Introduction to Ichimoku Cloud

Ichimoku Cloud, or Ichimoku Kinko Hyo, is a comprehensive indicator that offers a 360-degree view of the market. It’s not just another charting tool; it’s a complete system that integrates multiple aspects of technical analysis to provide a clear picture of the market trends, momentum, and potential support and resistance levels. The uniqueness of Ichimoku Cloud lies in its ability to provide a deep analysis of the market through five primary components, making it an indispensable tool for traders aiming for successful market predictions.

What is Ichimoku Cloud?

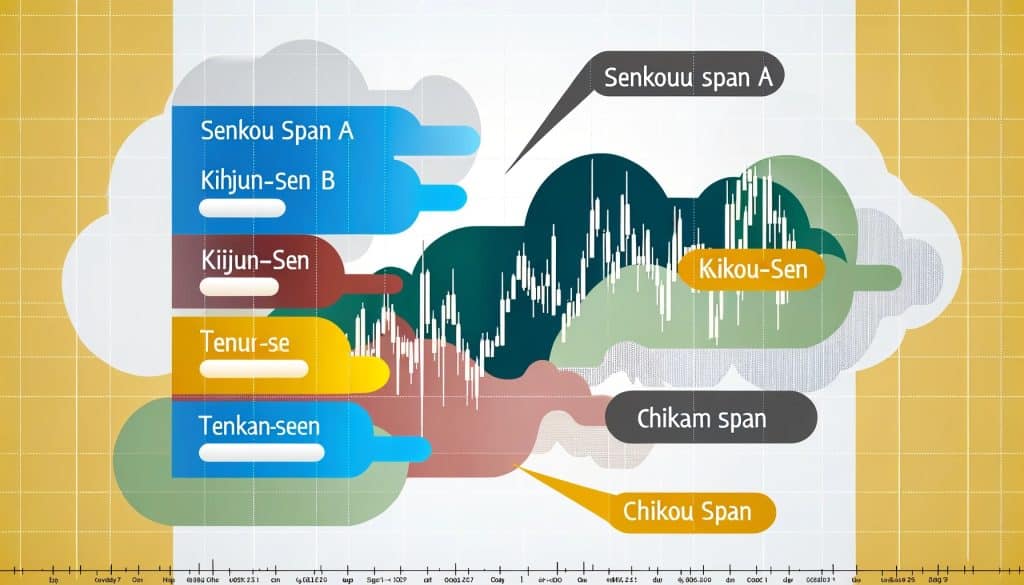

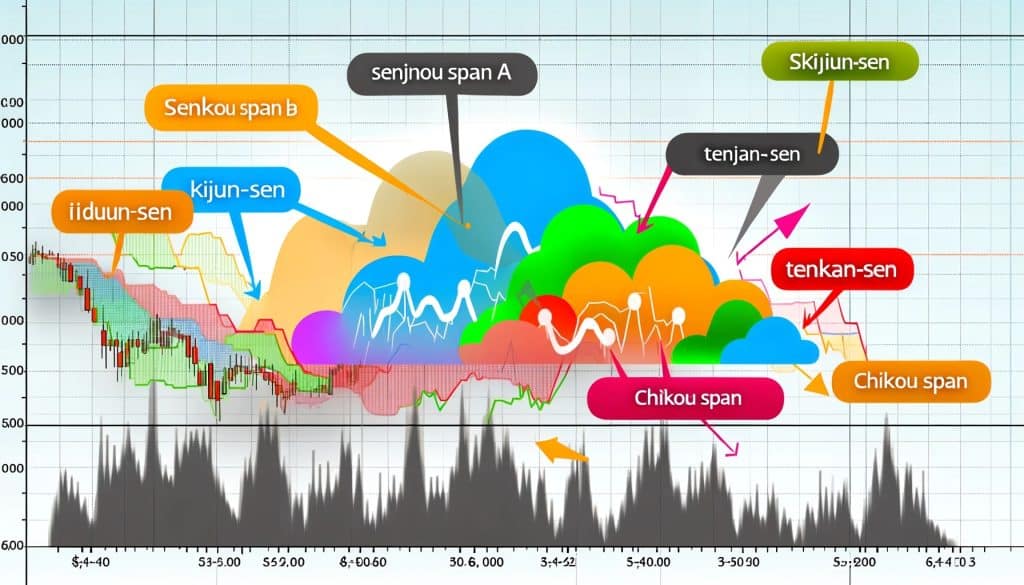

At its core, Ichimoku Cloud consists of five lines, each contributing to the overall picture of market action. These include the Tenkan-sen (Conversion Line), Kijun-sen (Base Line), Senkou Span A and B (Leading Spans A and B forming the “cloud”), and the Chikou Span (Lagging Span). Together, these elements create a comprehensive view of the market’s current and potential future direction.

