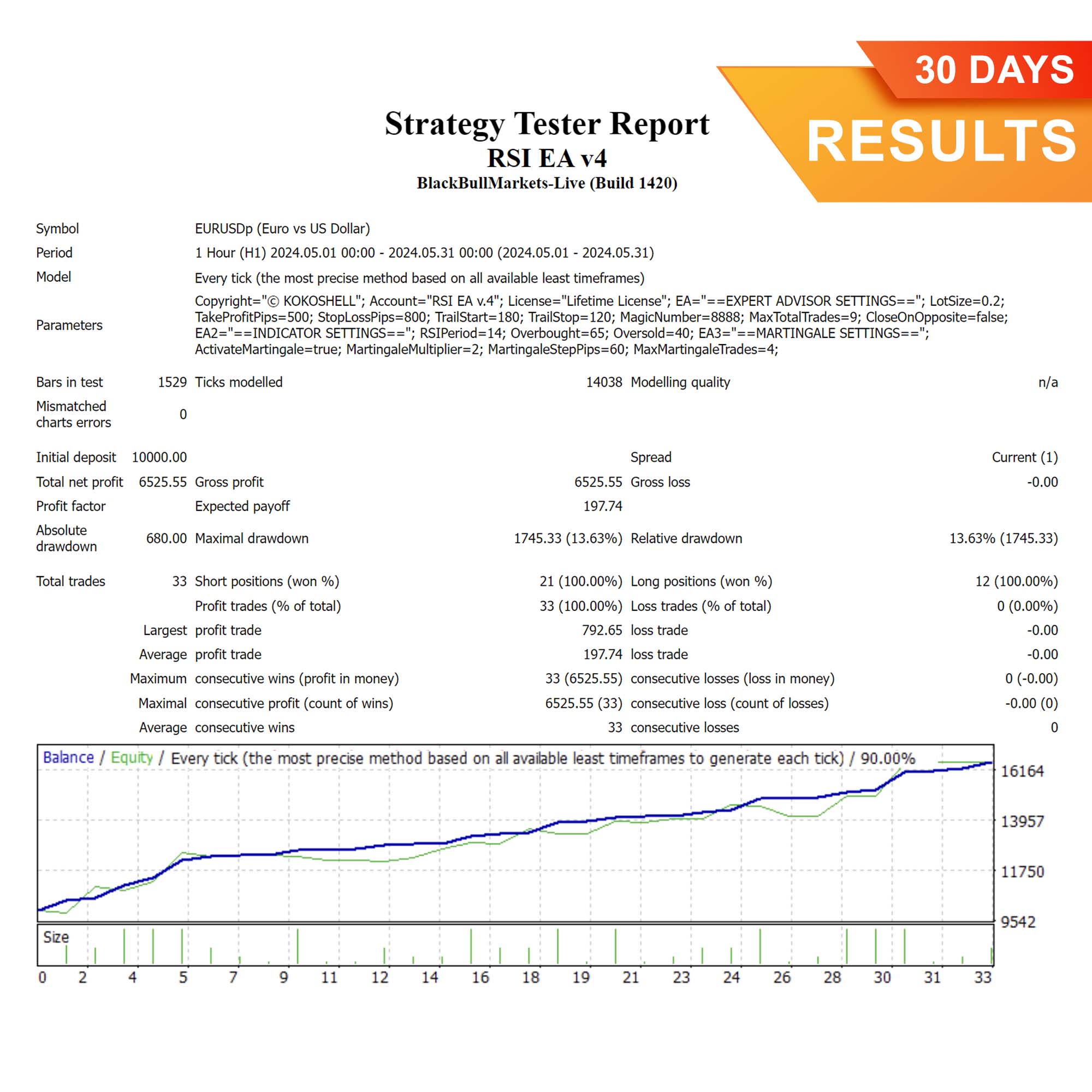

For those preferring ready-made solutions, additionally, purchasing or leasing proven trading algorithms is a viable option. Our expert advisors are designed to provide reliable, backtested strategies that have consistently delivered high returns.

- Tip: Verify the credibility of the source and request historical performance data before making a purchase. Our expert advisors come with comprehensive performance reports and customer testimonials to ensure transparency and trust. This allows you to leverage Automated Trading knowledge without needing to develop algorithms from scratch, thereby accelerating your path to $100k per month with Automated Trading.

Step 4: Backtesting Your Strategies for Success

Using Historical Data for Validation

Backtesting involves using historical market data to evaluate the past performance of your trading algorithms. Accordingly, this step is critical for understanding how your strategies would have performed in different market conditions, providing insights that can guide future adjustments and help you achieve $100k per month with Automated Trading.

