In the vast and volatile world of Forex trading, understanding the intricate web of relationships between currency pairs can provide traders with a significant edge. Correlation trading is a strategy that takes advantage of these relationships, offering a nuanced approach to navigating the Forex market. By identifying and leveraging the correlations between currency pairs, traders can make more informed decisions, hedge their investments more effectively, and even uncover hidden opportunities for profit. This detailed blog post explores the concept of correlation trading, its application, and strategies for maximizing its potential in Forex trading.

Deep Dive into Correlation Trading

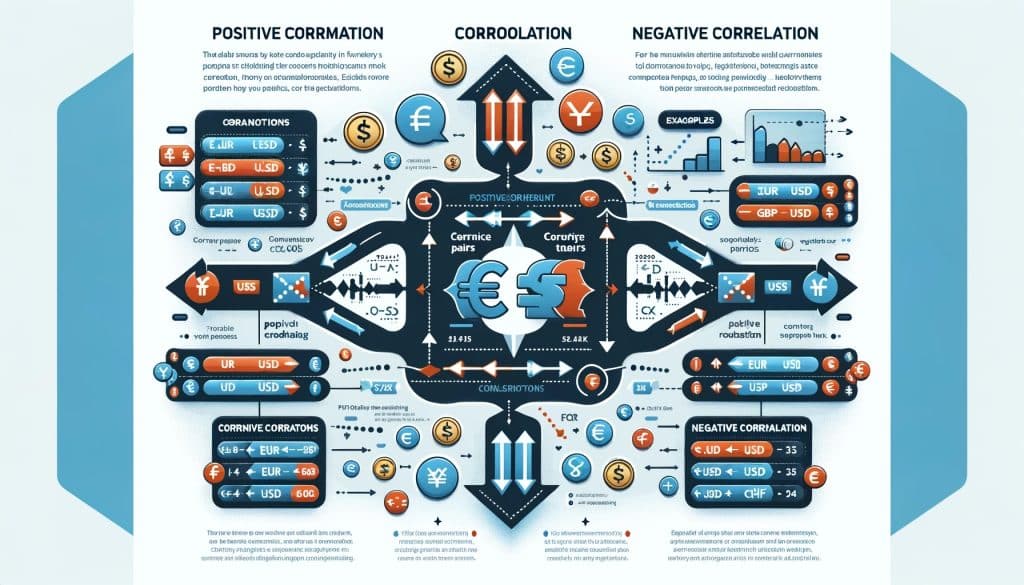

Correlation trading examines the mathematical relationship between the movements of different currency pairs. By identifying pairs that move in tandem or opposite directions, traders can predict future movements, hedge existing positions, and uncover new trading opportunities.

Understanding the Core of Correlation

- Positive Correlation: This occurs when two currency pairs move in the same direction. For instance, EUR/USD and GBP/USD often exhibit positive correlation because if the dollar weakens, both the Euro and British Pound tend to strengthen against it.

- Negative Correlation: Conversely, two pairs are negatively correlated if they move in opposite directions. A classic example is EUR/USD and USD/CHF; as the USD weakens (strengthening the EUR), it often strengthens against the CHF.

Correlation Coefficients: The Mathematical Backbone

Correlation coefficients quantify the relationship between currency pairs on a scale from -1 to +1. A coefficient of +1 signifies a perfect positive correlation, -1 indicates a perfect negative correlation, and 0 implies no correlation. Traders utilize these coefficients to gauge the strength of the relationships and make informed decisions.

Crafting Strategies in Correlation Trading

Strategic Hedging

Imagine holding a long position in EUR/USD amidst rising geopolitical tensions in Europe, potentially threatening your investment. By opening a short position in GBP/USD, which is positively correlated with EUR/USD, you can hedge against possible losses, as any adverse movement in EUR/USD is likely to be mirrored by GBP/USD.

Amplifying Gains

Consider the scenario where economic forecasts predict strong growth in Australia, suggesting an imminent rise in AUD value. By identifying positively correlated pairs like AUD/USD and NZD/USD, a trader could take long positions in both, doubling down on the anticipated AUD strength and potentially amplifying gains.

Practical Implementation of Correlation Trading

Step-by-Step Analysis

- Historical Review: Utilize a correlation matrix to assess the historical correlation data of your chosen currency pairs over your preferred time frames, identifying those with strong positive or negative correlations.