The Origins and Development of Ichimoku Cloud Analysis

Developed in the late 1930s by Goichi Hosoda, a Japanese journalist, the Ichimoku Cloud was the result of decades of refinement and testing. It was designed to be an all-encompassing indicator, providing insights that traders need to make informed decisions. Its development highlights a dedication to creating a tool that is both detailed and accessible, providing clear signals even in complex market conditions.

Understanding the Components of Ichimoku Cloud

Each component of the Ichimoku Cloud has a specific purpose:

- Tenkan-sen (Conversion Line): Represents the midpoint of the highest and lowest prices over the last 9 periods, highlighting short-term price momentum.

- Kijun-sen (Base Line): Calculated over the last 26 periods, it reflects medium-term momentum.

- Senkou Span A (Leading Span A): The average of the Tenkan-sen and Kijun-sen plotted 26 periods ahead, forming one edge of the cloud.

- Senkou Span B (Leading Span B): Represents the midpoint of the highest and lowest prices over the last 52 periods, plotted 26 periods ahead to form the other edge of the cloud.

- Chikou Span (Lagging Span): Plotted 26 periods back, it shows the closing price and provides a historical perspective.

Decoding Ichimoku Cloud

The Ichimoku Cloud’s design allows traders to quickly assess the market’s state by examining the relationships between its components. This section delves into how each element interacts within the system to provide market insights.

The Five Key Elements of Ichimoku Cloud

Understanding how to interpret the relationship between the Ichimoku Cloud’s components is crucial for effective analysis. For instance, when the Tenkan-sen crosses above the Kijun-sen, it’s considered a bullish signal, especially if this crossover occurs above the cloud. Conversely, a bearish signal is indicated when the Tenkan-sen crosses below the Kijun-sen below the cloud.

How Ichimoku Cloud Offers a Comprehensive Market View

The cloud, or ‘Kumo,’ offers insight into future support and resistance levels, with its thickness indicating the potential strength of these levels. A thicker cloud suggests stronger support/resistance, making it harder for the price to break through. This predictive aspect sets the Ichimoku Cloud apart from other indicators, as it provides both a current and future market analysis.

The Significance of Ichimoku Cloud in Technical Analysis

Ichimoku Cloud transcends traditional technical analysis by providing a multifaceted view of the market. This section explores its integration with other indicators and its role in trend identification.

Integrating Ichimoku Cloud with Other Technical Indicators

While the Ichimoku Cloud is powerful on its own, integrating it with other technical indicators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) can enhance its effectiveness. For example, an RSI can help confirm the momentum indicated by the Ichimoku Cloud, providing a stronger signal for entry or exit.

The Role of Ichimoku Cloud in Identifying Market Trends

The Ichimoku Cloud excels in identifying market trends. When the price is above the cloud, it indicates an uptrend, and when below, a downtrend. The position of the Chikou Span also provides insight into the strength of the trend. If the Chikou Span is above the price in an uptrend, it reinforces the trend’s strength.

Practical Applications of Ichimoku Cloud

Applying Ichimoku Cloud in real trading scenarios can significantly enhance decision-making processes. This section provides examples of setting up the indicator and highlights successful case studies.

Setting Up Ichimoku Cloud on Your Trading Platform

Most trading platforms offer Ichimoku Cloud as part of their suite of indicators. Setting it up typically involves selecting the indicator from the platform’s menu and applying it to the desired chart. Traders can customize the lookback periods for each component, though many stick with the standard settings initially provided by Hosoda.

Case Studies: Successful Trades Using Ichimoku Cloud

One notable example of Ichimoku Cloud’s effectiveness was observed in the forex market, where a trader identified a bullish signal through a Tenkan-sen and Kijun-sen crossover above the cloud. By entering the trade based on this signal and managing risk through stop-loss orders set just below the cloud, the trader capitalized on a significant uptrend, securing substantial profits.