Refining for Optimal Performance

Analyzing the results of your backtests and making necessary adjustments to optimize your algorithms is vital. Focus on key metrics like the Sharpe ratio, maximum drawdown, and average return per trade to gauge the risk and return profile of your strategy.

- Tip: Regularly update your backtests with the latest market data to ensure your strategies remain relevant and effective in current market conditions. Consequently, continuously refining your strategies helps maintain their profitability over time, crucial for reaching $100k per month with Automated Trading. Therefore, leveraging Automated Trading can help you adapt quickly to market changes.

Step 5: Implementing Robust Risk Management

Setting Risk Parameters

Effective risk management is, undoubtedly, the backbone of successful trading. This involves setting strict rules for stop-loss orders, position sizing, and diversification to protect your capital and manage potential losses.

Continuous Risk Monitoring

Regularly reviewing and adjusting your risk parameters ensures they remain effective. Automated tools can, therefore, help monitor trades and risk levels in real-time, allowing for quick responses to market changes.

- Tip: Utilize MT4’s built-in risk management tools that can automatically adjust your positions based on predefined risk parameters. Additionally, this proactive approach helps you stay ahead of potential market shifts, ensuring your path to $100k per month with Automated Trading. Furthermore, leveraging Automated Trading for risk management can protect your investments. Consequently, incorporating these tools can enhance your trading strategy significantly.

Step 6: Monitoring and Optimizing Performance

Regular Performance Reviews

Consistently monitoring your trading algorithms is, henceforth, crucial for maintaining their effectiveness. This involves analyzing real-time performance data and making necessary adjustments to ensure your strategies remain aligned with market conditions, pushing you closer to $100k per month with Automated Trading.

Strategy Adjustments

Based on your performance analysis, accordingly, tweak your strategies to align with current market conditions. Use performance metrics like win rate, average profit per trade, and drawdown to guide your adjustments.

- Tip: Keep a detailed trading journal to document your trades, strategies, and outcomes. Furthermore, this can help identify successful patterns and areas needing improvement. Moreover, a trading journal is an invaluable tool for continuous learning and adaptation, crucial for achieving $100k per month with Automated Trading. Consequently, leverage Automated Trading insights to fine-tune your approach.

Boost your Profits with Elite Automated Trading Systems

Step 7: Scaling Your Trading Operations

Gradual Capital Increase

Start with a small amount of capital and gradually increase it as you gain confidence in your strategies. This cautious approach helps you manage risks effectively while scaling up towards $100k per month with Automated Trading.

- Example: Begin with $10,000 and incrementally add more funds as your strategy proves successful. This methodical growth ensures you don’t overextend yourself financially.

Diversifying Trades

Spreading investments across multiple trading instruments and markets mitigates risk. Consider trading different asset classes such as stocks, forex, and commodities for diversification, essential for achieving $100k per month with Automated Trading.

- Tip: Use leverage cautiously to amplify returns without exposing yourself to excessive risk. Proper leverage management can significantly enhance your trading results. Furthermore, diversification also helps you capitalize on various market opportunities simultaneously. Consequently, leveraging Automated Trading across different assets can optimize your portfolio.

Step 8: Staying Informed and Adapting

Continuous Learning and Adaptation

Staying updated with the latest developments in Automated Trading and financial markets is crucial for long-term success. Therefore, engage in continuous learning through industry blogs, webinars, and online trading communities to stay ahead of the curve and move towards $100k per month with Automated Trading.

Adapting Strategies

Regularly update and adapt your trading strategies to reflect new market conditions and technological advancements. Hence, keeping a trading journal can help document your trades and strategies, aiding in identifying patterns and areas for improvement.

- Tip: Attend trading seminars and conferences to network with other traders and learn about the latest industry trends and technologies. Therefore, being part of a trading community can provide invaluable support and insights, helping you on your journey to $100k per month with Automated Trading. Consequently, leveraging Automated Trading requires constant strategy adjustments.

Maximize your Profits with PRO Automated Trading Systems

Must-Have Tools and Resources for Achieving $100k Per Month with Automated Trading

- MetaTrader 4: The premier platform for forex and Automated Trading, offering extensive technical analysis tools and support for Expert Advisors.

- Backtesting Tools:

- Amibroker: Excellent for custom backtesting and technical analysis.

- TradeStation: Integrated trading and backtesting platform.

- Quantopian: Ideal for Python-based backtesting.

- Educational Resources:

- Online courses from Coursera, Udemy, and Investopedia.

- Books such as “Algorithmic Trading” by Ernie Chan and “Trading Systems” by Tomasini and Jaekle.

