Unveiling the Power of Compound Interest in Forex Trading

In the realm of financial growth and investment, few principles are as universally lauded yet profoundly misunderstood as compound interest. Often hailed as the “eighth wonder of the world” by none other than Albert Einstein, compound interest represents not just a financial mechanism but a cornerstone philosophy for wealth accumulation. Within the volatile and opportunity-rich environment of Forex trading, the magic of compound interest emerges not merely as a theoretical concept but as a tangible strategy capable of transforming modest gains into substantial wealth over time.

Forex trading, with its unparalleled liquidity and the inherent potential for leveraging small movements in currency values, presents a fertile ground for the application of compound interest principles. Unlike traditional savings vehicles or even other forms of investment, Forex trading offers the unique advantage of frequency and flexibility, allowing traders to potentially compound gains on a much more rapid scale. However, this acceleration of wealth is not without its caveats; it necessitates a deep understanding of Forex market dynamics, disciplined trading practices, and, crucially, a strategic approach to reinvestment and risk management.

The principle of compound interest in Forex trading revolves around the reinvestment of profits to generate further earnings. This means that instead of withdrawing the profits from successful trades, these gains are used as additional capital for future trading, thereby increasing the potential return on investment through what is effectively an exponential growth strategy. The beauty of compound interest lies in its simplicity and its power—simple, because it requires no complex instruments or strategies; powerful, because over time, even small, consistent gains can accumulate to significant amounts.

However, the practical application of compound interest in Forex trading is often overlooked or underutilized by traders, particularly those new to the market. This oversight can be attributed to several factors, including a lack of awareness, the allure of short-term gains over long-term growth, and the inherent risks associated with Forex trading which can deter the consistent reinvestment of profits. It is here, at the intersection of knowledge, discipline, and strategy, that the true potential of compound interest can be unlocked.

This article seeks to demystify the concept of compound interest within the context of Forex trading, offering traders a blueprint for leveraging this powerful principle to accelerate wealth accumulation. Through a detailed exploration of the basics of compound interest, practical strategies for its application, and real-life examples of its transformative impact, traders will gain insights into how they can harness the magic of compound interest to achieve their financial goals.

As we delve deeper into the mechanics of compound interest, the strategies for maximizing its potential, and the habits that can foster a conducive environment for compound growth, it becomes clear that this principle is not just about numbers—it’s about a mindset. A mindset that prioritizes long-term growth over immediate gratification, that values discipline and risk management, and that understands the power of reinvestment as a tool for financial empowerment.

In the following sections, we will unpack the formula behind compound interest, guide you through the process of calculating it within your Forex trading endeavors, and outline actionable strategies to incorporate this principle into your trading plan. Whether you are a seasoned trader or just beginning your journey in the Forex market, the insights provided will illuminate the path to not just trading success, but financial freedom through the magic of compound interest.

The Basics of Compound Interest Magic

Understanding Compound Interest

At its core, compound interest is interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a deposit or loan. This concept is distinct from simple interest, where interest is calculated only on the principal amount. The power of compound interest lies in its ability to accelerate wealth growth over time, as the interest earns interest, leading to exponential growth of an investment.

In the Forex trading context, compound interest comes into play through the reinvestment of profits. Rather than pocketing all earnings, traders who harness the power of compound interest reinvest their profits, using them to increase the size of future trades. This strategy can significantly magnify the potential returns over time, assuming a consistent trading strategy and a disciplined approach to risk management.

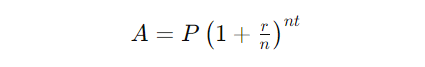

Compound Interest Formula Explained

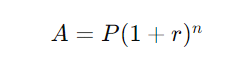

The formula for calculating compound interest is:

Where:

- A is the future value of the investment/loan, including interest.

- P is the principal investment amount (the initial deposit or loan amount).

- r is the annual interest rate (decimal).

- n is the number of times that interest is compounded per year.

- t is the time the money is invested or borrowed for, in years.

For Forex traders, this formula can be adapted to calculate the growth of trading capital over time, taking into account the reinvestment of profits. By adjusting the variables to reflect the trading scenario — for example, considering the average rate of return as the interest rate and the frequency of reinvestment as the compounding period — traders can project how their capital could grow through the strategic use of compound interest.