Strategies for Trading with Ichimoku Cloud

Developing strategies around the Ichimoku Cloud can lead to successful trades. This section outlines methods for identifying buy and sell signals and emphasizes the importance of risk management.

Identifying Buy and Sell Signals with Ichimoku Cloud

A simple strategy involves acting on the Tenkan-sen and Kijun-sen crossovers relative to the cloud. Buy signals are generated when the Tenkan-sen crosses above the Kijun-sen above the cloud, while sell signals occur when the Tenkan-sen crosses below the Kijun-sen beneath the cloud. Additional confirmation is provided by the cloud’s position and the Chikou Span’s location relative to the price.

Risk Management Strategies Using Ichimoku Cloud

Effective risk management with Ichimoku Cloud involves setting stop-loss orders based on cloud levels. For a long position, a stop-loss might be placed just below the cloud to protect against downward price movements. Conversely, for a short position, a stop-loss could be set just above the cloud. This method leverages the cloud’s predictive power for support and resistance to mitigate potential losses.

Advanced Techniques in Ichimoku Cloud Analysis

For those seeking to deepen their knowledge, exploring advanced Ichimoku Cloud techniques can offer new insights and trading opportunities. This section covers methods for utilizing the cloud in multiple time frame analysis and identifying trend reversals.

Utilizing Ichimoku Cloud for Multiple Time Frame Analysis

Multiple time frame analysis with Ichimoku Cloud involves examining the same currency pair or security across different time frames (e.g., daily, weekly, monthly) to gain a comprehensive view of the market’s direction. This approach can identify longer-term trends that might not be apparent in shorter time frames, providing a strategic advantage.

The Kumo Twist: A Key Indicator for Trend Reversals

The ‘Kumo Twist’ occurs when Senkou Span A crosses over Senkou Span B, indicating a potential trend reversal. This phenomenon is especially significant when it happens in conjunction with other bullish or bearish signals, such as Tenkan-sen and Kijun-sen crossovers. Recognizing a Kumo Twist can alert traders to early signs of a market shift, allowing them to adjust their strategies accordingly.

Ichimoku Cloud and Cryptocurrency Trading

Cryptocurrency markets, known for their volatility, can benefit from the insights provided by Ichimoku Cloud. This section explores the indicator’s application in these markets and how strategies can be adapted for cryptocurrencies.

The Effectiveness of Ichimoku Cloud in Volatile Markets

The Ichimoku Cloud’s comprehensive analysis is particularly suited to the fast-paced, volatile nature of cryptocurrency markets. Its ability to provide forward-looking insights helps traders navigate the market’s inherent unpredictability, offering a clearer view of potential price movements.

Adapting Ichimoku Cloud Strategies for Cryptocurrencies

When trading cryptocurrencies with Ichimoku Cloud, it’s important to consider the market’s increased volatility. This may involve adjusting the indicator’s settings to reflect shorter or longer time frames, depending on the trader’s strategy and risk tolerance. For example, reducing the lookback periods can make the indicator more responsive to rapid price movements common in the crypto space.

Comparing Ichimoku Cloud with Other Trend Analysis Tools

Understanding how Ichimoku Cloud stacks up against other analysis tools can help traders make informed decisions about which indicators to incorporate into their strategies. This section compares Ichimoku Cloud with moving averages and Bollinger Bands, highlighting its unique advantages.

Ichimoku Cloud vs. Moving Averages: A Detailed Comparison

While moving averages provide insights into market trends over specific time frames, Ichimoku Cloud offers a more nuanced view by incorporating multiple data points to predict future support and resistance levels. This forward-looking capability, combined with the cloud’s visual representation of market sentiment, gives traders a more comprehensive understanding of market dynamics.

The Advantages of Using Ichimoku Cloud Over Bollinger Bands

Bollinger Bands are used to gauge market volatility and potential overbought or oversold conditions. However, Ichimoku Cloud goes a step further by offering trend direction, momentum insights, and future price movement predictions. Its holistic approach enables traders to make more informed decisions based on a broader range of market factors.

Ichimoku Cloud in Day Trading

Day trading requires quick, informed decisions, and Ichimoku Cloud can be an invaluable tool in this fast-paced environment. This section discusses its application in day trading strategies and how it can enhance time management.

