Introduction to Divergence Trading

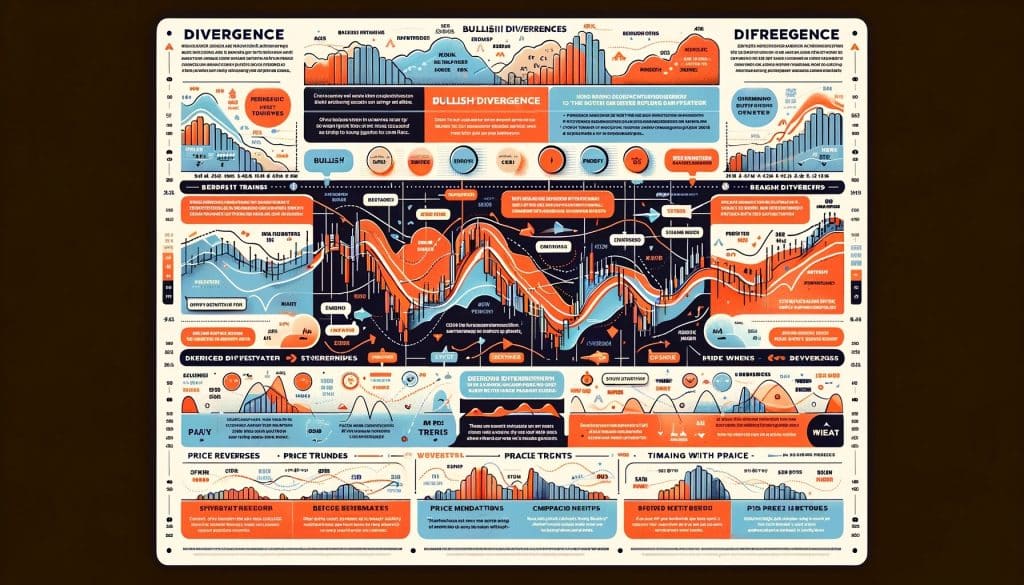

In the Forex market, divergence trading is a pivotal strategy for those looking to anticipate price reversals ahead of the curve. Divergence occurs when there’s a discrepancy between price action and momentum indicators, suggesting that a current trend may be losing strength and a reversal is imminent.

Understanding the Concept of Divergence

Divergence signals a potential change in price direction, especially when the price of a currency pair and a technical indicator like the RSI or MACD move in opposite directions. There are two primary types of divergence:

- Regular Divergence: Indicates a possible trend reversal.

- Hidden Divergence: Suggests the continuation of the current trend.

Indicators Used in Divergence Trading

Relative Strength Index (RSI)

The RSI is a momentum oscillator valued from 0 to 100, indicating overbought or oversold conditions. It’s instrumental in identifying potential reversals.

Example: Consider the EUR/USD pair trading in an uptrend. If the price makes a new high, but the RSI forms a lower high, this regular bearish divergence suggests the upward momentum is waning, and a reversal to the downside may occur.

Moving Average Convergence Divergence (MACD)

The MACD measures the relationship between two moving averages of a currency pair’s price. It’s effective in signaling the start of a new trend.

Example: In a downtrend of the GBP/JPY pair, if the price records a lower low but the MACD registers a higher low, a bullish regular divergence is identified, indicating a potential upward price reversal.

Implementing Divergence Trading Strategies

Step 1: Identifying Divergence Patterns

Spotting divergence involves closely monitoring the currency pair’s price and the behavior of the chosen indicator. Charting software with the capability to overlay these indicators on price charts simplifies this process.

Step 2: Confirmation and Trade Execution

After identifying a divergence, it’s crucial to wait for additional confirmation before executing a trade. This could be a candlestick pattern indicating a reversal or the price breaking a trendline.

Example: After spotting a bearish divergence on the USD/JPY pair with the RSI, wait for a bearish engulfing candlestick pattern before entering a short position. This ensures that the likelihood of a successful reversal trade is higher.