Calculating Compound Interest in Forex Trading

Step-by-Step Guide to Calculating Compound Interest Magic

Calculating compound interest for a Forex trading account involves several steps:

- Identify the Principal Amount (P): This is your initial trading capital.

- Determine the Average Rate of Return (r): Estimate an average rate of return on your trades. This will serve as the interest rate in the compound interest formula.

- Define the Compounding Frequency (n): Decide how often you will reinvest your profits. This could be after every trade, daily, weekly, etc.

- Set the Time Frame (t): Determine the period over which you want to calculate the growth of your investment.

- Calculate: Apply the formula to calculate the future value of your trading account, incorporating the reinvestment of profits.

Tools and Calculators for Compound Interest Magic

Several online tools and calculators can simplify the process of calculating compound interest for Forex trading profits. These tools allow traders to input their specific parameters (P, r, n, and t) to instantly calculate the potential growth of their trading capital over time. Utilizing these tools can help traders visualize the impact of compound interest on their investment strategy and make informed decisions about their reinvestment strategies.

Strategies to Maximize Compound Interest in Forex Trading

The application of compound interest in Forex trading transforms not just the potential for wealth but the very approach to trading. By focusing on the long-term growth of capital through reinvestment and strategic planning, traders can leverage compound interest to its fullest potential. Here are key strategies to achieve this:

Reinvesting Profits

The cornerstone of harnessing compound interest is the reinvestment of profits. Each time a profit is earned, instead of withdrawing it, the amount is added to the trading capital. This increases the size of future trades, potentially leading to larger profits, which are then reinvested again.

- Consistency is Key: Regularly reinvesting profits, regardless of their size, can have a significant impact over time. This consistent approach helps in capitalizing on the exponential growth potential of compound interest.

- Automated Reinvestment Plans: Some trading platforms offer tools that automatically reinvest profits according to predefined criteria, ensuring that the compounding effect is continuously applied.

Risk Management for Sustainable Growth

To sustain the growth achieved through compound interest, effective risk management is paramount. This involves not only protecting the trading capital but also ensuring that the reinvestment of profits does not expose the trader to undue risk.

- Balanced Leverage Use: While leverage can amplify profits, it also increases risk. A cautious approach to leverage, especially when reinvesting profits, can prevent substantial losses.

- Diversification: Spreading investments across different currency pairs or trading strategies can reduce risk. Diversification helps mitigate losses in one area with gains in another, supporting steady growth.

- Stop-Loss Orders: Implementing stop-loss orders protects the trading capital by automatically closing trades that move against the trader’s position, thus safeguarding the compound growth from significant downturns.

Compound Interest’s Role in Building Trading Wealth

Understanding and leveraging compound interest can lead to exponential growth of trading capital, but it requires patience, discipline, and a long-term perspective. The magic of compound interest lies not in short-term gains but in the accumulation of wealth over time.

- Long-term Planning: Successful Forex traders view their trading activities as a long-term investment. They plan their strategies with an eye on the future, understanding that the real benefits of compound interest manifest over extended periods.

- Reinvestment as a Priority: Making the reinvestment of profits a priority—even over the temptation to cash in on short-term gains—can significantly impact the compound growth of trading capital.

Implementing Compound Interest Strategies in Your Forex Trading Plan

Incorporating compound interest strategies into a Forex trading plan involves a systematic approach to reinvestment and risk management. This includes setting clear rules for when and how profits will be reinvested, defining risk tolerance levels, and selecting trading strategies that align with the goal of maximizing compound growth.

- Regular Performance Reviews: Conducting regular reviews of trading performance helps in adjusting strategies to optimize compound growth. This may involve changing the frequency of reinvestment, adjusting risk management strategies, or shifting focus among different trading instruments.

- Education and Adaptation: Continuously educating oneself about Forex market trends, compound interest strategies, and risk management techniques is crucial. The Forex market is dynamic, and strategies that work today may need adjustment tomorrow.

Conclusion: The Transformative Potential of Compound Interest in Forex Trading

The journey through the world of Forex trading, with its inherent volatility and opportunities, is often marked by the pursuit of strategies that promise quick gains. However, the principle of compound interest offers a path to wealth that is not predicated on elusive, overnight success but on the steady accumulation of wealth through discipline, strategic planning, and patience.