- Market Data Providers:

Conclusion: Reaching $100k Per Month with Automated Trading is Within Your Reach

Achieving $100k per month with Automated Trading is a challenging but attainable goal. It requires a deep understanding of trading principles, the right tools, and continuous optimization of your strategies. Therefore, by following the steps outlined in this Automated Trading guide and staying committed to learning and adapting, you can increase your chances of achieving significant financial success through Automated Trading.

Our expert advisors are, thus, here to support you every step of the way. With our proven algorithms, comprehensive performance reports, and dedicated customer support, you can confidently embark on your journey to financial independence through Automated Trading. Therefore, stay disciplined, remain informed, and continuously optimize your strategies to stay ahead in the dynamic world of financial markets, ensuring your path to $100k per month with Automated Trading. Leveraging Automated Trading will be key to your success.

FAQs: Your Most Common Questions About Making $100k Per Month with Automated Trading

How can I start learning Automated Trading?

Start by understanding the basics of financial markets and trading instruments. Resources like Investopedia, Coursera, and Udemy offer excellent courses on trading and algorithmic strategies. Additionally, reading books such as “Algorithmic Trading” by Ernie Chan can provide deeper insights. This foundational knowledge is essential for achieving $100k per month with Automated Trading. Therefore, leverage Automated Trading to enhance your learning process and results.

What are the best Automated Trading brokers and platforms?

MetaTrader 4 (MT4) is widely regarded as the best platform for Automated Trading. It offers extensive technical analysis tools, support for Expert Advisors, and a user-friendly interface. Other notable automatred trading platforms include NinjaTrader for futures trading and QuantConnect for algorithm development. Utilizing MT4 and other automatred trading platforms can significantly enhance your ability to reach $100k per month with Automated Trading. Consequently, leveraging Automated Trading brokers and automatred trading platforms can optimize your trading efficiency.

How do I develop my own trading algorithms?

If you have programming skills, you can develop your trading algorithms using languages like MQL4 for MetaTrader 4. Platforms like MT4 and QuantConnect provide environments for coding and backtesting your algorithms. Start with simple strategies and, subsequently, gradually move to more complex ones as you gain experience. For more insights and to find the best trading algorithms, visit KOKOSHELL Trading Bots. Developing effective algorithms is a crucial step towards achieving $100k per month with Automated Trading. Therefore, leveraging Automated Trading tools can simplify this development process.

How important is backtesting in learning Automated Trading?

Backtesting is crucial as it allows you to test your trading strategies using historical data. This helps you understand how your strategies would have performed in the past, providing confidence in their potential future performance. Regularly updating your backtests with the latest data ensures your strategies remain effective. Hence, backtesting is indispensable for anyone aiming to achieve $100k per month with Automated Trading. Consequently, leveraging Automated Trading platforms for backtesting ensures accuracy and efficiency.

What are some effective risk management techniques?

Effective risk management involves setting stop-loss orders, position sizing, and diversifying your trades. Using automated tools to monitor trades and risk levels in real-time can help you respond quickly to market changes. Regularly reviewing and adjusting your risk parameters is essential to maintaining profitability. Therefore, robust risk management is essential for achieving $100k per month with Automated Trading. Consequently, leveraging Automated Trading for risk management can enhance your trading stability.

Can I achieve $100k per month with Automated Trading?

Yes, achieving $100k per month with Automated Trading is possible with the right strategies, tools, and continuous optimization. It requires dedication, continuous learning, and adapting to changing market conditions. Therefore, following the steps outlined in this Automated Trading guide can significantly increase your chances of reaching this financial milestone. With persistence and the right approach, $100k per month with Automated Trading is within your reach. Leveraging Automated Trading can help you achieve this goal.

Leverage Automated Trading Guide for Success

This Automated Trading guide is designed to help you navigate the complex world of Automated Trading and achieve your financial goals. By following the detailed steps and leveraging the resources provided, you can optimize your trading strategies and increase your chances of success. Whether you are a novice trader or an experienced one, this Automated Trading guide offers valuable insights and practical tips to enhance your trading performance. By revisiting this Automated Trading guide regularly, you can ensure you stay on the path to achieving $100k per month with Automated Trading.

Exploring Automated Trading Platforms

To succeed in Automated Trading, choosing the right Automated Trading platforms is crucial. MetaTrader 4 is one of the top Automated Trading platforms, offering robust tools and features. Other notable Automated Trading platforms include NinjaTrader and QuantConnect, each providing unique advantages. Therefore, leveraging these Automated Trading platforms can significantly boost your trading performance.