Creating a Forex expert advisor (EA) from scratch is a meticulous task that combines strategy, programming, and testing into one seamless process. This guide is tailored to walk you through each step of developing a trading expert advisor from scratch, ensuring you have the tools and knowledge to automate your trading strategies effectively.

Introduction to Developing a Trading Expert Advisor from Scratch

Entering the world of automated trading by developing a trading expert advisor from scratch is an exciting venture for any trader. An expert advisor automates trading decisions, opening a new realm of possibilities for your trading strategy.

Fundamentals of a Trading Expert Advisor

Before we dive into the development process, it’s crucial to understand what an expert advisor is and how it can transform your trading approach. An EA is a program that executes trades based on predetermined criteria, removing the need for manual intervention and allowing for around-the-clock trading.

Step 1: Strategy Design for Developing a Trading Expert Advisor from Scratch

Crafting Your Trading Strategy

The cornerstone of developing a trading expert advisor from scratch is a solid, well-tested trading strategy. Define clear rules for entry, exit, and money management to guide the creation of your EA.

Risk Management Essentials

Incorporate risk management strategies directly into your EA to protect your investment. Define maximum risk levels, stop-loss orders, and other parameters to ensure your EA trades within your comfort zone.

Step 2: Programming Your Expert Advisor

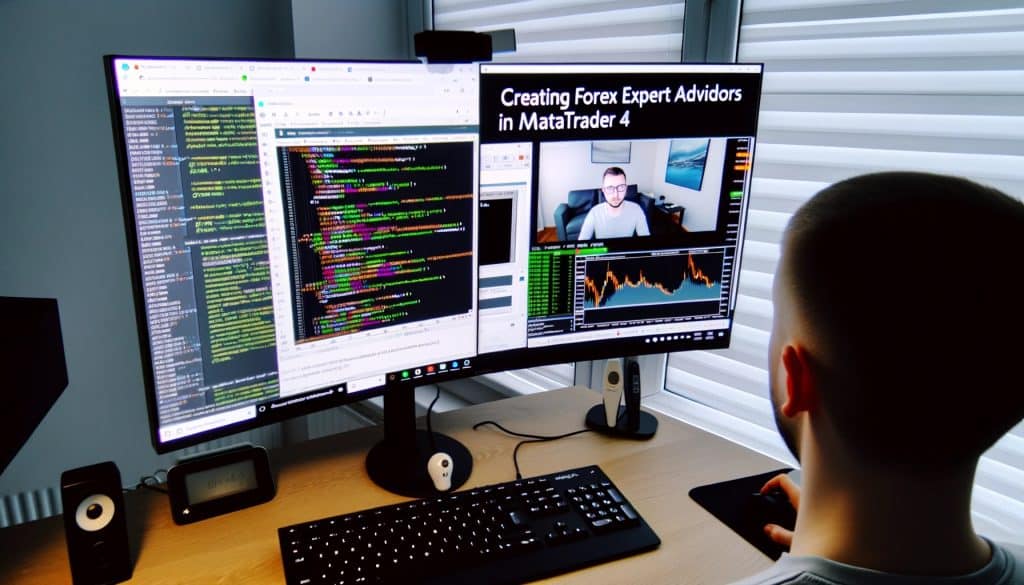

Mastering MQL4/MQL5 for Developing a Trading Expert Advisor from Scratch

Learning MQL4 or MQL5, depending on your MetaTrader platform, is essential for coding your EA. These programming languages are designed specifically for developing trading strategies into executable algorithms.

Using MetaEditor for EA Development

MetaEditor is your development environment for creating EAs. Start by drafting your code in MetaEditor, using your strategy’s parameters as the basis for your program’s logic.

Step 3: Testing and Optimizing Your EA

Backtesting Your Trading Expert Advisor

MetaTrader’s Strategy Tester is a powerful tool for evaluating the effectiveness of your EA against historical data. This step is critical in developing a trading expert advisor from scratch, as it allows you to refine your strategy before going live.

Optimization Techniques for Enhanced Performance

After backtesting, optimize your EA by tweaking its parameters for better performance. This iterative process ensures your EA is as efficient and profitable as possible.

Step 4: Live Deployment and Monitoring

Implementing Your EA in a Live Market

Transitioning from a development and testing environment to live markets is the final step in developing a trading expert advisor from scratch. Start with a demo account to test your EA in real-time conditions without risking capital.

Continuous Monitoring and Adjustment

Even after deploying your EA, continuous monitoring is essential. Be prepared to make adjustments as market conditions change to maintain the effectiveness of your EA.

Conclusion: Your Journey in Developing a Trading Expert Advisor from Scratch

Developing a trading expert advisor from scratch is a rewarding journey that can automate your trading strategy and potentially increase your profitability. By following this step-by-step guide, you’re well on your way to creating an EA that not only trades according to your specifications but also adheres to your risk tolerance levels. Remember, the key to a successful EA lies in thorough testing, continuous optimization, and diligent monitoring.

FAQs on Developing a Trading Expert Advisor from Scratch

What is a trading expert advisor?

A trading expert advisor (EA) is an automated system that executes trades on behalf of the trader based on predefined criteria and algorithms. It operates within the MetaTrader platform, analyzing market data, and making trading decisions without manual intervention.

Do I need programming knowledge to develop an EA?

Yes, developing an EA from scratch typically requires knowledge of programming, specifically in MQL4 or MQL5, which are the programming languages used for creating EAs in MetaTrader 4 and MetaTrader 5, respectively. These languages allow for the customization and automation of trading strategies.

How long does it take to develop an expert advisor?

The time required to develop an expert advisor can vary significantly depending on the complexity of your trading strategy and your proficiency in MQL programming. Simple EAs might take a few days to develop and test, while more complex strategies could take weeks or even months to perfect.

Can I test my expert advisor before going live?

Absolutely. MetaTrader platforms provide a Strategy Tester feature that allows for thorough backtesting of your EA against historical data. This is a critical step in developing an EA, as it helps identify any issues and optimize the strategy before deploying it in live trading conditions.

What are the risks of using an expert advisor?

While EAs can automate trading and potentially increase efficiency, they also come with risks. These include technical failures, such as connectivity issues or programming errors, and the risk of financial loss if the strategy does not perform as expected in live markets. It’s crucial to thoroughly backtest and forward test your EA and to use it within a well-considered risk management framework.

How can I optimize my expert advisor?

Optimizing an EA involves adjusting its parameters through backtesting to improve its performance. MetaTrader’s Strategy Tester allows you to run optimization scenarios to find the most effective settings for your strategy. Keep in mind that over-optimization can lead to curve fitting, where the EA performs well on historical data but poorly in live markets.

Is it possible to develop an expert advisor without coding skills?

While having coding skills provides the greatest flexibility in EA development, there are tools and services available that can help those without a programming background. These include EA builders and generators that offer a more user-friendly interface for designing trading strategies, though they may not offer the same level of customization as coding your own EA from scratch.

Can I sell my expert advisor if it’s successful?

Yes, if you develop a successful expert advisor, you can choose to sell it. Many traders and developers market their EAs through online platforms or trading communities. However, it’s essential to have comprehensive performance data and ensure your EA complies with any platform-specific requirements before offering it for sale.