The power of compound interest in Forex trading lies in its simplicity and the profound impact it can have over time. By reinvesting profits and adhering to a disciplined approach to risk management, traders can transform their initial investments into significant capital. This process, however, is not instantaneous. It requires a long-term commitment and a steadfast belief in the principles of compound growth.

Implementing Compound Interest Strategies in Your Forex Trading Plan

To truly harness the potential of compound interest, traders must integrate these strategies into their trading plans:

- Set Clear, Long-Term Financial Goals: Understanding what you aim to achieve through Forex trading will guide your approach to reinvestment and risk management.

- Embrace a Disciplined Trading and Reinvestment Approach: Discipline is crucial, both in executing trades according to your strategy and in consistently reinvesting profits to benefit from compound growth.

- Stay Informed and Adapt: The Forex market is dynamic. Staying informed about market trends and being willing to adapt your strategies will help optimize the benefits of compound interest.

The Journey Towards Financial Independence

The path to financial independence through Forex trading is not without challenges. It demands more than just an understanding of market trends and trading strategies; it requires a commitment to a principle that is as much about personal discipline as it is about financial acumen.

The magic of compound interest lies in its promise of exponential growth, but its true gift is the way it shapes traders into more disciplined, strategic, and patient individuals. These qualities are invaluable, not just in Forex trading but in the broader pursuit of personal and financial growth.

Final Thoughts

As we conclude our exploration of compound interest and its application in Forex trading, it’s clear that this principle offers a powerful tool for wealth accumulation. However, its full potential can only be realized through a disciplined approach to trading and investment. For those willing to commit to the long-term journey, the rewards of compound interest extend beyond financial gains; they include the development of a disciplined, strategic approach to both trading and life.

In the world of Forex trading, where opportunities and risks coexist, embracing the power of compound interest can be your guide to not just surviving but thriving. It’s a testament to the timeless adage that the most successful financial strategies are often the simplest—rooted not in chasing market trends but in adhering to fundamental principles that have stood the test of time.

FAQ Section: Compound Interest in Forex Trading

How does compound interest work in Forex trading?

Compound interest in Forex trading refers to the reinvestment of profits from trades into future trades, increasing the total capital over time and allowing for potentially higher profits on subsequent trades. Unlike traditional savings, where compound interest accumulates on a set schedule, in Forex trading, the frequency of compounding depends on the trader’s activity and strategy, allowing for more dynamic growth of investment through the reinvestment of profits.

Can you give an example of calculating compound interest for a Forex trading account?

Certainly. Let’s say you start with a trading account of $10,000 and achieve a 5% return per month. If you reinvest your profits each month, the calculation for your account balance after one year would involve the compound interest formula:

Where:

- A is the amount of money accumulated after n periods, including interest.

- P is the principal amount ($10,000).

- r is the monthly interest rate (5% or 0.05).

- n is the number of times the interest is applied (12 months).

After applying the formula, your account balance after one year would be approximately $17,958.92, demonstrating the power of compound interest in growing your Forex trading capital.

What are the best practices for maximizing compound interest in Forex trading?

Best practices include:

- Reinvesting Profits: Consistently reinvest your trading profits to benefit from the compounding effect.

- Risk Management: Implement solid risk management strategies to protect your capital and ensure sustainable growth.

- Continuous Learning: Stay informed about market trends and refine your trading strategies to maintain or improve your rate of return.

How often should I reinvest profits to benefit from compound interest in Forex trading?

The frequency of reinvestment for maximizing compound interest depends on your trading strategy and goals. Some traders might choose to reinvest profits after every successful trade, while others may do so on a weekly, monthly, or even quarterly basis. The key is consistency and ensuring that your reinvestment strategy aligns with your overall trading plan and risk tolerance.

Can compound interest really lead to significant wealth accumulation in Forex trading?

Yes, compound interest can lead to significant wealth accumulation in Forex trading over time, provided traders maintain a disciplined approach to reinvestment and adhere to sound risk management principles. The exponential growth potential of compound interest, combined with strategic trading decisions, can substantially increase a trader’s capital, leading to higher profit potentials. However, it’s important to remember that Forex trading involves significant risk, and there are no guarantees of profit.