The Stochastic Oscillator, a mainstay in the arsenal of Forex traders, offers a window into market dynamics that few other indicators can. Crafted by George C. Lane in the late 1950s, its enduring relevance speaks to its efficacy in deciphering market momentum, spotting potential reversal points, and guiding traders through the volatile waters of the Forex market. This extensive blog post aims to unravel the complexities of the Stochastic Oscillator, presenting actionable tips, refined strategies, and detailed examples to enrich your trading experience.

Decoding the Stochastic Oscillator

Anatomy of the Stochastic Oscillator

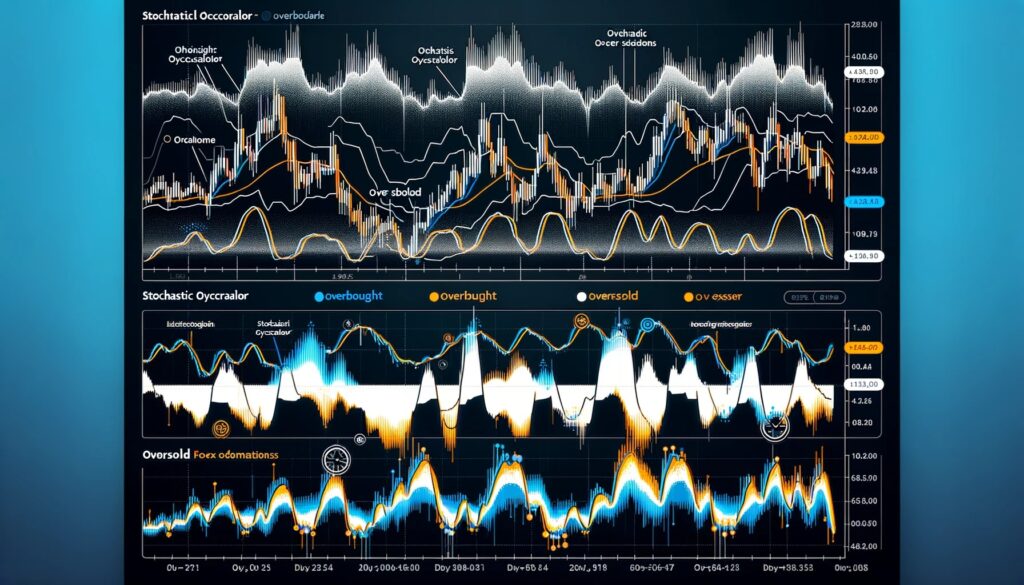

At its core, the Stochastic Oscillator is a momentum indicator that compares a specific closing price of a currency pair to a range of its prices over a certain period. The result is plotted as two lines: the %K line, which tracks the current market momentum, and the %D line, its moving average, serving as a trigger for trading signals. This dual-line setup oscillates between 0 and 100, with the key thresholds set at 20 and 80 to highlight overbought and oversold conditions, respectively.

Why It’s Indispensable in Forex Trading

The true power of the Stochastic Oscillator lies in its ability to unearth overbought and oversold market conditions, offering a glimpse into potential price reversals. It shines a light on the underlying momentum (or lack thereof) behind price movements, enabling traders to differentiate between genuine market shifts and mere noise.

Strategic Mastery of the Stochastic Oscillator

Navigating Overbought and Oversold Territories

The primary utility of the Stochastic Oscillator is in identifying markets that have reached their peak buying or selling thresholds. An overbought signal emerges when the oscillator reads above 80, hinting at a saturated buying spree that could lead to a price correction. Conversely, an oversold signal below 20 suggests a potential exhaustion of selling pressure, ripe for a bullish reversal.

The Art of Spotting Divergences

Divergence with the Stochastic Oscillator is a nuanced signal of an impending market reversal. A bullish divergence forms when the price records a lower low not mirrored by the oscillator, indicating weakening bearish momentum. A bearish divergence, on the other hand, occurs when the price hits a higher high that the oscillator fails to confirm, suggesting an upcoming bearish turn.

Leveraging Crossovers for Entry and Exit Points

Crossovers between the %K and %D lines are pivotal moments that can signal entry or exit opportunities. A bullish trading signal is flashed when the %K line crosses above the %D line within the oversold territory, marking a potential uptrend initiation. A bearish signal is indicated by the %K line crossing below the %D line in the overbought region, potentially heralding a downtrend.