Step 3: Risk Management

Implementing stop-loss orders just above the recent high in a bearish divergence scenario or below the recent low in a bullish divergence scenario can protect against sudden market movements against your position.

Real-World Example of Divergence Trading

Bullish Regular Divergence on EUR/USD: Assume the EUR/USD is in a downtrend, and you observe the price making lower lows while the RSI starts to make higher lows. This divergence suggests the selling momentum is decreasing. Upon the formation of a bullish candlestick pattern as confirmation, a long position is taken. The trade is protected with a stop-loss order placed below the recent low of the price, aiming for a profit target near the previous high, anticipating the mean reversion move.

Challenges and Solutions in Divergence Trading

One significant challenge is the occurrence of false signals. To mitigate this, traders often combine divergence signals with other technical analysis tools, such as Fibonacci retracements or support/resistance levels, to improve the accuracy of their trades.

Conclusion

Divergence trading in Forex allows traders to harness the power of momentum indicators to forecast potential price reversals. By meticulously analyzing price and indicator movements, waiting for confirmatory signals, and adhering to stringent risk management protocols, traders can effectively utilize divergence strategies to enhance their trading performance in the Forex market. Continuous learning and practice remain key to mastering this approach, as market conditions evolve constantly.

FAQs on Divergence Trading in Forex

What is divergence trading in Forex?

Divergence trading is a strategy used in the Forex market to identify potential price reversals based on discrepancies between price action and momentum indicators. It involves spotting situations where the price of a currency pair and an indicator like RSI or MACD move in opposite directions, signaling that the current trend may be losing strength and a reversal could be imminent.

How do I spot a divergence in Forex trading?

To spot a divergence, you need to observe the price of a currency pair and compare it with a momentum indicator such as the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD). A divergence occurs if, for example, the price makes a new high while the indicator makes a lower high (bearish divergence) or if the price makes a new low while the indicator makes a higher low (bullish divergence).

What are the types of divergence in Forex?

There are two main types of divergence in Forex trading:

- Regular Divergence: Signals a potential reversal of the current trend. Bullish regular divergence occurs when the price records lower lows while the indicator shows higher lows. Bearish regular divergence happens when the price achieves higher highs, but the indicator displays lower highs.

- Hidden Divergence: Suggests the continuation of the current trend. Bullish hidden divergence is identified when the price makes higher lows, but the indicator forms lower lows. Bearish hidden divergence occurs when the price creates lower highs, and the indicator shows higher highs.

Can divergence trading be used with any Forex pair?

Yes, divergence trading can be applied to any Forex pair. However, it tends to be more effective with major and minor currency pairs due to their higher liquidity and lower spreads. It’s also important to consider the pair’s volatility and the trader’s familiarity with its behavior when applying divergence strategies.

What indicators work best for divergence trading?

The most commonly used indicators for divergence trading are the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD). Other indicators like the Stochastic Oscillator and the Commodity Channel Index (CCI) can also be effective in identifying potential divergences.

How do I confirm a divergence signal before making a trade?

Confirmation of a divergence signal can come from various sources, including:

- A reversal candlestick pattern (e.g., a bullish engulfing or a bearish shooting star) near the divergence point.

- A break of a trendline in the direction suggested by the divergence.

- The indicator crossing over a central line or moving out of overbought/oversold territory, depending on the specific indicator used.

What are the common mistakes in divergence trading?

Common mistakes in divergence trading include:

- Trading on divergence signals alone without waiting for additional confirmation.

- Misidentifying market conditions where divergence strategies might be less effective, such as strong trending markets.

- Failing to implement proper risk management practices, leading to outsized losses on incorrect signals.

How important is risk management in divergence trading?

Risk management is crucial in divergence trading, as with any trading strategy. It involves setting appropriate stop-loss orders to limit potential losses, sizing positions correctly to manage the risk exposure, and diversifying trades to avoid heavy losses from a single incorrect prediction. Effective risk management ensures that traders can withstand the losses from the inevitable incorrect signals and continue trading.