- Economic Insight: Stay informed about upcoming economic events and policy decisions that might impact correlated pairs, adjusting your strategy to reflect these insights.

Executing Trades

With correlations identified and economic contexts understood, you’re ready to execute trades. For a negative correlation strategy, you might go long on USD/CAD and short on USD/JPY if you anticipate dollar strength but want to hedge against potential volatility in oil prices, which significantly impact the CAD.

Ongoing Strategy Review

Constantly monitor the correlation coefficients and the macroeconomic landscape, ready to adjust your positions. Correlations can fluctuate due to changing economic policies or global financial trends, necessitating flexible strategies.

Addressing Challenges in Correlation Trading

The Dynamic Nature of Correlations

Correlations are not static; they can shift due to fundamental changes in economies or market sentiment. Regularly updating your analysis tools and staying abreast of global economic news are essential practices.

Mitigating False Signals

While correlations can indicate potential price movements, they’re not foolproof. Incorporating additional analyses, such as technical patterns or fundamental indicators, can help validate your trading decisions, reducing the risk of false signals.

In-depth Example: Correlation Trading in Action

Consider the impact of U.S. monetary policy on correlated pairs. If the Federal Reserve announces an unexpected interest rate hike, the USD is likely to strengthen. A trader might observe this and consider the historically negative correlation between EUR/USD and USD/CHF. Anticipating a fall in EUR/USD, the trader could short EUR/USD while simultaneously going long on USD/CHF, capitalizing on both movements.

Conclusion: Mastering Correlation Strategy for Enhanced Forex Success

Correlation trading offers a sophisticated framework for navigating the Forex market, allowing traders to make more nuanced decisions, effectively manage risk, and uncover hidden opportunities. By diligently analyzing correlations, staying informed on global economic trends, and continuously refining strategies, traders can leverage the power of correlation trading to achieve greater success and profitability in the Forex arena.

FAQs on Correlation Trading in Forex

What is correlation trading in Forex?

Correlation trading in Forex is a strategy that involves using the statistical relationship between two currency pairs to make trading decisions. By identifying pairs that move in tandem (positive correlation) or in opposite directions (negative correlation), traders can hedge their positions, double down on market movements, or identify counter-movement opportunities for profit.

How is correlation measured in Forex trading?

Correlation in Forex trading is measured using the correlation coefficient, a statistical measure that ranges from -1 to +1. A coefficient of +1 indicates a perfect positive correlation, meaning the currency pairs move in the same direction. A coefficient of -1 indicates a perfect negative correlation, meaning they move in opposite directions. A coefficient near 0 suggests no significant correlation.

Can you give an example of how to use correlation trading for hedging?

Certainly! If you have a long position in EUR/USD and anticipate market volatility that could weaken the EUR, you could hedge this position by taking a short position in GBP/USD. Since EUR/USD and GBP/USD often move in similar directions (positive correlation), a loss in the EUR/USD position could be offset by gains in the GBP/USD short position.

What are the risks associated with correlation strategy?

The primary risk in correlation trading is the assumption that historical correlation will continue into the future. Economic events, policy changes, and market sentiment can alter correlations suddenly and without warning, potentially leading to unexpected losses. Additionally, relying solely on correlation without considering other market factors can result in misinformed trading decisions.

How do I find correlation coefficients for Forex pairs?

Correlation coefficients for Forex pairs can be found using financial analysis websites, Forex trading platforms, or financial market data services. Many trading platforms include tools or indicators specifically designed to calculate and display the correlation between selected currency pairs over chosen time frames.

Is correlation trading suitable for all traders?

Correlation trading can be suitable for traders at all levels but requires a deep understanding of the Forex market and the factors that influence currency movements. Beginners should approach with caution, taking time to study correlation patterns and their implications thoroughly before incorporating them into their trading strategies.

How often should I check the correlation between my traded Forex pairs?

The frequency at which you should check the correlation between traded Forex pairs depends on your trading strategy and the time frame of your trades. For short-term traders, checking correlations daily or even more frequently might be necessary, especially during periods of high market volatility. Long-term traders might review correlations on a weekly or monthly basis, adjusting their strategies as needed to reflect changes in market dynamics.

Can correlation strategy be automated?

Yes, correlation trading can be automated using algorithmic trading systems that monitor correlation coefficients in real-time and execute trades based on predefined rules related to these correlations. Automated trading requires careful setup and monitoring to ensure that the algorithms accurately reflect the trader’s strategies and risk management principles.