Enhancing Trading with Advanced Stochastic Oscillator Insights

Tailoring Oscillator Settings

Customizing the Stochastic Oscillator settings can significantly boost its efficacy. While the default 14-period setting is widely used, adjusting the time frame or smoothing parameters can align the oscillator more closely with your trading strategy, whether you’re scalping, day trading, or swing trading.

Synergy with Other Technical Tools

Integrating the Stochastic Oscillator with other technical analysis tools creates a robust trading strategy. For instance, using it alongside trend lines or moving averages can confirm trend directions, while pairing it with Fibonacci retracement levels can pinpoint precise entry or exit points.

Incorporating Price Action for Comprehensive Analysis

Beyond the oscillator’s readings, incorporating price action analysis—such as candlestick patterns and support/resistance levels—can enrich trading signals. For example, a bullish engulfing pattern near a support level, coupled with an oversold Stochastic reading, could amplify the confidence in a long position.

Real-World Application: Enhancing Forex Strategies

Case Study: EUR/JPY Currency Pair

Imagine the EUR/JPY pair in a downtrend, with the Stochastic Oscillator deeply entrenched in the oversold zone. Suddenly, a bullish divergence appears as the oscillator begins to ascend, diverging from the continuously falling price. This discrepancy could signal traders to prepare for a potential bullish reversal, especially if confirmed by a subsequent %K and %D bullish crossover.

Conclusion

The Stochastic Oscillator is more than just a momentum tracker; it’s a multifaceted tool that, when wielded with expertise, can uncover deep market insights, signal potential reversals, and guide Forex trading strategies toward success. By delving into the strategies outlined, customizing settings to fit your trading style, and synergizing the oscillator with other analytical tools, traders can elevate their market analysis, refine their trading signals, and navigate the Forex market with increased precision and confidence.

FAQs about using the Stochastic Oscillator in Forex trading

What is the Stochastic Oscillator?

The Stochastic Oscillator is a momentum indicator developed by George C. Lane in the late 1950s. It compares the closing price of a Forex pair to its price range over a specified period, typically 14 periods, to identify overbought and oversold conditions in the market. The oscillator moves between 0 and 100, with readings above 80 indicating overbought conditions and readings below 20 signaling oversold conditions.

How does the Stochastic Oscillator work?

The Stochastic Oscillator works by plotting two lines: the %K line, which represents the current price level relative to the high-low range over the specified period, and the %D line, which is a moving average of the %K line. Traders use these lines to identify potential reversal points in the market, with crossovers between the %K and %D lines serving as buy or sell signals.

Can the Stochastic Oscillator predict market reversals?

Yes, the Stochastic Oscillator can help predict potential market reversals by identifying overbought and oversold conditions, as well as through divergence. When the price of a currency pair makes a new high or low that is not confirmed by the Stochastic Oscillator, it suggests that the current trend may be losing momentum and a reversal could be imminent.

How do I use Stochastic Divergence in trading?

Stochastic divergence occurs when the direction of the price trend and the direction of the Stochastic Oscillator trend diverge from each other. Bullish divergence happens when the price records a lower low, but the oscillator makes a higher low, indicating potential upward momentum. Bearish divergence occurs when the price makes a higher high, but the oscillator makes a lower high, suggesting potential downward momentum. These divergences can signal potential entry points for traders.

What are the best settings for the Stochastic Oscillator?

The best settings for the Stochastic Oscillator can vary depending on your trading style and the market conditions. The standard setting is 14 periods for the %K line and 3 periods for the %D line. However, traders looking for more sensitivity might shorten the periods, while those seeking to filter out market noise may opt for longer periods. Experimentation and backtesting are key to finding the optimal settings for your strategy.

Should I use the Stochastic Oscillator on its own?

While the Stochastic Oscillator can provide valuable insights into market conditions, it’s most effective when used in conjunction with other analysis tools and indicators. Combining the Stochastic Oscillator with trend analysis, price action, and other technical indicators can help confirm signals and reduce the likelihood of false positives, leading to more informed trading decisions.

How do I interpret a crossover in the Stochastic Oscillator?

A crossover in the Stochastic Oscillator occurs when the %K line crosses above or below the %D line. A %K line crossing above the %D line from below, especially in oversold territory (below 20), can signal a buying opportunity as it suggests rising momentum. Conversely, a %K line crossing below the %D line from above, particularly in overbought territory (above 80), may signal a selling opportunity as it indicates falling momentum.