The Role of Ichimoku Cloud in Scalping Strategies

In scalping, traders aim to capitalize on small price movements, making quick trades throughout the day. Ichimoku Cloud can aid scalpers by providing instant visual cues about the market’s direction and momentum, allowing for rapid decision-making and entry/exit signal identification.

Time Management and Ichimoku Cloud: Maximizing Day Trading Efficiency

By providing a clear view of potential trading opportunities and market trends, Ichimoku Cloud helps day traders manage their time more effectively. Instead of analyzing multiple charts and indicators, traders can rely on the Ichimoku Cloud to quickly assess market conditions, freeing up time to focus on executing trades.

Ichimoku Cloud and Swing Trading

Swing trading strategies aim to capture gains in a stock or currency within an overnight to several weeks time frame. Ichimoku Cloud’s comprehensive analysis makes it a valuable tool for identifying longer-term trends that are crucial for swing trading.

How to Use Ichimoku Cloud for Long-Term Trend Following

Ichimoku Cloud’s forward-looking capabilities allow swing traders to identify potential trend continuations or reversals. By analyzing the cloud’s shape and the relative positions of its components, traders can spot strong trends and make decisions based on the likelihood of these trends persisting over their intended holding period.

Swing Trading Strategies Enhanced by Ichimoku Cloud

A common strategy involves entering trades when the price is above the cloud in an uptrend or below the cloud in a downtrend, with additional confirmation from the Tenkan-sen and Kijun-sen lines. This approach helps swing traders align their trades with the overall market momentum, increasing the chances of success.

Ichimoku Cloud in Forex Trading

The Forex market’s continuous operation offers ample trading opportunities, and Ichimoku Cloud’s comprehensive analysis can be particularly effective in this environment. This section covers its importance in Forex trading and provides real-world examples.

The Importance of Ichimoku Cloud in Currency Market Analysis

Forex traders rely on Ichimoku Cloud to identify key currency pair trends and momentum. Its ability to provide a detailed view of potential future price movements makes it an essential tool for navigating the Forex market’s complexities.

Case Studies: Ichimoku Cloud in Action in the Forex Market

An example of Ichimoku Cloud’s application in Forex trading involves a currency pair exhibiting a bullish Tenkan-sen and Kijun-sen crossover above the cloud, signaling a strong buying opportunity. By entering the trade based on this signal and using the cloud as a guide for setting stop-loss and take-profit levels, traders can effectively manage risk while capitalizing on the trend.

The Psychological Aspects of Trading with Ichimoku Cloud

Trading psychology plays a critical role in successful trading, and Ichimoku Cloud can provide psychological benefits by offering clear, actionable signals. This section discusses how it can help traders understand market sentiment and build confidence.

Understanding Market Sentiment through Ichimoku Cloud

The cloud’s color and the position of its components relative to the price can provide insights into market sentiment. A green cloud indicates bullish sentiment, while a red cloud suggests bearish sentiment. This visual representation helps traders gauge the overall market mood and align their strategies accordingly.

The Psychological Edge: Building Confidence with Ichimoku Cloud

By providing a structured approach to market analysis, Ichimoku Cloud helps reduce uncertainty and indecision, allowing traders to make more confident decisions. The clear signals generated by the indicator can bolster traders’ confidence in their trading choices, leading to a more disciplined and successful trading approach.

Ichimoku Cloud Software and Tools

Choosing the right software or trading platform that offers robust Ichimoku Cloud analysis features can enhance a trader’s ability to utilize this indicator effectively. This section recommends platforms and discusses customization options.

Recommended Platforms for Ichimoku Cloud Analysis

Many trading platforms, including MetaTrader, TradingView, and Thinkorswim, offer comprehensive Ichimoku Cloud analysis tools. These platforms allow for customization of the indicator’s parameters, enabling traders to tailor the analysis to their specific strategy and market conditions.

Customizing Ichimoku Cloud Settings for Optimal Use

While the standard settings for Ichimoku Cloud (9, 26, 52) are widely used, traders may find that adjusting these parameters for specific markets or strategies can improve the indicator’s effectiveness. Experimenting with different settings on a demo account can help traders identify the optimal configuration for their trading style.

Common Mistakes to Avoid in Ichimoku Cloud Trading

Effective use of Ichimoku Cloud requires awareness of potential pitfalls. This section highlights common mistakes and offers tips for accurate analysis.

Overreliance on Ichimoku Cloud: Balancing Analysis Tools

While Ichimoku Cloud provides a comprehensive market view, relying solely on this indicator without considering other factors, such as economic indicators or market news, can lead to misguided decisions. Traders should use Ichimoku Cloud as part of a balanced analytical approach.

Misinterpreting Signals: Tips for Accurate Analysis

One common mistake is acting on signals without confirmation from other Ichimoku Cloud components or additional indicators. For instance, a Tenkan-sen and Kijun-sen crossover should ideally be confirmed by the cloud’s position and the Chikou Span’s alignment with the trend. Waiting for multiple confirmations can reduce the risk of false signals.

The Future of Ichimoku Cloud in Market Analysis

The continuous evolution of trading technologies and methodologies suggests a bright future for Ichimoku Cloud. This section explores emerging trends and the potential integration of AI and machine learning.

Emerging Trends in Technical Analysis and Ichimoku Cloud

As financial markets become increasingly complex, the demand for advanced analysis tools like Ichimoku Cloud is likely to grow. Traders and analysts are constantly seeking ways to refine their strategies, and Ichimoku Cloud’s comprehensive analysis capabilities make it a valuable asset in this pursuit.

The Role of AI and Machine Learning in Enhancing Ichimoku Cloud Analysis

The integration of AI and machine learning technologies has the potential to revolutionize the way Ichimoku Cloud is used in market analysis. By automating the interpretation of Ichimoku Cloud signals and identifying patterns that may not be immediately apparent to human analysts, these technologies could enhance the indicator’s predictive accuracy and usability.

Learning Resources and Communities for Ichimoku Cloud Enthusiasts

Engaging with learning resources and communities dedicated to Ichimoku Cloud can accelerate the learning curve and improve trading outcomes. This section provides recommendations for books, courses, and online forums.

Books, Courses, and Online Resources for Ichimoku Cloud

Numerous books and online courses offer in-depth analysis and tutorials on Ichimoku Cloud, catering to both beginners and advanced traders. Resources such as “Trading with Ichimoku Clouds” by Manesh Patel and online platforms like Udemy and Coursera provide comprehensive guides to mastering this indicator.

Joining Communities and Forums for Ichimoku Cloud Trading

Participating in online forums and social media groups focused on Ichimoku Cloud trading can provide valuable insights and support. Platforms like Reddit, TradingView, and specific Facebook groups offer spaces where traders can share experiences, strategies, and tips for using Ichimoku Cloud effectively.

FAQs: Addressing Common Queries About Ichimoku Cloud

This section answers some of the most frequently asked questions about Ichimoku Cloud, providing clarity on its use and benefits.

What makes Ichimoku Cloud different from other technical indicators?

Ichimoku Cloud is unique in its comprehensive approach to market analysis, combining trend direction, momentum, and support/resistance levels in a single indicator. This holistic view allows traders to make more informed decisions based on a wide range of market factors.

Can Ichimoku Cloud be used for all types of trading?

Yes, Ichimoku Cloud is versatile enough to be applied in various trading styles, including day trading, swing trading, and long-term investment. Its adaptability to different time frames and markets makes it a valuable tool for traders across the spectrum.

How difficult is it to learn Ichimoku Cloud?

While Ichimoku Cloud may appear complex at first glance, its components are straightforward once understood. Traders can quickly learn to interpret its signals and incorporate them into their trading strategies with practice and study.

Is Ichimoku Cloud suitable for beginners?

Yes, beginners can benefit from using Ichimoku Cloud, especially if they take the time to understand its components and how they interact. Starting with the basics and gradually exploring more advanced techniques can make the learning process manageable and rewarding.

How can I start incorporating Ichimoku Cloud into my trading strategy?

Begin by familiarizing yourself with the basic components of Ichimoku Cloud and their interpretations. Practice identifying signals and patterns on historical charts, and consider using a demo account to apply Ichimoku Cloud strategies in a risk-free environment before transitioning to live trading.

Conclusion: Embracing Ichimoku Cloud for Successful Trading

Ichimoku Cloud stands out as a powerful tool for traders seeking a comprehensive market analysis method. By understanding its components, applying its strategies, and learning from common mistakes, traders can effectively incorporate Ichimoku Cloud into their trading arsenal. Whether used in isolation or in conjunction with other indicators, Ichimoku Cloud offers a path to more informed and confident trading decisions, ultimately enhancing trading success.